Financial Lessons I Have Learned As An Expat

Being an expat has brought me many experiences and lessons. Some of them are financial, others aren’t. In this blog post, I want to go a bit deeper into my personal experience as a Spanish expat living in the UK and what financial lessons I’ve learned from it.

Table of Contents

Expat Life Background

I’ve lived in the South of England for over 5 years, the time has gone by so fast. I almost feel like being half British. I greet people with you alright mate and expect everyone say sorry at all times, no matter what.

When I look at the pictures that I posted on my Instagram during my first days of living in Brighton, I can’t distinguish any wrinkles on my face, and it also seems that I didn’t know much about what grey hair actually means neither!

Fortunately, ageing in a foreigner country has also accelerated (I think) my knowledge acquirement and helped me develop a forward-thinking and open mindset, where I don’t believe in flags, but people that believe in themselves instead.

I remember well that quick learning sensation of my first year as an expat. It felt like in 12 months I had grown the equivalent of 10 years of living in Spain (or Catalonia). I switched from listening to dull politicians to strangers’ background stories, which was a lot more interesting!

But it wasn’t all fun.

Before I stepped my feet on British lands, I felt a bit down, I did not value myself much. I thought I was a bit worthless, like a shy little dog sharing territory with nasty bulldogs in an animal shelter. I was not able to compete, to bark and growl loud enough to get the top-quality ration of food, but I always thought that it didn’t matter though, as to whether I fought or not, I knew there would always be enough leftovers to carry on, at least, until the next day.

But that was THE problem, I would do nothing and still be able to survive.

Luckily that was all about to change in the UK. Here I would have to fiddle with a new lifestyle full of unknowns.

I Learned How To Earn

The first three months were easy and fun. As I had worked in Spain for over 4 years, I was entitled to get Spanish benefits for over a year period in the form of monthly payments. The good thing about the EU is that I could move to any EU member state and still be able to enjoy my Spanish benefits for three months.

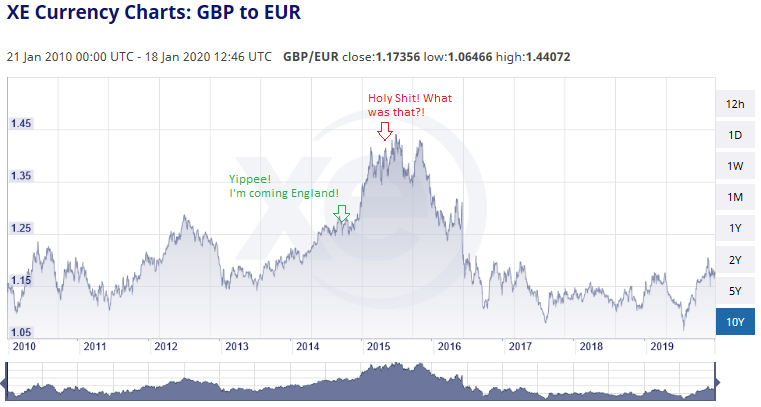

After that, things got a bit more challenging. Besides having no longer any income type, the pound value against the Euro increase from 1.25 to 1.40 almost overnight. Goddammit! (that is an American word, I know, I know! 🙂 )

The shy little dog said: Ok Tony, you had enough, just book a flight back home, find a new job you won’t like, join an English academy and continue building your career and English from there.

But that wasn’t the point of all of it! The point was to survive, no to run!

Seeing my savings decrease day after day was scary! But how I could make money? I had been the last 4 years sitting on my arse in an office. Most foreigners like me made money on the hospitality sector. Me carrying a tray full of glasses and dishes to serve to customers? I couldn’t imagine that!

So, I had to learn to earn again, but this time life would be my trainer, not schools. Surprisingly, it was easier than I thought. I managed to convince someone to give me an opportunity to learn how to housekeep in a hotel. In a few days, I was the quickest of most of my colleagues.

That result left me in shock, I just couldn’t believe it! It didn’t seem that I was a little dog anymore. Where the heck I took all that energy from? How did I manage to learn and be so efficient in this short period of time? An industrial mechanical engineer making beds guys! What the hell?!

Then, I realised that the human’s brain and body are designed to perform at its best during “survival” times, as I could learn from reading the Emotional Intelligence book. It felt like having superpowers, honestly! I was stronger, faster and cleverer than ever and enjoyed “a nothing can stop me” feeling for a while.

I knew I had to fight if I wanted to “survive”. I learned to dig hard and discovered that the hardest I dig, the luckier I would become.

Now I was THE bulldog.

I learned how to earn in the real world.

I Learned How To Spend Less

If I wanted to complete my goal successfully (learn English) I knew it would cost me money. English courses are extremely expensive, and I wasn’t up for paying thousands to accomplish my goal.

Is there a monetary shortcut? I mean…, I live in an English-speaking country after all, why to pay money for something that a country itself can teach me?

This route is much cheaper but also much harder. It involves starting from scratch, you need to build your own base structure back up from the bottom, and qualifications, certificates or diplomas are worthless at the beginning. I wasn’t better than anyone else.

So, taking the shortcut seemed like a no brainer, it would be stressful but worth it (that internal stress would transform into external grey hair appearance later on!). There is a limited knowledge one can learn from a school anyway, the interesting lessons stand out there, in real life.

Suddenly, things like fancy televisions, watches, expensive clothes, cars or having the latest super iPhone version to show off to colleagues mattered nothing to me.

I valued other things instead, like living in a room close to Asda, Aldi or any other cheap supermarket. Sharing a house with someone acceptable. Meeting open-minded people who don’t mind going to a gay pub to enjoy some cheaper drinks or making friends who would listen to you without any judgement and without looking at your possessions.

Can you believe that I was happier spending less?

Believe it!

I Learned What Currency Risk Means

How much is the Pound worth today against the Euro? Checking this on a daily basis was a “bad” habit I developed during my first months. I was periodically transferring money in Euros from Spain to Pounds in the UK using Transferwise*, which was the cheapest well-known option to transfer funds among the expat community.

*If you join Transferwise using this link I am afraid you’ll get nothing and I’ll get £50 for every three people who join.

The issue was that me and my friends were trying to “time the market”.

Will the £ go down tomorrow? Maybe it’s better to wait a bit and transfer a larger sum later on?

That bad habit continued, and I ended up hooked at trading FOREX myself with an ending story of losing 45K EUR.

As I commented earlier, the Pound value increased dramatically against the Euro, and suddenly 1000 € was worth £700 instead of £800.

Source: https://www.xe.com/currencycharts/

The lesson I take from this is actually rather basic, but I think it is sometimes overlooked. From my personal point of view, anyone who’s planning to retire in a country that uses a different currency should add a margin of safety percentage to their retirement pot.

I sometimes wonder if everyone from the financial independence community who plans to retire abroad has taken the currency-risk into account.

I Improved On Researching

Every country works differently and finding out how things work in a new unknown environment can become somewhat stressful. The more developed are your researching skills for finding reliable information the better. And as every skill, the more you practise it, the more you master it.

This skill will have a positive impact on my finances, otherwise, I would have never known how to invest tax-efficiently using ISAs or even bump into the financial independence community J

Final Words

There are many more life lessons I have learned as an expat, but they are not financial ones.

Generally speaking, living abroad for a certain period of time opens up your mind towards a different vision. You become an observer and watch crowd movements to theoretically “copy” them and become a crowd member, or in other words, to adapt yourself to a new culture. At least that was how I experienced it. But watching how the crowd behaves raise questions sometimes and especially if some of their habits involve loads of spending or bragging about possessions or a high social status lifestyle.

Moving out of your comfort zone is the key sentence of the whole experience. Most employers value it massively, and it gives a lot of confidence to oneself, which is ideal to have a better opportunity to increase your income in the future. And not to talk about the networking benefits of speaking another language, especially English that can open some business opportunities, collaborations and an extensive amount of other advantages.

Let’s connect

What do you think about the financial lessons I’ve learned as an expat? Do you think that I may be missing some? Perhaps, you are or were an expat yourself and would like to share your own experience?

Then don’t hesitate to write a comment down below, I would love to hear from you and connect with awesome people ?

If you would like to know more about me and the purposes of this blog, you can do so on the about page.

If you like what you read, please click on the like button and share it with others.

You can also follow me on Twitter, where I share some random thoughts from time to time and connect with other like-minded people or Facebook if you wish.

Thanks for reading 🙂

Tony

Related Posts

9 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Fascinating to read your story, Tony – you have shown exactly why this country needs immigrants who come over here to work and provide benefit to society and to the British economy.

I can’t think of anything that you’ve missed as an ex-pat – you took opportunities, learned, researched and succeeded!

As ever, I hope you continue to succeed and attain your FIRE goal!

Hi weenie a thousand thanks for your kind words 🙂

Things are going well on my working career, but unfortunately not so well on my investing one. There’s another mess coming soon! 🙁

Congrats, Tony, on sticking at it and learning an immense amount along the way. The living and working abroad experience is on my list for this decade, so examples like this are food for thought!

There is, however, one important omission in your discussion of British integration: what is your position on Marmite? ?

Thanks, Hustle Escape 🙂 No matter what your age is the experience will be lived differently but I am 100% sure that it is still worth it.

Haha, good point on the Marmite. I absolutely hate it! It’s the worst combination of ingredients I have ever tried. My half Spanish side says it loves chorizo instead! yummy yummy! :p

I’m not angry, just disappointed ? Although I can’t disapprove of the chorizo alternative!

[…] I have been a user of this app for over 4 years. I must say that the only reason why I originally downloaded it was because it is among the top-rated platforms in the UK. All I wanted at that time was to trade FOREX, a game that didn’t turn up too well for me. For the curious ones, I explained a bit about how I developed this negative addiction here. […]

Thanks for the article Tony! I’ve been an expat in two different countries and I’ve sure felt the pain of currency risk. Brexit anyone? The pound lost a lot of value after that vote and I felt that. Painful! I’m now much more focussed on my “home currency” and trying to protect against exchange rate risk. My index funds are based in EUR for that very reason. Wish you all the best!

Hey, thanks a lot for stopping by,

It makes total sense to invest in funds based on Euros, that’s what most people do. In my case I was not too sure how long I’d stay in the UK, so I kept my savings in ISAs, which are only £ based, to benefit from the tax advantages.

Welcome to the blogosphere, I wish you all the best.

[…] while ago I wrote a similar post in which I narrated the financial lessons I learned thanks to coming to the UK. This one goes a bit beyond […]