Portfolio Update #49 Q3 2024 – €298,143

This is my 49th portfolio update in the blog. It is time to look at the books for the third quarter of 2024 and write about what’s happened over the last three months.

Table of Contents

New job

The most relevant thing that happened last quarter was starting a new job. In my previous update, I mentioned that I had a new job offer that would get me back to managing people. However, as I also mentioned, I was interviewing with another local company. That other company also offered me a job with the same salary, but less responsibility, more holidays, a better benefits package and the opportunity to work in a more interesting field. On top of that, it is only 6 miles from home, which would contribute to time and fuel savings — so I decided to reject the position as a design leader for a normal mechanical design engineering role with this local company.

I started at the beginning of September and I would say it’s going well so far but feel a bit strange in. In our office, we have only about 30 employees, however, the company has a global presence and several offices around the world, so it has the kind of political structure of a big company. I’ve always worked in small companies with a more “familiar” working culture, so I guess it’s going to take a while for me to adapt to this new environment. I have nothing to complain about my new colleagues, they have all been welcoming and helpful so far. The working atmosphere is great with no douchebags around, which is a super plus these days!

Summer

The summer in the UK was decent. We continued enjoying and exploring the countryside part of Wales, the Peak District and the Lake District. For the first time in the UK, we went camping a couple of times with some friends and loved it! It’s something we’d like to do again next summer if possible, as this gives us the option to start exploring further areas such as Scotland.

We also went to two weddings. One was family-related in Czechia, and the other was for friends of ours in Slovakia.

British Citizenship Completed

That’s it! I had the British Citizenship ceremony, and became a dual citizen in September, so that is another of my 2024 goals completed. Nothing much has changed for me, though. The only thing is that I will be able to vote in the next general election.

Quick Recap of Q3-2024 Numbers

- Net worth: €761,986 (+2.8%) – details HERE

- Portfolio value: €298,143 (+6.78%) – details HERE

- Quarterly Total Growth: €15,343

- Savings Rate so far in 2024: 13.1%

Comments

The numbers for Q3 look great. I managed to get my savings rate for this year back to green.

Investment Portfolio Breakdown

This is how my investment portfolio breakdown looks this quarter:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

That was another great quarter for my investments as stocks performed well. I am solely contributing to my SIPP until the next tax year begins or Labour makes some drastic changes to pensions. In addition, my salary has increased, which means I will be automatically contributing more cash to my workplace pension. My new employer contributes to my work pension more than my previous one, 5% against 3% before. That all helps to keep the roller coaster going up!

Dividend Portfolio

Now as usual I get to look into my dividend portfolio which generated £177.19 of passive income this quarter (£259.35 last quarter).

There were no significant additions or changes to my dividend portfolio this quarter. I opened an initial small position with Siemens using some accumulated cash from dividend payments. I would like to expand this position over time if it stays in a similar price range.

In October, which would be part of Q4, I sold my full position with Toronto-Dominion Bank after learning about the company violating anti-money laundering laws. A similar story happened to Wells Fargo a few years ago, which took a big hit. It has recovered since then, but it took a few years before the company earned some trust back. I am disappointed with Toronto-Dominion and the banking system in general. Back in the day, I decided to invest in a Canadian bank because they had a reputation for being highly regulated and trustworthy. Well, that wasn’t the case. This essentially puts me off investing in banks. Lesson learnt, the banking sector won’t have a place in my dividend portfolio. Luckily for me though, I managed to sell Toronto at a profit 🙂

Now I have some cash spares in my account which I am using to buy Siemens mainly but also some J&J, GSK and Legal & General.

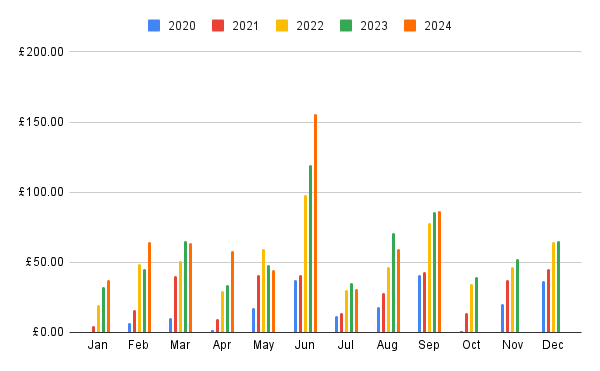

Here’s an overview of my monthly dividend income so far:

See you on the next one!

Tony

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.