Risk-adjusting My P2P Lending Portfolio

It took me longer than expected but I have finally come along *something* to use as the first step to risk-adjust my P2P lending portfolio.

When investing via peer-to-peer lending platforms, it is easy to lose focus and end up having a messy P2P portfolio caused by promotions, bonuses, or cashback deals. As I mentioned in my December’s update, the latest problematic issue with Kuetzal recalled me that I still got some homework to do to improve my P2P portfolio allocation.

But now, being realistic, how do I improve it? We have a lot of information regarding how to invest in stocks and bonds backed by historical statistics, which we find written in tons of books and blogs, but what about P2P?

What I read the most about P2P online looks something like this:

Use my link to join XXX and get YYY extra!

So, initially inspired by Nerd Factor’s Risk vs Return Analysis P2P Portfolio, and in order to get the numbers in place, I decided that I would do my own self-assessment too.

This self-assessment is unprofessional and based under my own criteria. For the time being, I only compare platforms I use, and according to the purposes I use them for. For instance, EvoEstate* offers all type of real estate investments, but I only invest in buy-to-lets, which lowers the investment risk type. Therefore, please note that before relying on the data.

Table of Contents

How does the risk-reward analysis work?

The risk-rewards analysis is based upon the peer-to-peer lending risks I summarised on this post.

If you run through it all, you will count 7 main P2P risks: Borrower risk, Loan Originator risk, Platform risk, Cash drag risk, Liquidity risk and Market risk.

Every platform has a different risk exposure to these risks according to the risk factors (see excel document below for more info). To give you an example, a company that offers investments from several countries has a lower market risk than any other offering opportunities from just one country.

Risk-relevance

This is completely made up. I give a risk-relevance to every risk type according to my own judgement. The platform risk has the highest risk-relevance percentage, whilst cash drag the lowest. That means that the score on platform risk has a higher impact on the total platform risk score.

Have a look at the chart to see how I have divided this up.

Risk Score

The total risk factor score and risk-relevance give us a platform risk score, calculated as follows:

Risk – Reward Highlight Results

Finally, the risk-reward number is given by the multiplication of the risk-score and the average investment return from every platform.

It gives a final score to each platform. To put it down simply, the higher this score, the better risk-rewarding a platform is.

Here’s how I have calculated this:

P2P Risk-reward analysis

This is an embed excel document where anyone can see how platforms score. The analysis isn’t perfect and it probably has some inaccuracies.

I apologise for not going more into detail.

Explaining the scoring criteria for every single risk factor would have made this post extremely extensive and hard to understand. Remember that this is a personal analysis. I am, however, open for questions, discussions and corrections one may notice should be done.

I will eventually keep updating this post with renovated analysis, as platform features can change over time or I add new ones to the roaster.

Sorry if it looks odd, still learning 🙂

Highlights and comments

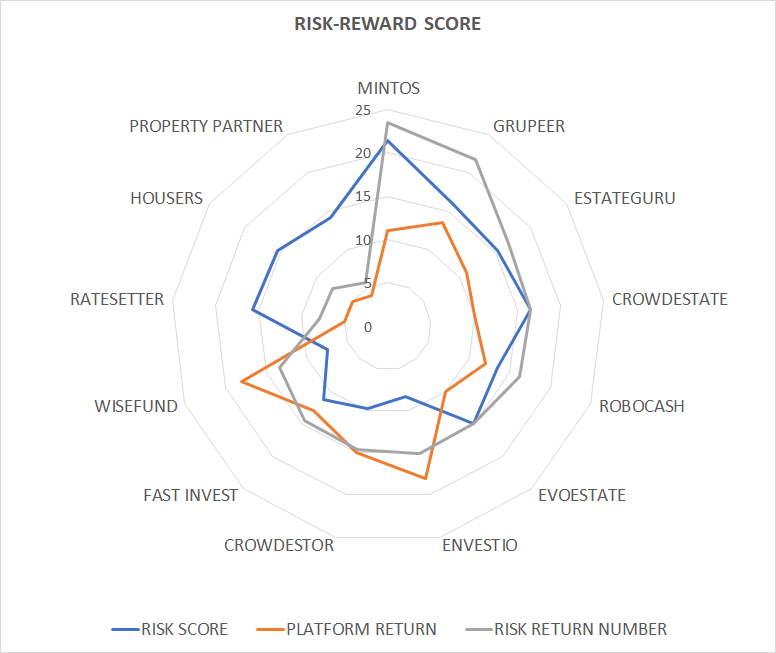

According to my unprofessional self-assessment, the best risk-rewarding platform is Mintos*, followed by Grupeer* and EstateGuru*.

At the other end of the spectrum stay Property Partner, Housers and RateSetter.

Mintos* has the highest scores on 4 out of 7 risks (Loan Originator risk, Platform Risk, Cash Drag risk and Market Risk)

Grupeer* gets the highest score on borrowers’ risk as some loans have collateral besides the buyback guarantee. However, it lacks liquidity as a result of no having neither secondary market nor platform buyback (yet).

EstateGuru*, Crowdestate* and Robo.cash* have similar risk-rewarding scores. All three are properly established and profitable business with a high level of transparency (public annual reports). That makes them score high on platforms risk (the risk I value the most).

Behind are EvoEstate*, Envestio*, Crowdestor* and FastInvest*. Evoestate has ranked well in spit of being a new platform and counting on BTL investments only. If I were investing in loans or equity project the start-up platform would rank better on my list. Similar goes for Crowdestor, you can find projects yielding over 20% sometimes, but I do not generally invest in them, lowering my expected annual return. Envestio lacks geo diversification among others and Fast Invest transparency.

Wisefund ranks badly despite its high returns as it barely has any track record and lacks on transparency. The platform guarantees to have a protection fund to cover interest payments and a third part buyback guarantee to cover defaulted loans. This sounds great but neither the protection fund value not the company behind the buyback guarantee are shared.

Finally, due to low returns, the three bottom ones are RateSetter, Housers and Property Partner.

Find all scores summarised on the following radar chart.

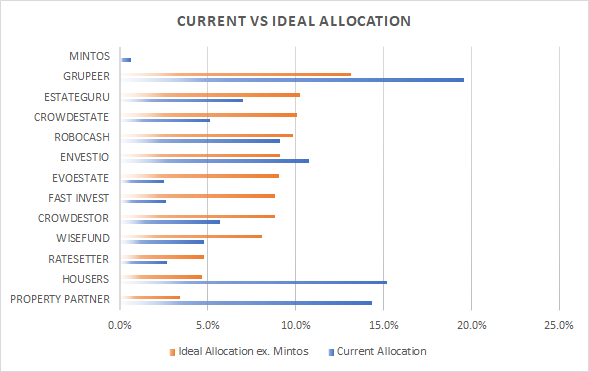

My Ideal P2P Allocation

All facts given, this is how my ideal P2P portfolio allocation should look like:

For any new readers, I am not able to invest via Mintos* marketplace as I am residing in the UK. Hence, that’s why I have excluded Mintos from the current ideal allocation.

Finally, because I know you are a chart lover 🙂 I am adding a comparison chart that shows how off-set my current P2P allocation is from my ideal one.

That defines my main urgent moves, lower Houser’s, Property Partner’s and Grupeer’s portfolio value and increase the others.

Thanks for reading 😀

Tony

Related Posts

5 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Good luck with that, also I would not allocate more than 10% of portfolio to P2P as they are high risk investments.

Thanks for a great presentation of your approach. Target diversification looks very reasonable.

Good luck

Your analysis is particularly timely now, with all the problems surrounding the Kuetzal platform..

I have not checked even all of the platforms you mention, but if you think that it is a good idea to invest 45% of your portfolio in Wisefund (burning), Fast Invest (burning), Crowdestor (most projects have no collateral), Envestio (already shut down), Crowdestate (lot of problematic projects without sufficient collateral) – then you still have to learn about risk and looks like it will be a painful lesson. Be careful!

Yeah agree, this post would need a total make over Kristaps. I don’t even think they can all be comparable. It was a good fun to play with the spreadsheet at least!