Why I Am Changing To Global Index Funds

Vivid readers will have noticed in my recent portfolio updates and saving reports, that I am changing my investing strategy to global index funds.

Having had a hand in the latest SavingNinja thought experiment related to the lockdown, I wrote about how Covid-19 has produced an effect of realization on me. I mentioned that I wanted to change the trajectory of my onemillionjourney.com towards a KISS (keep it simple, stupid) perspective, but I did not give many details on how I would do it.

So, here’s a quick summary:

“Investing in global index funds or ETFs (preferably accumulators) following an automatic monthly contribution schedule, whilst I am drinking a beer, enjoying the near home sea wave stunning sound, and sitting on the terrace during a lovely sunny day.”

That’s basically the summer edition summary of my investing strategy for 2020.

Is that the end of the post then? Can the reader leave the site and go back to Twitter now?

Well, not yet. Hold on a sec, fast runner!

This strategy is easy to understand, that’s right. But unfortunately, the reasons why I am following it are not that simple.

So, stick with me (yup, grab a beer that’s fine), and we’ll go through the main reasons on why I am changing my investing strategy to global index funds.

Table of Contents

Time and simplicity

The older I become, the more it comes to my attention that time is my most valuable, non-renewable asset.

I must admit something: I’ve got a little gambler inside me, and that needs feeding! Whether I like it or not, that’s my reality, and the best thing I can do is to embrace it as it is. That needs some time.

But, once the little gambler is fulfilled with some P2P investments or dividend stocks (which will take 10-20% of my total portfolio as much), this question comes:

How much time do I want to spend on finding the new hot pick stock or timing the market?

0° 0′ 0″

Global funds will allow me to manage most of my portfolio in a simple and time efficient way. Setting up automatic investments will require no time from my side and rebalancing twice per year takes 30 minutes.

There are many other ways to spend meaningful time, as learning new skills, exercising, side hustling or simply just enjoying from being closer to my loved ones. These are far better investment opportunities to me.

Broad diversification

When it comes to investing, people tend to stick with whatever they know best, preferring to trust what’s most familiar. This is known as “home bias”. I have to say that I am not an exception and I have invested disproportionally in both of the countries I thought I had a better edge on, Spain and the UK. The result is a heavy disproportion on my alternative investments, having allocated more than I should have in platforms such as Property Partner and Housers.

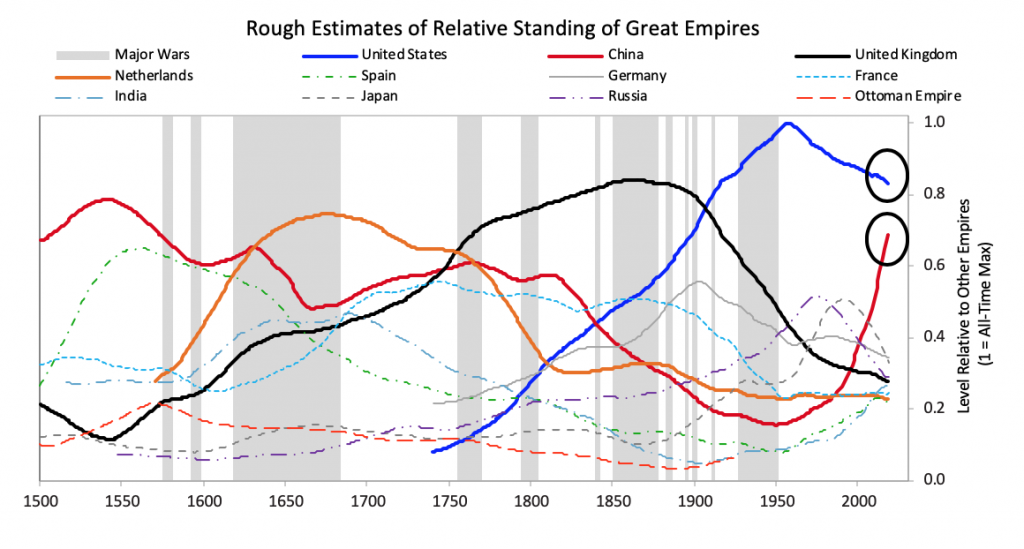

I believe that being overexposed to any country is a mistake, and that also includes the US. A recent article written by Ray Dalio shows the Big Cycles Over The Last 500 Years and how empires have arisen and consequently fall.

Certainly, US investors have enjoyed from the highest stock market return over the last century, but will that last forever? Governments are taking unprecedented measures to combat Covid-19. Will that make China the new empire? Will US stocks continue outperforming the rest of the world stocks during the next 20-30 years that I am expecting to be fully invested in?

Honestly, I don’t know the answers, and if you do, bravo! I won’t stick my neck out for endorsing your beliefs though!

Low fees

Investing in global index funds or ETFs is one of the cheapest ways to gain from all the benefits of a well diversified portfolio.

The idea is to make as few as possible transactions to avoid being charged commissions, spread fees, currency exchange fees or any sort of stamp duty taxes.

In terms of costs, accumulators index funds are the cheaper option, as they reinvest dividends automatically, fact that helps to avoid being possibly changed for any of the above mentioned fees.

Accumulator ETFs are another smart option, but they tend to be more expensive to purchase, although the ongoing change (ODF) is generally cheaper.

As I am still in the accumulating phase, the ideal investment vehicle would be index funds, as I am growing my portfolio by buying assets in a monthly basis, following the paying myself first approach. That means I will at least have 12 transactions a year. These are a lot of transactions that can become costly, reason why index funds are more economical in the beginning.

As John C. Bogle puts it: “You put up 100% of the capital, you took 100% of the risk, and you got 33% of the return”. It sounds crazy because it is. This is how much paying fees can erode our investments over the long haul.

We invest money to make money work for us, not to pay top executive brokers or Wall Street wolves their over-inflated wages.

Asymmetric risk/reward

The big picture of stocks is that they always go up. Over time the economy and the population grow, and working efficiency and productivity improves. This makes business more profitable, which drives the stock prices up.

Mankind tendency to improve productivity and growth is a natural instinct. We’ve come up with all sorts of theories, engineering masterpieces, ways to communicate, growing food, transportation, etc. All of it with the purpose of productivity growth and quality of life. That’s what humans have been doing for thousands of years, and it is quite unlikely we will stop doing so anytime time soon.

That’s why I and everyone believes that in the long term stocks will always go up, at least in a worldwide basis speaking.

Knowing this fact does not only give me a peace of mind but also an asymmetric risk/reward level on my investments, where the odds of having positives returns outweighs the risks of losing my money.

Furthermore, investing globally doesn’t necessarily mean investing in stocks only. There are several global index funds or ETFs for other asset classes such as bonds or property, that still allow us to diversify our asset allocation without losing international focus.

Silencing the enemy within

The single biggest threat and the major risk to our financial well-being is ourselves. Failing to become the master of our brains and psychology can ruin any financial independence road at any given time. Combine it with a ‘piece’ of one’s ego and you will be removing your train railings off the track, leading you to an unknown painful destination.

That’s not what we want.

From what I could read in this Jason Zweig’s article, neuroscientists have apparently found that the parts of the brain than process losses are the same parts that respond to mortal threads (amygdala). Good investment decisions come from our rational mind (cortex). Having the amygdala messing around with our decisions will generally lead to financial mistakes.

From now on, if you see mad people on Twitter allocating 80% of their money on Bitcoins you know why.

Investing in global funds for the long term is the simplest system and procedure to protect investors from ourselves. Overcomplicate it and you’ll be fighting against the worst enemy there is: yourself.

Conclusions

Investing in global index funds is a passive investing strategy that makes our money work for us while we spend our precious time on doing other things we want or like. Followers of this strategy understand their incapability to outperform the financial markets and accept the fact of not having an edge to do so.

Its diversified geographic exposure lowers the market and currency risks, but most importantly, it silences the highest risk there is — ourselves. Your emotional stability will thank you for taking this approach.

To top it up, this strategy allows investors to keep and asymmetric risk/reward portfolio in a cost-efficient way.

Sleep tight.

Now, with your permission, I am going to grab a beer.

Cheers!

Tony

Related Posts

28 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Glad you are changing! Index fubds are super easy and relaxing. Perfect to enjoy with Estrella Damm!

Haha, I rather Estrella Galicia, you should try it next time you go to Spain for a holiday 😉

Once a month I buy Vanguard’s Total World ETF and go on with my life. That has been my go to strategy in the past 5-6 years. Click buy and go to the beach. That’s it.

Welcome to the club ?

That’s exactly what I do now with any new income, but I still enjoy investing in dividend companies quite a lot but within a reasonable limit percentage.

Thank you 😀

Woo, Tony! Welcome to the simple side 😉

You’ll have to find something more to talk about in your monthly updates now as your investments will be on autopilot 😀

Hey SN thanks! That’s right, I’ll have to come up with some funny stories. I’ve overused the topics of sunbathing and drinking beer so maybe I can talk about bellies or elephants now? ;P

Good strategy, I like it! A lot of global markets are undervalued compared to others, and it helps to avoid home country bias. Good post!

Hey thanks, that’s right, as I understand it, there’s a big gap in terms of value between the US and the rest of the world cos of the FAANG and other technology stocks. Does that mean that US stocks will underperform in a 10 years term? Again, I don’t know, and that’s why holding world trackers seem the best option for me.

I am sooo happy I have found your blog – it is so nice to see somebody on FI journey who is not an investment banker or manager at Google with 6-digit salary :). Good luck!

Thanks, Joey for your kind words, truly appreciated 😀

Welcome to the light side! Hopefully this will free up more of your time whilst making you more money 🙂

Thank you Doc 😀

Yayyy that’s great! You can still keep up with the others ways of investing to feed your little gambler inside, but global index funds are great for diversification. Index & chill from here to retirement!

Exactly, while eating some Nachos on the way! ;P

Hi Tony,

I think it’s a great idea to invest mainly in a global index fund. It really takes away a lot of stress that comes with the share market. You should definitely be sleeping easy my friend!

I have also some bigger holdings in various index funds, but they are not all global (i.e. country specific, emerging markets, USA, and Global funds). Having the emerging markets, and Sweden specific means that I am not overexposed to big American corporations. I am pretty happy with these so far!!

The other advantage is that if you do see something of good value, you can always reallocate some of your funds ?

Matt

Hi Matt,

I do sleep well indeed even with the recent increase in temperatures 😉 I wondered about adding an emerging market index fund to the roaster as the Vanguard world equity fund only takes 10% of emerging markets which seems a bit low. But again, I rather simplify It all as much as possible for now, at least until I get rid of some P2P platforms.

Appreciate the stop Matt 🙂

[…] One Million Journey is transferring his investments to index funds (19) […]

Hey Tony

I was glad to read that you have changed your investing strategy to global index funds.

Like you, the gambler inside me is kept happy with a bit of ‘fun’ money, with my Dogs of the FTSE portfolio and I’ve recently started a ‘£10 US portfolio’ which I haven’t written about yet.

The ‘serious’ side of my investing, ie the huge majority of my equity portfolio is in global trackers and investment trusts.

My portfolio could still be more simple, I have far too many different types of ETFs and investment trusts but happy with the number right now, although I’m sure I will further simplify over the coming years.

Good luck with this passive investing!

Thanks, weenie, yes I finally did it! It’s like stop smoking, I feel like I gave up on a bad habit 🙂

Looking forward to reading more about your’ £10 US portfolio’. You got me curious here!

Hey Tony

I touched upon my £10 US portfolio in my April update, although at the time, I didn’t know it was going to be a portfolio, it was just going to be a few stocks and I was just testing out Freetrade’s fractional shares function.

I’ve basically got a list of well known US companies and I’m just going to buy £10 in each and see what happens. Tesla is already showing +30% and even just owning a fraction, I’m getting paid dividends from some stocks, although it’s just pennies! It’s just a bit of fun, not recommended as any real strategy.

[…] that’s exactly what I did. I put it all in my global tracker ETF. Although it’s a “Shame” that I won’t be able to practice balconing in […]

This is such an interesting post! I actually don’t use index funds – but in my investment trusts I make sure not to be overexposed to one country. (Though up until last year I was definitely overexposed to China, I’ve balanced that now). I definitely think a global approach is better – I actually have no money in the West.

[…] on the supermarket, which is quite high for us. Even though we are back to shopping at Lidl, my new investing strategy allows me to drink more beer, and that costs some money. In addition, my GF is jealous of me, so […]

[…] as I am in the accumulating phase of my journey, I still rather focus my investing strategy in global funds. I’ve seen some people buying gold desperately as if there was no tomorrow. Not because an […]

[…] almost my entire savings for this year went to purchase global equity funds, and these have done pretty well so far! (fingers […]

[…] use the Invest and ISA accounts, the former to invest in dividend stocks and the latter to buy a Global Index Fund on a monthly […]

[…] fund. My investments here will be Index Funds and ETFs, consisting mainly of global funds, as I explained here. I will follow a stocks and bonds balanced approach. My current balance stays at 70/15 I will only […]

[…] second main reason for this sudden drop in income related to a change in my investing strategy during that same year, […]