Portfolio Update #18 May 2020 – 98,145€

Guys, I got good news this month.

I have no new bruises on my face! Or better said… My avatar has got no new bruises on his face. He was getting a “bit” overwhelmed after mistreating him so badly the previous two months, here and here.

So, let’s move on and see how a painless face translates in terms of numbers, stay with me! 😉

Table of Contents

Quick Recap of May Numbers

- Portfolio value: 98,145 € (1.14%) – details HERE

- Monthly Transactions (Deposits – Withdrawals): 1,213 €

- Monthly growth from investments: 2,602 €

- Passive income: 105 € – details HERE

I know, I know!! Why the heck I am still below the 100K? — You may ask. Well… the one to blame is called the United Kingdom, as the pound has fallen from 1.15 to 1.11. If I applied the former I’d be at 100,658 €. To be honest, I rather wait a bit longer and surpass the 100k once and for all, so I can drink more beers to celebrate it? haha.

OK Tony, stop making jokes that aren’t funny to anyone except you and let’s get into the details, shall we?

Portfolio Performance

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted as future withdrawal tax payments

May was another good month for stocks in general. My pension, which is 100% invested in a world index tracker had the biggest rebound, whereas my S&S ISA, which is also invested in bonds and the FTSE 100 Index, did not get that far. Normally a hammer on the Pound means an extra push for FTSE 100, but even that hasn’t been that impressive in May when compared with its big brother S&P500.

As I am simplifying my strategy, the whole process of investing is taking me less of my time and energy, and I have to say that I am liking this new approach. When I look back in time and think about how much I spent on tracking all my P2P investments (to end up losing money anyway), I want to hit my head against the wall!

Alternative Investment Portfolio

So, let’s not get back where I was and keep withdrawing funds from my alternative investments, and carry on leaving platforms until I keep 5 or 6 as much.

I currently hold 10 platforms, meaning I need to get rid of 4 of them at least. Abundance and Estateguru* are two of the platforms I know I want to keep for certain, and Fast Invest, Property Partner and Housers are three of which I’d like to leave, the last two being especially hard to transform into cash or liquidate.

Property Partner has extended the suspension of all dividend payments to the 30th of September. That’s making a total length of dividend suspension of 6 months. Residential rent areas increased from 6.1% in February to 29.7% in May. The Purpose-Built Student Accommodation sector remains uncertain as it relies on the demand from students for the coming academic year, which is far from being clear at this stage. Most of these properties are geared. While I am not too worried about the residential properties, the student accommodation blocks are at a major risk.

Housers continues being as disappointing as usual, but at least it generated some income. Many Spanish investors run out of patience and began legal procedures against the platform.

My investments at Estateguru* are doing well, which is certainly impressive during these times. My portfolio consists of 59 loans, of which only 2 are delayed for over a period of 60 days. No defaulted loans.

Similar goes for Crowdestate*, my expected next payments are being transferred into my account pretty much on time. At the time of writing (06/06), only one payment is delayed out of my 15 loans. So, things are going well here so far too.

I only have three investment with Evoestate*, two rental holiday apartments in Spain (Alicante and Cadiz) that are still not generating any income because of the lockdown and an office building in Tallinn, Estonia that is on track with payments. I would expect to start earning income from Spanish properties since the lockdown is being eased now.

Many of my business loans from Crowdestor* are back on track with payments. So, some more good news from this site. I have good vibes with this platform, but let’s just see how it continues to evolve during 2020. I like many of their loans, but on the other side of the coin, I don’t like that it’s not regulated from any financial authority.

I have no remaining short term loans at Robo.cash*, but only long ones. Terms last until November, so it’ll take me about 5 months to fully exit this platform. It’s true that they seem to be in a strong financial position, but I am becoming more reluctant to invest in platforms that don’t show where my money exactly goes.

Ratesetter is another platform that I will leave as soon as I get my £100 cashback, which I expect to happen in August.

The situation at FastInvest is worrying. It has introduced a special remuneration for delays, promising a bonus for not proceeded payouts within a period of seven days. For the time being, I have 3 delayed withdrawals, the longest being for 6 weeks. Let’s see if I can get rid of FastInvest prior they get rid of me!

Dividend Portfolio

May was another quiet month for my dividend portfolio.

This is the outlook of my holdings at the month ending:

Dividend Payments

Three of my holdings distributed dividend in May.

AT&T (T): 10.34 €

Mastercard (MA): 0.56 €

iShares Developed Markets Property Yield USD: 9.85 €

Total Income in May: 20.8 €

That’s makes almost 20% of my total monthly passive income. 🙂

New Holdings And Purchases

My dividend portfolio makes 10% of my total investible assets, which is the limit size I want to keep it at. As a consequence, I am no longer actively looking for new stocks to buy. However, I am keeping a close eye on the Noble 30 Index by the European DGI and some other stocks such as the Spanish clothing company Inditex (ITX) and the American semiconductor Intel (INTC).

2.63 Wells & Fargo (WFC) shares @ 23.47

0.64 AT&T (T) shares @ 29.34

6 iShares Developed Markets Property Yield USD @ p1569

5 Invesco (IVZ) shares @ 6.79

2.16 Walgreen Boots @ 42.3

The €45K Project Fund

I’ve been a non-smoker for over a year. That’s right, ONE YEAR has already flown by since that.

I had a look at the latest changes in duty rates for tobacco products in 2020. As stated on the official government site, these are the increases:

“As announced at Budget 2020 the duty rate on all tobacco products will continue to increase by 2% above Retail Price Index (RPI) inflation. It was also announced that hand-rolling tobacco will rise by an additional 4%, to 6% above RPI inflation this year.”

The Retail Price Index (RPI) inflation seems to be somewhere close to 1.9%, taking into account that I used to smoke a hand-rolling tobacco, it means a total whopping price increase of almost 8% for 2020.

All of that means is that my monthly contributions towards my €45K Project Fund increase from £50 to £54 moving forwards.

So, £54 that went into the ‘Liverpool Community Homes Debenture 2’ project that is still funding in Abundance.

So far, I have recovered 2.14% of my loss = 965.2 EUR

44,034.8 EUR left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

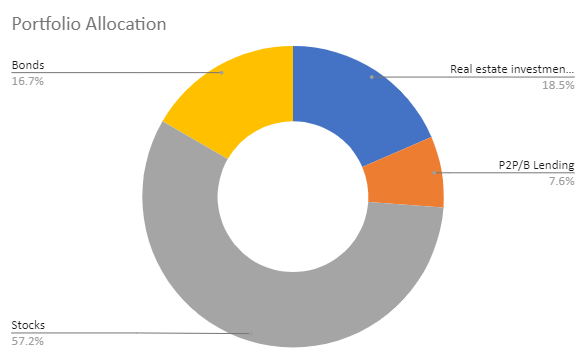

Portfolio Allocation

It’s been a while since I last shared my allocation on a portfolio update, so let’s just do that and write some comments on it.

As you can see, stocks are taking more than half of the doughnut chart, whereas alternative investments are down to 26% and bonds take only 16.7%. I am keen to be somewhere close to 70% stocks, 20% bonds and 10% alternative investments. So, I still need to keep doing what I am until I get close to my allocation target.

This is it for this month, be back in July. You guys take care and stay safe.

Tags In

Tony

Related Posts

10 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Nice post and congrats!

Damn currency fluctuations though aye, haha!

Thanks J, similar think happened last year, before the summer, and then it rebounded nicely against the Euro. Hopefully it will repeat in 2020 as well 🙂

[…] Tony’s Portfolio update 18 May 2020 […]

Wrote one reply, but I don’t think it went through, so let’s try again.

Congratulations on being a non-smoker for an entire year! Not an easy feat, I can imagine.

Agreed with your investing strategy. Much easier to track when it’s all in one or two funds! Looks like we’re adopting a similar strategy – stick most of it in an index fund, and then allow a small amount to satisfy the desire to dabble.

Thanks for insisting Doc.It seems something must be wrong, but I’ve got no idea what it can be. I am definitely not an Elon Musk, haha.

Thanks, it’s a great personal achievement. It was painful, but totally worth it. 🙂

That’s the approach I am taking now. I keep my Vanguard ISA as it is (rebalancing twice per year as much), and began a new one with Trading212 this tax year, where I only purchase the World ETF from Vanguard.

Much easier.

My dividend portfolio is made out of blue chips companies mainly. That said is quite passive as well (according to the ‘Intelligent Investor). Then 10% with P2P or Tesla types of shares to feed the little gambler!

Almost there, Tony! Keep up the good work.

Hehe, thank you for cheering me up! 😀

Great update Tony – unlucky with the currency fluctuations but you’ll be at the 100k in no time!

And congrats on being a non-smoker for a year! None of my friends are smokers now, with the last one having switched to vaping, which is cheaper than smoking and in some ways ‘healthier’ but probably worse in other ways (unknown risks). I hope eventually, she will give that up too.

Thanks weenie :D, I sometimes wish I had it all in a single currency, so I’d have one less thing to worry about, but it’s something I must deal with whether I like or not (so, I better like it!).

I tried vaping as a preparation to stop completely but it did not work out with me. I became addicted at it, and ended up vaping too often. As you say, it’s a relatively new thing, so we haven’t got enough data to know all the risks. Hopefully your friend will stop that too, yes. We’ve got enough testers I believe, no need to contribute on that.

[…] The total return of current holdings still remains in the red but has improved slightly since May (- 8.48%). […]