Portfolio & Savings Update #26 January 2021 – 124,201€

Friends! The first month of this new year January 2021 is behind us and thus it is time for another portfolio and savings update.

Table of Contents

January In A Nutshell

January was an emotionally intense month, where nothing and a lot has happened at the same time. Nothing in terms of going nowhere due to restrictions and a lot in terms of changes.

Ever since the promotion, my framework of ideas or paradigm has made a substantial change. There’s a big difference from one day being a senior designer who designs, to being a “manager” with the “mission” of building up a designing team from scratch.

Many times, when working for a family run business as per my case, it involves having no training programs of systems of any kind set in place. In a way, I like this, as it gives me the freedom to self learn and improve along the way without the necessity of being told off how you must do things constantly.

Unfortunately, due to several reasons, I’ve barely had any chance to learn my new role. I’ve been involved in a Faulty Towers situation in which I had to put a lot of my personal time to try sorting out. When I say the personal time I mean exchanging days of holiday, working during Christmas, Saturdays and also one or two hours of extra work during weekdays.

My new “mission” went from having meaning to becoming a totally fuck*d up fella. How much of my own time I should put trying to sort out other people’s mess? Obviously, the argument was that other people mess had become my own mess too.

Reading a lot of personal development stuff has made me an emotionally stronger and determined guy, but when the situation loses its own balance for the a long term things begin to fall apart.

And that is exactly what’s happened to me. My life started to go downhill since my promotion. As days passed, the downhill becomes more prominent, accelerating at a speed I had never encountered before. Then I soon reached the bottom, which meant I would start acting meanly to others, including those I love.

Is that the price to pay for more money and recognition? It’s definitely not a price I am happy to pay for.

I visualized how my life would look like in ten years if I were to continue following this road. I could see myself being mean to my partner and kids every day after work and having an unhappy life, which is not exactly what I wrote on my one million journey plan.

Giving in My Notice

It was clear to me, this was not my path, and I was ready to shake it out of my life! So, soon after experiencing that visualization, I handed in my notice ready to fire my boss!

Phew!

— Tony | Onemillionjourney.com (@JourneyMillion) January 26, 2021

I’ve just given n my notice at work!

What a relieving feeling!

Saving for a f*ck you money fund during 2020 was a good decision.

Thanks to that I no longer need to do a job that makes me miserable!

F-you!!

I’ve really come to truly realize how important it is to keep oneself financially healthy. As much as you think that you have total control of your life – it isn’t true, it’s just an illusion.

Whether we like it or not, life can turn sideways at any time, and not being financially stable can put you in an undesirable situation in which you can’t escape, meaning you become a prisoner of your own life – scary!

I’ve also really come to truly realize how important it is to keep yourself in balance. Losing your balance can have destructive compounding results. It all starts with being unhappy at work, then being unhappy at home, then getting a divorce, then losing your kids, then becoming an alcoholic (do I need to continue?). You get the point, I hope.

A lot more has happened since I gave in my notice. I am still working, the work environment is slightly more relaxed (at least I am managing to write this on a Saturday morning before I go for a sunny walk, YAY!!) and I have extended my notice, but there are some exciting changes coming along in 2021, muahahaha! 😀

I was supposed to write about this experience on a separate blog post, but I’ve been experiencing this thing some call writer’s block. There are a lot more reflections behind this experience, so I shall write a proper post sometime (maybe or not I don know).

OK, enough emotional witting, let’s dip into January numbers, shall we?

Quick Recap of January Numbers

- Portfolio value: 124,201 € (+3.29%) – details HERE

- Contributions to the portfolio: 2029 €

- Monthly growth from investments: 376 €

- Passive income: 304 € – details HERE

- Savings Rate: 59.3%

The savings rate is below what I had expected due to a major fact happening in January. My partner lost her job, meaning that I need to cover a higher percentage of our expenses. My savings rate goal for 2021 is 60%. It’s going to be challenging to accomplish given this new situation, but I will certainly keep doing my best, as usual!

I am close to my saving target in January thanks to a couple of things:

- I scrapped my Fordkari (sniff, sniff!!! sad moments :(), which made me £132 of extra income. The car needed a £300 fix to pass the MOT, so I didn’t think it was worth the investment. I am back to using public transport which seems to be running pretty well during Covid-19 times thanks to the increase on the number of busses on circulation.

- I am now pulling out 300 Euros from the rental warehouse in Spain to my UK ISA. This is going to be shown as rental income in my…

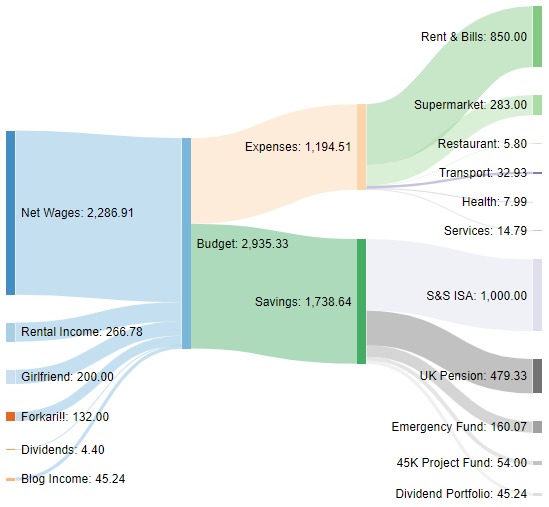

…Monthly Cash Flow Sankey Diagram

Total income in January equals £2,935.33 (3,316.55 EUR).

Total expenses are £1,194.51. I’ve seen a significant increase in the Rent&Bills category, going from £450 to £850. The Supermarket or groceries expense has also taken the hit!

My partner contributes £50 a week, which despite the situation it’s very helpful to cover part of the monthly expenses.

There has not been a lot of action on the dividend side of my portfolio. Total interests derived from bank and P2P accounts were negative £-2.18 (yes, negative!), more on this later.

January Portfolio Performance

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

Value stocks seem to have gained some momentum in January, a fact that it is being reflected on my dividend portfolio, where I enjoyed from a +2.4% gain. Finally, this is some good news for the value investing philosophy as it had been underperforming the market for a worrying number of years on a row!

Since I recently sold my Vanguard Value ETF, the only side of my portfolio in which is partly value-oriented is my dividend portfolio. It seems a bit unfortunate that I sold the value ETF just before gaining some momentum, but emerging markets (the fund I bought in exchange) have also done great since it has increased +9% since I bought it back in December!

On the P2P side, my Crowdestor account keeps losing money which has contributed to having a negative interest income this month.

Some good news is that I managed to exit another platform successfully as RateSetter is now part of the past. Taking into account the £100 cashback reward, the annualized return was 10%, so finally a happy ending story in the P2P world for me!

Pound Sterling increases against the Euro from 1.11 to 1.13. Woo-hoo!

Dividend Portfolio

My dividend portfolio in January generated 4.97 EUR of passive income.

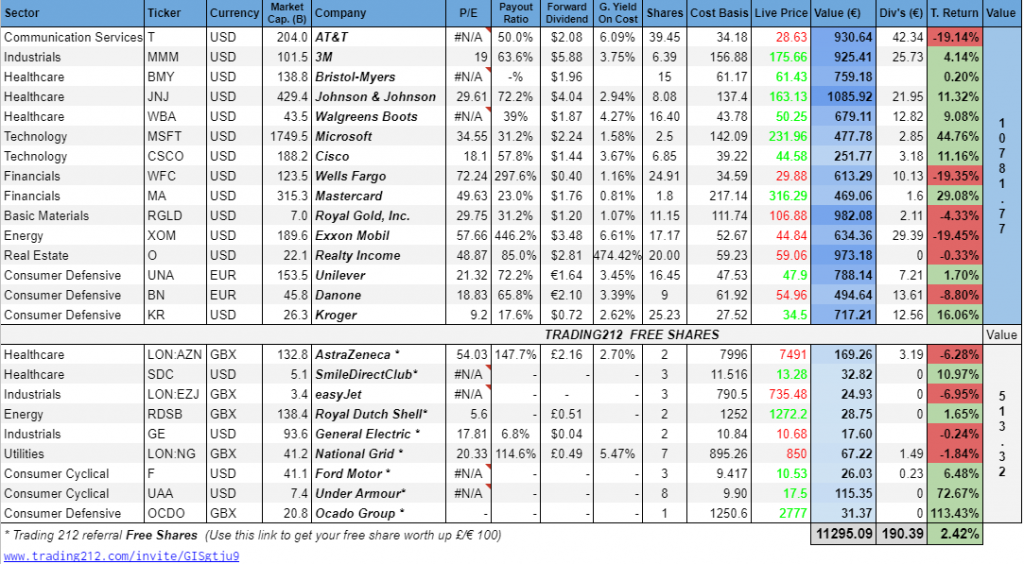

This is the outlook of my holdings at the end of the month:

It will be soon one year since I began with my dividend journey experiment and to be honest I am very happy I did take this step. I’ve connected with many other knowledgeable people and I have deepened my leanings about general investing. I read more annual and quarterly reports as well as other investors analysis and opinions. Furthermore, I also listen to more podcasts and videos on YouTube. And not only that, but the fact that I take it as a hobby, or as a way of disconnecting from the engineering world, It has added positive value in my lifestyle, so I don’t consider it a waste of time,

In 12 months, my dividend portfolio has generated 242 EUR of passive income. Based on an average invested amount of 9K EUR, my net yield is 2.7%. Considering that I held companies that paid no dividend in 2020 such as Disney or First Solar, that I am invested in low dividend payers such as Microsoft and Mastercard, and that some of the free shares I earned pay no dividend at all, a 2.7% net yield look acceptable to me, especially if I compare it to the negative yields from the P2P lending industry.

I am looking forward to beginning my second year of dividend income and to start comparing it year over year! You shall soon start calling me pro dividend investor babies! 😉

Dividend Payments

Three companies paid dividend in January:

- National Grid (NG): 1.14€

- Cisco (CSCO): 1.72€

- Royal Gold (RGLD): 2.11€

Total Dividend Income in January: 4.97 €

New Holdings And Purchases

Besides reinvesting all my dividends, all contributions to my dividend portfolio came from earned free shares this month.

- easyJet (EZJ) 1 share @ p806.2 *FREE SHARE*

- easyJet (EZJ) 1 share @ p800.4 *FREE SHARE*

- easyJet (EZJ) 1 share @ p764.8 *FREE SHARE*

- Ford (F) 1 share @ $9.97 *FREE SHARE*

- Royal Dutch Shell (RDSB) 1 share @ p1398.2 *FREE SHARE*

- iShares Developed Market Property ETF (IWDP) 58.93 shares @ p1801.5 *FULLY SOLD*

- Realty Income (O) 20 shares @ $59.23 *NEW POSITION*

- AT&T (T) 5 shares @ 28.69

- Royal Gold (RGLD) 1.12 shares @ $106.81

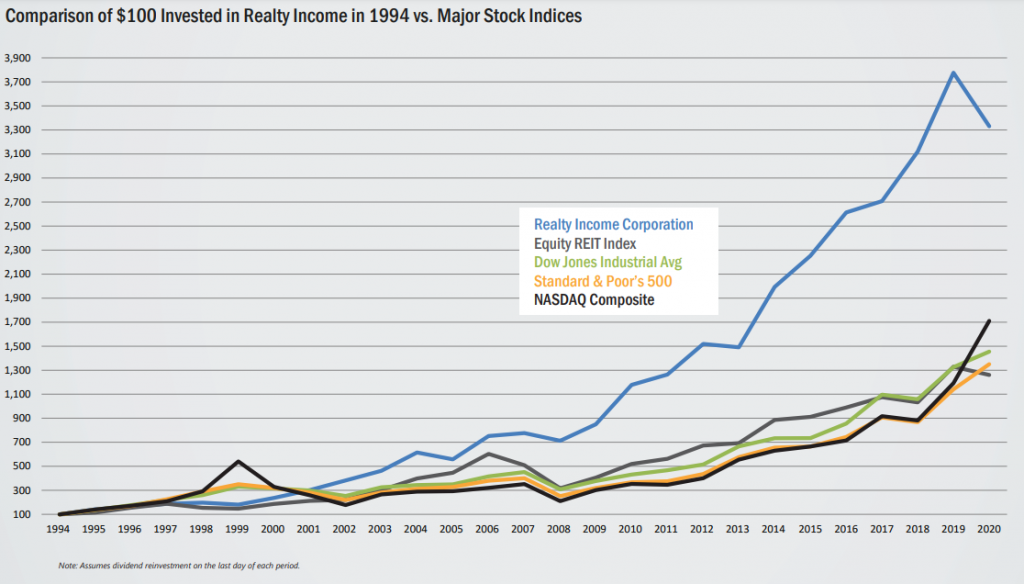

The main movement in January was selling the Property ETF IWDP in exchange for Realty Income (O) REIT.

The IWDP ETF portfolio consists of 319 REITs spread around developed markets with a focus on income. I have no doubts about IWDP being one of the best ETFs to own for added diversification. However, it comes at a high cost, as the total expense for keeping this ETF in your portfolio is 0.59%. The distribution yield at the current share price is 2.88% which is rather low coming from an income-focused investment fund.

I’ve carried an uneasy feeling since I initially purchased IWDP due to these ratios, but my lack of expertise in the REIT world did not allow to choose any specific REIT, so I thought diversification and overpaying was the way to go until I made my mind a bit clearer.

I’ve been looking at tons of REITs for a while, Spanish REITs, UK REITs, US REITs, Retail REITs, Industrial REITs, Residential REITs, Health care REITs and so on.

With so much variety, how do you choose only one?

I don’t know how to answer this question, so I took the easy path and chose a REIT within the S&P 500 dividend aristocrats — Realty Income (O) The Monthly Dividend Company.

All being said, the fact that this REIT pays monthly dividend was a major fact for choosing it!

I looked at others such as STAG Industrial Inc (STAG), W.P. Carey (WPC) and Federal Realty Investment Trust (FRT) but Realty Income (O) got to win also thanks to the popularity in the dividend investing community.

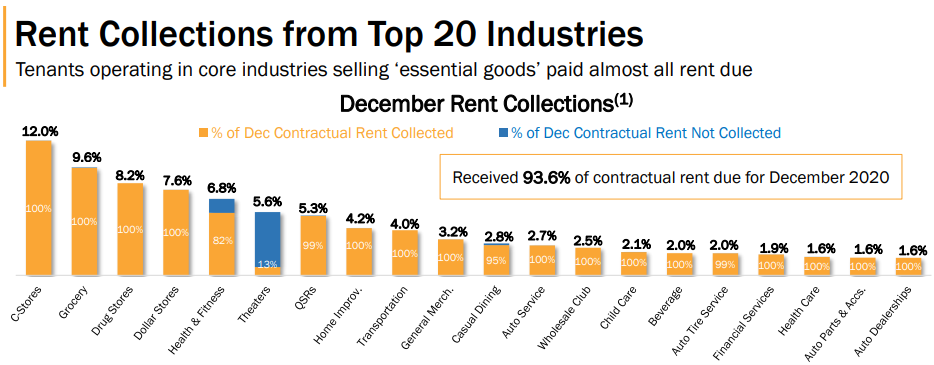

Facts And Figures I Liked About Realty Income (O)

- Large-cap stock with a market capitalization above $29 billion.

- Wide diversification with a portfolio of over 6,500 properties under long-term net lease agreements.

- S&P credit rating A-

- The portfolio consists of retail standalone properties (not malls).

- Attractive dividend yield of 4.6%

- 93 quarterly dividends increases (23 years)

- Great past returns and performance.

- The company received 93.6% of the rent in December despite Covid-19

- Did I mention it pays monthly dividends???!!!

So to conclude, is Realty Income the best REIT to own? Unfortunately, once again, I have no proper answer to this question. All I can say is that I feel confident about it. Being familiar with many of the top 20 tenants helps to build confidence, as these are strong businesses. To name a few: Sainsbury and Argos, Walgreens Boot, Walmart, Kroger, Home Depot, FedEx, and so on.

The €45K Project Fund

Another month has passed which means I saved more money as a non-smoker, cash that goes into my 45K Project Fund.

As we started a new year, it’s time to apply the corresponding price increase in tobacco. The duty rates for rolling tobacco increase a whopping 6% above RPI inflation, the same as the previous year. The RPI inflation for 2020 is 1.5% if I am not wrong, which means that If I were a smoker today, I’d be spending 58 EUR, which is 4 EUR more than last year.

To round it all up I will increase my monthly contribution to the 45K Project Fund to 60 EUR a month from now on.

I am still struggling to invest new contributions as Abundance Investment has gone quiet and Qardus offer a low amount of funding projects which become fully funded before I got a chance to invest.

So far The 45K Project Fund consists of:

- Abundance Investment: 1,140.7 EUR

- Kiva: 82.49 EUR

- Qardus: 344.9 EUR

- Cash: 125 EUR

So far, I have recovered 3.76% of my loss = 1,693.09 EUR

43,306.91 EUR left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

Goals and Habits 2021

It’s time to have a look at how I am doing with my 2021 goals and habits for 2021.

This time, all my goals are measurable so the same as last year I’ve built a table to keep an eye on the progress.

I could have had a better start in regard to my 2021 goals. I started the year paying a lot more attention to work which affected the results.

I injured my left foot during a run, so I’ve been unable to keep that habit which has largely impacted the number of steps I make. I also notice my stress levels increasing. My foot is much better now, but I fear it will start hurting again if I push for a run too early.

I recently discovered the Peloton app. Some folks on Twitter recommended it, so I decided to give it a go and signed up for the 30 days trial. I have not stopped using it since day one. I am doing all my weight lifting exercises (strength classes) and guided meditations using the app. It’s also helpful to keep track of workouts and how much you train which becomes handy for my goal tracking purposes. It costs £12.5 a month in the UK, which I think it’s well worth the money considering a gym membership costs no less tan £20. If you are also in Peloton you may meet me in one of the classes as a 1millionjourney. 6 pack abs, I am coming for you! 😉

The book I read this month was The 7 Habits Of Highly Effective People by Stephen R. Covey. A bit boring and tough to read, but it contains valuable insights. In case you wonder what these 7 habits are, I am going to write them down for you so you can decide whether it may be a book you would be interested in reading it.

- Be Proactive

- Begin With The End In

- Put First Things First

- Think Win/Win

- Seek First To Understand, Then To Be Understood

- Synergize

- Sharpen The Saw (Continuos learning)

This is it for this month, I hope you have a great month wherever you are and thanks for reading.

Peace!

Tags In

Tony

Related Posts

8 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

It’s a shame that the promotion wasn’t what you thought it would be, but good to hear that you were able to take action and hand in your notice. The benefits of pursuing FI! Looking forward to seeing what you’ve got in store for 2021 🙂

Relieved to see that you were eventually able to get all of your money back from RateSetter, even if it took far longer than expected. I always felt guilty that you used my referral link, and then not long after the liquidity crashed!

Oh yeah, I forgot that I used your link to join, wow, it’s incredible that over a year has gone since then, Jesus! Glad it worked out well! 😀

I may be able to negotiate something with my boss as managers are trying their best to keep me around the business. The way they reacted after I handed in my notice surprised me. The fact that I am not desperate for work or money puts me in a better negotiating position. We’ll see how it develops.

Too bad the promotion didn’t turn into your dream job.

But now that Tony is out of a job (soon maybe) and the missus too – and the fordkari is gone too, is Tony and GF gonna leave the UK in favor of a more sunny location, maybe? 😉

Happens, knew the risks of accepting the new role, I don’t regret trying it at all. New experiences, new learnings.

Hehe, it’s on the table as a possibility. We have a couple of plans in mind, we’ll choose according to how covid evolves (it’s hard to plan ahead decisively as you never know what the next move for the virus will be). Hopefully, we’ll get something clearer as the spring approaches 🙂

Btw, I like your new Canadian dividend acquisitions, especially Bank of Nova Scotia! I am convinced it will cash you in better returns than some of your previous P2P lending investments (or at least a better risk-reward balance). Looking forward to following the development of your “new” stock portfolio.

Hey Tony

Just catching up on my blog reading! Good to hear that you have exciting opportunities for 2021 – you were right to step up for that promotion but also right to hand in your notice when you realised the job was not healthy for you. FIRE gave you the option to do what you did and like you say, you are now in a strong place to negotiate.

Anyway, here’s to more dividends this year!

Ou yeah with or without job dividends will always be there haha 😉

[…] One Million Journey Portfolio & Savings Update #26 January 2021 – 124,201€ […]

[…] That was my initial mindset after all the BS meetings I had had with owners/managers. Soon I noticed that what the company wanted from me didn’t line up with my long term professional goals. Owners were after replicating my skills to someone else, trying to “make a copy of me”. I sensed lies were behind their fake words, as I found myself becoming more of a trainer rather than an actual manager. Disappointment+covid+lies+GF losing job+things I needed to do in Spain (=) equalled hasta la vista babies! […]