Portfolio & Savings Update #40 Q2 2022 – €186,588

Hola amigos/as! Another quarter went by, which means it is time for a quarterly portfolio & savings update to count Q2 2022 in the books.

Table of Contents

Q2-2022 In A Nutshell

It’s been three months since I last posted on this blog, it seemed like ages to me. Despite not publishing updates, I’ve managed to keep on tracking my income, expenses, and investments on a monthly basis successfully. If I deleted my Twitter account and blog, I think I would probably be just fine with my long-term financial goals. However, I missed the thought process of writing on the blog. I like the action of sitting, thinking, and writing. It resets my mind.

So, what’s been happening during Q2-2022?

A lot. Some are sad events and others are happy ones.

April was a tough month as my mother passed away. I was happy with me no longer writing monthly updates, otherwise, the April update would have been the most depressing thing you would probably read in this entire year. That event leaves me with me being an orphan at the age of 36 with no siblings, kind of scary if you ask me. There’s no doubt that I need to prioritize my health and finances, as I don’t have a lot of people around to help me if things twist the wrong way for me.

Luckily for me, funerals and burials take place within the next two or three days of the death in Spain. After that we spent a couple of days hiking in the mountains to get myself back to a “position of a life attack”, and then we took our flight back to Liverpool.

Before all this happened, I had had interviews with 2 employers. They both offered me a job while I was in Spain, so I knew I was coming back with a job starting date. That was great, as it allowed me to disconnect from sadness and refocus on being back to normal.

Out of these two jobs, I accepted the one with worse conditions. The better one offered me £3,000 of annual extra salary, £3,000 extra on car costs, a permanent contract and annual bonuses. The one I took was only a 6-month fixed contract with no further benefits. Choosing one job over the other wasn’t easy, the higher paying with a permanent contract one was at first the obvious one, as it allowed me to earn more and also buy my so much dreamed UK house, but it had two huge drawbacks: it was located in Bolton, which would mean relocation to Manchester or Bolton long term, and it was a business in the construction sector. I got tired of working in the construction sector in the UK, so why accept a job that I know I may don’t enjoy so much? So I ended up taking the risk and accepting the other one, despite the lower wages and worse conditions. I now work for an engineering consultancy, whose owner is Catalan, so I get to speak Catalan and English at work in the UK. My colleagues are all clever guys with different backgrounds, I work with an Indian, a Brazilian, and a Scouser (apparently they don’t like to be called British) and love it! Best of all is that I am refreshing a lot of mechanical engineering concepts that were full of rust in my brain and, I am also learning a lot about engineering applied to life science, automation, pharmaceutical, the tobacco industry, food industry, etc. I am actually doing a master’s degree job despite holding only a Bachelor´s, this is an opportunity I am having thanks to skill shortages and also being Catalan! 🙂

I’ve been doing this job for two months, I am happy, I enjoy it for now, but the biggest drawback is that I can’t apply for a mortgage, so unless I can get a permanent position within this company soon I am not too sure if this will be a happy ending story.

Besides all of this, we continued discovering Liverpool. Despite the shitty weather we are having this summer, I like it here more than in the South of England. I struggle with the accent, though, but hope to fine-tune my ears soon (hopefully!). There is plenty to discover around, for instance, we still haven’t visited Manchester. It’s going to take a while before we get bored of this area! 🙂

Let’s jump into the numbers for this quarter.

Quick Recap of Q2-2022 Numbers

- Net worth: €521,496 (-2.7%) – details HERE

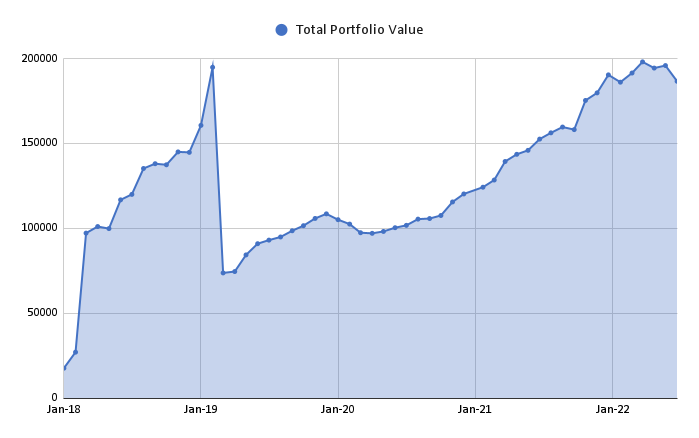

- Portfolio value: €186,588 (-5.7%) – details HERE

- Monthly growth from investments: €-17,615

- Passive income: €3,977 – details HERE

- Savings Rate: 42%

Comments

My savings rate is stabilizing since I didn’t pay any rent this second quarter. I had to buy a car for commuting, though this was not counted as an expense, I still needed to pay for taxes and car insurance. In April I spent almost £600 on buying stuff we needed for our new place in Liverpool. Inflation is getting to a level we haven’t seen in many years, it will be challenging to keep saving rates above 50% or 60% as I used to. My flat in Spain is also going against me at the moment, as we don’t seem to find a reliable buyer. Once I sell it, it will save me around €1,700 a year, a nice amount to be put elsewhere as to my dividend portfolio for instance.

My portfolio overall has been kind of holding tight until June when it experienced a drop of nearly €-10,000 despite me contributing nearly €3,000.

I have no mental issues with the value of my equities going down, but it annoyed me to see my global fund bond crashing since it should be a lower risk, lower volatility investing asset. It seems to be recovering quickly since mid-June. Fingers crossed that recovery completely materializes so I can sell them to buy equities at a discount, which was the initial purpose of my holding them for starters.

(See my full index portfolio here.)

Will I manage to at least reach the €200K mark this year?

Monthly Income and Expenses

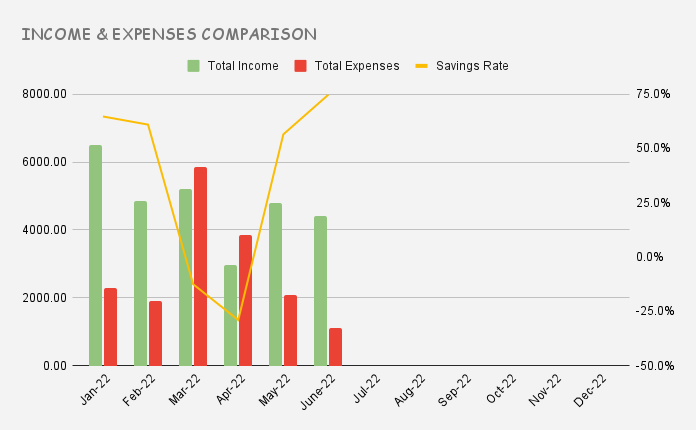

This quarter, savings amounted to £5,131 (5,951 EUR).

This is the outlook of my income and expenses in 2022 so far:

Glad to see my savings rate recovering after the major expenses I had when relocating back to the UK. My average savings rate for this year so far is 40.6%. Unsure If I will manage to increase that back up to 50% but 40% still looks good to me considering the current situation.

Portfolio Performance

As I like to do on a quarterly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

The spreadsheet looks bloody red for this quarter!

There are no major big changes in my portfolio compared to the last quarter. Perhaps the only significant event was the crash of Luna and its stablecoin UST. I had sold all my Luna coins before the crash when it was at around $80, the problem is that I used the proceeding to buy UST instead, so I ended up losing it almost all anyway. I still hold UST coins in Binance at a value of $33. I couldn´t be bothered and decided to write it off from my investments. We received an airdrop of the new Luna 2 token as compensation, but it kind of looks funny in the spreadsheet to me so I think I may just remove it unless its price shots up next quarter?

Another major development in the crypto sphere was (what is likely) the bankruptcy of Celcius Network. Fortunately, this hasn’t affected me as I didn’t use this platform. What I use though is Nexo, and even though it seems to be doing just fine, I don’t feel comfortable investing that much EURX with them. I have fixed deposits until August that currently pay a 9% interest. Hopefully, they manage to stay in business until I manage to withdraw at least some of my investments.

On the P2P side of things it’s all plain sailing on Estateguru and Reinvest24. The Crowdestate exiting progress is going well, I’ve now withdrawn more than I invested, so even if I lose all my remainings in the platform, returns would still be positive. Housers and Crowdestor are being a slow and painful withdrawing process. On Property Partner, I am just waiting for PP management to sell the last property I’ve got in my portfolio.

In case you’d be interested in joining Estateguru or Reinvest24, you are welcome to use my links below. Also, check out this comparison between the two.

Dividend Portfolio

Finally, I get to look into my dividend portfolio which has generated €148.81 of passive income this quarter, super!

This was the outlook of my holdings at the end of June:

The only relevant move from my side this quarter was to sell my Danone shares in exchange for some Broadcom and Cisco shares. I am not confident about how Danone will manage to compete during this inflation crisis and beyond. Danone’s products are expensive, and I expect consumers to go after bargains. I even stopped buying Danone and Alpro products because I find better deals in other brands. I know Danone has been trying to cut its product range down to reduce costs, but what this tells me is that the company spent on ID resources and money to create products that aren’t working. To top it up, they cut their divident last year, it’s only paid annualy and the withholding dividend taxes are as high as 25%. It just doesn’t add up in my portfolio.

I’ve also recently bought some Microsoft shares with the aim of increasing my holding in the technology sector. This is how my dividend portfolio allocation is looking now:

Dividend Payments

I received dividend payments from these beauties:

| Ticker | Company | Apr | May | Jun |

| T | AT&T | 10.86 | ||

| MMM | 3M | 9.06 | ||

| LGEN | Legal & General | 9.6 | 51.02 | |

| BMY | Bristol-Myers | 6.72 | ||

| GSK | GlaxoSmithKline | 10.77 | ||

| JNJ | Johnson & Johnson | 7.42 | ||

| WBA | Walgreens Boots | 6.61 | ||

| BATS | British Tobacco | 19.98 | ||

| LEG | Leggett & Platt | |||

| HD | Home Depot | 5.57 | ||

| UVLR | Unilever | 12.07 | ||

| BN4 | Danone | 16.66 | ||

| KR | Kroger | 4.26 | ||

| CSCO | Cisco | 2.12 | ||

| AVGO | Broadcom | 5.13 | ||

| MSFT | Microsoft | 1.25 | ||

| MA | Mastercard | 0.71 | ||

| XOM | Exxon Mobil | 12.9 | ||

| RGLD | Royal Gold | 2.55 | ||

| O | Realty Income | 4.16 | 4.32 | 4.32 |

| TD | Toronto Dominion | 10.59 | ||

| Q2-2022 –> | Monthly Income –> | 34.33 | 69.84 | 114.48 |

Here’s an update on my year-over-year dividend comparison:

Legal & General dividend kicked in June which ramped up my income since this is a semiannual dividend payer company. It’s rewarding to see the dividend income slowly gaining moment in a bear market.

That was it for now financial friends, hope you had a good quarter yourselves?

Tony

Related Posts

2 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Sorry to hear about your mother 🙁

How are you feeling about it now, since you had a few months to digest her passing? I know she’s been ill for a while. At some point its better that they get peace than to suffer in pain or agony.

Hope your job sitiuation pans out! I know it most have been difficult to choose between those two offers, but it def sound like you made the right choice 🙂

I’m quite ok Nick, thank bud. Tbh it has been kind of a relief since I knew this had to happen eventually for years. I can at least now look forward to living my life and she’s finally resting in peace which is what she wanted long ago.

Thanks! I definitely care less about money and more about being happy. Our lifes may turn upside down at any time, so let’s enjoy while we can in a balanced way ??