Portfolio & Savings Update #31 June 2021 – 152,533€

Ladies and gents, another month went by, which means it is time for another monthly portfolio & savings update to count in June 2021.

Table of Contents

June In A Nutshell

My second month in Spain was pretty eventful. Here’s a list of things I’ve been up to or happened during June:

- My portfolio has surpassed the 150K mark, which was one of my goals for this year! Yay! I was not expecting to reach this mark so early in the year. This is mostly thanks to stocks (70% of my portfolio) which have performed well so far this year. That puts me slightly ahead on my millionaire plan.

- I managed to sell a lot of second hand products which main mission was to collect dust. That gave me an extra income of £703.5 to add to my compounding machine.

- We enjoyed hiking on Alta Garrotxa and Costa Brava (Lloret-Blanes) despite the higher that I would like temperatures.

- I managed to post another millionaire interview and a review on Reinvest24.

- We moved my mum to her new home care.

- I finally received my fist Covid-19 jab.

So, overall, it was a great month. I can’t wait to continue enjoying the rest of the summer months. However, Covid-19 cases seem to be increasing quite a lot here in Catalonia, and given that tourists are allowed to come in and restrictions are quite tolerant, I can only see it getting worse for the upcoming weeks. I should be fully vaccinated and “protected” but my partner won’t get a vaccine as she is not Spanish. I tried to get advice on what possibilities she’s got, but no one could give me a clear answer on what to do, so I am still expecting to have another rather quiet summer, as the risk for not vaccinated people are just way too high.

Quick Recap of June Numbers

- Portfolio value: €152,533 (+3.15%) – details HERE

- Contributions to the portfolio: €2,694

- Monthly growth from investments: €4,600

- Passive income: 1,194 € – details HERE

- Savings Rate: 69%

Stocks had a nice run in June and that gave a welcomed boost to my portfolio. Many investors seem to be concerned about the stock market entering a bubble. I keep hearing about an imminent market crash since the very first day I put my first £ to work. Bubble or not, I am going to stick firmly to my plan and keep dollar-cost averaging stocks month after month.

After some pondering and testing, I came up with my new investing strategy.

For now, I plan to continue contributing to my SIPP about £1,000 a month. Then I expect to be able to invest another £500-750 on the FTSE All-World Acc via my old Freetrade account, which I had forgotten I even had! Then I am also expecting to invest another 350-500 Euros in Fidelity MSCI World Index Acc, which is another accumulator global fund, but this time via a Spanish platform. I am also going to keep a close eye on dividend stocks and alternative investments such as P2P, but always keeping in mind my allocation target.

I think this will work as a starting point. During the next months, I will see how it works and if happy, then I can “formally” write it down on my year 2 millionaire plan update.

Monthly Income and Expenses

In June, family income went through the roof as we got 1.3K Euros on tax returns and a double payment on pension. So the total income was £7,605 (8,821 EUR).

Unfortunately, we also had more expenses than usual as I had to buy a new fridge for 350 EUR (still waiting to be delivered because of chip shortages), had to take my car to the garage again as the starter motor died (268 EUR), bought a new smartphone for my mum (100 EUR), paid yearly council taxes (250 EUR), contributed the annual 360 EUR to the community of neighbours and also spent a bit more on eating out (you know paellas and these type of tasty Spanish dishes are extremely tempting :D). Altogether we spent £2,359 (2,736 EUR), which is also a lot of money.

Despite this, it is nice to see that I managed to keep the savings rate above my 60% target!

Savings Chart

Portfolio Performance

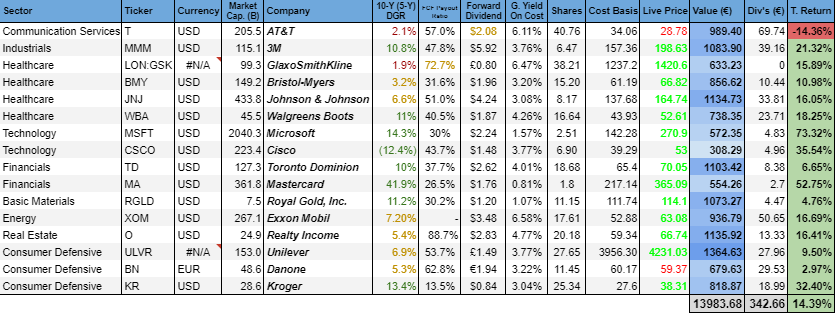

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

In June, the S&P500 Index increased 2.2%. That went pretty much in line with my returns on my S&S ISA accounts and my dividend portfolio. My UK pension always shows higher returns, as I count employer contributions and tax reliefs as investment returns.

I added my new two global funds, FTSE All-World and Fidelity MSCI World, but these show small monthly returns as they were added late in the month.

Return to date is -15.9%, I am getting closer, babies! My financial mistakes with Algotechs, Envestio and Grupeer are about to be kicked out!

Alternative Investments Portfolio

No new additions to my investment portfolio this month.

I am withdrawing funds from Crowdestate as most new development loans have a full bullet repayment schedule. I am a big fan of earning monthly interest on my P2P investments, so I am always trying to avoid full bullets loans.

I continue withdrawing funds from Crowdestor. 11 out of my 16 loans are late, so until this ratio has not improved, I plan to continue doing so.

My investment return with Property Partner is at the edge of becoming negative after the latest property valuation update. I hope this will be just temporal and the student block’s price will rise as Covid-19 fades. At this stage, even Housers’ performance is greater than Property Partner’s. A Spanish product doing better than a proudly made British one? That is interesting to watch!

Qardus is doing well but does not offer enough projects, so after some cash drag issues, I decided to withdraw.

Similar issue with Abundance, not enough projects or the returns are way too low.

Still, no luck withdrawing funds from FastInvest. I still believe in miracles, though, so let’s see!

That finally leaves me with Estateguru* and Reinvest24*, which are the platforms I like the most at the moment. Estateguru is completely hustle-free if using the autoinvest feature, so I just keep it on and look forwards to earn interest payments every month. On Reinvest24, I am following closely their first German rental project and plan to buy some shares when it gets a bit closer to the funding target. Both of these platforms offer bonuses if using the links down below to join:

Dividend Portfolio

My dividend portfolio in June generated 48.07 EUR of passive income.

This was the outlook of my holdings at the end of the month:

My dividend portfolio keeps looking green and good. The total value is now near the 14k mark. As per my current investing strategy, my dividend portfolio should be 10% of the total value of my portfolio. That means I’ve now got about 1,000 Euros of room left for further purchases.

I am happy to keep all my current holdings for the long term, although I’ve considered selling Mastercard as it seems a bit expensive to me.

So, I will be looking to add another dividend payer to the roaster. Ideally, for the sake of diversification, I should be looking to add a utility stock as I’ve got none, however, there are several tempting consumer defensive stocks on my watchlist. As usual, it will be a tough decision to choose one.

Dividend Payments

In June, I received dividend payments from a total of 6 companies:

- 3M (MMM): €6.68

- Johnson & Johnson (JNJ): €6.05

- Walgreens Boots (WBA): €5.42

- Unilever (ULVR): €11.81

- Kroger (KR): €3.18

- Microsoft (MSFT): €0.98

- ExxonMobil (XOM): €10.58

- Realty Income (O): €3.37

Total Dividend Income: €48.07

Here’s an update on my year-over-year dividend monthly income comparison, so far so good.

The €45K Project Fund

Another month has passed which means I saved another €60 as a non-smoker, cash that goes into my 45K Project Fund.

In June, I contributed all non-smoked funds to the Global Clean Energy ETF.

So far The 45K Project Fund consists of:

- Abundance Investment: €1,452.4

- Kiva: €431

- Qardus: €251.3

- Global Clean Energy ETF: €573.3

So far, I have recovered 6.01% of my loss = €2,708

42,292€ left to go.

¡Vamos!

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

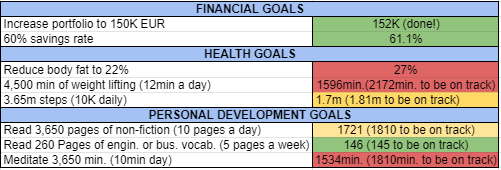

Goals and Habits 2021

It’s time to have a look at how I am doing with my 2021 goals and habits for 2021.

All my goals are monthly measurable, so I’ve built a table to keep an eye on the progress, this is how it is going so far:

Goals and Habits This Month

Goals and Habits Previous Month

I am struggling to keep on with my goals. It’s not surprising that I am doing well on my financial goals since this is a personal finance blog, but in reference to my health and meditation goals, I can’t catch up with them. Although 10/12 minutes a day seems nothing, it’s easy to lose the pace. I should have removed the weekends and do 10/12min weekdays instead. I may be changing it, as not being able to catch up is quite demotivating. Furthermore, I am also now busier than before and have less free time than when I set these goals during tough lockdown times.

That is all for this month. Thanks for reading.

Cheers.

Tags In

Tony

Related Posts

13 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi Toni

A lot going on, thx for sharing your financial highlights. Your savings rate is very strong and will fuel your wealth accumulation nicely. Congrats for smashing the 150‘000 milestone which is a kind of gamechanger. Your compounding machines will move faster and faster.

All the best, Toni, and keep it up.?

Cheers

Hi Myfinancialshape,

It’s quite motivating when you see the compounding machine getting bigger and bigger! Let’s keep it that way!

Thank you for stopping by 🙂

Hi Toni,

Money spent in good food is always money well spent, always keep that in mind hahaha. I kind of envy your Summer experience to be honest, here we are almost wrapping up the summer already. Pretty impressive saving numbers by the way, I think I range between 30% and 40% working on getting closer to 50% but it’s getting hard to balance that with life. I have also been struggling quite a bit in sticking to my goals lately, there’s up and downs I guess, sure you’ll be back on track in no time.

Cheers!

Hi Juan,

I completely agree with you, it has been a while since I last enjoyed Spanish food, so it was about time I did a catch-up! 😀

It will be the my first proper summer in seven years, so I feel I need to enjoy it as much as I possibly can.

Thanks for the savings rate. On my first posts, I reported 30-40% and now I am between 50-70%. This blog and the community were key to achieving that, so stick around and keep going and chances are it will just get better and better!

cheers!

[…] One Million Journey Portfolio & Savings Update #31 June 2021 – 152,533€ […]

Good to see things are generally going well, Tony. Hopefully you can figure out a way to get your girlfriend vaccinated. Does Spain have pop-up vaccine centres? There have been a couple of times recently, when we’ve been walking through town towards the end of the working day, that we’ve been offered a vaccine there and then to avoid wastage due to people not showing up to their appointment.

Regarding the goal to meditate 10 minutes each day – although I don’t set aside any specific time to meditate each day (I probably should…), I find that I end up doing a lot of thinking to myself either just before falling asleep, or whilst standing in the shower. Perhaps if you could include that in your tracking, you’d easily smash the target! You might view it as cheating though, haha.

Hi Doc,

They have but in Barcelona and Girona cities but they still ask for Spanish ID, Spanish residency proof, and the equivalent of a NIN. She has non of it and it can take several months before she could get one. The only solution would be to go to the Czech Republic but even so, is complicated as Spain is considered a high-risk area.

Haha, I guess I could add it, I’ll think about it 🙂

Hi Tony

These are strong numbers, on the back of a massive savings rate your investments are firing from all cylinders. I like your diversified approach. Keep it running ?

Cheers

Thanks, SavyFox, all pistons are on fire! 🙂

Hi Tony

Sorry, am really behind on my blog reading so just catching up now.

Congrats on surpassing the 150k mark, well done!

I see you mention that you are still paying into your SIPP but I didn’t think this was allowed if you were no longer resident in the UK (unless I’m mistaken and you are still in the UK and only went to Spain briefly?) Best to check on this perhaps.

Dividend payments continue to grow and your graph is looking good.

Keep at it and all the best with your goals.

Hey Weenie, no need to apologize for not reading earlier!

To the UK, I am still UK fiscal resident, but this will change if we don’t return before the end of October, at which time I will become a Spanish taxpayer. Even after that, I believe I can continue to make contributions, however, the tax benefits are limited. I have stopped contributing anyway until we settle for good (hopefully someday!)

[…] “clear” new investing strategy I stated last month is no longer clear (I know, I know, I am a lost cause sometimes!). I stopped contributing to my […]

[…] stock market massive run helped me to achieve this early in the year. Thank you, Mr. […]