Portfolio & Savings Update #28 March 2021 – 139,342€

Ladies and gents, It’s that time of the month once again, and thus time for another portfolio and savings update for March 2021.

Table of Contents

March In A Nutshell

March was just another waiting month in which I began counting the days I have left living in the UK. I can resemble this feeling with Christmas Santa’s countdown song for kids during Decembers!

I am enormously grateful for not having purchased a property in the UK, it would have put a considerable amount of extra pressure on my back considering how mad Brexit is turning out to be. Instead of having to deal with remortgages, red tapes, advisors, unwelcome fees, tenants, buyers and so on, all I had to do as a renter was to give two months notice, and I am free of worries and happy like a bird in the Spring.

The increase in tension between the UK and EU, which seems to become a long term Cold War, is having a noticeable impact on people as I’ve come across more staring at my foreigner looking face more often than usual. It would really be a pity to leave with a bitter end, so I hope these tensions will decrease and I can take the returning flight recalling positive thoughts. . If I am lucky enough I should be able to enjoy my last pints in garden space with colleagues after the 12th, but I am not sure if I will manage to see some of my friends before I go.

There’s a rumour at work that says the company it’s heading towards a disaster. Shortage of metals, powder paint, all sorts of mechanical fitting and fixings are not delivered on time since a large percentage of it came from the EU. Some of these goods are now being purchased from China, which has massive lead times. Having your machinery stopped because you can’t get material in must be frustrating. On the other side of the road, you have the developers pushing for our product as they have to meet deadlines and return investors money back (if you are invested in UK developments loans I wish you good luck!).

In the current environment, it seems like unless you work in the IT or software related industries, your job is highly unreliable, and thus you should be thinking about building that emergency fund up to give you better options in case the s*it hits the fan in your household. Uncertainty is backed up with cash in the bank from my point of view.

Anyway, I am not particularly worried about the stability of my employer since I actually wanted to leave, but it got me into checking similar jobs and salaries in the Barcelona area which are about 27-30K a year compared to the 40K I earn now if converted to Euros. That is quite of a difference, I am not sure if I would be motivated enough to take this job for that salary, as happiness feed via paellas, tapas and sunshine can only last so long!

As always, there’s a lot of uncertainty ahead. I don’t even think I remember what certainty means, but what I do remember is that my million journey continues with or without certainty.

So, without further ado, It’s time to show you the numbers babies 😉

Quick Recap of March Numbers

- Portfolio value: 139,342 € (+8.76%) – details HERE

- Contributions to the portfolio: 5,484 €

- Monthly growth from investments: 11,250 €

- Passive income: 447 € – details HERE

- Savings Rate: 57.3%

That is impressive growth, isn’t it? Where did it all come from? — You may wonder.

- Did I invest in a growth stock? Nope

- Did I leverage? Nope

- Did I find a new investment product on the web that I can’t wait to promote on the blog and make money out of readers ignorance? Nope

- Am I lying? Nope.

- Did I invest in algos, FX, crypto or any other similar big s*it? For god’s sake, NO!!!

So, how the heck did I achieve this?

Easy, peasy, Japanese my friends! I contributed an extra £23,900 into my UK pension, partly feed by withdrawing from existing S&S ISAs and some extra savings I had been accumulating in a savings account in 2020 after the coronavirus hit (what I used to call my F-You Money Fund in the UK). Since I will be shortly using Euros and got already enough cash saved in Euros in Spanish banks, I don’t think I will need a F-You Money Fund kept in Pounds anymore, hence the larger than usual contribution to the portfolio this month.

The reason why I have contributed so much to my UK pension is to protect some of my capital from the Spanish taxman, as if I live for more than 183 days in the country I will become a fiscal resident. The Spanish HMRC (Hacienda) is investing heavily into improving its tracking technology. It’s currently one of the most advanced in this matter as they try to fight massive corruption and money laundering issues. They recently even caught the former king of Spain doing malpractices in the past. So no jokes here in terms of doing things right and legal.

From now on my current investing strategy, which I wrote in the first year update of my one million journey plan is no longer valid.

I should write a blog post to summarize the changes in my investing strategy. After some intensive research, I kind of know what I could be doing, but It’s hard to set anything in stone, since we may come back, stay in Spain, move to Ireland, or get lost in some weird part of the world! (if covid let us).

Let me get quickly dig into my savings before having a closer look at the performance of my investments.

Monthly Cash Flow Sankey Diagram

Total income in March equals £2,873.79 (3,362 EUR).

Total expenses: £1,226, slightly above my average.

Something unfortunate happened in March. Have I ever mentioned that I love having a bath in the blog? Probably not as it’s quite personal. Let me tell ya, I absolutely love it! (which is something I will miss a lot in Spain besides fish and chips). I usually like reading while enjoying the warmth of the water. Since I don’t purchase more physical books (they are way too heavy to move around in boxes) I use electronic devices. So, what happened? Well, I accidentally dropped my phone in the water and it died, ouch! I purchased a new one which I received the next day. Two days passed and my old phone came back to life! (Old Huaweis are terribly good!).

I spent money on something that actually didn’t need. That left me an unwanted feeling for a couple of days, which in a way I think is positive as it means I don’t need possession to be me, to be happy with myself and this is an important aspect to bear in mind.

Spent money on what you need, and put the rest work hard for you — that’s a millionaire mantra.

Anyway, back to my exciting phone story. I opted to pay the phone in 5 different instalments of £60 at no extra cost, so this will take a small bite on my SR for the next four months. By the way, I purchased the Google Pixel 4a, it’s a great phone for the price and has everything I need. It’s not a posh-looking Apple, but since I don’t need to impress anyone what I value is practicality accessible at a reasonable price, Pixel 4a really stands out on that.

I am now a bald bearded Googled guy (and soon tanned as well!).

March Portfolio Performance

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

Another great month in which I am cutting more distances with my losses, moving from -23.1% in February to -20% in March. That’s a nice jump. I will soon be leaving the 20s behind. Woohoo!

Stocks did well generally. My dividend portfolio grew nicely (more on this later) and my P2P investments carried on pretty much as usual. I received some delayed payments on my Crowdestor account and Housers also paid some cash in (a miracle!). No changes for Fast Invest, as I am still waiting for pending withdrawals since January.

The previous month I classified the P2P platforms that I invest into two groups. Those with a positive outlook, and those with a negative outlook. My perception hasn’t changed, so go and check it out if interested.

Estateguru, which is one of my favourite P2P lending platforms, has a 1% referral bonus for the whole month of April. If you join by clicking on the banner down below, you and I will get a 1% bonus from any primary market investments you make in April. After that, both of us will earn a 0.5% bonus for the balance of the 90-day bonus period.

Property Partner gave us an update on the whole property portfolio and shared some good news in regard to dividend increases and recommencing dividends for another 29 properties. My own portfolio consists of 9 properties. Up to now, only three of them paid a dividend. This will increase to 5 after the announcement. Altogether the whole portfolio yields 3.43% net in the UK (gross once in Spain). It is an improvement, but it’s far off from being a good investment if compared to the results an investor can achieve investing directly in the most popular REITs.

In March, I opened my first, and quite possibly my last SIPP. To keep things simple, I used Vanguard as I already have an S&S ISA account with them. My SIPP is counted in my UK pension in the breakdown. This is the account I used to contribute the £23,900 I mentioned above. Vanguard is adding the tax relief in the total value immediately as you make your contributions. Hence, the massive returns showed this month in spite of theoretically still not having this money in my SIPP.

I made more changes to my portfolio (It has been quite a month!). I sold all my ETFs or funds that were generating dividends, and bought accumulators instead. This is once again to avoid the Spanish taxman. I updated my current holding on my Stocks & Shares ISAs page.

Pound Sterling increases again against the Euro from 1.15 to 1.17. I hope the trend will continue for longer.

Dividend Portfolio

My dividend portfolio in March generated 47.03 EUR of passive income.

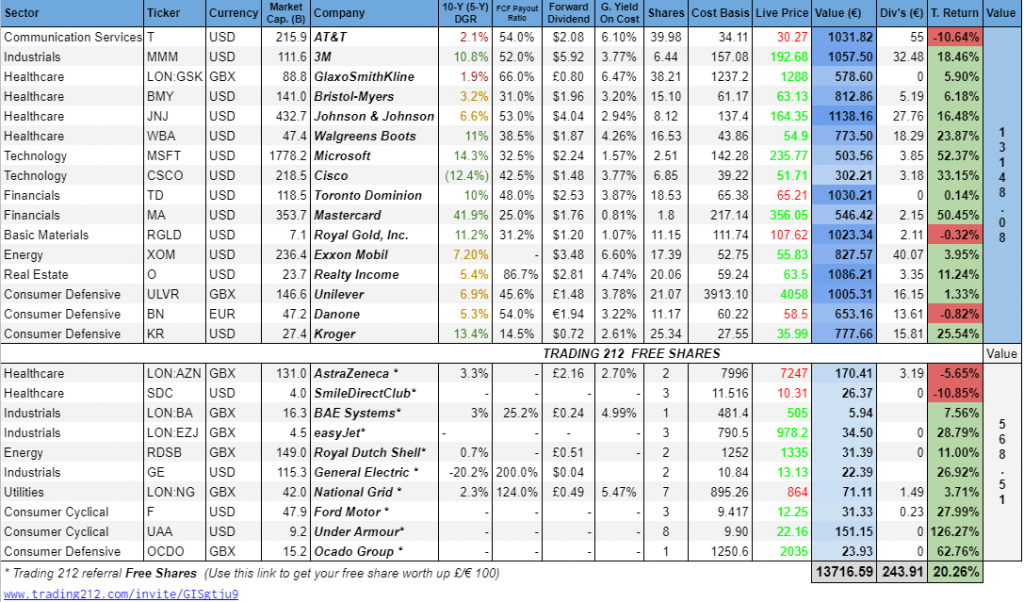

This was the outlook of my holdings in the end of the month:

The total value of my dividend portfolio grew by 9.5%. I am not sure this is too exciting as I like to reinvest the dividends in the companies I already own, but hey, my million journey needs growth babies, so I will take the gains with no complaints! ;-p

I spent some more time changing some data shown on my spreadsheet. I exchanged the PE ratio column for 10-Y (or 5-Y within brackets) dividend growth ratio as I believe this piece of data is more relevant for dividend investing.

Ideally, I want to see companies that pay a high yield, have raised the dividend by 10% annually over the last 10-Y, and have a healthy FCF payout ratio that “guarantees” the dividend sustainability and capability to keep growing dividend at similar compounding rates.

I am glad I introduced this change as it made realize that I should sell Wells Fargo sooner rather than later. And I did!

I’ve been doing some homework on the spreadsheet that tracks my dividend stocks.

— Tony | Onemillionjourney.com (@JourneyMillion) March 21, 2021

It now reflects the data that matters the most to me:

– 10Y Average Dividend Growth Rate

– FCF Payout Ratio

– Gross Dividend Yield On Cost

After this update, I’ve realized I should sell $WCF soon! pic.twitter.com/9OQHBQ0aLZ

I have not written much about my dividend investing strategy because of two reasons:

First, I am still learning, and second, it does not play the main role in my portfolio.

Dividend Payments

March was a good month as nine companies paid dividends:

- 3M (MMM): 6.75€

- Johnson & Johnson (JNJ): 5.81€

- Walgreen Boots (WBA): 5.47€

- Unilever (UVLR): 8.94€

- Kroger (KR): 3.25€

- Microsoft (MSFT): 1€

- Wells Fargo (WFC): 1.78€

- Mastercard (MA): 0.55€

- Exxon Mobil (XOM): 10.68€

- Realty Income (O): 3.35€

Total Dividend Income: 47.03€

Here’s in an update on my year over year dividend monthly income comparison:

New Holdings And Purchases

Besides reinvesting all my dividends, I contributed another 449 EUR. Most of this came from withdrawing cash from Crowdestor and Housers.

Trading 212 has temporally stopped accepting new registrations due to excess growth. That means I earned no free shares at all this month, so no contributions from this side 🙁

Monthly purchases and additions (except reinvested dividends):

- Unilever (UNA) 20.95 shares @ 45.67 *SOLD OUT*

- Unilever (ULVR) 21.05 shares @ 45.67 *NEW* (switch to avoid withholding tax on dividends)

- Wells Fargo (WFC) 24.91 shares @ 39.24 *SOLD OUT*

- Toronto Dominion (TD) 18.43 shares @ 65.38 *NEW*

- GlaxoSmithKline (GSK) 16.74 shares @ p1267.2 *ADDITION*

As I mentioned earlier, I took the decision to sell Wells Fargo at over 8% profit without counting dividends. Other banks have done much better since vaccination news first came around. So, buying this stock was in a way a “mistake”.

Given that I want to keep a well diversified dividend portfolio means that I should keep a bank stock in it, even if it seems like not the right time to buy bank stocks.

So, I built a watchlist with the best and more popular dividend bank stocks from the US and Canada reflecting the most important metrics for bank stocks.

This is the result:

As highlighted, I ended up buying Toronto Dominion (TD). I have a bias for investing in Canadian banks stocks, not only because they have provided such great returns to their investors over the past, but because it adds some currency diversification to my portfolio amid a weakening US Dollar. (Thanks Nick from TotalBalance.blog for sharing that insight).

The watchlist is sorted by dividend yield. At the top are those with the highest yield and at the bottom those with the lowest. TD offers a 3.85% yield. It seems to be sustainable as the payout ratio is low and the dividend has grown 10% annually as average over the last 10 years. The reason why I chose Toronto Dominion instead of Canadian Imperial Bank or Bank of Nova Scotia is that the dividend growth and payout ratio look better. I believe that over the long term that gives TD a higher probability to keep growing their dividends whereas CM and BNS are a bit more restrained.

We shall see how this experiment matures.

Disclaimer: Please remember that I am doing this solely for fun. Neither this is a professional analysis nor I have the knowledge to do it, so do your own due diligence before investing in individual shares.

The €45K Project Fund

Another month has passed which means I saved another £60 as a non-smoker, cash that goes into my 45K Project Fund.

Abundance Investment has finally issued another “investing” opportunity. It is not attractive as an investor at all. A 10 years loan paying 1.6% interest. But, hey! I promised this fund would be 100% ethical so I invested all-cash fund reserves into this loan.

There are a few more ethical platforms I could join that I mentioned in previous posts, but I rather to keep it simple as this fund is still small so no extreme needs to diversify.

So far The 45K Project Fund consists of:

- Abundance Investment: 1,452.2 EUR

- Kiva: 82.49 EUR

- Qardus: 364.5 EUR

- Cash: 0 EUR

So far, I have recovered 4.22% of my loss = 1,899.19 EUR

43,100.81 EUR left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

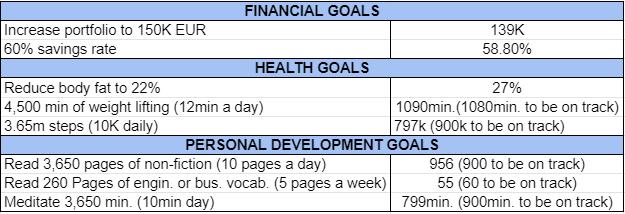

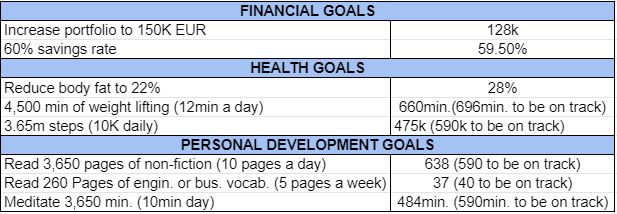

Goals and Habits 2021

It’s time to have a look at how I am doing with my 2021 goals and habits for 2021.

All my goals are monthly measurable, so I’ve built a table to keep an eye on the progress, this is how it is going so far:

Goals and Habits This Month

Goals and Habits Previous Month

I am slowly catching up with my goals, I am back on track on my weight lifting goal, I managed to be consistent with meditation (challenging), however, I must do more and try meditating 15min a day more often. I have only 12K left to reach my goal of 150K, it seems it will be a piece of cake (thanks to the UK pension system). As usual, the biggest challenge for me is to reduce body fat. I managed to reduce it by 1% in March, but reducing another 5% looks impossible to me at the moment.

The book I read this month was Get Rich With Dividends by Marc Lichtenfeld, hence why I put the time this month into checking out my portfolio and finding a new bank stock. A practical book, I really enjoyed. There are loads of books about dividend investing out there. This is my second one and not last.

This is it for this month, I hope you have a great month wherever you are, and thanks for reading.

All the best,

Tony Pepperoni 😉

Tags In

Tony

Related Posts

12 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Congrats on another great month! And thanks for the mention. My CAD portfolio had treated me pretty awesome this month! The Exchange ratio has been working in my favor. Hope to see the trend continue!

When are you leaving for Spain?

Cheers!

Thanks Nick. It’s good to have your Danish insights put into the English speaking community.

1st of May if everything goes fine, still a nice ride ahead!

[…] One Million Journey Portfolio & Savings Update #28 March 2021 – 139,342€ […]

Great to see that your dividend portfolio is taking off so well!

Fully understand your reluctance to buy. Spain is probably a better buyers market now, and the stock market is outperforming the house market in many places worldwide.

Hey thanks, you seem to be doing well as well!

I am not very confident about the Spanish economy as a global. It has underperformed for many years and it will quite possibly continue doing so until it doesn’t sort out all the political issues and get rid of the labor party.

Looks like another good month, Tony!

It’s a shame that you temporarily killed your old phone, but at least your misfortune can help your readers (i.e. me, haha). My current phone is a Huawei and, whilst I don’t intend to drop it in water any time soon (or ever!), it’s good to know that it’s sturdier than I thought.

Good luck with the move at the end of the month. Hope it all goes well!

Hey, thanks Doc!

Haha, yes, if you ever drop it, wait a few days before buying a new one. It’s scary how much dependent we are on technology nowadays, specially smartphones. For instance, I could not access my bank account without it (HSBC) and had my bus ticket saved in the app.

I’ve come to the conclusion that anyone can be replaced (or gotten rid of) from work so having an emergency fund (or some other means of income) is essential.

Anyway, it’s exciting to read that you will be heading to the sunnier climate of Spain soon and that you have ‘open plans’ of what you might doing or where you might be living next!

Hi, sorry for the late response (I did write a reply a few days ago, but it did not go through)

I couldn’t agree more with you weenie. Saving for an emergency fund comes before investing a peppy elsewhere. Sometimes those who earned the most are those who save the least. I take the example of the operator manager of the company I work for. High salary, big mortgage, great car, but no savings. Now he wants to change his job but can’t afford it, and finding a new job on his role can take up to several months. That’s not a great place to be in!

Thanks. For the time being it does look exciting! I love the options that this lifestyle brings up to me! 😀

Hi Toni

Another month in the books. I like your detailed updates and it’s great to see how you Investments are gaining steam. Interesting also your stock moves. You added to your GSK position. I have it in my portfolio, for years, and besides the huge dividend I have been a bit disappointed. Great brands etc. but GSK just shows no real growth.

Anyway. There is quality no doubt about that but management needs to bring the company back on track.

Congrats on a very solid month and keep it up!

[…] One Million Journey Portfolio & Savings Update #28 March 2021 – 139,342€ […]

[…] One Million Journey Portfolio & Savings Update #28 March 2021 – 139,342€ […]