Portfolio Update #3 February 2019

Ladies and gentlemen welcome on board to my Spanglish portfolio update once again. Thanks for choosing to spend the next 3-5 minutes of your time reading about anything that crosses over my mind during the update. I ‘ll begin with some facts about my personal life.

February has been hectic when compared with my quiet January. Even though I took the vitamins that guy from total balance recommended on his January update, I was hit by a flu wave just at the best time – two days before my flight date to Barcelona. I missed it and with the expectation of feeling better in the next two following days, I purchased a new flight ticket. Luckily flight tickets over this time are cheap, costing me £37. It still translates to a reduction of -1.8% on my saving rate, that compounding over 30 years would have been… (Stop it Tony! move on mate!).

Now seriously, rather than the money, what really made me feel sad was losing two days of being at home, and also the compounding of the following bad luck…

Thanks to the delay, I had just one day left to renew my passport. Had my appointment, everything sorted, great! Until I arrived at the police office to find out that they were suffering from networking errors, not being able to renew any passports at all. Jesus Chris! Of course, Tony! You are back in Spain, where things never work! Remember? At that time, I felt more British than Spanish, complaining to every human being surrounding me, poor officers. There was a dog too, but it did ignore me, behaving as the smarter in the room. I do understand now when tourists come to Spain and complaint about the services, bless you! If I would write a blog post about frustrating experiences about it, I will get the longest post by far.

Anyway, after this experience and still holding my old passport with frustration, we travelled to Paris and stayed there for a few days. My bad luck finally seemed to be vanishing, except for the 7€ I paid for the worst hot dog I’ve never swallowed and 10€ I donated to a scam save the children charity.

What about the luck of my investments? Did they also get some temperature this month?

Without further ado, let’s get cracking!

Table of Contents

Monthly Highlights

- Portfolio value: 194,810€ (+21.4 %)

- Monthly Transactions (Deposits – Withdrawals): -1520 €

- Monthly earnings: 34,358 €

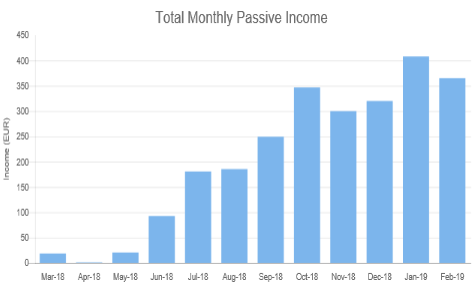

- Passive income: 365 €(-10.5%)

February, in spite of being the shortest month of the year it has produced impressive record earnings ever since January 2018. There was definitely some temperature here over the last four weeks. I wouldn’t mind being sick for a few days every month if that turns out to be a good month of earnings 🙂

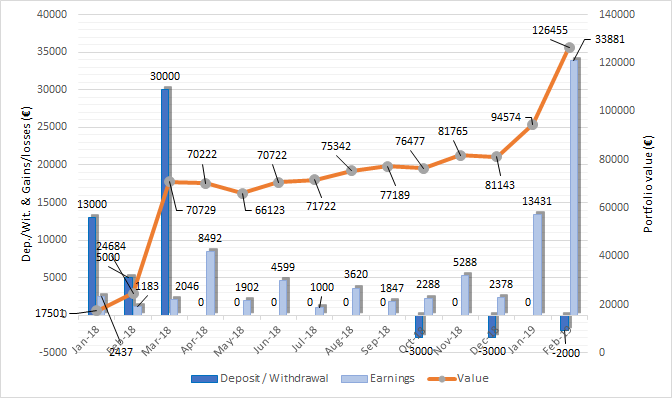

The following chart shows how the value of my portfolio is evolving, my monthly transactions and earnings:

Passive income

Although we had a hotter than expected February, the temperature of my passive income decreased -10.5%. Corporate and Treasury bonds haven’t paid dividends yet and my S&P500 ETF pays quarterly, so nothing coming in from here neither until April.

I am quite far away from reaching my goal of 700€ by the end of the year, but I still think I can archive it by pushing more cash into crowdlending platforms.

Monthly earnings by platform

Crowdestate is the top performer within my property crowdfunding portfolio, increasing 2.2%, while Envestio stands out to be the best among my P2P Crowdinvesting platforms, reaching 1.5%. The Forex market has been volatile, and the algorithmic platform has been able to close an impressive amount of positive trades, lifting up the account by nearly 27%!

The GBP/EUR currency ratio jumps a little from 1.15 to 1.16, which quite surprises me. Whatever happens with this ratio over the next few weeks doesn’t worry me too much. Pound dropping like a brick could translate into a great investing opportunities. So, I will keep a close eye on that.

| Platform | Inception date | Value January | Transactions | Value February | Earnings | Return February | Cumulative Return |

|---|---|---|---|---|---|---|---|

| Algotechs | 20/11/2017 | 94574 | -2000 | 126,455 | 33,881 | 26.8 % | 194 % * |

| Vanguard (£) | 14/03/2018 | 26,487.4 (30,460.5 €) | +500 (580 €) | 27,082 (31,415 €) | 95 (110 €) | 0.35 % | 3.14 % |

| Property Partner (£) | 21/01/2018 | 5,847 (6724 €) | 0 | 5,866 (6805 €) | 20 ( 23.2 €) | 0.33 % | 7.1 % |

| Housers | 26/03/2018 | 6,603 | 0 | 6,630 | 27 | 0.4 % | 3.6 % |

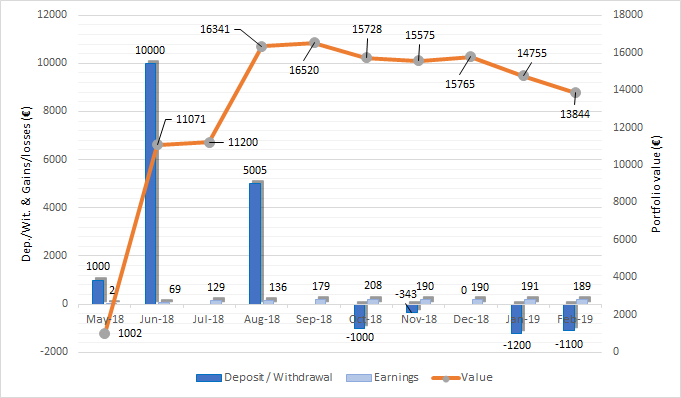

| Grupeer | 19/05/2018 | 14,755 | -1100 | 13,844 | 189 | 1.3 % | 11.8 % |

| Mintos | 05/08/2018 | 3,107 | +500 | 3,638 | 30 | 0.84 % | 5.38 % |

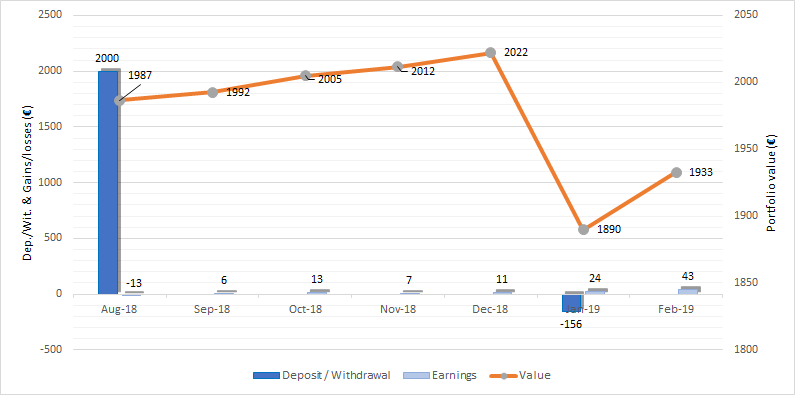

| Crowdestate | 16/08/2018 | 1,890 | 0 | 1,933 | 43 | 2.2% | 4.5 % |

| Envestio | 15/10/2018 | 2,503 | +500 | 3,048 | 45 | 1.5 % | 6.7 % |

| Fast invest | 29/10/2018 | 1,031 | 0 | 1,042 | 11 | 1.1 % | 4.2 % |

| TOTAL | 160,617 € | -1,520 € | 160,617 € | 34,358 € | 21.4% | 104% |

*Success fee is not deducted yet

Algotechs

When I look at the profits on Algotechs I just can’t believe it. My trading account increased by nearly 34K, this is close to the money I make for the whole year of working. As I have surpassed the value of 100K my succes fee is lower from now on, dropping from 25% to 20%. Algotechs has the right to withdraw the sucess fees once per quarter. However, in some cases, they don’t take it for compounding purposes, helping you and them to get better long-term profits.

So, how come the ATS software performed so well? A big stake came out after no negotiations were reached on Trump’s meeting with Kim Jong Un.

The willingness of the president to walk away without a deal could cause traders who are betting on a trade deal between the U.S. and China to reduce their odds of an agreement being reached. That made the currency exchange EUR/USD to be very volatile, adding that the software is leveraging the trades more than usual recently, resulted in a day earnings over 12K.

Now that I have surpassed the 100K landmark I would like to withdraw some money in a monthly basis. I have been able to withdraw 2000€ this month, which makes me feel that things regarding the colapse of their previous bank are improving , but I am still confused about how all of this mess will end up.

Some of you have shown interest to know more about how Algotrading works. I’m no an expert, but I have learnt some insights since I began investing with Algotechs. Let me know down below the comments if you would like to hear more about it and I will add it to my list.

Vanguard

As planned in my previous post, as long as I live in Great Britain, I will pay myself first £500 every month after payday, and trasnfer this money to my Vanguard portfolio account. Last month I used that money to buy more USD Corporate bond ETF shares. This one I’m just keeping it as cash for the time being. My instinct tells me to wait and see how the markets move over the next few days, as the MACD and Stockatichs are still within overbought limits and the S&P500 is now at the 2800 resistence level. Whether I buy anything or not, leaving a little over £600 of free cash won’t hurt me.

To conclude with, my account is 95£ fatter and increased by 0.36% against the 3% S&P500 Index. My ISA is not precisely beating the market this year so far, but I am totally fine with that and some quietness from at least one of my investing portfolios is very welcome.

Vanguard is a portion of my little British Empire as an Expat

Property Partner

Property Partner seems to be stuck with no new property purchases. There’s only one development loan opportunity available only for High Net or Sophisticated Investors. After reaching out to the customer service, I was told that there will be a new investment oportunity during the first week of March, so I may put some spares in.

None of the two property acquisitions I invested back in December have been completed yet, leaving me with no fees to pay and a net income of 20£.

If you feel like interested in Property Partner, you could check what property shares I own and how much cash flow they are giving me on this page. I also wrote a review after one year of investing, where I share my personal opinion and results.

Property Partner is also a portion of my little British Empire as an Expat

Housers

Another buy-to-sell opportunity exited this month onHousers , two months earlier than expected. It delivered a 6.01% annual return against the 7.2% promised during the initial funding period. While my previous and first exited project had a better than expected return, this second one has fallen short by more than a 1%. I don’t hold any other buy-to-sell opportunities and only plan to invest in development loans from now on, as the returns against the risks are not rewarding enough. Housers offered me a 1% cash back if I reinvested back the exited project funds, which I did.

Three of my other investments didn’t pay out – Firenze San Gallo, Merano and Dulcinea. The first two had maintencence and running costs and the last the tenant missed the payment.

Although incluging this hitches, income from Housers has still been better than in January, thanks to the exited project.

My 50 Estadio Nacional shares are still in the marketplace to sell.

It’s been now one year of investing through Housers, I will possibly write a review to express my opinion, experiences and returns archived after 12 months. I know there are tons of reviews out there, and I know no one will join using my links, but the research involved behind writting a review is very powerful as a learning tool.

Grupeer

Grupeer, another month of greatness. Other three projects exited succesfully, returning me 2300€ back in my account. I had a lapse of concentration and left the auto-invest on after the first project exited so, 1200€ were reinvested automatically. I didn’t commit the same mistake for the other two and withdraw 1100€, which were deposited succesfully in my Transferwise account after two days.

The platform turns 2 years old and has announced positive news, the main ones being:

- It has reached profitability and plans to realise financial statements in April.

- The default investments on the platform have an impressive rate of 0%.

- It has again introduced several short-term loans, which were not available for some time, with a 13% interest.

However, this doesn’t change my idea of continuing with my crowdlending diversification and I will keep withdrawing until it gets down to 10K.

To point out: Even though I withdrew 2300€ over the last two month, my passive income barely changed.

Mintos

Same as in January, I deposited part of my Grupeer withdrawn funds to Mintos, 500€. After 6 months of using the platform, my confidence is rising and I plan to keep adding funds during the next coming months.

Mintos adds another trophy to its store, winning for the third time the

AltFi’s “People’s Choice Award”. Although the average returns in Mintos are lower than in other crowdlending platforms, investors still chose it as a favourite platform.

Crowdestate

Crowdestate seems to be adding new opportunities with monthly interest payments again, Hooray! Perhaps they heard my voice from my previous portfolio update! 😉

I reinvested the funds from the exited project Rataskaevu 5, 10123 Tallinn (III) inBaltic Forest OÜ (VII) and Nord Company, both at a 16% rate of return, 1 year term and secured debt. Excellent!

Envestio

My plan for Envestio is still to keep adding funds until May, when my 2.5% bonus for 270 days will finish.

Also, the first project I invested in exited this month, rising a bit my confidence on this platform.

Fast Invest

Interest rates on the current Euro investments are lower. My auto-invest portfolio, which was set at a minimum of 13.5% has brought some cash drag in lately, forcing me to change the strategy at 12% minimum.

Earnings during the last three months are alike month after month, but that will change slightly if no loans with higher returns pop in soon.

How are my 2019 goals going?

On my first portfolio update I set several goals I would like to accomplish this year, it’s time to review how I’m progressing:

Increase portfolio value between 180,000 – 200,000€

→ 194,810€ – Unexpectedly, goal completed! (for now…some storms may come)

Increase passive income to 700€/month

→ 365€ – It will be challenging but I still have some faith

Read at least 12 books

→ 1.8/12 – I’ll push that one on during my summer holidays. Currently reading Ego is the enemy by Ryan Holiday. Absolutely loving it! I want to write about it to remember the main book insights deeply.

Become fitter, reduce body fat to 15% (21% now)

→ 21% (last month 20%) – Not only I paid through the nose for that hot dog that it even made me fatter! Need to spend more time in the gym and running next month.

Improve my writing and speed

→ Perhaps slightly improving. I think I made a mistake choosing this one as I can’t really measure it…

Write 20 blog posts

→ 8/20 – I’m getting there! 🙂

Earn my first blog income and donate it to a charity

→ No income yet – But I have a plan to tick that one off if in December no one has joint a platform using my links, hihihi.

Savings Rate

‘My savings got better in February. Despite the fact that I lost 1.8% on the flight ticket purchase, mi rate is 36% (11% last month) YAAY! 🙂 . I still have to pay more than my misses as she is only working part time with expections of full time during the summer season, at which time I expect to save 50%.

My landlady wanted to increase the rent by £25 per week. We are already paying £200 per week and there was no way we would accept that. We told her we’re going to leave and luckily changed her mind, keeping the rent at the current amount, £200.

Until next time

I am honoured to announce that the blogger Route2FI has invited me for a blog post interview, which I happily accepted. There will be a nice round of question that I sort of have to answer in some way 😉 A new experience that I am so looking forward to! Stay tunned if you are curious about an Spanglish guy pursuing a million in a somehow complicated atmosphere.

You can follow me on twitter where I share some thoughts from time to time and connect with other like-minded people.

Disclaimer: Some of the links on this post are affiliate ones and some others are not. If you join to a platform using my affiliate links you will get a bonus or commission and so will I. I’m going to donate any commission I get throughout 2019 to a charity. You can read more about the purposes of this blog here and where this money is going to go here

Tags In

Tony

Related Posts

24 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Wow, this is a great month for you! Keep up the good work!

Hey Radical FIRE thank you! Keep up with the good work you too, love reading your blog post, You’ll get there! 😉

Holy shit, Tony!

What an awesome month for your algotechs trading! Where do I sign up? ? And Thanks for the mention BTW ?

You do realize that if it continues at this rate, you’ll reach your goal in 2 years! :O

Glad your unlucky start was replaced by a record income from algo ?

Hi Nick thanks:)!

Reaching the million in two years would be great, but I don’t know how markets will fluctuate in the future so it’s difficult to predict.

Also, I am not dreaming much about it, as long as the bank issues are not 100% sorted.

Wow, nice income this month!! I hope to ever earn that much in a year haha. Your passive income is also going great, I hope you will reach the € 700 at the end of the year!

Hi! Congrats for your results. I’ve seen that you had problems with the withdrawals from algotechs, are they solved? I would like to hear more about algotechs, it’s really difficult to find reviews from real users.

Thanks

Hi Santi! Thanks for stopping by ?

Yes, I had withdrawals issues for a long time. This month I was able to withdraw 2000, but this is not enough to fully confirm that everything is ok yet.

This month I will try to withdraw more money again and I will post the outcome on my next update.

Thanks for showing interest

Cheers ?

I’ll wait for your update then! ? Gracias y que lo sigas petando

Holly cow! Algotechs volatility is crazy, man! 34k income in a month? OMG

Seems like you’re going to have a fun ride towards your 1M, my friend ? Like a roller-coaster I’d say! XD

Yeah… tell me about it man!

Thanks for stopping by boss! 😉

Adding this blog to my favorites! First time here and definitely coming back again!

I recently started investing with Crowdestate. So far, so good! Have you tried NEOinvest p2p platform? It is offering 14-17% return, but with suck big returns, probably the risks are bigger too.

Hi Rolands,

I’m glad you like my blog, thank you for telling me 🙂

My experience so far with Crowdestate is very positive and none of my investments has defaulted. What I like the most is their thorough due deligence on their investments and how all the data is transparently displayed on the website.

I heard about NEOinvest before, but for now I am happy with my current platforms, and I’ll stick into these for a while. Once the grow further, then I will think about diversifing across new ones.

Thanks for stopping by, I will definitely follow your too 😉

Hi Tony

I do like your Portfolio Performance Overview graph – I’d like to experiment with my graphs but at the moment, just keep them simple – must find the time to have a tinker on them!

Good luck with your passive income, it’s only early days so plenty of time for them to continue to grow. I’m hoping to average just under £350 per month this year, which is probably enough to cover my quite a few of my household bills!

I don’t even know what to say about the Algotechs, except wo!

And yes, congrats on your great savings rate, which you achieved despite that flight ticket purchase!

Hi Weenie,

Thanks for spending a few minutes of your time on my site. The graph is made using Excel, as you say, it’s just about experimenting until you get the one you like, but yeah.. it took me quite long time actually! A simple one is enough if it does the job for you.

Thank you. Getting loads of passive income is probably not the fastest way to grow my porfolio, as i will have to pay more on taxes, but still feel the need of getting some cash monthly, so in a case something would happen my emergency fund won’t get hurt that much.

Take care! 🙂

Hate to say it Tony but algotech looks decidedly dodgy to me. The awards mentioned on their website dont exist that I can see and the awards The European do run don’t mention algotechs as a winner at all in 2018. Normally an award logo like that is a link through to the award page.

If you can withdraw more I would do so immediately. I sincerely hope you prove me wrong

Hi fatbritabroad,

I trully appreciatte you try to help sharing your opinion. It’s true, the award from The European is gone. I was already investing with them when they got it (back in March 2018 I think), but I don’t know the reason why The European removed it. Perharps, they decided to do so to protect their identiy after the mess with the Danish bank.

I also hope to prove you wrong man, but to be honest, I am getting geared up to accept losing that money…, just in case.

Thanks again for stopping by mate!

“Ladies and gentlemen welcome on board to my Spanglish portfolio update once again.” Made me laugh in the first sentence!

That Algotech income is crazy! I’d certainly be interested to read more about it in a future post, but I don’t know if I could handle the volatility.

Sad to hear that your month started off poorly, but at least it seemed to pick up and improve by the end.

Looks like you need to set some more ambitious goals, you’ve already achieved some of them and it’s only March!

Hi Dr Fire!

It’s funny! I’ve just finished reading your Feb update and then I see a comment of yours here, hehe. I don’t know why I can’t find your site on Wordrepress reader app? You use WordPress right?

I am glad you laughed. I read it to my girlfriend before posting it and she laughed too, so I thought it could be funny for someone else 😉

Yeah, I wanted to play it safe with my goals to not desmotivate me at first, as it was just right at the start of blogging, but I think you are right, I’ll need an update and go for something more challenging.

Cheers neighbour,

Ha! That is funny. Clearly we are both very exciting people, reading finance blogs on our Friday night!

Yeah, I use WordPress, but I’m still learning! I commented above whilst logged in to WordPress, this time I’ll try whilst logged out (but still using the same email address) and see if anything is different. I don’t really know anything about the WordPress reader app in particular. Is it an RSS feed? I just subscribe to blogs via feedly, which I imagine is similar?

Your opening paragraphs were all pretty funny!

That’s fair enough. It’s good to set achievable goals at first, but as you approach them it makes sense to start stretching yourself!

Haha certainly, very exciting people!

Ok, so probably I can’t find you cos you don’t have it installed, which I think comes with the JetPack plugin. Now I’m answering from my iPad WordPress app , without needing to go to my site. But if using feedly works for you that’s more than enough.

Total sense, it’s time to stretch myself out, thank you for pointing this out Dr Fire. With some practice, I may get to your impressive 5 years goals setting approach, hehe.

Take care buddy,

Hey Tony,

I read your update and also an interview you recently did on another blog. A few questions popped into my head about your portfolio.

Maybe you talked about these topics in your blog, so point me to the posts if I missed them.

So, the questions:

1. About the increase of your portfolio by ~20% in one month – how are you comfortable with such a high allocation in algo-trade platform? Is it something you’re involved in or have more knowledge about? Can you recommend further resources (from your blog or other)?

2. What happened between February and March (2018)? 🙂

3. What was your starting point 4 years ago? The reason I’m asking is because I saw you made ~50% ROI last year, but floating around 200k with a ~30k gross salary in ~4 years doesn’t add up.

Although I have much to discuss, I’m most interested in the algorithmic trading – and I assume that it’s a major factor in the answer to the third question. So, I can’t ask for something specific, but would like to hear your thoughts on AlgoTechs and algorithmic trading in general (as someone who is considering trying it out).

Cheers!

Hi Monk Wealth,

First of all, thank you for reading through the interview and portfolio update.

1. I am not comfortable at all with my current allocation, but due to the issues with the Danish Bank account, I am struggling to get succesful withdrawals, which makes the allocation look more unbalanced over time. It’s not something I am involved with, I’ve learnt some bits and pieces since I started, but definitely not enough to develop my own algotrading software. Some very intelligent people spend years developing and back testing their own algorithmic trading software, which they then use for themselves (like banks, hedge funds or big financial institutions) or sell it to others. For instance, if you download the Forex trading platform Metatrader 4 or 5 (https://www.metatrader4.com/en/automated-trading), you will find an app marketplace, where you can buy the software you may like and use it to make your trades automaticaly. On this page https://www.myfxbook.com/most-popular-forex-systems) you can find the most popular systems, reviews, performnace, and further info.

For an introduction to algotrading, have look in investopedia, wikipedia and Motley Fool (https://www.fool.com/knowledge-center/what-is-algorithmic-trading.aspx)

2. In March I added 54K in my active investment portfolio. Some of this money went to Vanguard and Algotechs. My mum inherited and saved some funds, which she decided to give them to me and put to work.

3. 4 years ago I was neither investing nor tracking anything. I had some savings, which most where in a bank fixed term deposit account. I can’t say an exact number, but roughly 4 years ago I had about 10-12 K saved. Hope it all adds up slightly better now? 😉

Algotading is very risky, I certainly don’t recommend it to anyone who is not capable of understanding how it works and the massive risks behind. If you ask me why I put so much money in it, then I will tell you that I didn’t know what I was doing and it has been my biggest investing mistake. However, it is an interesting topic and it’s very appealing to give it a go, but never add more than 5% of you balance in if you decide to feed your curiosity.

Cheers! 🙂

[…] GBP/EUR currency ratio stays at the same value as my last portfolio update – […]

[…] portfolio is about to reach an all-time high since February 2019. Despite the rather stratospheric run, it’s taken 3 entire years to get back to where I was, […]