Portfolio & Savings Update #35 October 2021 – 176,236€

Ladies and gents, another month went by, which means it is time for another monthly portfolio & savings update to count in October 2021.

Table of Contents

October In A Nutshell

This was another rather intense month. We started it in the city of Madrid and finished it in the south of Portugal. In between, I experienced some working insanity at its finest, which seems to be kind of the new normal in the UK? (building sector). In a way, I am grateful that I can work remotely overseas (with no fuel and food shortages), as it allows me to manage my stress levels more efficiently.

So, how is it in Portugal? I won’t lie, It’s lovely! From one day to another, we went from waking up at 5-6 degrees to 15 deg. Midday temperatures are about 20-22 deg., and we are lucky enough to stay in a flat with a sunny balcony, which helps lower those stress levels from work. I shall be making the most while it lasts, of course!

We are staying in a resort area, and given that the high holiday season is behind us, it is quiet. However, we are not the only ones. Besides Portuguese people, there are a lot of British, French, and Danish people. Our flat is close to a villas’ neighbourhood. It feels unreal to live nearby such valuable assets!

A funny fact is that local people confuse me for being Portuguese, so whenever we go to a shop, coffee shop, or simply the supermarket, the staff speaks to me in Portuguese. I guess I don’t look like Brit, do I? Perhaps I need to eat more and don’t put sun cream on my skin, so I get sunburned. That way I am sure I will be talked in English and don’t struggle that much with the language haha 😉

It’s interesting that I understand a lot of written Portuguese, as the similarity with Spanish and Catalan languages is clear, however, understanding when they talk it’s a hell of a challenge! But I’ve improved lately. I now know what a “saco” means (bag), so I will no longer look like a Gibraltarian ape in the supermarkets when a retail assistant asks me If I want a bag. Progress!!

What about food? Well, considering that wages in Portugal are lower than in Spain, daily living expenses are higher than I expected. Some items are more expensive, and others cheaper, but overall I’d say the final bill is similar. For some reason, potatoes are way cheaper but also get rotten in no time. I almost didn’t manage to cook our Sunday tortilla because of it, what’s wrong with the Portuguese potatoes!!!?

OK, before I start talking about apples next, shouldn’t you be looking at October numbers, Tony?

Yes, I should!

Quick Recap of October Numbers

- Portfolio value: €176,236 (+12.06%) – details HERE

- Contributions to the portfolio: 13,787 €

- Monthly growth from investments: €3,653

- Passive income: 1,154 € – details HERE

- Savings Rate: 52%

My portfolio made a hulking increase of over €17K, which is nice to see.

Stocks did fairly well, but most of the increase came from the capital liquidation I got after completing the sale of my garage. That was an injection of €16K of extra cash sitting in my bank account that needed rearrangement.

So, what did I buy? — you may ask.

Well, I doubted a bit on what to do since we always seem to be at all-time highs these days. My first idea was to simply just increase my monthly contributions to the portfolio for the next following months, but I felt like that cash was “burning on my hands” and had to do so something with it a bit quicker.

So, pretty much like a shopping addict would run to a shop, I run to log in to my investments accounts and invest. That’s what I’ve allocated so far:

- €10,000 to purchase a new Index Fund: Vanguard Global Small-Cap EUR ACC via the platform MyInvestor* (no commissions for one year if joining with my link, only for Spanish residents).

- €500 to Reinvest24*. (Get a10 Euros bonus if joining with my link).

- €950 to buy crypto assets.

- €500 to my dividend portfolio.

Out of the remaining €4,050 to relocate, some money will go to buy more Crypto and to cover a future tax payment that will be due soon (Yup! Selling a property in Spain is not tax-free, another thing to add to the “sucks list” to live in Spain, I’m afraid).

Monthly Income and Expenses

This month, the family income was £7,206.58 (8,503 EUR).

That was another great month for income for the exact same reason as the previous month — the capital gains on selling the garage, however, that tax bill due quite ruins the excitement.

My passive income only covered 28.3% of all expenses. This was a very expensive month, in which I paid for our accommodation in Portugal and taxes on Q3 rental income. As Juan from The Somewhat Intelligent Investor pointed out, tracking passive income coverage on a monthly basis doesn’t give you a real picture on your progress, as expenses fluctuate from one month to another, so I will be comparing it in a YTD (year-to-date) basis from now on. So far this year, my total passive income has covered the 37.7% of my total yearly expenses. Let’s work on improving that ratio moving on.

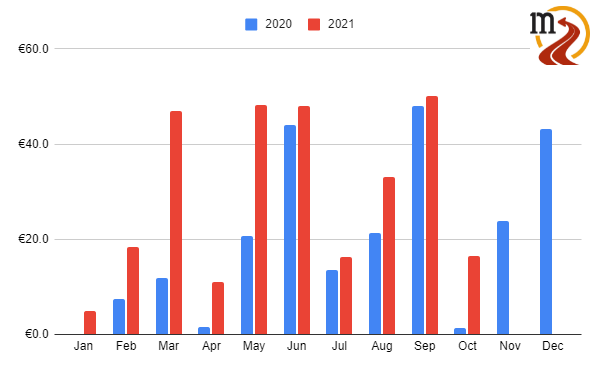

Savings Chart

Portfolio Performance

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

A month covered mainly by green with sweet returns. I’ve shortened my total loss by another 4%, reducing from 15% to 11%. With some luck, I’ll be entering the single-digit percentage soon! However, I am unsure about how long stocks will continue to rise, as it all seems unrealistic, but let’s not lose the optimism, of course!

Crypto Portfolio

It took me ages, but I’ve finally taken the decision to get my feet wet in crypto.

Why now?

Earlier this year, I gave a go at trying to understand the world of crypto, but I failed. Basically, I read the Cryptoassets book by Chris Burniske and Jack Tatar which have good reviews. But it looked too complicated to me, and it seemed like a tone of research/time was needed to get a grasp of the investment. Given that I am quite passionate about dividend investing, I decided to continue spending time on dividends research only.

But then 2 things happened:

- I noticed dividend investing is only time-consuming when you are building up your portfolio. I bought mainly blue-chips, dividend stable companies, so I can hold them forever and not have to worry about them (much). I read the eventual quarterly report, but that doesn’t take that long. Sometimes all you need to do is follow Twitter accounts that will summarize it for you, like @DividendWave which is one of my favourites. As a conclusion, my dividend portfolio is a rather passive investment at this stage, meaning that I got more time to learn and explore about other strategies or topics.

- I came across the DeFi (Decentralise Finance) concept and I felt in love with it. I didn’t learn much about DeFi on the Cryptoassets book, as it was published in 2017 and this is a concept that started to get traction afterwards. DeFi opens up a new system in the world of finance. I felt I was getting outdated and needed to renew myself by learning how this thing works. The best way for me is by getting my feet wet and by investing and experimenting with small amounts, and this is basically what I am doing now. I shall get me/you updated! 🙂

I consider myself a Crypto illiterate at this stage. If there’s something I’ve learned deeply in the world of investing is that the biggest risk in investing is oneself. Me putting a lot of money on something I consider myself illiterate wouldn’t be a smart move. I did that once, and it didn’t work very well.

Alternative Investments Portfolio

My alternative investment portfolio provided me with €60.94 (€91 last month) of passive income.

My rental yield on my Property Partner portfolio increased slightly after the last quarterly update, but the equity value of some properties keeps going south, resulting in disappointing returns overall.

Housers paid less interest than the €2.5 monthly fee. One of my larger loans entered into a debt collection program, which isn’t looking any good 🙁

My investments in Crowdestate and Qardus are paying on time 🙂

9 projects out of 14 are late in Crowdestor, although passive income has been consistent over the last months.

Same old, same old on FastInvest (endless withdrawing times).

And finally, my favourites Estateguru* and Reinvest24*, which keep giving sweet income every month, are doing well.

Dividend Portfolio

My dividend portfolio this month generated €16.53 of passive income.

This was the outlook of my holdings at the end of the month:

As usual, I reinvested all dividend payments in the same stock.

I added €50 worth of 0.58 Royal Gold (RGLD) shares to rebalance the lost ground. I see this stock as being around €1,000 of value and rebalance it when it offsets too much. If the stock market goes south, then theoretically Royal Gold should do better as it’s reliant on the Gold price for its valuation. It’s in that situation when I would sell RGLD shares at a profit to buy other dividend stocks on the cheap. This is a concept I learned from Ray Dalio. It is not a popular strategy among the DGI community, but I am happy to do things my way (otherwise why pick up individual stocks and not stick it all to index funds?)

Another dividend stock I bought more shares of is British American Tobacco (BATS), 14.66 shares worth €450 to be precise. This is a stock I entered only a couple of months ago after doing some research and creating a tobacco stocks comparison table. The stock dropped a bit since then, and I just thought it’s such a bargain, so needed to get more shares to the dividend roaster machine!

After this month’s big contribution to the portfolio, my dividend portfolio makes 8.5% of my total portfolio. My target is 10%, which means I’ve got some homework to do in November. I want to look into adding a semiconductor stock as the potential over the upcoming electric/metaverse/crypto era is huge, so demand for chips is only going to skyrocket as we move forwards.

Dividend Payments

I received dividend payments from a total of 4 companies:

- GlaxoSmithKline (GBX): €8.67

- Royal Gold (RGLD): €2.46

- Cisco Systems (WBA): €1.88

- Realty Income (O): €3.52

Total Dividend Income: €16.53

Here’s an update on my year-over-year dividend comparison:

Similar to April, October is not generally a good month for dividend payments, but it’s good to see the YOY improvement. This income feels low to me now. I am sometimes tempted to add more to my dividend portfolio, but investing strategies exist to follow them for as long as they work, or we feel confident in changing them. So far mine is working, and I don’t feel confident about changing it just quite yet (except for the small crypto change), so I shall just continue to stick to it as usual.

The €45K Project Fund

Another month has passed, which means I saved another €60 as a non-smoker, cash that goes into my 45K Project Fund.

This month, I actually forgot to contribute all non-smoked funds to the Global Clean Energy ETF. I’d like to ideally automate this purchase every month, but Trading 212 only allows you to do so if using pies, which I am not a big fan of. So, what I’ve just done instead is to schedule a monthly payment from my Revolut account to my Trading 212 Invest account, that way I’ll not forget about it again.

So far The 45K Project Fund consists of:

- Abundance Investment: €1,489.3

- Kiva: €454

- Qardus: €196.6

- Global Clean Energy ETF: €865.3

- Cash: €96 (ready to be invested in GCE ETF)

So far, I have recovered 6.89% of my loss = €3,101.2

€41,898.8 left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

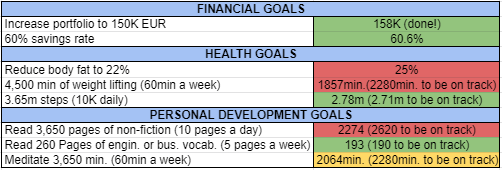

Goals and Habits 2021

It’s time to have a look at how I am doing with my 2021 goals and habits.

All my goals are monthly measurable, so I’ve built a table to keep an eye on the progress, this is how it is going so far:

Goals and Habits This Month

Goals and Habits Previous Month

I am on track with my steps goal, but I am still struggling to keep up with some others. It’s not that I like to use excuses, but the lack of having a routine makes it more challenging to keep up with goals.

I stopped meditating completely :(. I guess I don’t need it anymore? I found it useful back during lockdown times in the UK, as I felt more anxious and pressure at work was high. The move to Spain/Portugal has also improved my mental health, so I couldn’t notice any real effect on me. That’s going to make me save some money, as I used mainly the Peloton app for meditating and stopped the membership (that’s why the price fell so much this week, I am such an influencer, you see? ;P)

That was all for this month, we shall “see” each other again in December!

Cheers.

Tony

Related Posts

4 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi Tony!!!,

Thanks for the mention :), happy to hear you found something interesting in my blog. I can see you are a brave man, getting into Crypto!! My self, after some ups and downs decided to drop cryptos entirely. On top of the fact that I am also a huge illiterate in the field, and I find it too volatile/moody.

Regarding your quest to get into the semiconductor space, have you considered Intel? It’s a classic and their dividend yield got better with the last price drop. If all goes well, they should be able to catch up with the demand and even if their CPUs don’t get back on top, their foundry business should be a good deal. Then you have others dividend paying as well, like Nvidia and AMD, although their yields I believe is much lower.

Portugal sounds pretty good so far, glad you are enjoying it, those temperatures do look good! Sure you’ll overcome the language barrier soon. How’s your bride to be doing with the language difference though? Sounds like there’s a bigger gap there than from Spanish to Portuguese hahaa.

Anyways, thanks again for the mention, and hope you guys keep enjoying southern portugal!!

Cheers

Hi Juan,

That’s why I am not planning to allocate much to crypto, so the high fluctuations don’t have a considerable impact on the total value of my portfolio. Also, some of my crypto investments are in the form of stablecoins, so this should hopefully not vary in value.

Intel and Texas Instruments are great candidates. Thanks for mentioning all of those. I shall compare them and choose the one that looks better to me.

I don’t think she understands much, poor she. We’ll spend Christmas in the Czech Republic, so there it will be poor me!

Thanks Juan, appreciated! 🙂

Hey Tony, I noticed that you have some Terra on your crypto portfolio and I was wondering if you are actually using the Terra ecosystem or just holding some coins for trading.

Please take a look at Anchor Protocol. You can deposit UST in the Earn tab and get almost 20% APY. I wrote some steps on how to do this on my blog. Take a look if you are ready to take the leap and actually use one of these cryptos instead of just betting on the price action!

Hi MrsX,

Yes, I am using the Terra ecosystem. Anchor Protocol was in fact what got me introduced. I’m also learning and using Mirror and Nexus Protocols. Will check out your blog to learn more about it 🙂