Portfolio & Savings Update #32 July 2021 – 156,223€

Ladies and gents, another month went by, which means it is time for another monthly portfolio & savings update to count in July 2021.

Table of Contents

July In A Nutshell

July is normally my favourite month of the year. It’s my birthday month (I turned 36 which means I can feel the 40s right in the corner!) and I also get to enjoy the sunnier weather. However, I have to say I did struggle with the warmer temperatures. In the UK, you get to know when heatwaves are about to come one month in advance, but here they just come out of the blue! We’ve had several days of 35-37 degrees that affected my productivity, focus, sleep, exercising habits and well in fact my whole lifestyle. Luckily the worst seems to be over (temporally I guess), and today I get the chance to enjoy a cloudy with sunny intervals’ day, which makes it ideal to write my monthly update within a non-suffocating range of temperatures.

Few things that happened during July:

- Got my second Covid jab. I felt some side effects the next day, but the day after I was completely fine.

- Continued with emptying the flat and garage. It’s astonishing to see how many things my parents kept, some belongings are 30 years old. This is like digging and endless hole, I always get to find more stuff to trough away! Help!

- We enjoyed more hiking and successfully completed a 6h route to Vall de Nuria. Beautiful landscaping, trying to do the most while over here.

- Truly enjoyed a restaurant lunch with my mum and GF to celebrate my birthday.

That was basically my July.

Now, I’ve got to decide what to do with my flat, on whether to rent it or sell it and use the money as a deposit to buy another place. It’s a tough decision, as selling means I will remove my roots from my hometown for good. The simplest thing is to sell it and move on, but the emotional attachment to this flat is deep. Hopefully, with some time, I am able to decrease that depth and make a rational decision.

Quick Recap of July Numbers

- Portfolio value: €156,223 (+2.41%) – details HERE

- Contributions to the portfolio: €2,901

- Monthly growth from investments: €-258

- Passive income: 1,172 € – details HERE

- Savings Rate: 56.5%

All my portfolio growth this month come solely from contributions. My investments in stocks stayed pretty much flat, except for my Emerging Markets Fund, which dropped about -7%. My bonds increased by 1.3%. This helped to buffer the drop slightly.

That “clear” new investing strategy I stated last month is no longer clear (I know, I know, I am a lost cause sometimes!). I stopped contributing to my SIPP and will keep UK work pension contributions to the legal minimum as if I don’t return before October I enter the risk of being charged back some taxes (as I understand it).

So, in July, I only bought more Global Funds shares using my Freetrade general account, a new dividend stock and invested more capital in Reinvest24*.

Monthly Income and Expenses

In July, the family income was £5,462.69 (6,391 EUR).

I continued selling everything that has some value and I know I won’t need it. I managed to make £864.1 as I sold some of my old DJ equipment.

Major expenses this month were: house insurance, rental income tax (paid quarterly), caring costs and an energy efficiency certificate for our flat that is required for both renting or selling a property.

So, despite the extra income thanks to selling online, I did not reach my 60% saving rate target but a 56.5%. 🙁

Savings Chart

Portfolio Performance

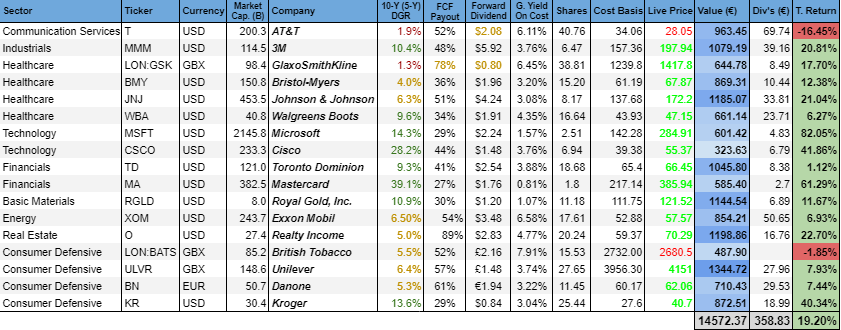

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

In July, I made a tiny but welcomed step towards nearing the 0% T. Return. -15.9% in June against -15.6% this month, a 0.3% improvement.

The Global Clean Energy ETF had a bit of a correction and my S&S ISA suffered from the -7% on emerging markets.

Alternative Investments Portfolio

A new investment product offered by Crowdestor caught my eye — Crowdestor Flex. It’s been sold as a new way to earn passive income, where you add funds to a wallet and these are invested in a portfolio of “financially healthy and stable businesses”. You can earn 12% annual interests that are paid daily and withdraw whenever you want for just a 1 EUR fee. Now, considering that my annual returns on Crowdestor are way below 12% (8%), I find this move suspicious and will surely continue to withdraw all I possibly can from this account.

Property Partner made it, my account is now worth less than my initial investment. I managed to sell my shares on another student property at a final rate of return of 4.49%.

Qardus is doing well but does not offer enough projects, so after some cash drag issues, I keep withdrawing.

Still, no luck withdrawing funds from FastInvest. I still believe in miracles, though, so let’s see!

That finally leaves me with Estateguru* and Reinvest24*, which are the platforms I like the most at the moment. Estateguru is completely hustle-free if using the auto-invest feature, so I just keep it on and look forwards to earn interest payments every month. On Reinvest24, I bought 200 EUR worth of shares on their first German rental project, which should start producing juicy monthly dividends soon!

Dividend Portfolio

My dividend portfolio in July generated 17.17 EUR of passive income.

This was the outlook of my holdings at the end of the month:

In July, I added a new dividend stock to the dividend juicer machine — British American Tobacco.

That may come as a surprise, as one of my investing principles on picking individuals stocks was to preferably avoid unethical stocks. Tobacco and sugary stocks were out of my radar since day one.

So what has changed?

My point of view has changed in Spain for a couple of reasons:

- Drinking Coca-Cola and Pepsi after long hours of walking with hot weather has been so helpful. The product is great, the problem is how people use the product, and it is one’s responsibility to use adequately for the benefit of one’s health.

- Tobacco products aren’t great, but in today’s world most people are fully aware of the harmful side effects of smoking, so again, it’s one’s responsibility. In addition, some Tobacco stocks are heavily investing in marijuana. I am a big fan of legalizing marijuana for medical treatments, specially for people who suffer from terminal illnesses. I don’t smoke myself, but if I knew I am about to die in a few months, I would like to be able to smoke marijuana to easy the mental pain. Ah! Also, people here smokes a lot on terraces without having any consideration to other people. You know what they say that ex smokers are very sensitive with the smoke of others? Well, It is true, it gets on my nerves, so at least knowing that I will be paid a dividend won’t disrupt my joy to enjoy a sunny terrace that much?

I did a bit of research by comparing the main tobacco stocks, here’s the comparison table I built:

British American Tobacco has the second-highest dividend yield (the first if considering the 0% withholding taxes as a British listed company), over 20 years dividend growth history, a healthy FCF payout ratio that has room for future dividend growth, and it is the one with the highest 10 years sales growth/EPS/dividend growth. It is also nice to see that all three ratios line up closely.

Before having a look at tobacco stocks, I checked some dividend utility stocks first, but after hours of research, I could not find anything attractive enough. Revenues of most utilities have declined or barely grown over the last 10 years, and the same goes for their dividend growth. Yields aren’t stratospheric, neither.

So, after this purchase and at the current value, my dividend portfolio makes 9.55% of the total portfolio. That’s close enough to my ideal 10%. Now it’s all about waiting to collect the delicious juice!

If you wonder where I am taking the 10 years data from, then let me tell is from TIKR Terminal. It’s free (for now) and anyone can sign up via a referral link like mine. I don’t get paid anything for you joining via my link, at least at the time of writing. I find this site very helpful, so it’s worth sharing with readers.

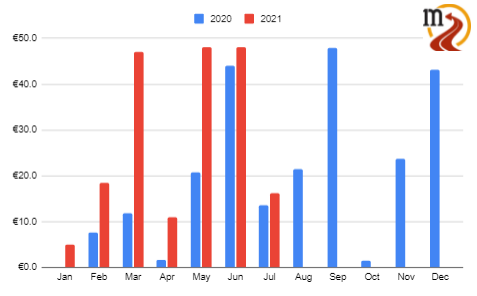

Dividend Payments

I received dividend payments from a total of 4 companies:

- GlaxoSmithKline (GSK): €8.49

- Cisco (CSCO): €1.83

- Royal Gold (RGLD): €2.42

- Realty Income (O): €3.43

Total Dividend Income: €16.17

Here’s an update on my year-over-year dividend comparison:

The €45K Project Fund

Another month has passed which means I saved another €60 as a non-smoker, cash that goes into my 45K Project Fund.

In July, I contributed all non-smoked funds to the Global Clean Energy ETF.

So far The 45K Project Fund consists of:

- Abundance Investment: €1,464.9

- Kiva: €431

- Qardus: €238.8

- Global Clean Energy ETF: €626.8

So far, I have recovered 6.14% of my loss = €2,761.5

42,238€ left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

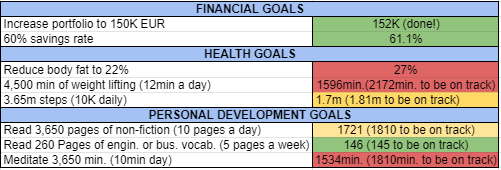

Goals and Habits 2021

It’s time to have a look at how I am doing with my 2021 goals and habits for 2021.

All my goals are monthly measurable, so I’ve built a table to keep an eye on the progress, this is how it is going so far:

Goals and Habits This Month

Goals and Habits Previous Month

I’ve reduced my body fat from 28% at the beginning of the year to 25.5% at the end of July. The target is still far away, but it’s nice to see the improvement. I am right there on my step goal. It’s a real challenge to keep it up when working 100% remotely. Weight lifting is an absolute disaster, I could not motivate myself with such high temperatures. Heat is lower in August so far, so I’ve been doing a bit more these days.

I lowered my goal target on meditation and weight lifting since I don’t follow the habit on weekends. I used to during the lockdown times, but now I find it unnecessary to meditate on weekends, for instance.

That is all for this month. Thanks for reading, y hasta la vista, babies! 🙂

Cheers.

Tony

Related Posts

6 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hey T,

There’s only 31 data in July 😉

*days (damn spell check)

Made a mistake somewhere?

Hey Tony

I like your updates, again strong passive income and robust savings rate. Keep it up?

Cheers

Great update again Tony!

Thank you, appreciate you are still sticking around 🙂