One Million Journey Plan – Year 4 Update + Net Worth Projection

Planning, analysing, documenting, and reviewing are some of the habits that mark the path to achieving my desired one million target. Four years ago I wrote my one million journey plan statement and net worth projection in the form of a blog post here.

The plan includes a yearly review, analysis and a blog post to document the progress, which is what I am doing now. However, last year, which corresponds to year 3, I missed it and hence I broke my yearly habit. If I approach James Clear, is likely he would tell me I am doomed as I broke the rule of habit. Luckily for me, I am still not at that stage, but I’ve lost focus. That means I have been lately distracted by temptations such as buying a new EV, buying branded clothes, stopping considering investment options, and going to restaurants more often, among others. In general, the keeping up with the Joneses feeling kicked in. I am struggling to keep my cash in the savings accounts untouched, and that is not the usual me.

The main reason for not doing the update last year was lack of time. 12 months ago I was working on a rather challenging project that had to be delivered by Christmas, and also doing a side designing job that I also needed to complete on time before Christmas. It was also during this time last year when we started house hunting — that also consumed time.

But now I am a bit more relaxed, I stopped doing side work after purchasing the house, as it was not possible for me to focus on the house move and the renovation improvements plus the requirements of my client. My client understood, and now that I have less urgent work to do at home, I have some more spare time to focus on other things, such as this year 4 update.

Table of Contents

One Million Journey Plans Recap

The first thing I want to do is an updates recap. On each update, I assumed a net worth projection giving me a reference on what year I can expect to hit the million. I have now two net worth projections plus a third one that is coming at the end of this post.

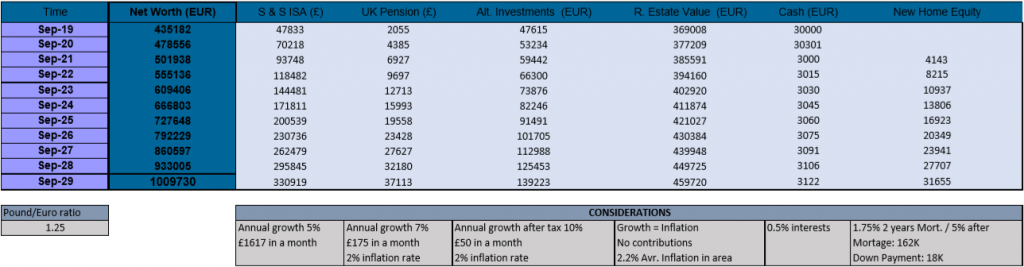

Original Net Worth Projection (2019)

- Expected net worth in 2023: €609,406

- One million Euros target hit in 2029

- Original net worth projection and plan statement: Here

Year 1 Net Worth Projection Update (2020)

- Expected net worth in 2023: €525,535

- One million euros target hit in 2032

- Year 1 blog post update: Here

I didn’t do well in 2020. It was the Covid year and the fall of many P2P leading platforms. I lost money with Envestio and Grupeer. In addition, I needed to spend money on care needs for my mum, which ate most of the net income earned via renting the warehouse. My contribution expectation to the portfolio decreased, and a new net worth projection was needed to take that into account. Instead of becoming a millionaire by 2029, I was now expecting a 3-year delay.

Year 2 Net Worth Projection Update (2021)

Due to market uncertainty at the time of the update I decided to not assume a new net worth projection. Market returns that year were high, so my net worth made a noticeable advance and managed to catch up with the net worth values projected on the original update, so I just decided to stick to the original as a reference once again.

- Year 2 blog post update: Here

Year 3 Net Worth Projection Update (2022)

As I explained in this blog post, I missed this update mainly due to lack of time. Luckily this is only a one miss and won’t affect my plan.

I would suggest to myself to read this blog post about building good habits more often.

Year 4 Results

After this recap, I am more clear on where I am at, so let’s move on by taking a closer look into the fourth year.

As usual, I take my net worth numbers from the latest Q3-2023 and compare them with the previous values of Q3-2022. That way, I can read what’s been happening on a year-over-year basis.

As reported, my net worth in Q3-2023 is €664,155

My net worth in Q3-2033 was €543,658

There’s a significant YOY increase of €120,497 here. Later I will analyse where this growth is coming from.

Next, I can compare the Q3-2023 value against my original net worth projection and my year 1 projection.

- Q3-2023 original NW projection: €609,406

- Q3-2023 year-1 NW projection: €525,535

I am exceeding the most pessimistic projection by €138,160, and the most optimistic original one by €54,749. That is positive news for me as I am still on track to potentially become a millionaire by 2029 as projected in the original projection 🙂

Analysis of Year 4 Results

Another aspect I like to consider in these updates is to analysis of the results and where the growth has come from.

Here’s a list of what has happened in Year 4:

- I sold my hometown flat. This alone has not impacted my net worth value, I just had a change of asset classes as I cash out the value of the flat.

- My mum had life insurance in place, I received €30K after her death. This directly impacted my net worth value.

- My mum no longer needing care means I can again keep and invest the net income derived from the rented warehouse. That is an extra income that adds more than €10K net per year.

- I inherited 25% of my old grandma’s house which was sold for €120K. That was another €30K of cash that I was not aware of and directly impacted my net worth.

- I generated close to £10K as a side income in the latest tax year. Again this is an extra I was not expecting that adds up.

- We bought a house in the UK. Even though it has been recent, I believe this action has already impacted the net worth. We renovated the kitchen fully, painted the walls and added new flooring (although this is not 100% finished for the whole house). I am counting that this increased the value of the house by 8%, so roughly that’s an extra £15K increase in the net worth numbers.

These are the main financial points of year 4. I had a lot of cash activity and movements, all mainly derived from my mum’s death. Financially speaking year 4 was a great year despite the market behaving rubbishly.

Changes In My Investing Strategy

The next chapter of this recorded document is to report any changes in my investing strategy.

So, what has changed since the year 2 update?

Back to Stocks & Shares ISA and SIPP

In 2022 I returned to live in the UK and with that all the investing perks of living in this country. I am again prioritising investments via a tax-advantaged Stocks & Shares ISA and SIPP.

Global Funds

No changes in my investing philosophy. My principal monthly investment is still purchasing shares of global funds trackers as shown on my index funds portfolio.

Dividend Growth Investing

My dividend growth investing strategy remains stable. I see it as the fun part of my investing journey, and as such, I rather limit the portfolio allocation to close to 10%.

The UK government implemented changes to the tax policy for dividends. The dividend allowance for the 23/24 tax year is £1,000 for basic taxpayers. This is reduced to £500 for the following tax year. Looking at my dividend portfolio, I can see a projected annual dividend income of £787.

This dividend tax policy change currently affects me as my dividend portfolio sits outside of tax-advantaged accounts and is held in Euros. I am ok for this year as my annual dividend is below the dividend allowance, but this changes the next year as the dividend allowance is reduced.

To avoid being taxed on dividend income I plan on transferring progressively my dividend portfolio to an S&S ISA, starting next year. I will need to sell my stocks held in euros, convert the cash in pound sterling so it can be deposited in an S&S ISA and then buy the same stock using pounds. I don’t like this as is going to mess things up but I have no other choice if I want to avoid the tax man.

P2P Lending

Investing in P2P lending is risky. I don’t plan on making big investments in this industry until the risks of a global recession are over.

Cryptocurrencies

Similar to P2P lending, investing in crypto assets is a high risk, so again I don’t have big plans for this asset class. I own some Bitcoin, Nexo and shares of a crypto fund that has performed poorly. I am not selling anything, but won’t be any time soon buying anything either.

The Plan (Revision 4)

All that being said leaves me with a newly revised plan, the revision 4 plan.

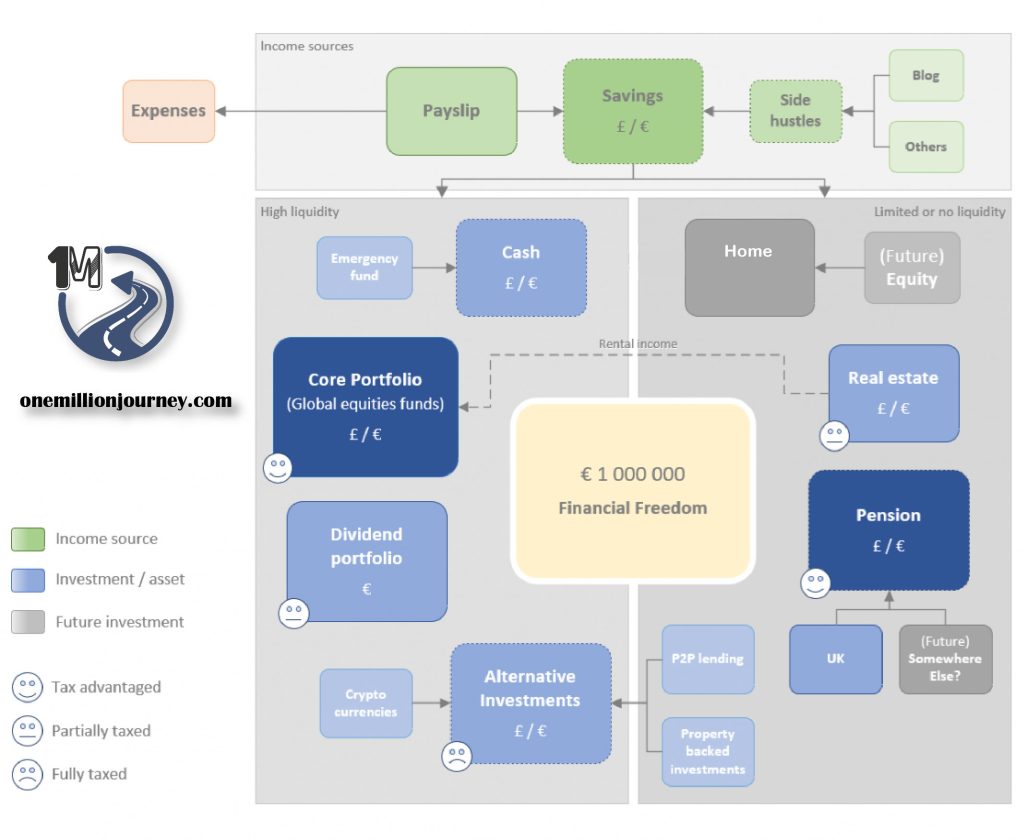

It is still based on the first and fourth CashFlow Quadrant as explained by Robert Kiyosaki, so the core plan remains intact.

My main source of income comes from my employer, which puts me in the “E” (Employee) quadrant. Saving and investing puts me in the “I” (Investor) quadrant—my cash flows between these two quadrants.

Obviously, a lot can happen before I hit the million. I could switch to being a self-employed (S, second quadrant) design engineer, but for the time being, I prefer to focus my strategy on the first quadrant (E) as I don’t plan on a full switch yet.

One Million Journey Chart Plan Revision 4

The main goal is to reach a €1.000.000 Net Worth. This will be enough to provide me with financial freedom and long-term financial stability.

Global Index Accumulator Funds are part of my core portfolio. The returns out of this portfolio are tax-advantaged within ISAs or SIPPs. I expect to contribute around £1000 a month to this fund. My investments here will be Index Funds and ETFs, consisting mainly of global funds, as I explained here. I will follow a stocks and bonds balanced approach. My current balance stays at 70/15 I will only rebalance once per year, in December, except during extremely volatile markets, such as the one we had in March 2020. This is no longer my plan. My plan is to get rid of my bonds. I expect a small recovery when interest rates begin to go down, that’s when I think it could be a good time to sell. My expected annual growth rate for the next 10 years is conservative at 5%. This is a fast liquidity account.

Pension will also play its role. I am enrolled in my employer’s pension scheme. Every month I contribute 8% of my payslip and my employer contributes 3%. I also get tax relief from the government. That approximately sums up to £225 a month at the time of writing. All info on how that works is explained here. I set my investment strategy as adventurous, and what it basically does is invest in a world index tracker for a 0.5% annual fee. This is more expensive than other world trackers, but it is still worth it, considering my employer contributions. My expected annual growth rate for the next 10 years is 10%. I won’t have access to this account until I am 55 or 57 or 60 or whatever the government decides during the next 20-something years. That’s primarily why my investment accounts in global funds are my core portfolio instead of my pension.

Alternative Investments will only constitute no more than 10% of my investable assets at any time. 2020 showed us the real risk of investing in P2P lending assets. My crypto investments will be taken as part of my alternative investments. Currently, I am at a withdrawing stage with no plans to contribute any money to this asset class for the time being.

My Dividend Portfolio will also only constitute 10% of my investable assets. I believe that I am not smart enough to outperform market returns. On the contrary, I enjoy reading financial reports and widening my learning about companies that pay a dividend consistently. I also enjoy learning about how their sector works. Putting a toe in these waters is my personal way of becoming a more well-rounded individual.

Cash provides me with safety and options. Safety in terms of an emergency fund to be utilized in case of unexpected events such as losing my job, health issues or any sudden expense. Options in terms of investing at a given opportunity. Cash is mostly kept in savings accounts, some are easy to access others are fixed. will be kept in checking or savings bank accounts. These accounts are paying between 5-6% and give me a yearly income of over 4 thousand Pounds.

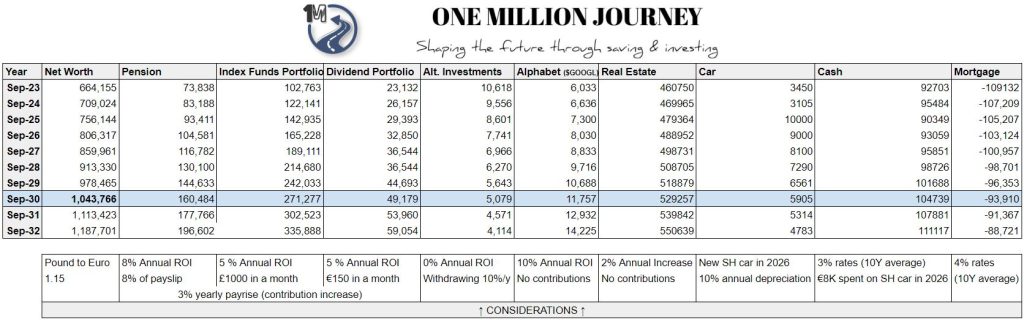

Net Worth Projection – Millionaire By 2030?

I finally come to the point where I need to see when I can possibly expect to become a millionaire.

In this year 4 update I decided to make a new net worth projection. Although I could still expect to hit the million by 2029 as per my original projection, the structure on which was based is outdated. I now own a home, don’t invest that heavily in alternative assets and introduced dividend stocks to my interesting strategy.

Finally, as an ending shot, this is how the original network projection looks like:

As a reminder: This blog post considers my own personal situation. Yours will be different, so don’t take anything of what I’ve written in this post as investment advice. If unsure, seek professional advice.

Thank you for reading, I hope it has motivated you to think about your personal financial plan.

Comments, suggestions or questions are always welcome.

Tony

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.