Portfolio & Savings Update #25 December 2020 – 120,235€

First of all, I’d like to wish you all a happy new year 2021 and welcome you warmly to another portfolio update, this time being for the month of December 2020.

Table of Contents

December in a nutshell

Am I the only one who terribly wanted to put an end to 2020?

I feel like I am not actually looking forward to starting a new year with a renewed set of possibilities, but to having stepped over to such a difficult and strange year instead, so I can move on trying to forget a year full of unforgettable facts.

However, besides the difficulties we’ve expereienced throughout the year, global markets have done well thanks to the billions that governments and central banks have put as a stimulus, but on the other side of the investing fence, many P2P investments haven’t (in many platforms, investors money worked as a”stimulus”, with the difference that we can neither print money nor get paid by others people taxes). I plan to do a sort of 2020 recap in a separate blog post together with new goals and methods to work on during this new year, so more on that shorty.

In December something exciting actually happened. It was unexpected.

In my previous update, I was a bit hopeless about advancing on my professional career here in the UK as an ex-pat. But a few days after publishing that blog post, something would change for good.

My boss asked me to assist in another interview for hiring a new potential design engineer. I thought that assisting to another interview would be another waste of time, but as I worked from home on that day and live only 15min away from my workplace, I thought it could be a good opportunity to get some paid fresh air and recharge my car battery before it flats again!

But, to my surprise, the candidate not only seemed to be a perfect match for the job but was also an ex-pat with a similar engineering background to mine.

Two days later after the interview, he was offered the job.

He accepted soon after.

And what happened after that?

Tony from onemillionjourney was promoted! YAY!

I got promoted at work today! ?

— Tony | Onemillionjourney.com (@JourneyMillion) December 4, 2020

Fu*k! I am so happy about it!

(for now)

After that, it has all been stress, stress and more stress, and I know this is only the beginning. But no worries, I am still happy about it (for now).

I have now several challenges ahead. Challenges that will consume much of my time moving forward and will put blogging and tweeting on a different priority tier. I have never been a manager before, and even though I initially just need to manage one person, it will take me some time before I get 100% comfortable with my new role, or in other words, before I acquire and practice the new skills that will allow me to feel comfortable.

The truth is that I’ve been wanting and getting ready for this for some time, and it also comes with a significant pay rise, which hopefully will help me to shortcut my current 12 years million plan.

It is important to mention that albeit I am looking forward to becoming the best of what I can and to fulfil the position to the best, there is a substantial risk on me to stop enjoying my job and end up burning out. That’s why I decide to avoid lifestyle inflation and keep my F-U money fund in a good and healthy condition, so I can use it to cover the risk of me needing to breathe in the future.

Having said that, it’s time to have a closer look at what’s happened this month financially speaking:

Quick Recap of December Numbers

- Portfolio value: 120,235 € (+4.1%) – details HERE

- Monthly Transactions (Deposits – Withdrawals): 2,709 €

- Monthly growth from investments: 2,198 €

- Passive income: 1,235.89 € – details HERE

- Savings Rate: 71.4%

Despite the extra expenses that the Christmas festive season brought, December was a great month for both, my savings and my portfolio growth.

A welcoming extra 1,000 € came in this month in the form of “rental income” thanks to our warehouse and my mum requiring less money this month, as no care assistants were allowed to enter the hospital due to all patients being put in quarantine, following a small Covid-19 outbreak that surged within the premises. It was not fun to hear about this, but now that the hospital seems to have it under control, a thousand bucks saved and invested is much appreciated!

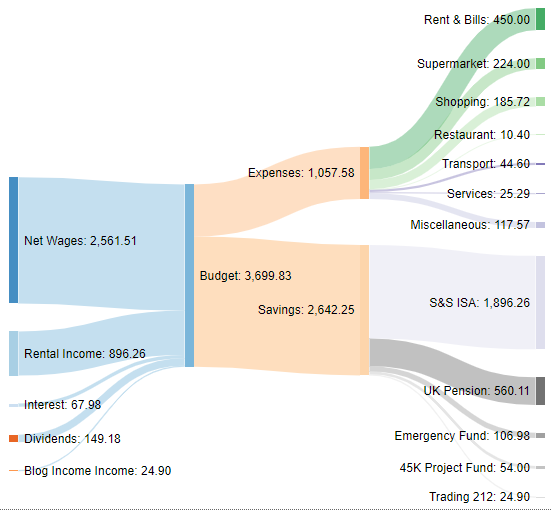

Monthly Cash Flow Sankey Diagram

Total income in December equals £3699.83 (4,106.8 EUR). Seeing a number four in front of the euro figures gives me some good vibes, as it basically means I’ve reached a new high in monthly income.

Total expenses are £1,057.58 which is quite low for December. In November, I bought some last-minute gifts on Black Friday. That has helped to lower the Christmas bill this month. The Supermarket bill has also got larger (my belly knows well about it!).

It’s also great to see how my pension contributions have automatically increased following my latest pay rise.

It was also a good month for ISA and portfolio dividends.

December Portfolio Performance

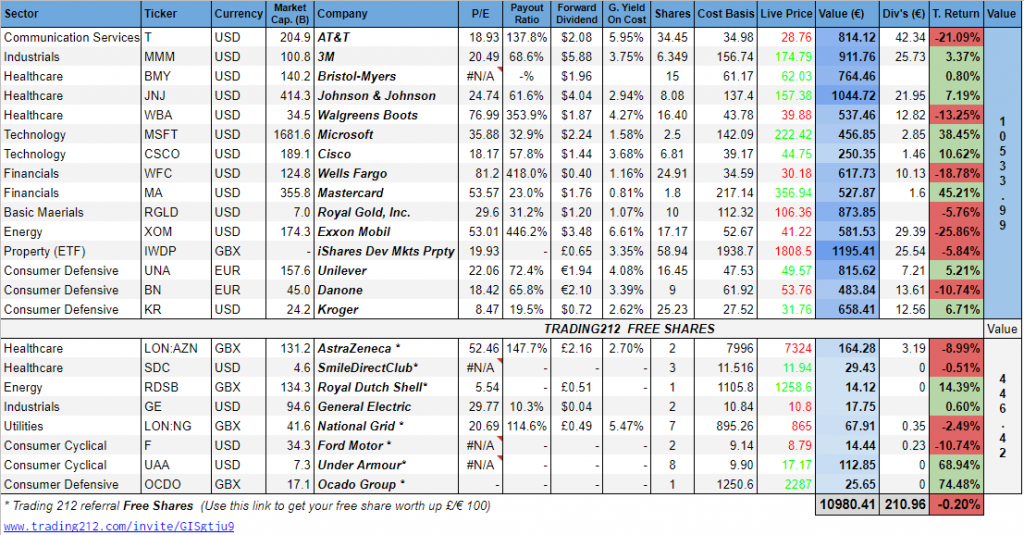

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

I am glad to see another month when returns continued to raise, which means that I am 1.7% closer to breaking even. I hope that 2021 will be the year when I got to see recovering some of my money lost with Algotechs, Grupeer or Envestio. Any recovery, even if it’s a small one will be so beneficial to get me to the green percentage much quicker!

Fast Invest gave me a small virtual “Christmas gift”, adding into my account some delayed payments all at once. They also gave me a Christmas headache by asking to upload my documents (once again) and cancelling a pending withdrawal I had requested weeks ago until I don’t do so. This is obviously and strategy to win time on their side. I hope I can create some antibodies soon, so I can get rid of this virus called Fast Bloody Invest.

It’s also interesting to see how some of my virtual money at Crowdestor has literally disappeared. Perhaps this is an example of the investor’s monetary stimulus I mentioned earlier?

In December, I sold the Global Value Factor ETF from my Vanguard ISA I mentioned last month, and purchased the Emerging Markets Stock Index Accumulation Fund instead.

Now that the UK is completely out of the EU, I wonder how the Pound Euro exchange rate will fluctuate moving forwards. I’ve always been convinced that the £ will rise over the long term, or at least my portfolio hopes so! For the time being it remains at the same value: 1.11.

Dividend Portfolio

My dividend portfolio in December generated 43.12 EUR of passive income.

This is the outlook of my holdings at the end of the month:

It was a good month for both, capital appreciation (+2.5%) and dividends.

In December, I sold all my shares of two companies; Disney and Invesco and bought shares of two other companies in exchange; Bristol-Myers Squibb and Royal Gold.

The share price for Invesco rose from $10 in September 2020 up to $18 in December. That’s the company trading at 16 times earnings, which is its historical average. According to analysts, the growth for the next 5 years is expected to be negative. The dividend growth for this stock is also negative and to top it up they cut their dividend during the first coronavirus wave. Adiós!

Selling my Disney shares was a bit more painful. I wouldn’t mind being a super long term holder of Disney as I truly love this company, but I’d rather keep my portfolio clean and tidy as I don’t want to end up having too many companies in my portfolio. Disney stopped paying dividends in 2020 which isn’t ideal for a dividend portfolio. In addition, Wall Street optimism with Disney + has shot up the share price above what I think it’s rational. The consensus EPS forecast for 2024 is 6.73. The highest PE ratio the company has traded for the last 10 years is 20. If I multiply 6.73 times 20 = $134.6. The stock currently trades at $181. That’s another Adiós!

Royal Gold is a 1981 founded company based in Colorado. It operates in the basic materials sector and gold industry.

As described by the Motley Fool:

“Royal Gold doesn’t own any gold mines because it approaches making money from the sector differently. It chooses instead to acquire streaming and royalty agreements with mining companies.

These contracts give it the right to purchase metals from certain mines at an agreed-upon price, or the right to receive a percentage of a mine’s production. It’s a high-margin business, which enables Royal Gold to generate robust cash flow.

I think that adding a gold company to the portfolio is not a bad idea since most of the companies I own are based on the dollar currency, which has been losing a lot of ground, especially against the Euro. I really like the margins (45%) and balance sheet of this company (Total Cash: 413 m vs Total Debt: 279 m). In addition, it also pays a dividend of $1.2 per share (1.1% yield) which is quite high for a gold company. The company has raised the dividend for 19 years. The last 5 years growth rate is 11% and the payout ratio looks healthy.

Finally, I added Bristol-Myers basically because our beloved Warren Buffet also did so and because I liked their balance sheet and the average annual earnings growth of more than 20% expected over the next few years. The company operates in the healthcare sector and drug manufacturers industry. Its shares currently trade at a little over eight times expected earnings, which seems like a bargain to me. 14 years of dividend growth, 9% dividend growth over the last 5 years and a decent yield of 3%!

Dividend Payments

Eight companies paid dividend in December:

- 3M (MMM): 6.5€

- Jonhson&Johnson (JNJ): 5.01€

- Walgreens Boots (WBA): 5.31€

- Kroger (KR): 3.16€

- Microsoft (MSFT): 0.98€

- Wells Fargo (WFC): 1.74€

- Invesco (IVZ): 10.25€

- Exxon Mobil (XOM): 10.17€

Total Dividend Income in December: 43.12 €

New Holdings And Purchases

Besides reinvesting all my dividends, all contributions to my dividend portfolio came from earned free shares this month.

- General Electric (GE) 1 share @ $10.79 *FREE SHARE*

- General Electric (GE) 1 share @ $10.9 *FREE SHARE*

- National Grid. (NG) 1 share @ p857.2 *FREE SHARE*

- Invesco (IVZ) 80.15 shares @ $17.93 *SOLD*

- Walt Disney (DIS) 7.15 shares @ $153.23 *SOLD*

- Royal Gold (RGLD) 10 shares @ $112.32 *NEW PURCHASE*

- Bristol-Myers Squibb 15 shares @ $61.17 *NEW PURCHASE*

The €45K Project Fund

Another month, another £54 was saved as a non-smoker and put in the 45K Project Fund. However, I could invest it nowhere due to the lack of new opportunities in both Abundance and Qardus, so I am keeping it as cash until a new investment opportunity arises.

So far The 45K Project Fund consists of:

- Abundance Investment: 1,120.5 EUR

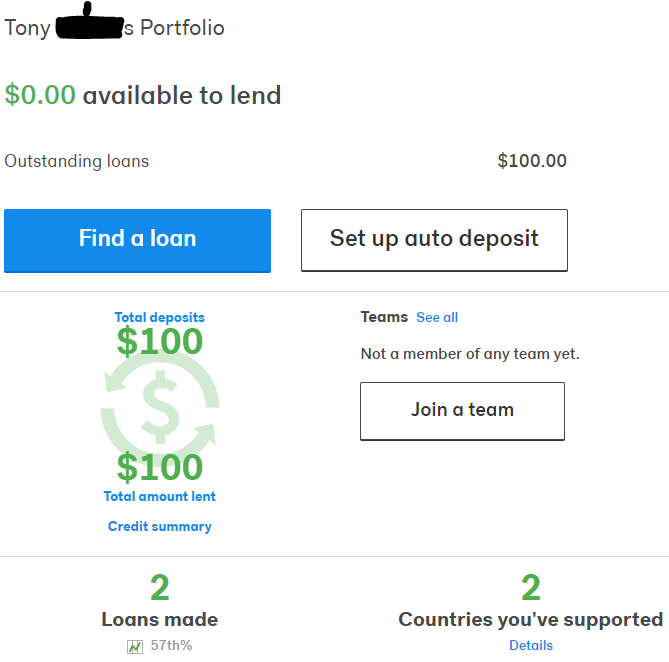

- Kiva: 82.49 EUR

- Qardus: 335.2 EUR

- Cash: 60 EUR

So far, I have recovered 3.55% of my loss = 1,598.19 EUR

43,401.81 EUR left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

Blog Income 2020

As I promised at the start of 2020, I donate 50% of my blog income, and I’ll show it with full transparency by the end of the year.

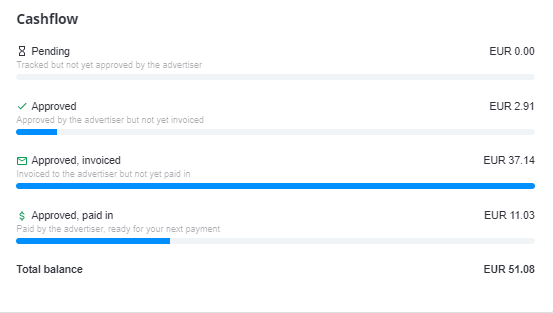

Affiliate sales in 2020 sum up to 131.86 EUR, however, 51.08 EUR still haven’t been paid to me, which leaves a net of 80.78 EUR for 2020. see images below:

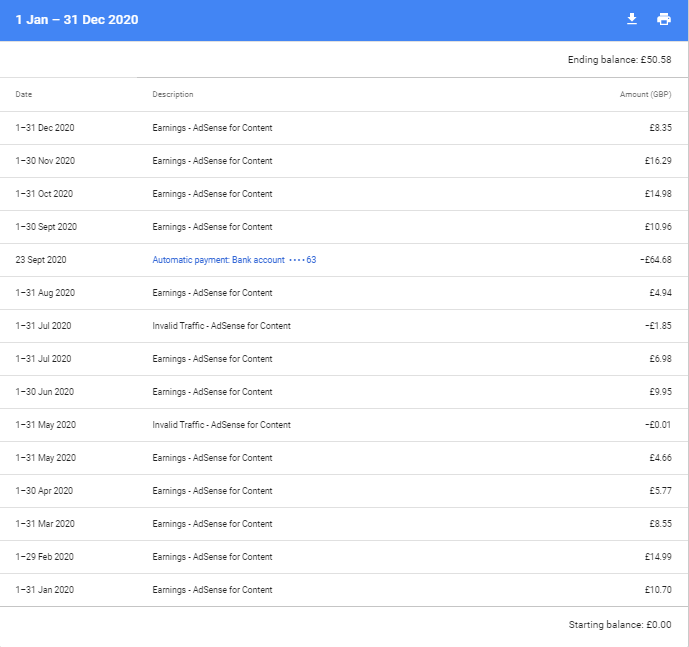

Google Adsense income sums up £115.26, however, I have only received one payment of £64.68 paid in September.

My third source of blog earnings is my Trading 212 free shares. The value of all earned free shares on the 31st of December 2020 was 446 EUR. I hope readers will excuse me, but I have no plans of selling my free shares to donate 50% of its value quite yet. I plan to do so once I have exceeded the number of free shares we are entitled to earn, which is 20 free shares per person, 20 for me and 20 for my GF. Or put differently, I will sell all my shares and donate 50% of its value once I have earned a total of 40 free shares. So far, I’ve earned 26.

Having said that, my total blog income for 2020 was 152 EUR. 50% of that is 76 EUR. As you can see in the previous section (The €45K Project Fund) I donated 82.49 EUR ($100 approx.) to Kiva so far, which exceeds that amount.

This is it for this month, I hope you have a great month wherever you are and thanks so much for reading.

Tags In

Tony

Related Posts

10 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Happy new year, Tony!

Congratulations on the promotion. Looks like a good month to cap off a mixed year. Here’s hoping that 2021 is better for everyone. All the best!

Thanks, Doc. I appreciate your words. All the best you too.

Congratulations on your promotion Tony and I wish you good health and happiness for this year. You have built a solid foundation and now you just need to continue…

Thanks, Druss appreciated man.

Likewise, health and happiness stand above anything else.

I think my foundation is solid, but there’s still loads and loads to learn unless I stick to global funds. Step by step.

Having added a small dividend portfolio this year helps me to be engaged with continuous learning.

[…] One Million Journey shared his December 2020 Portfolio & Savings update. I find his report always refreshing to read. It’s extensive and I like how he shares his […]

Happy New Year, Tony!

Congrats again on your promotion, well done – let’s hope you can put your payrise to good use investment-wise!

Good to see your dividend income continuing to rise.

May 2021 be a happy and prosperous one for you.

Thanks, weenie happy New Year to you too! I’ll certainly try to contribute as much as possible to my ISA, although I wouldn’t mind spending a nice chunk of cash on holidays once we come out the woods.

Likewise, all the best in 2021.

[…] started, but we decided to postpone it until things got better. Time passed, and then I got a promotion. I took it as an interesting temporal challenge and opportunity to learn and gain some experience, […]

[…] started the year with a lot of excitement after I had been “promoted” as a design manager in December 2020. It sounded like the perfect pre-Christmas gift. My professional goal at that time was to leverage […]

[…] began the yr with numerous pleasure when I have been “promoted” as a design manager in December 2020. It seemed like the easiest pre-Christmas present. My skilled objective at the moment used to be to […]