Portfolio Update #24 November 2020 – 115,523€

Amigos, welcome to another portfolio update, this time being for the month of November 2020.

Table of Contents

Quick Recap of November Numbers

- Portfolio value: 115,523 € (+7.6%) – details HERE

- Monthly Transactions (Deposits – Withdrawals): 1,007 €

- Monthly growth from investments: 7304 €

- Passive income: 96 € – details HERE

Even though all my sources of passive income combined contributed less than 100€ this month, (my lowest since July 2018), global markets have been on the rise and have affected my portfolio positively.

Could we have more months like this one please, Mr. Market? 😉

As my portfolio allocation is gradually increasing towards having a larger exposure on stocks (63.7% at the moment), the value of my portfolio is getting more and more impacted by the stock market volatility.

This makes me happy for two reasons:

- It seems I took the right decision by exiting P2P investments and adding on global funds.

- This is the first time I had a value increase of my portfolio of more than 7K since the Algotechs scam, which reminds me that I am slowly getting back where I once was, all thanks to having better results during 2020.

I see this as a sign of improvement, which at the end of the day it’s what I am after.

Novemeber Portfolio Performance

As I like to do every month, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted as estimate future withdrawal tax payments

Portfolio performance since I started investing still stands on the red, but it has now dropped to the twenties for the first time. If the stock market continues to perform within the average yearly rates (7%-10%), I may get a chance to “recover” losses within a three or four years time bracket.

As usual, my UK pension did better thanks to my employer contributions and tax reliefs. The difference between the returns achieved in my pension and my ISAs is just getting wider and wider. 5% vs 16.9% annualized.

As overall, my portfolio this month increased by 6.81%, which is great. I have to say though, that the S&P500 did better increasing around 10%. The main reason for this difference is because 36% of my portfolio is still invested in bonds and P2P investments.

The Pound Euro exchange rate remained at the same value: 1.11.

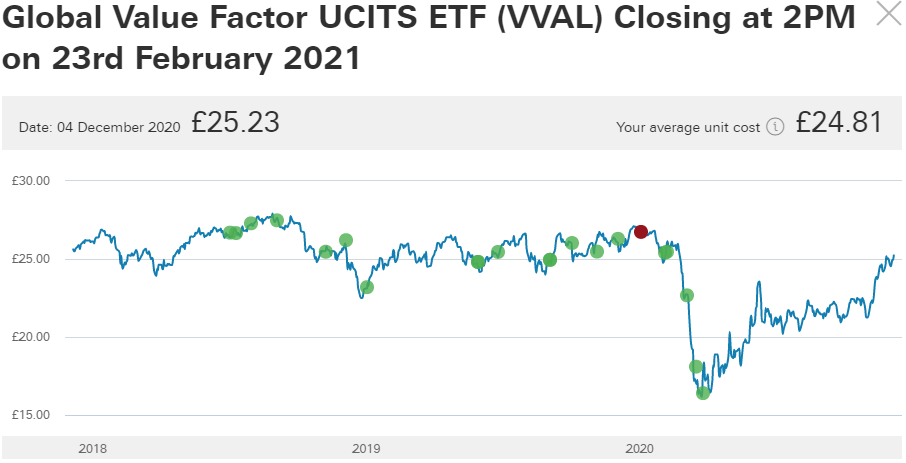

Vanguard To Close Its Factor UCITS ETFs

In November Vanguard sent a secured message to investors to announce the closure of all Factor UCITS ETFs.

I was a bit disappointed after reading this news as I was planning to be a long term investor of one of its funds, the Global Value Factor ETF with the ticker VVAL.

I made the first purchase in 2018 soon after reading The Intelligent Investor by Benjamin Graham as I shortly explained here. I was convinced that this would turn out to be one of my best investments but it did not materialize as total return since inception has been only 2.3%.

The current value of my position stands at a value close to £10K. I need to decide whether to wait until the fund is closed in February or to sell my positions before.

The closure of these funds should come as no surprise. As a general pack, none of them has performed very well during the last years. As a consequence, investors have slowly lost interest in them.

I found this video recorded by Ramin Nakisa from PensionCraft useful, as he explains in a simple way why Vanguard has decided to close its funds. It’s also interesting to learn the basics of how Vanguard operates as a company.

Alternative Investment Portfolio

My Alternative Investment Portfolio provided me with 65.62 € of passive income. That accounts for 68% of my total passive income this month.

In November, I managed to withdraw all my money from Robocash (1.8K) and over a thousand Euros from Housers. So that was another nearly 3K that I used to buy more global funds.

I have about 20K invested in P2P which is still more than what I want. There’s a lot more I’d like to withdraw from Housers and Property Partner, so I hope I’ll be able to do so with no losses as time goes by.

The following are the platforms which I am currently invested in, classified from 1 to 7 9 by my level of contentment. I have not included Qardus* on the list yet, as it’s too early to express any level of contentment.

1. Crowdestate

My investments on Crowdestate* are still doing well. None of my loans has defaulted and all payments are on track at the time of writing (05/12/2020)

As I am happy to keep my Crowdestate portfolio close to 2K, I am no longer withdrawing funds at this stage. I have close to 300 Euros of cash in the platform that is waiting to be invested in new development loans, which will be preferably secured by a first-rank mortgage.

2. Estateguru

Things still keep running fairly well at Estateguru’s*.

My portfolio consists of 31 loans (35 last month), where 27 are being paid on time and 4 are late (4 last month). I have no defaulted loans so far.

My account value is 1.8K, but I have about 300 Euros ready to be withdrawn. That’s going to leave my account at 1.5K, which is the amount I am happy to keep with Estateguru.

If you want to give it a try, please consider using this link and get a 0.5% bonus on your investments made during the first three months.

Out of all my current platforms, Crowdestate and Estateguru are the only ones that I have not experienced any problems (so far). But, from now and moving down the list it just gets worse and worse.

3. Crowdestor

The outlook at Crowdestor’s* is still worsening compared to the previous month. Out of 18 loans I am invested in, 8 are delayed (7 last month).

Crowdestor seems to have promoted Anatoly Putna as a new COO. He’s recently introduced a new statistics page on their website to improve transparency with investors. Its shows 109 out of 152 projects as delayed, which accounts for 71%.

In my portfolio “only” 44% of my loans are delayed, which means I am in a better position than average.

Results are disappointing either way, but at least no bullshit transparency builds some trust from my point of view.

Will see.

4. Property Partner

Property Partner kept paying rental dividends in November.

Not much happened this month, so there’s nothing to report.

5. RateSetter

RateSetter is having a tough year as it was forced to halve interest rates for the rest of 2020 in an attempt to stabilize their provision fund.

I am on the slow process of trying to exit this platform. I requested all my funds back in August. There are 16,500 investors (18,850 last month) in front of me before I can withdraw my money.

It seems things are speeding up, so I could potentially be able to access my money in 8 months, which is much better than the initial 3 years!

6. Housers

Housers is slightly getting a bit better although total returns are still a laugh.

One of my buy-to-let investments was sold in October. Investors received the cash of the proceedings in November. In my case, that was 1000 Euros which were lovely to have and I immediately withdrew. The IRR of this investment ended up being 2.2%, which is ridiculous.

I still got many projects that are not generating any income at all, but less than before.

7. Fast Invest

Fast Invest monthly income is stabilizing. I managed to sell some of my loans on the secondary market and recently asked for another withdraw. How long it will take me to get that money in my bank no one knows.

Dividend Portfolio

My dividend portfolio in November generated 23.77 EUR of passive income.

This is the outlook of my holdings at the end of the month:

It was a good month for capital gains (+10%), a fact that has put my dividend portfolio in a greener look than the previous month.

Invesco has especially done well since I mentioned its breakout in my September’s update. However, I still plan to completely exit this position as it is a stock that I am not so confident about. I would instead rather be a shareholder of BlackRock (BLK) as it has a more “predictable” future although it seems a bit expensive at the moment.

ExxonMobil and Wells Fargo have also done well after the news about the Covid-19 vaccine was announced globally.

Dividend Payments

Four companies paid dividends in November:

- AT&T (T): 12.8€

- Unilever (UNA): 3.62€

- Mastercard (MA): 0.52€

- iShares Dev Mkts Prpty (IWDP): 6.83€

Total Dividend Income in November: 23.77 €

New Holdings And Purchases

Besides reinvesting all my dividends, all contributions to my dividend portfolio came from earned free shares this month.

- Royal Dutch Shell (RDSB) 1 share @ p1105.8 *FREE SHARE*

- SmileDirectClub, Inc. (SDC) 1 share @ $9.15 *FREE SHARE*

The €45K Project Fund

Another month, another £54 was saved as a non-smoker and put in the 45K Project Fund.

I November I earned some blog income, so I donated another $50 to Kiva.

So far The 45K Project Fund consists of:

- Abundance Investment: 1,103.1 EUR

- Kiva: 82.49 EUR

- Qardus*: 333 EUR

So far, I have recovered 3.37% of my loss = 1,518.59 EUR

43,481.41 EUR left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

This is it for this month, hope you have a great month wherever you are.

Merry Christmas!

Tags In

Tony

Related Posts

5 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi Tony,

Great to see that your well over the 100k now. I am in a similar position to you in terms of composition (% in market / in p2p etc). It’s also good to see that Fast Invest has started to pay out loans again, but who knows how long it would take to (or if we can) make any withdrawals.

The market is also crazy high at the moment. Especially when hospitals (in the US) are full!

Probably an unpopular opinion, but it would be good to see the market drop ~30%, to allow me to snap up some more great dividend companies. Once you invest in great companies for the long term, the market drops don’t really affect you at all 🙂

Power on!

Matt

Hey Matt thanks for your comment (and sorry for my late reply).

It does seem like things at FastInvest start to work out a bit better, however withdrawals are still late as I am waiting for about 4 weeks since my last request…

The market acts irrationally due to the billions put in via stimulus packages. It’s scary if you think short term but as a long term investor I still sleep well at nights! I added a Gold company to the roster recently to level up the game 😀

Likewise, I always welcome market drops, although I would not have as much cash to buy the dip this time, but just my monthly standard contributions.

All the best Matt!

Hey Tony, love your blog! Congrats on being 42% of the way towards your net worth goal! Another great increase this month for you. I’m a big fan of your dividend stocks too, they all have great payouts. Keep up the great work!

Ei thanks Tyler for stopping by and writing a nice comment.

[…] One Million Journey Portfolio Update #24 November 2020 – 115,523€ […]