Portfolio update #4 March 2019

Hey, what’s up Macarenos and Macarenas? 😉 Another month went by quickly and here I am again, updating my investment portfolio. I can’t believe that this is already my forth portfolio update, when it seems to me that it all started yesterday, time flies!

Unfortunately, my investments during this month haven’t flown as time has but fallen off by a shocking 64% in just a few days. If you read my last post “Hola Net Worth” you already know what I am talking about, if you didn’t, you’ll soon find out. This March has been the toughest month since I seriously started investing my money back in 2017, and my first time experiencing and accepting a loss.

That’s how the game works and it comes to most of us sooner or later, some will lose more money than others, but it is an experience that we’ll eventually encounter on the journey. In a way, I am happy that this has happened to me now and not close to my retirement age. I’ve learnt a huge lesson and paid hard for it, but trust me guys, I will remember it the whole of my life. Also, I am happy because I’ve sensed how losing money squashes me down, and survived from it.

Writing about it helps immensely, and the support of some of you guys is hugely helpful. Thank you so much! After this experience I feel ready to go through a market downturn while not panicking and being rational minded, and most importantly, being confident that I will never give up with this journey! So, when I look at it from the positive side of the coin I am even grateful. From now on, I proclaim myself as a volatility-proof person 😉

Without further ado, fasten your seat belts, DON’T

Table of Contents

Monthly Highlights

- Portfolio value: 73,722€ (-64 %)

- Monthly Transactions (Deposits – Withdrawals): +3303 €

- Monthly earnings: -125,474 €

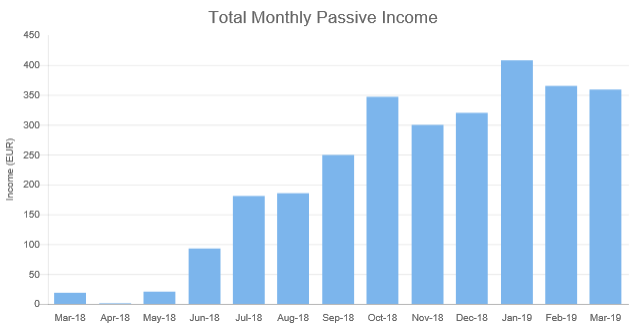

- Passive income: 359 €(-1.6%)

Leaving on the side the minus symbol, it’s impressive, isn’t it? It’s impressive how the algos have fuc**d up all the cummulated gains and part of my deposits over a year in just a few days. Algotechs and its innovative leading algotrading technology is indeed on the top, on the top of leading others towards losing money.

As a result my portfolio value chart now resembles the Portaventura Dragon Khan roller coaster, combined with the feeling of Hurakan Condor (middle guys). Cheers Algotechs!

Yep, this is my investment porftolio and not the S&P 500 at the end of 2018.

My new portfolio allocation

Good news is that my new portfolio allocation looks sensible now.

Look at that! The beauty of almost a symmetry! 🙂

Passive income

Algotechs extinction hasn’t affected my passive income though, which essentially all comes from my bond funds, real estate crowdfunding and P2P lending. I no longer focus on hitting my target of 700€ per month by the end of 2019, as after filling up my Net Worth balance sheet I realised that alternative investment takes the 10% of my total assets. When considering the risks, this is the maximum I want to put in.

EU FI-bloggers passive income chart

This is an idea that Eelis@thewealthyfinn came up with recently, and I loved it. As a big part of our FI journeys depend on our passive income, what a better way to create community than sharing it together? The final chart will have between 10-20 bloggers, so if you are a FI blogger and it looks appealing to you, I am sure Eelis will be happy to hearing from you. This chart shouldn’t be considered as a competition, but supportive and a community builder.

Monthly earnings by platform

My ISA has grown +2.2% this month, being the biggest move. The recent inverted yield curved has made investors purchase more bonds, lifting up the trading price of my bonds ETFs. In March, my best Real Estate crowdfunding platform is Crowd Estate (+1.1%) and my best P2P/B lending platform Envestio (+1.3%)

The GBP/EUR currency ratio stays at the same value as my last portfolio update – 1.16

| Platform | Inception date | Value February | Transactions | Value March | Earnings | Return March | Cumulative Return |

|---|---|---|---|---|---|---|---|

| Algotechs | 20/11/2017 | 126,455 | 0 | 0 | -126,455 | -100% | -100 % |

| Vanguard (£) | 14/03/2018 | 27,082 (31,415 €) | +2,000 (2320 €) | 29,672 (34,419 €) | 590 (684 €) | 2.18 % | 5.6 % |

| Property Partner (£) | 21/01/2018 | 5,866 (6805 €) | -500 (+580 €) | 5,366 (6224 €) | 0 ( 0 €) | 0 % | 7.1 % |

| Housers | 26/03/2018 | 6,630 | 0 | 6,661 | 31 | 0.5 % | 4.1 % |

| Grupeer | 19/05/2018 | 13,844 | -2,000 | 12,003 | 159 | 1.15 % | 13.3 % |

| Mintos | 05/08/2018 | 3,638 | +1,490.8 | 5,158 | 29 | 0.8 % | 6.6 % |

| Crowdestate | 16/08/2018 | 1,933 | 0 | 1,953.7 | 20.7 | 1.1% | 5.6 % |

| Envestio | 15/10/2018 | 3,048 | +2,075 | 5,163 | 40 | 1.3 % | 8.8 % |

| Fast invest | 29/10/2018 | 1,042 | 0 | 1,054 | 12 | 1.2 % | 5.4 % |

| Trading 212 | 03/2019 | - | - | 1,084 € | - | - | - |

| TOTAL | 194,810 € | +3,306 € | 73,722 € | -125,474 € | -64% | -44.7% |

Algotechs

Everything seemed to work just fine, my trading account was over 100K, reducing my succes fees, also, succesful withdrawals seemed to be back on track. until the 7th of March, when the game entered the danger zone. Since October 2018, the EUR/USD has traded between the range of 1.145-1.128 roughly. As I was told by the risk managment executive, Sebastian Nino, Algotechs increased the trades value as it was considered safe, due to the trading pair being stuck within the mentioned range for a long time. On the 7th of March, the pair dropped suddenly, taking the opposite expected market direction. This is something completly normal, it’s happened many times and the algorithm has always been able to get through profiting, but on this time I had no enough free margins to ride the wave, which in Forex translates into add more money or it’s game over baby. This is a massive Algotechs mistake and by no means I would add any single penny to a company run by a bunch of people with dubious skills.

But, has this happened simply because of a luck of skills? Or is there something else behind? I will tell you what, I will post the images and do some simply calculations and you tell me your conclusions on the comments down below, if you wish.

Bealgo dashboard

Bealgo is the unregulated broker that Algotechs deals with and uses to run its ATS software. When logging in a dashboard is shown as follows:

Here everything looks cool, no negative values. The profit is over 96K prior Algotechs success fee, which with my current account value is 20%. I own Algotechs 19,219.36 €.

MT4 trading account

But then, when I head over to my MT4 trading account the perspective changes dramatically.

Such a coincidence! My open trades value has been decreasing just down to the value where my Equity almost equals Algotechs success fee. According to Sebastian Nino, if I decide to give up and trigger the order to close all positions, Bealgo would pay the success fee to Algotechs first and leave me the leftovers, less than 200€ at the time of writting! What’s inacceptable is that they would even get paid when their software has performed like a shit!

WTF is that?

After this exciting news, I decided to not close positions and keep tracking and sharing my real account experiences with my readers, that hopefully at some point will be anyone googling the word Algotechs or Bealgo – if they don’t vanish before I actually rank.

So, a few honest words to anyone reading:

Unless you enjoy using notes as a toilet paper, I wouldn’t recommend to invest in neither Algotechs or any unregulated broker /

Tony @ One Million Journey 😉algotrading company, as the odds are that you will lose your money sooner or later and won’t have any regulation to protect your investments, you’ll end up just like me, totally fuc**d up.

Lastly, the downhill mobile phone screenshot run:

Nice ride, innit?

Vanguard

The 2018-2019 tax year is coming to an end on the 5th of April here in the UK. My initial plan was to withdraw money from Algotechs to max out my ISA before the new tax year begins, but as this has been an impossible task to accomplish, I’ve only managed to add £8350. I made the last push and paid myself £500 out of my payslip and added an extra £1500. I used the free cash I had in my account and this new cash to buy more shares of the USD Treasury Bond UCITS ETF (VUTY) and I added a new ETF to my portfolio – the FTSE 100 UCITS ETF (VUKE)!, which I purchased prior the ex-dividend date and should cash me in the next dividend payment on the 10th of April, otherwise I would have to wait another 3 months, as it pays dividends in a quarterly basis.

Here is why I purchased it:

The British Index yields 4.5% and it has always been on my watch list, but I never made the move because of Brexit uncertainty. After googling for a while, I came upon with an excellent dividend-based valuation, which transparently calculates the FTSE100 intrinsic value and shows a clear discount. Also, it seems to be that some British companies are willing to rewards shareholders during this period of uncertainty by increasing their dividend yield, so a future 5 or 6% yield wouldn’t surprise me. To top it up, a drop in the Pound Sterling would impact the Index favourably, as The FTSE 100 generates about 70% of its revenues from overseas.

As a personal conclusion and opinion, I believe the FTSE100 index is an excellent long-term buy, as sooner or later investors will gain confidence again over the British market, lifting it up to its intrinsic value while cashing in a nice dividend on the way.

Remember, this is only my opinion and it shouldn’t be taken as an investment advice.

To conclude with, my account earns £590 (2.2%) this month against the 1.1% from the S&P 500 Index. Great! Some good news thank you!

So far this year:

- S&P 500 Index : +13%

- My 50/50 balanced Vanguard ISA: 5.07%

Vanguard is a portion of my little British Empire as an Expat

Property Partner

Property Partner has improved the way data is displayed on the platform, adding multiple tables that makes it easier to track and compare investments. I personally love this new addition, as first, it saves me time to track my investments, and second, it looks like a brokerage account. Until now, I’ve tracked my properties manually, making my own investments table and posting it on my Property Partner page, but this will no longer be required 🙂

In February I had two properties on a purchasing process. One of them was stopped as it could be subject to a Compulsory Purchase Order (CPO), returning me £500 that I withdrew as the newest investment opportunity doesn’t look attractive to me. The other one was successfully completed last minute on Friday. For some reason (hope a mistake), I was changed Property Partner fees twice, which gives me a monthly net earnings of £0 LOL.

Investing in Property Partner is a long term investment, 5 years at least, as the initial 2% fees will take some of your rental dividends, same as if you would buy real estate on your own.

In April the next valuation round is taking place, so I will get a refreshed update on the value of my existing property shares. House price in England has fallen during the first quarter of 2019, London taking the hardest hit -3.8%. Most of my properties aren’t located in London and I shouldn’t see such a drop, but I am expecting a decrease on capital gains.

If you are a first time reader and feel curious about the platform, check out my personal review and results after one year of investing here.

Property Partner is also a portion of my little British Empire as an Expat

Housers

Housers, has also introduced some changes, redesigning the whole website and making it easier to navigate, especially on mobile phones.

My “Albufera” development loan is due after 12 months, but the repayment of the principal hasn’t been funded by the developer yet. Their argument is the delay on the building permit from the Alfafar town hall. However, a 12% delay interest will be paid to investors according to contract. (previously 10%).

Housers paid me the promised cashback last month after I reinvested the returned funds from the last buy-to-sell exited project on the 25th, after I had writen my Housers review and results after one year of investing. So, just in case you check it out, you will see a slight difference in the March numbers.

My 50 Estadio Nacional shares are still in the marketplace to sell.

Grupeer

Some more projects exited on time this month on Grupeer, allowing me to withdraw another 2000€ to improve my P2P lending diversification portfolio. This has been my fifth withdrawal without any issues at all. Looking forward to reading their financial statement that was promised to be issued in April.

This is how my diverfication process and Grupper chart looks now:

Mintos

Same as in January and February I deposited part of my Grupeer withdrawn funds to Mintos, 1490€. My total deposit on Mintos is slighhly over 5000€, which is the current limit I am happy to invest in a single platform for now.

Crowdestate

I’ve got not much to talk about Crowdestate this month, I had no issues, no deposits or exited projects. The only thing is that I have over 70€ of cash drag, which I can’t reinvest as the minimum is 100€. Crowdestate demands a larger amount of capital if we want to shorten the cash drag time. Next month I may deposit this extra 30€ to get rid of the drag, if any opportunity I like comes.

Envestio

I deposited another 2075€ on Envestio, same as on Mintos, that’s going to be my last shot here. The total deposited amount is 5000€.

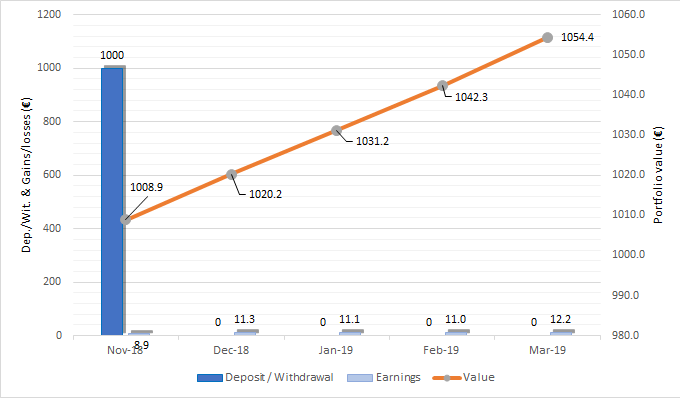

Fast Invest

I have no plans to add any funds on Fast Invest either.

The magic of compounding is showing after the fifth month, getting a 12.2€ record earnings 🙂

How are my 2019 goals going?

On my first portfolio update I set several goals I would like to accomplish this year, it’s time to review how I’m progressing:

Increase portfolio value between 180,000 – 200,000€

→ € – Storms came and unless I succesfully rob a bank there’s no way I can get that. Next month I will set a new goal value

Increase passive income to 700€/month

Read at least 12 books

→ 2.5/12 – This month I’ve been reading “The science of getting rich by Wallace D.Wattles” (amazon affiliatte link). My next read: Principles, Life and work by Ray Dalio (amazon affiliatte link)

Become fitter, reduce body fat to 15% (21% now)

→ 19% (last month 21%)

Improve my writing and speed

→ Looooads to improve, although I feel a bit more confident with my writting. English is not my native language and it will take me a considerable amount of time to master it, if I never really archive it. On the meantime, I hope I am not making people blind while reading through my blog and grammar mistakes. Sorry!

Write 20 blog posts

→ 12/20 – I’m getting there! 🙂

Earn my first blog income and donate it to a charity

→ Archived! I am so happy about this one! Alegria! I got my first blog income! Someone joint Mintos through my referral link adding my first 5€. To whoever joined: A thousand thanks! As I said, by the end of 2019 I will donate the total sum of the OMJ blog income made throghout 2019 to the Bill & Melinda Gates Foundation. Next goal : Earn 25€ and donate it by the end of 2019.

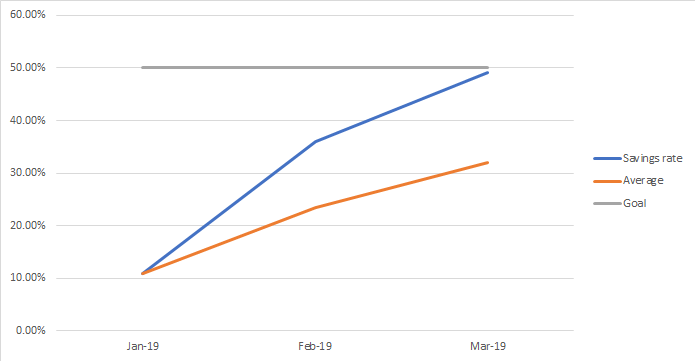

Savings Rate

This is only my third month tracking saving rate, but I would like to introduce a small chart to represent how much of my income I save monthly, I know it still looks a bit odd but I just couldn’t wait anymore! After the Algotechs fall off I need upwards charts to give me positive feelings, so there it goes!

My target is to save at least 50% of my annual income. I will reach the target once the orange average line on the chart crosses the top grey line. My savings rate for this month is 49%, yaaa maan! 🙂

Until next time

This month has been terrific for me, I thought I would always remember the March of 2019 as the month of the UK leaving the EU and not me losing so much money, this mark will always remain on my investment portfolio value chart, a lesson that will never be forgotten. I am glad March is over now, and we are heading for a hopefully shiny Spring season, where Spanish songs are played more often on the UK radio and reminds me that I should go “despacito” rather than “rapidito” on my investing journey.

Lastly, I would love to hear what other people think I should do now, your advice will be honestly appreciated:

- Write a blog post about my investing experience with Algotechs/Bealgo.

- Ignore that and write about something else, like a FIRE plan.

- Start over again from scratch starting with a new domain name and blog.

Thanks for reading! 🙂

You can follow me on twitter where I share some thoughts from time to time and connect with other like-minded people.

Disclaimer: Some of the links on this post are affiliate ones and some others are not. If you join to a platform using my affiliate links you will get a bonus or commission and so will I. I’m going to donate any commission I get throughout 2019 to a charity. You can read more about the purposes of this blog here and where this money is going to go here

Tags In

Tony

Related Posts

19 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi Tom. Sorry for your loss with algorithm traders. Wonder how that is possible. No huge correction at the market. The loss should have came at december correction. Now all the stocks are growing. What the hell thouse algos were trading?

Algotechs is trading Forex, not stocks. (At least that’s what they say…).

Oooo forex. That is risky. Especialy if you go after excotics like venezuela or belarus betting on bounceback ect. Yes you can do good money until you will hit the rocks one time. You can even lose all of your money on USD/EUR with leverage 1000:1

Thanks P2035,

Exactly, that’s sort of what happened or they made it happen. At the end, 70-80% of the whole market is controlled by Algos, it’s an Algos competition, and Algotechs lost the game

Thanks for sharing your experiences, especially with Algotechs. I was thinking of starting an investment with them, but held back because of the bank problems and other negative comments I found on the internet. After reading your latest experience, this is definitely dead in the water now. Did you actually lose all the money you deposited with them, or just the gains that you made? I hope you take comfort in the knowledge that you have spared other people the same fate as yours by telling your story. Good luck with your future investments!

Thanks Rob,

Well, if my post prevented you from investing with them then it hasn’t been worthless, it does console me, hope many others will read it, and take the same decision as yours.

I deposited a total amount of 50K and withdrew 5K only, that makes a real loss of 45K.

Oh, man… what a disgrace… I’m very sorry. But on the flip side, you are very young and have many years of investment opportunities in front of you!

Regarding blog topics: let us know your FIRE plan! ?

Un abrazo!

Many thanks for your kind words and opinion about the topic, it’s much appreciated Inversor Millennial.

Otro abrazo para ti, gracias!

Hey Tony, I bet this was a tough one! But I’m glad you got something out of writing it ?

I see absolutely no reason why you should go for Option 3. Aim high, the million should still be your ultimate goal!

I think you should go for both Option 1 and Option 2, but I understand if you feel like you’re DONE talking about Algotechs.

I also stumbled on thewealthyfinn this month, and found the “passive income of bloggers” graphs cool! My own current passive income seem a little weak compared to the guys on the list though ?

I love that distribution pie-chart now! Symmetry – yum! ?

Yes it was Nick, another new experience to add in the bag. Now I feel so damn relieved!

I feel exhausted of talking about Algotechs. Will it be helpfull for others if I would write a post about my experiences? Would it teach something?

Yeah well so does mine, it all depends on your future investing plans, as if you would want to you could also have a good stream of passive income 😉

Yeah now I just need to keep the symmetry like that and don’t mess it all up again, haha 😉

Hi Tony

I don’t know what to say except sorry to hear of the losses you have incurred from the Algotechs. After I had read about your successes with it in previous posts, I had done some reseach myself as I was interested but what I kept reading (other than promises of big profits) were problems that people had of withdrawing their cash. I guess you knew the risks involved but still, hard to swallow the loss so I thank you for sharing this.

Your one million plan is still viable as you are young and focused but I understand if you were to quit and start over.

Whilst I would be interested in seeing another post about what happened with your algo investments, it is of course up to you if you want to spend time writing about it. There’s no need to write about it immediately whilst the losses are fresh on your mind – perhaps bank it as a future post to write about (if at all).

All the best.

Hi weenie,

Back over a year ago when I started with Algotechs everything looked positive on the web. What I didn’t know is that you can’t barely trust most of what we read online, specially reviews.

I had been trading Forex myself so I understood the risks at a certain level. But there were other type of concepts I wasn’t aware of, like where my money was actually going, how it was kept and what would happen if sth happens…

Thanks, I’m hopping that sharing my bad experience will at least help someone.

I think that banking it as a future post may be the best thing to do until I get fully over it. Your point of view as an experienced blogger is very helpful. You’re coaching us for free and says a lot about you.

Btw, I joined oddsmonkey via your site 😉 I see all of you are making money with it so I wanted to give it a go. Now I need to find some time to learn and understand how it works, which seems difficult as I’ve never bet before but I at least will try and see whether I like it or not.

Thanks for joining Oddsmonkey via my site, Tony – much appreciated. Two recommedations – take things slowly, there’s no need to rush as the profits will come; consider a separate bank account just for matched betting as there will be a lot of activity and it might be better not to get that all mixed up with your usual outgoings, bills etc. Good luck and if you ever have any questions, drop me a DM on Twitter.

Hi Tony,

Sorry to hear about your loss through Algotechs. But kudos to you to be able to still be here writing about it!

The other good factor here is that you have multiple sources of passive income. You could possibly write about this?

I don’t see any reason why you should delete this domain and start new. Its always good to track success and failures as they are both part of the investment roller coaster!

Matt

Hi Matt, Thanks for stopping by and approaching.

If we are brave enough to share our successes we should be brave enough to share our mistakes, and learn from them. I’m sure that many other focused bloggers with the dream of reaching FF would have done the same. Not writing about it would mean to stop believing, and that’s something I/we can’t“afford” to lose.

Thanks for the idea, it’s actually sth I had planned but I’ve procrastinated a bit,hehe. Another thing I would like to do is adding a S&P500 vs P2P vs Property crowd vs ISA returns comparison chart, similarly as do do on your site 😉

Regarding the domain, Thanks again for expressing your point of view. I’m now 100% convinced that keeping it is the right thing to do for me.

We must go on! 😉

To be fair I think you should write a post about it at some point. It may teach others not to be drawn in by things like this.

A post behind how you came across it what research you did and why you ultimately decided to invest and what you’d do differently with hindsight would be hugely beneficial to others

For what it’s worth im massively sorry for you man.

Yep, it will teach others while I heal my wound once and for all.

ThAnks for sharing your thoughts, it’s has been very helpful.

I think a similar situation can happen to any of us. Trying to retire early requires a bit of risk taking. None of us knows how a stock, p2p or real estate or any other market will develop in the future.

Good luck on your next investing path.

I would like to know the essence of the mistakes you have made on Algotech.

Hi Drussak thanks for stopping by,

We don’t have a crystal ball and we never know how our investments will perform in the future, so I think diversification is key to minimise risks. My huge mistake was to allocate so much money in such a risky asset in hopes of retiring earlier. A beginner mistake…

Likewise 😉