Portfolio & Savings Update #47 Q1 2024 – €263,901

The first quarter of 2024 has concluded, so it is time to write another portfolio & savings update in the blog.

Table of Contents

Breaking even in Q1-2024

This quarter was somehow special. In February, my portfolio returns surpassed, for the first time, my early losses in algo trading (€45K) and P2P lending platforms (Grupeer and Envestio). I lost over €59K! Recovering from this has taken 5 full years of saving and investing. This was an important personal milestone, and I’ve finally made it!

However, like everything, there are always pros and cons.

The latter is that getting to this point was my main motivator to keep saving, investing and documenting the progress in the blog. Recovering my money by investing fuelled my burning desire to save and invest, and now it is gone.

The pro I take is that I’ve developed a series of habits that are beneficial for the future of my finances and my life in general.

It’s just that burning desire to achieve something that is gone. I need to fulfil it with something else. I am not too far from reaching a million, and I know all I need to get there is simply — time. There is no real challenge to becoming a millionaire for me any more.

Perhaps it is time to think less about my net worth and give something back to society? Whether that is by raising kids, donating, or volunteering, I don’t know. But I feel something needs to change for me to keep thriving in life.

Quick Recap of Q1-2024 Numbers

- Net worth: €728,441 (+7.1%) – details HERE

- Portfolio value: €263,901 (+8.4%) – details HERE

- Quarterly Total Growth: €19,951

- Quarterly Savings Rate: 20.6%

Comments

This quarter, my net worth and portfolio gained from the stock market growth. We are having a nice upward moment, but as usual, I am a bit sceptical about the sustainability of such growth and prefer to pound cost average monthly as opposed to investing a lump sump. Interest rates are at their highs, so it is not the end of the world if you keep some cash on the side.

We spent extra on refurbishing the bathroom and toilet downstairs this quarter, so savings are low, but happy to see I am still on the plus side!

Investment Portfolio Breakdown

This is how my investment portfolio breakdown looks this quarter:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

So, here it is, babies! 😉 Total returns are positive at +5.2%, so as said earlier that accounts for a big personal milestone accomplished.

I reduced the size of the table to focus on the part of my portfolio that is important — stocks. I want to get rid of everything that isn’t a company and end up with an almost 100% stock investment portfolio.

Simplifying my investments is one of my goals for this year. Given the last price rise of Bitcoin, I decided to sell off. I sold in two tranches, a first half at $67K and a second half at $71. I cashed in a +30% return, which is nice. Not only that, but I got rid of my Nexo coins also at a profit, although substantially lower! I am now a crypto-free man.

Another move I made this quarter was to transfer my Vanguard ISA to Invest Engine, so I avoid the 0.15% Vanguard fees on funds value and get some cash back from Invest Engine as they are running a bonus campaign if you transfer your ISA with them.

Dividend Portfolio

Now as usual I get to look into my dividend portfolio which generated €194 of passive income this quarter (€183.7 last quarter).

I’ve had no contributions to my dividend portfolio for quite a while as I didn’t want to surpass the £1,000 dividend allowance for the 23/24 tax year. However, this can change as we enter a new tax year in the UK. I will use the new £20K allowance to repurchase my dividend stock within an ISA tax wrapper. For that, I need to sell my stocks in a general trading account with Trading 212, exchange euros for pounds, deposit £20K into a new ISA and repurchase my dividend stocks. It’s a festival of FX exchange fees and stamp duties, but that is better than paying future capital gains taxes and tax on dividend income, especially now that the Labour Party is likely to take the UK’s ship steering wheel and changes to the tax system may be introduced.

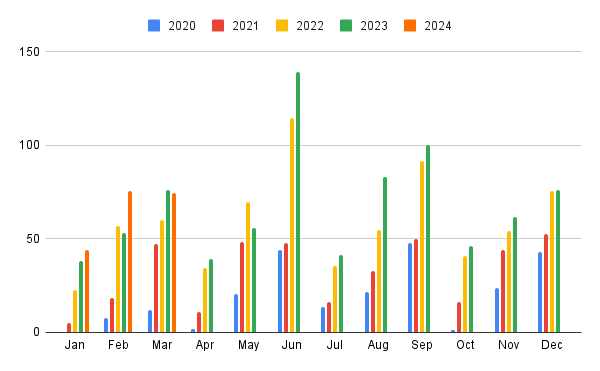

Here’s an overview of my monthly dividend income so far:

Dividend income in March 2024 was lower than in March 2023. That was mainly thanks to Walgreens’ dividend cut.

Systems & Goals Update

We started the bathroom renovation at the end of January. My contact helped us initially with removing the tiles and all the bathroom elements. As expected, part of the plasterboards and floorboards were rotten. This was caused thanks to an old leak at the edges of the bath. Sadly, we didn’t notice that during our viewing, otherwise, we could have negotiated for a discount.

We removed all the floorboards and the rotten plasterboards and replaced them with new ones. We decided to not change the layout of the bathroom during the design stage, which made the plumbing work easier. I managed to learn and do it all myself without major issues.

Once the walls were fixed and the bath fitted in, my wife and I finished the rest of the bathroom.

Once finished, the next goal was to refurbish the toilet downstairs, so we moved on to that next. Being now a plumbing “expert” it felt like a piece of cake. However, it took ages to complete as Victoria Plumbing delivered a toilet bowl that didn’t fit with the cistern. To date, the issue is still ongoing (for the fifth week), so in the end we asked for a full refund and bought a new toilet in one of my new favourite shops in town: Screwfix! 😉 Thank God we had no issues with that one and managed to complete the project!

We’ve spent approximately £4,500 to refurbish both the bathroom and toilet downstairs.

The same house as ours nearby has recently been sold for £240,000, and that was only partly refurbished with no new bathroom. We paid £190,000. I am confident we could sell it for at least £230,000 just a year after, not bad hey? 🙂

Nonetheless, we still have things to improve. The second bedroom is the next on the list. We repainted it and decorated the main wall with wood strips. It looks great!

Now we are focusing on the outdoors, which is the perfect timing as warmer and sunnier days approach.

I also made some progress with obtaining British citizenship. I passed the Life in the UK test, and next week I have an English listening and speaking exam that I need to pass for the application.

I am doing fairly well with my systems and goals this year. I exercise five times a week and eat a bit healthier, although I should socialize a bit more. However, that will change as we approach better weather, and we aren’t that busy with refurbishing any more.

See you in the next update.

Tony

Related Posts

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.