Monthly Update #9 August 2019 – I Bought a Fordkari!

Ladies and gentlemen welcome back to my Spanglish monthly update, it’s nice to see you all again 🙂

August has been a pretty busy month for me. The beginning was easy, as I sang Hakuna Matata often. You should have watched me sing while washing dishes and dancing on my own at the same time, obviously, in a talented way, as no plates were broken! 🙂

My two weeks of working as a Kitchen Porter in the UK paid off finally!

Ok, now jokes on the side, this is a quick summary of what’s been going on over the last few weeks:

- I bought a depreciating asset (Goddamnit!), luckily it was a Fordkari though! – More details on this at the end of the post.

- Though being August, I haven’t had any holidays. I don’t find attractive to overpay for being overpacked, so I and GF are always trying to avoid this, at least until we have kids. It has been quieter at work and had coffee breaks more often (with no smoking involved!). I’ll take some days off when everyone is back and gets busier (These are the sort of skills you learn in England guys – How to earn the same money for doing less and still don’t be fired)

- I joined three new platforms: RateSetter, Crowdestor and Robocash.

- I and my misses have been watching a 30 days video series course to improve on the “12 categories of life”. This has been time-consuming, as it involves taking notes and doing exercises in our journals. We hope this will help us in making the decision on “where the heck are we going to live, for god’s sake?”

- So we watched most of the videos and run through the categories individually, The 12th is life vision, where we visualized our lives during the next 5 years.

- We both visualised life in England, owning our property and raising two kids! 🙂 YAAYY?

Since then, these are the three words I have been typing on Google the most: Mortatges, Rightmove and Zoopla (last two being property websites).

This is quite possibly one of the most important decisions of our life, as an extra, it involves settling in a foreign country. It isn’t a definite decision just yet though, but only a “let’s see what choices we have”.

So, this month we have been busy meeting with a mortgage advisor, researching and viewing properties. That gave us a brief on how things work here as first-time buyers, but obviously, there’s so much reading and researching I’d like to do before going ahead, as we nearly made a rushed financial decision that would have probably put us on a future financial pressure.

I am not a super productive machine, so all of that has left me with little time to spend on my blog and will possibly continue for a while, so I may don’t show up that often, sorry guys.

Right, without further ado, let’s get cracking on the numbers for this month.

Jump to:

Table of Contents

Monthly hightlights

- Portfolio value: 94,839 (+2%) – details HERE

- Monthly Transactions (Deposits – Withdrawals): 1,829 €

- Monthly growth from investments: 50 €

- Passive income: 404 € (-18% ) – details HERE

- The €45K Project Fund value is 433 € (+13%)

- Weeks as a non-smoker: 14!

Monthly earnings by platform

As I commented on my last Net Worth update, I sold my AMAT shares and purchased shares of Lam Research (LRCX) and Micron (MU) instead, which both belong to the semiconductor sector. I had been wanting to do that for some time as I like more their financials, in addition, AMAT seems to be losing market share against their competitors. I am keeping First Solar (FSLR) for the long run as it appears to be the one to own (leader) within the solar panel industry. This is just my experimental Trading 212 fun account, it’s nothing really serious at all. I don’t leverage and pay no commissions on trades so it’s just adding some fun on the game 🙂 So far it’s doing well, +7.6% in August!

I finally joint and validated my account on Freetrade, but haven’t purchased anything yet. I may have the chance to swop my ISA from Vanguard portal to Freetrade and own the same Vanguard ETFs. I need some more time to work that out.

I used Property Partner’s

On the alternative side of my portfolio, Envestio, Grupeer and Fast Invest are my top performers,

The GBP/EUR currency ratio keeps its value at 1.1,

| Platform | Inception date | Value July | Transactions | Value August | Earnings | Return August | Cumulative Return |

|---|---|---|---|---|---|---|---|

| Property Partner (£) | 21/01/2018 | 5,894 (6,483.4 €) | -159 (-175 €) | 5,767 (6,343.7 €) | 32 ( 35.2€) | 0.5 % | 8.2 % |

| Vanguard (£) | 14/03/2018 | 46,360 (50,996 €) | +780 (858 €) | 46,766 (51,442 €) | -374 (411.4 €) | -0.8 % | 17.1 % |

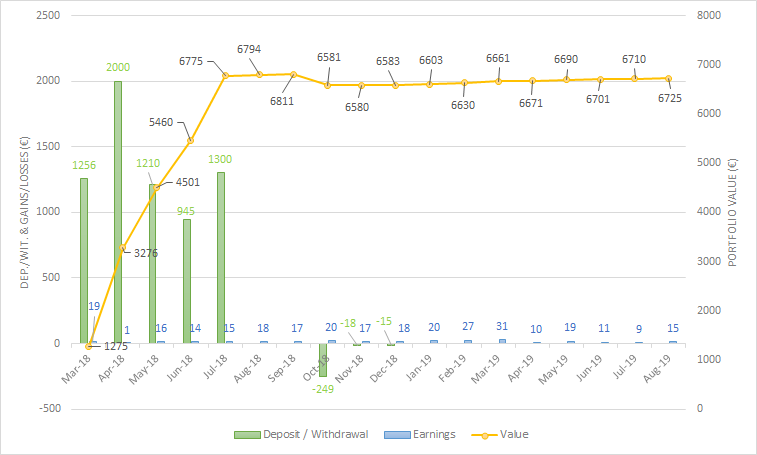

| Housers | 26/03/2018 | 6,710 | 0 | 6,725 | 15 | 0.2 % | 5.1 % |

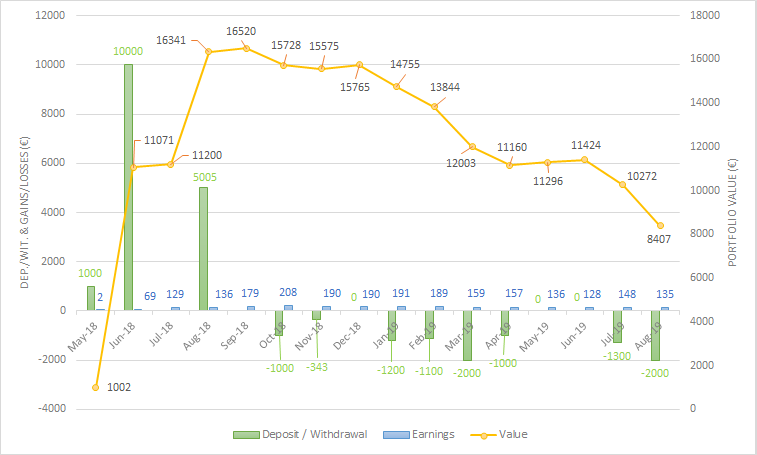

| Grupeer | 19/05/2018 | 10,272 | -2,000 | 8,407 | 135 | 1.3 % | 20.5 % |

| Mintos | 05/08/2018 | 4,128 | -2,009.4 | 2,149 | 30 | 0.7 % | 11 % |

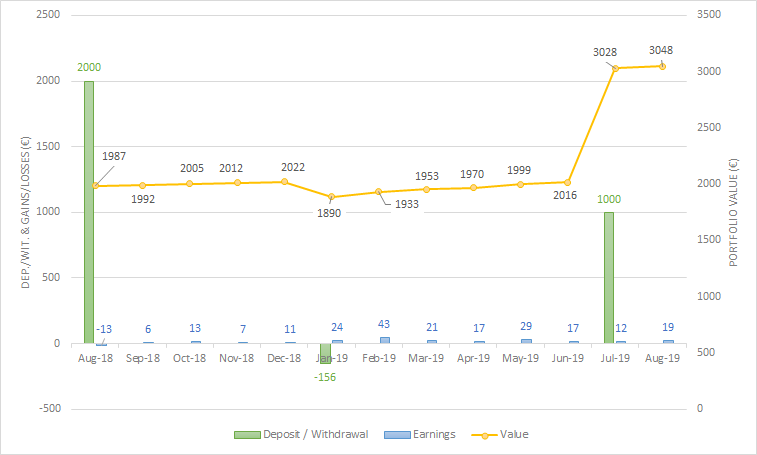

| Crowdestate | 16/08/2018 | 3,028 | 0 | 3,048 | 19 | 0.6 % | 10.2 % |

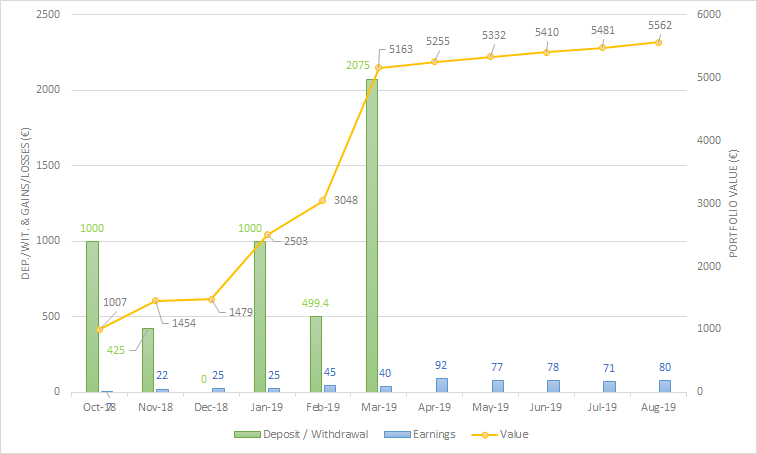

| Envestio | 15/10/2018 | 5,481 | 0 | 5,562 | 80 | 1.5 % | 15,8 % |

| Fast Invest | 29/10/2018 | 1,078 | 0 | 1,114.9 | 12.1 | 1.1 % | 11.5 % |

| Trading 212 | 03/2019 | 1,394.3 | 0 | 1,508 | 106.4 | 7.6 % | 38.3 % |

| EstateGuru | 10/05/2019 | 3,024.6 | 0 | 3,038.8 | 14.2 | 0.5 % | 1,7 % |

| Abundance (£) | 31/05/2019 | 344 (378.4 €) | 50 (55 €) | 394 (433.4 €) | 0 | 0 % | 0 % |

| RateSetter (£) | 04/08/2019 | 0 | 1000 (1100 €) | 1000 (1100 €) | 0 | 0 % | 0 % |

| Crowdestor | 12/08/2019 | 0 | 2000 | 2004.2 | 4.2 | 0.2% | 0.2% |

| Robocash | 15/08/2019 | 0 | 2000 | 2010 | 10 | 0.5 % | 0.5 % |

| TOTAL | 92,999 € | 1829 € | 94,839 € | 50 € | 0.05% | -38.3% * |

*Includes Algotechs loss

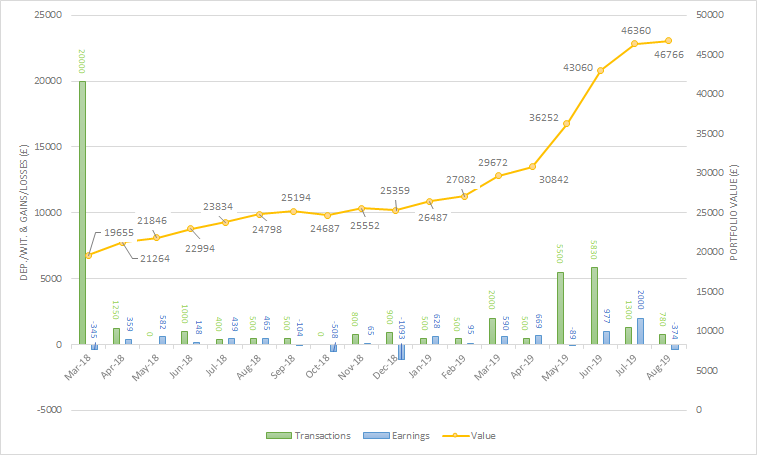

Stocks & Shares ISA

My Stock & Shares ISA portfolio increases by +0.9%. Stock markets decreased in August, but my monthly contributions were greater than the loss.

From now on, every month I’ll pay myself £780 out of my payslip (£500 before). This has been set as automatic regular monthly payments, as follows:

- FTSE 100 UCITS ETF (VUKE) £130.00

- S&P 500 UCITS ETF (VUSA) £130.00

- USD Corporate 1-3 year Bond UCITS ETF £130.00

- USD Corporate Bond UCITS ETF (VUCP) £130.00

- USD Treasury Bond UCITS ETF (VUTY) £130.00

- Global Value Factor UCITS ETF (VVAL) £130.00

The best performer so far is USD Corporate Bond UCITS ETF (VUCP) 29%

The worst performer so far is Global Value Factor UCITS ETF (VVAL) -7.5%

So far this year:

- S&P 500 Index : +16.8 %

- My balanced Vanguard ISA: + 14.3 %

My strategy here now is to keep my ISA balanced between ratios of 40/60 – 60/40 until 1) A definite market crash has happened or 2) I have bought a house 3) I get a clue on what we’ll be doing the next 5 years.

Related content (though a bit outdated): My little British Empire as an Expat

Property Partner

Property Partner managed to return £32.

This amount is greater than usual. The reason being is simple, I was able to sell some of my property shares at a premium! I am not expecting to have the same luck for the remaining property shares though.

The value of some shares decreased even further whereas others didn’t change.

For any new readers, I don’t recommend to invest via Property Partner platform unless one of these two conditions are met: 1) Invest over £25K in equities or 2) Invest on developments loans (you’ll need to be a sophisticated investor in order to so).

The AUM fee starts applying from now on, but any shares sold before the 5th of February of 2020 will receive a rebate. I still got 5 months before that. I am not expecting to be able to exit the platform without experiencing loses.

So far I’ve sold shares of three properties with a total return of 14.5%, 11.3% and 0.3%.

This is how the process is looking:

Related content: Property Partner Review & Property Partner Stabs Their

Housers

Income from Housers in August was 15€. That is a bit better than the previous month which was only 9€. This is income after-tax.

The first payment from the new 1000 EUR “defaulted” loan was paid a few days late in the end with an interest rate of 12%. The

If any of you would like to know in detail how Housers deals with defaulted loans and the full procedure it follows, please let me know down below the comments and I’ll write a short post about it according to my experiences with the platform. If you have been following my updates though, you should have an overall idea of how it works.

Related

EstateGuru

EstateGuru returns 14.15 EUR. That’s a new record for this platform. I have a portfolio of 54 loans, where 3 are delayed on payments.

Similar as Crowdestate, not every loan on EstateGuru pays monthly interests, so I am expecting an irregular monthly income.

My initial 3 months 0.5% bonus is over now. I’ve used the basic auto-invest tool since the beginning, which only allows setting two parameters; the period (12 months) and type of investments (bullet with interests) but has a minimum investment of 50 EUR. The average return on the loans selected by the basic auto-invest is 11%. You could do better if you are willing to invest over 250 EUR per project as the auto-invest tool improves, allowing you to set other parameters such as the LTV, interests, stage loans and security, among others.

EstareGuru is running another cashback campaign in September, but this time you’ll need to invest at least 1000 EUR to get a 0.5% bonus or over 10,000 to get a 1%.

Crowdestate

Crowdestate portfolio grows 19 EUR. My portfolio here consists of 15 loans with an average expected return of 13.64%. I’ve got currently 7 loans that carry delays on repayments. While there have been always some delays, 7 out 15 isn’t common. My loans don’t have a buyback guarantee but are secured by other assets or guarantors, still, it wouldn’t surprise me if I would have to write off some money. Bear with me to see how this issue ends up.

For the time being, this is how the portfolio is growing:

Mintos

Mintos

UK residents are still not allowed to invest in Mintos, so I am just withdrawing any free cash until further notice.

Mintos has released a two months overview on its new Invest & Access tool, sharing some results on their blog. I’ve surprisingly been mentioned on the post! You can check it out here if you are curious 🙂

If not, here’s a super short summary:

“Since Invest & Access was launched, 69% of new investors on Mintos have used this tool to create their investment portfolios on Mintos. 18% of new investors

More than 80% of cash withdrawals from Invest & Access to investors’

Related content: Mintos Review

Grupeer

Some more loans matured, so I was able to keep my diversification process on. I am not planning to diversify further for the time being, so I have turned the auto-invest tool back on. One less thing to bother about, goood!

This is how the chart looks now:

I wrote a Grupeer review after 15 months of investing.

Anyone who joins and invests a minimum of 100 EUR through THIS LINK from the 16th August to 16th of September 2019, will get a possibility to win 20 EUR for the upcoming investments.

The winners will be announced in my September monthly update. GOOD LUCK FOR THOSE WHO JOIN!

As you will see down below, not many people have joint so far… so there may be a good chance to win 20 EUR? – No pressure!

Envestio

Envestio returned 80 EUR in August, it’s once again the best performer within my P2P lending portfolio.

This is my 10th month with the platform and so far I haven’t experienced any delays at all. Envestio is slowly becoming one of my favourite platforms, together with Mintos, Grupeer and EstateGuru.

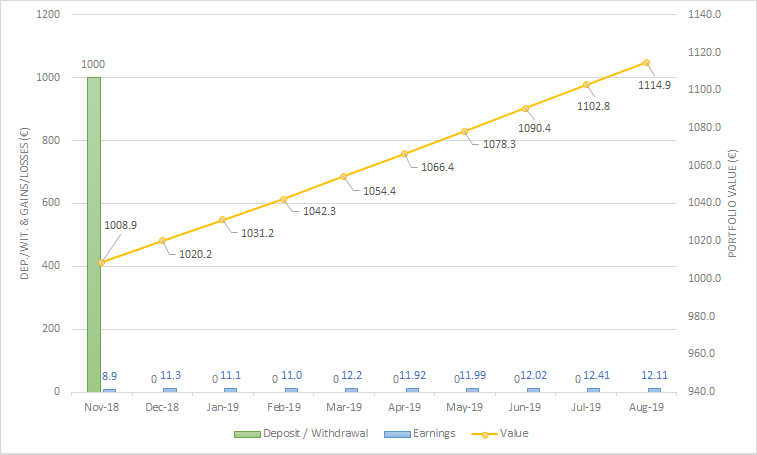

Fast Invest

Fast Invest returned 12,11 EUR.

So far this platform is the best on providing steady monthly income. The numbers are just spot on month rear month.

My auto-invest is set at 13% minimum interest rate, and it seems the loan book is adequate as I’ve never had cash drag issues.

Fast Invest is also the account that I am using to test the power of compounding by myself, on real time and with real numbers.

The €45K Project Fund

This month I saved another £50 as a non-smoker, funds I transferred to Abundance and used to invest in the new ethical investment opportunity listed on the platform.

Things run very slowly here, but I’ll receive my first return shortly. I can’t wait to see this fund growing!

I’m keeping all the data on a monthly basis, so I shall soon be able to make a nice chart to show the evolution. – I know you love them! 😉

So far, I have recovered the 0.96% of my loss = 433 EUR

44,567 EUR left to go.

Related content: Investing Ethically, Recovering €45K through Investing in Myself First

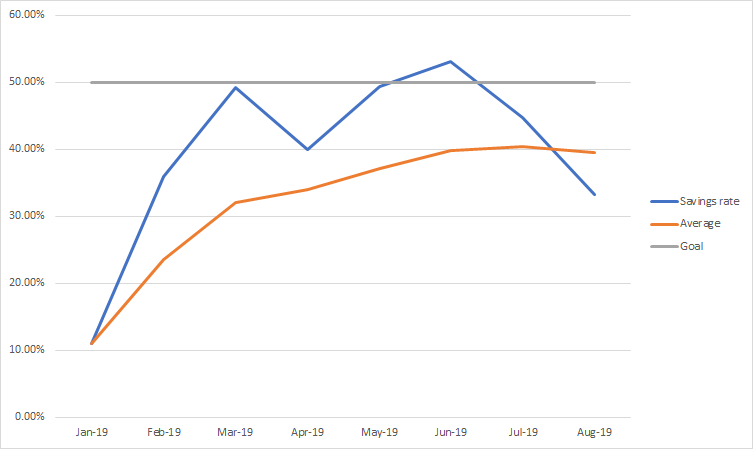

Savings Rate

My total net income in August was £1,888.56 (2,077.4 EUR).

My Ford

My savings rate without the car insurance expense would have been 49.5%.

Health after non -smoking

I purchased not one but two Fitbit chargers, so I make sure I never abandon my lovely watch on the night table anymore 🙂

I’ve been on schedule, running constantly but no pushing myself to the limit, as it has been a battle of ice-cream against running lately!

I’d like to mention that I was first inspired to add this section by Ditch The Cave and to keep it up thanks to Dr Fire, who has also decided to start tracking his health in a monthly basis. Vamos guys!

My cardio level fitness is at 51, improving from the initial 49.6 back in May. I’m becoming a real terminator here! 😉

The donation milestone

Some more people used my links this month, thank you for doing so.

I am still far off my donation target of 1000 EUR. I’m not putting a lot of work on it I must admit, but its good to see that it keeps growing at least.

Most of my affiliates are linked in Target Circle now, so it will be much easier to show my blog income transparently, as it is the major, and mainly only, source of income from this blog.

Besides this income, I’ve got £3 from Property Partner.

Joining links and offers

Property Partner (share up to £1500, details here)

Estate Guru (0.5% bonus on your investments made during the first 3 months)

Mintos (1% bonus on your investments made during the first 3 months – UK residents temporally not accepted)

Envestio (5 EUR first deposit bonus + 0.5% bonus on your investments made during the first 270 days)

Grupeer

Fast Invest

Crowdestate

Crowdestor

Oddsmonkey (UK residents only)

Trading 212 (Free shares worth up to $/£/EUR 100 )

The Fordkari is here!

Finally, the time has arrived! I’m glad to

Say hello to my new car, the POWEFULL aaaand UNBEATABLE….. ….FORDKARI!

I haven’t’ read the book “The millionaire next door” quite yet, but I think I may

On my previous monthly update, I mentioned that I had to return my EU car back to Spain, as I wasn’t able to drive it for longer than 6 months in the UK.

That left me without a car on the way back. My idea was to use transport for awhile and see whether that could be enough to keep going.

I tried! But the bus is not only expensive (£86.5 every 4 weeks) but also runs late all the time. It’s a coaster bus so it mainly transport retirees, who are not normally on a hurry I’d say!

As we also live out of the town centre, shopping was a problem. We purchased all stuff online but my

I had in mind to write a post about it but time flies.

Some quick numbers:

The Fordkari cost me 450£, the annual insurance was 307£ and annual road tax 130£. That makes £887. I could expect some maintenance issues, so I’ll round it up to £1000.

It’s a 1.3 litres petrol engine, so I’d expect the commuting petrol costs to be £30 a month, £360 a year.

Total first year costs of owning a Fordkari for commuting are £1360.

The annuals commuting costs for a bus in my area are £1124.

By owning a Fordkari the first year I overpay £236.

But the second year I won’t have to buy a car, because I already own it, hence increasing the chance of saving money.

As a conclusion, the numbers are tight but a car gives something that holds value to me, and that is freedom!

Unexpected maintenance issues

The maintenance costs of owning a car are challenging to predict. There are several factors that can go wrong within the mechanical and electrical complexity of a car.

Our driving skills also need to be considered.

Take the following case as an example.

As an European, what can possibly go wrong when driving in the UK?

This:

Until next time, Mind The Gap amigos/as!

not with me but with the side payments I mean!

Thanks for reading! :D

You can follow me on twitter where I share some thoughts from time to time and connect with other like-minded people and now even on Facebook too.

Disclaimer: Most of the links on this post are affiliate or referral ones. If you join to a platform using my affiliate links you may get a bonus or commission and so could I. I’m going to donate any commission I get throughout 2019 to a charity. You can read more about the purposes of this blog here and where this money is going to go here. Thanks.

Tags In

Tony

Related Posts

17 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Fantastic post!

You have taken self-development seriously, good for you ? And only a real man can drive Ford Ka ?

Ps. If you want to earn more & have a side hustle:

Since you live in England now, I suggest you to look for Matched Betting. It is quite lucrative side hustle and can be done oustide UK also. I wrote a post about it, and I’m learning it. In my first 2 weeks I made 400 Euros. It definitely is something I’m thrilled about.

– Financial Nordic

Haha thanks fantastic Nordic, you’re right, some balls are required to drive a Ford KA 😉

Thanks for the suggestion. I used to do Match Bettings but regulations are getting tougher and bookies were constantly asking me for documentation, blocking my account. They don’t seem to like that I have no British passport and I am not a homeowner.

Thanks for another entertaining and interesting update. Congrats on your improving health after giving up smoking and saving the money that you would have burned!

I see you have joined more crowdfunding platforms, a more stable way of earning money than the stock markets, I think. But you haven’t joined Kuetzal yet?

I hope the Ka doesn’t break down or it could turn out to be a bad investment!!

Hey Rob,

Thanks, glad to see it entertains someone 🙂

The main reason why I am joining new platforms at the moment is because I can’t invest with Mintos until the new regulation with the UK has been sorted. So I am trying to find “equivalents” platforms like Robocash. I joint Crwodestor only because I liked their Renewable energy project. I haven’t dug much into Kuetzal as it hasn’t transmitted confidence to me since the beginning, but it is still on my radar.

The Ka could break down but it would be very unfortunate as the mileage is low and I only use it for commuting (10 miles per day)

Thanks for stopping by 🙂

Ahh, awesome news that you’ve decided to start a family/buy a place! My area is really good for house prices and commutable into London if you want to be neighbours ?

Well done on opting for a cheaper car! My partner is saying bye to her 4 year Ford Fiesta car lease soon and is deciding what the best second hand car is for value, might take a look at the Ford KA ?

Your numbers are doing well…? I think…? :)) You have so many investments, like Nick from TotalBalance, so confusing! ?

I just shove it all in an index tracker and be done with it. (other than my recent cheeky Tesla shares.)

Hey SN,

You got me curious, so I’ve just checked and the average price in your area is higher than mine.

According to Zoopla, the average price for a flat in my area is 157K (decreased -4% last 12 months), 195K the area we were after (-6% last 12 months) and 277K in yours (decreased -11%). I’d need a 50K deposit at least to buy in your area, which is over the amount I’d be happy to pay. Also, I wouldn’t have a permanent contract, as it is a new area, and I hold no British passport. Odds are that no bank will lend me a penny hehe. It would be cool to be neighbours though, so at least you could teach me personally how to match bet and actually make some good money like a real pro? And I could teach you Spanish you can use it in California?

Bear in mind that the consumption ratios of old Ford Kas are high (America haven’t bother much about that until now), so be sure to check on that before buying – it will all depend on how long-distance she’ll drive.

They seem complex to you because you aren’t in the crowdlending sphere, which I understand. Was match bettings easy at first? The P2P lending market in the UK is limited and not especially rewarding (low yields), so you are not missing out much (yet).

Good luck on the Tesla shares, I’ll be following that for sure 🙂

Thanks for the shoutout Tony! Your exercise update is much better than mine though, haha. I need to up my game in September!

I’m super impressed at how you managed to get a car for such a cheap price. When I bought my first and only car about 10 years ago, I paid around £1000. You managed to halve that price! Impressive. If you’re only driving short distances than it should be perfect! I sold my car about a year after I bought it, and haven’t owned one since. I’ve always lived in or very near a city, so have been able to walk everywhere, or walk to the train station to travel to visit other friends, etc. I suspect that, if I lived further out then I would need to get a car as well. Public transport is usually good in UK cities, but not so much outside!

Hey Dr.

As long as the exercise update works for you then it should be fine, the better is the one that brings results 😉

I got it so cheap because one of my colleagues has a home garage. He buys cars from people that want to scrap them, fix them and resell them.

To be honest I miss committing by bus as it allowed me to choose between reading or listening to a podcast on the way, while when driving you can only listen to a podcast, which isn’t always appealing to me, so I end up switching the radio on to listen to Boris or la Macarena song!

Sounds like a great and exciting month – I agree going on holidays in July or August is far from optimal. Too many people and too expensive!

I love seeing your passive income sources grow, hopefully Mintos will sort the UK thing out soon and you’ll be able to invest again. Just wondering, how do you get such high returns with Grupeer? I’m getting between 13-14% and I can’t find any higher loans on their platform.

Keep up the great work mi amigo!

Hi Radical FIRE,

The return I display is the ROI since the inception date, so the 20.5% isn’t annual.

Interest rates at the time I started were higher at 15%. In addition they offered 1% cash back on some loans, which was credited straight away after investing. That has helped boosting my returns, but it also carries more risk as I deployed chunks of 1000EUR per loan. Luckily payments have been on time and none of them have defaulted.

Now I personally prefer to deploy lower amounts of capital per loan. That helps diversification and lower risks, but it also affects returns and liquidity too.

Hope that helps.

Thanks, you too. Looking forward to follow your mini retirement experience ?

All the best with the mortgage and house hunting – it’s supposed to be a buyer’s market right now. One question to ask yourself might be – are you looking to buy a home or an investment? In this economic uncertainty, perhaps the former might lead to less heartache (that’s just my view).

Good going on the health and fitness drive. I’ve increased my own cardio fitness level by 2 points over the last month or so, but know that there’s more I can do. However, I’m currently a little obsessed with the sleep tracker on my fitbit!

Hope you’re enjoying driving your Fordkari – my sister had one, only hers was purple! She loved it!

Hey Weenie thanks,

Yup, it appears to be a buyer’s market. That’s why I’m in a claiming walls mood, not that I’m Spider-Man but I’m hungry for buying at a discount I mean. Prices on the area we’re looking have dropped between 6-12% as the property markets has slowed down and actually even would say that’s it’s in a sort of a brake. So far we aren’t being very lucky though as all we find would require some work and I’m one person only, so it’s a tough one but not impossible.

We plan to buy as a home as we are renting at the moment.

That’s great weenie! Fit bit is a fabulous tool if you enjoy it and helps you get better. I don’t focus much on the sleeping part, perhaps is because i feel very energetic since I stopped smoking. I used to sleep 8 hours before and would wake up tired. Now I sleep 6.5h and I feel fresh.

As long as your energy levels are adequate for your daily living I wouldn’t worry much about the sleep?

Yeah I still enjoy my Fordkari and best of all I haven’t damage any other wheel. Fingers crossed!

Amazing Post Tony.

I found your Fordkari story particularly funny ? I also live in United Kingdom, and I know how expense public transport can be…

Aside, since it was the first time I was visiting your blog, I couldn’t understand your Portfolio reduction in March-19, so I read your previous posts and I learned about it. I am really sorry that you had to go through such an experience. Unfortunately it is not uncommon, since these unregulated brokers that have “magic” algorithms to create remarkable returns are growing and spreading. I am glad that you had the courage to learn the lesson and continue investing, many people would have given up, so I congratulate you for that, and for your amazing blog!

Hey Gonzalon,

Thanks for your positive feedback 🙂

My experience with Algotechs wasn’t funny at all, but it has made me learnt a lot, though it was a bl**dy expensive one!

Blogging about it helps and the community has been very supportive. I am so grateful for it. In addition I think it helps others, as as you say this industry has been growing over the last years and some fraudsters keep making business without any consequences in Europe.

Thanks for your nice comment and support Gonzalon 🙂

LOL

Really funny, hard work, good post.

I wish you the best in you way to financial freedom. It’s great reading someone who makes things properly without forgetting the main goal: enjoy living!!!

Kind regards from Spain,

David

Thanks, David for stopping by a drooping a nice comment, appreciated.

[…] Forkari! Every time I remember about this car it makes me laugh! I bought it during the summer of 2019 for £450 and served one year of commuting purposes. £450 of annual depreciation compared to the […]