Portfolio Update #48 Q2 2024 – €279,199

This is my 48th portfolio update in the blog. It is time to look at the books for the second quarter of 2024 and write about what’s happened over the last three months.

Table of Contents

Solar Panels And Battery Installed

The most relevant financial move this quarter was installing solar panels on the roof of our house. Although this was a long-time desired asset, I wasn’t accounting for installing them this year; therefore, it wasn’t noted on my 2024 to-do list.

So, what changed my mind? Installing solar panels and batteries has become cheaper thanks to the price reduction on panels and batteries. In addition, our (now old) government slashed the VAT on solar panels to 0%, which also helped to squeeze the total installation cost down.

Knowing that, I started analysing the possibility of installing solar panels as a long-term investment. I requested quotes from a few installers to get an idea of the price energy savings potential. The cheapest came out at £7,940. That is to install 10 panels of 440W each, a 3.6kW hybrid inverter and a 5.32kWh battery.

The installation took place at the end of May. Our grid energy consumption for June was only 2.2kWh, or in other words £0.55 for the whole month. How cool is that? In addition, we also get to export any excess electricity we produce to the grid and earn some passive income. So far, we are very happy with the efficiency of the system. In total, we expect to be £800 a year better off, which in “grosso modo” is around a 10% annual return on investment.

New Job Lined Up – Back To Management (maybe?)

The workload at my current place hasn’t picked up since the end of 2023 and the outlook is not looking bright. I decided to keep an eye on the job marketplace for new opportunities until I came across a new partly management role for the same industry I worked before; the landscaping / outdoor construction sector. I went through a two-stage interview, the second one being with the CEO of the whole main European group behind the UK brand. It was intimidating, as I’d never had an interview with the CEO of a major European company before. I performed very well on the technical side but showed a lack of expertise in the management/leadership questions.

The second interview seemed positive, but I was not sure that I would get an offer given my current lack of management skills. But I did! I was offered a 12-month development program to reinforce those management skills while leading a team of 5 designers including me. If I succeed, this will put me in the higher earners bracket, which is a great achievement for a foreign non-Londoner design engineer.

I won’t start this role until the beginning of September, so I have some time to be ready for it.

However, the demand for mechanical engineers in the northwest area is high thanks to recent investments in nuclear energy, and recently a local engineering company has shown interest in hiring me. They seem to be willing to improve the other offer. I had a positive first interview and passed to the second stage interview which will be soon.

I feel like since Brexit, the Europeans that have remained have become better-valued assets. Perhaps that’s why I seem to have more options with choosing the direction of my career. That is the impression I have, however, I also moved to the north after Brexit, maybe it could be that it is just different here than in the south of England.

Holidays

We spent one week in my lovely Catalonia, Costa Brava. I managed to meet with some old friends and family. We stayed mainly in Roses and l’Estartit, but showed my loved one other beautiful places such as Cadaques, Port Ligat, El Prat de la Selva, Begur and Empuriabrava. We hiked from Roses to Cala Montjoi following Cami De Ronda along the coast, and as usual, we deeply enjoyed the stunning views.

This is kind of the route we followed:

And these are some of the pictures we took along the walk:

😍

Quick Recap of Q2-2024 Numbers

- Net worth: €740,984 (+1.7%) – details HERE

- Portfolio value: €279,199 (+5.8%) – details HERE

- Quarterly Total Growth: €?

- Quarterly Savings Rate: -44%

Comments

My network and portfolio value keep on the rise, however it was a terrible quarter for my savings. In addition to the £7,940 to install the solar panels, I spent a whopping £1,630 to apply for British citizenship, it is painful, but I guess necessary if what I plan is on living here permanently.

Investment Portfolio Breakdown

This is how my investment portfolio breakdown looks this quarter:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

The boredom of my portfolio is now highly noticeable. I love it. The fact that I don’t have to worry about my investments gives me plenty of time to focus on other important things.

In April, we started a new tax year. That means I can invest another £20K in a tax wrapping account (S&S ISA). Normally I would try to spread it over 12 months, so that would be about a monthly investment of £1666 in world index funds.

This year I’ve done something different. Since I held my dividend-paying stocks in a non-advantage general account, I transferred those to an S&S ISA, so I don’t get caught by the tax man as allowances are being further reduced.

I hated doing this as the transfer was not cheap and lost some accountability for my investments, but well, it is done now, and it’s the best I could do for my investments for the long term.

Now that my ISAs are maximized for this tax year, the strategy is to simply contribute more to my pension. Currently, my ISA value is greater than my pension, and that should be the opposite.

Dividend Portfolio

Now as usual I get to look into my dividend portfolio which generated £258.35 of passive income this quarter (£165.77 last quarter).

Since my dividend portfolio is now held within an S&S ISA, all my dividends are paid in pounds sterling. Before I received all dividends in Euros, that was the main reason why I didn’t have dividend stocks in ISAs. I thought currency diversification would be good for me as I plan to retire in an EU country, however the government has ruined that after capping tax allowances.

During the exchange to ISA, I decided to revise my dividend portfolio (something I don’t do as often as I should) and do some cleaning. I sold two stocks that I should have sold a long time ago. These are AT&T and Walgreens, for the obvious reasons of higher debt / low growth expectations and recent dividend cuts.

What did I get in exchange?

I bought two European companies; a long time followed Ahold Delhaize and a Coca-Cola HBC which does the bottling and distribution of Coca-Cola beverages mainly in Europe. There are plenty of EU companies I would like to own such as ASML, Siemens, Diageo and Dassault Systèmes among others. I’m hoping to buy more of these in the future as opposed to American stocks.

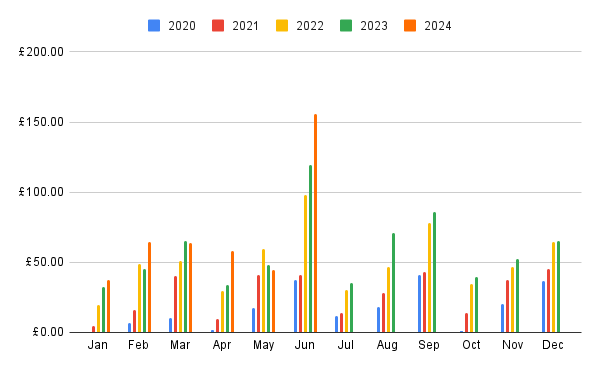

Here’s an overview of my monthly dividend income so far:

It’s nice to see that in June I crossed the £150 mark and also received the highest income ever in a month.

Systems & Goals Update

In January, I wrote the systems and goals I wanted to focus on in 2024 here.

I’ve accomplished another of my goals for this year. My application to become a British citizen was approved! Yay! Although I received the confirmation from the home office in what is technically Q3, I can’t wait three months to document this in the blog. So yeah, before the end of this year, I should have my British passport and become a dual citizen! 🙂

Tony

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.