Income, Expenses & Savings, May 2020 – £1,228.5 Saved

Ladies and gents, another (lockdown) month has gone by, which means that we are one step closer to be financially independent! 😀

So, what’s been happening in May?

Table of Contents

Work

My lifestyle has barely changed since the previous month. My employer still keeps employees split into two shifts, so I work intermittently from home and office.

Workload dropped a bit, so my plans of being a productive fella while working from home are falling apart. Nevertheless, I am still optimistic about my future job security. The company is placed in a good position as we are being involved in the redevelopment project for Battersea Power Station in London, that plans to go on until 2025, so hopefully, that should pay my bills for some months. My misses is still furloughed and possibly won’t be back at work until July. Her job should also be quite safe, as she works for a strong positioned UK holiday resort (it is predicted that Brits will spend fewer holidays offshore after Brexit, apparently).

As a result, we keep tracking home prices in our area of interest, but they haven’t fallen much so far. If we are both able to keep our jobs, we may have a good chance to get into the property ladder in the UK, but it depends on other factors, like my mom’s health, which is uncertain at the moment, or property prices, which could potentially remain the same even in the event of a long term downturn, as the area is popular among retirees.

Holidays

My worries about not being able to enjoy some of my holidays in Spain are less significant. My mom, family and friends are all well and healthy. Our warehouse lessee seems to be doing business fine and pays rent as usual, and to top it up, we are enjoying from clement and calm weather with cloudless skies, which is out of the ordinary for this time of the year.

I even noticed a fashion change that resembles the Spanish during these times, especially on teenagers. Many of those sunbathing or playing games on the sand with shirts off still don’t know what sun cream means and the vast majority end up with a prawn-looking style, that’s not trendy! (we should not get confused!).

Good weather means that I was also lucky enough to be able to enjoy the sea these days, doing some activities such as playing basketball, walking and running on the promenade, along the seashore, or in the water barefoot during low tides, and I was even brave enough to go for a swim! Remember that I am a Mediterranean guy, and we are not used to the ocean’s lower water temperatures.

These are all things that I normally do during my holidays when I go down to Spain, just that this time is costing me no extra money on flights and accommodation, so I can’t complain much so far.

The only one that seems to be complaining is my Fordkari, as no rain has meant no shiny looking any more. Long are those days when it looked like this. As a form of protesting, it decided to run out of battery after the Ve day bank holiday, so Tony pepperoni would have to spend 24 bloody Pounds for a garage mechanic to bring a battery restore kit! 🙁

Income, Expenses & Savings Rate

I was hoping I’d be able to keep my expenses close to last months low until I realised this May had 5 weekends!

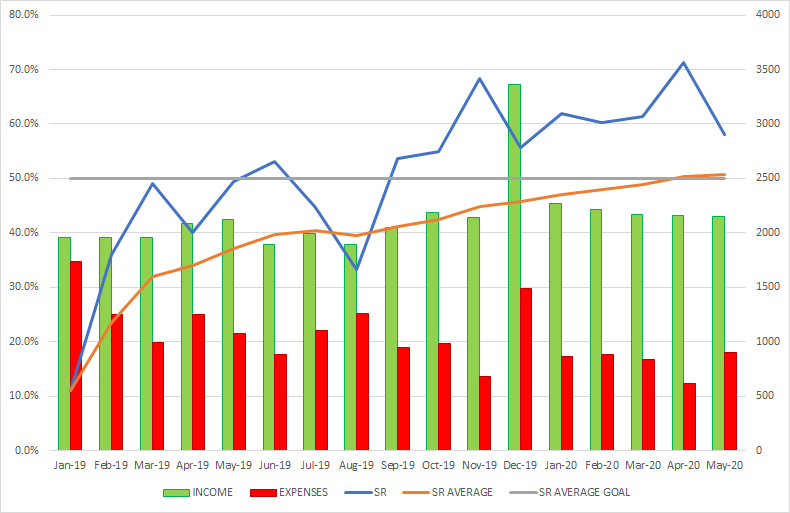

This is an overview chart of my income, expenses and savings rate so far:

My total net income in April was £2,148.8 (2,388.4 EUR), around the usual number.

Expenses: £920.3.

I was able to save £1228.5, which results in a savings rate of 57.2%, that’s above my current minimum saving target of 50%.

Monthly Cash Flow Sankey Diagram

Breaking it down into categories, this is how my cash has flown during May in Pound Sterlings (£):

Income

May wasn’t either a good month for affiliate nor referral income as I got £0. On the other side, I am trying to monetise the blog via Google Adsense, but that isn’t’ going very well either, as not many visitors click on the ads. I am thinking about removing it once I get to the minimum payments threshold of £60. I am currently at £45. At my speed, I think I’d need at least three more months, as an average I earn about £5 a month, which is almost what I pay for my host service.

Bank interest comes from my bank account with TSB, which pays 3% gross interest on balances up to £1500.

Expenses

I paid £650 on rent and bills. That hurts as we normally pay £450, but as I said earlier, this month had 5 weekends. We pay rent every Friday set as a standing order, 5 Fridays = 5 payments. I feel like wanting a mortgage right now!

I spent £206 (£115.17 last month) on groceries. Again, a 5 weekends month has affected on my groceries expenses. Besides that, we also went shopping at Sainbury’s once, as queues at our regular lockdown supermarket (Tesco) were insanely long. Sainsbury is more expensive, so that has contributed to the higher expense.

Transport includes the £24 garage bill and car taxes. I still have a quarter of the tank full, so I managed to get by without refilling my tank since April.

Services includes blog expenses and others: £5.76.

Another easy month in terms of tracking expenses.

Goals

Time to have a look at how I am keeping on with my 2020 goals. As Peter Drucker said 40 years ago, what gets measured gets improved.

Some of my goals aren’t monthly measurable, but some others are. I’ve built a simple table to display the progress.

May goals

April goals (comparison purpose)

Overall, it’s been another good month for my goals.

- I lost another kilo.

- Resting heart rate is below 60 bmp, as I keep running and exercising on a daily basis.

- I am above the 10k daily steps target having walked more than 1.5 million steps! (excuse April’s wrong unit conversion values).

- On track with my reading goals. Finished “Happy Money” and a free (but outdated) e-book about “social media marketing”. It was not very useful, so I only count it as half of my goal accomplishment).

- Doing well on blog posting, although I feel a bit burned and I lack writing motivation sometimes.

I am trying to get used to reading ebooks with my Ipad, as there seem to be some free resources and cheaper price on books, but I miss the experience of touching a physical book with my hands, and also its smell. My local library is not so great either.

Currently reading “Your money or your life” (classic) and another book about confidence, which is also in my reading goals list.

That was it. Stay safe amigos and …

¡Hasta la vista babies! 😉

Tags In

Tony

Related Posts

10 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Great read, thanks for the update! Nice to see that your SR average is now above your goal. All your work seems to pay off, so keep it up! Wish you the best and will be back here to see how you’re doing.

Thanks for your kind words. I am enjoying your blog, so hope you’ll keep it going.

Thanks! Will keep blogging and I’m aiming for 2 posts per month at the moment. Next update is coming up in a weeks time!

That’s an amazing seaside view. Shame it isn’t in Spain though; I can almost feel how cold that water must be!

I’m with you in preferring physical books. Much nicer to hold and read. However, the fact that you can get some classics for £0.99 or even for free on the Kindle helps to increase the appeal of digital books. Interested to hear what you think of Your Money Or Your Life once you finish it!

Thanks, Doc. To my surprise, it was quite OK once I got used to the temperature.

Another disadvantage of physical books is the space they take and how heavy they are when moving out, hehe. But on the other hand, I love the proud feeling of looking at my bookshelf and look at everything I have read so far.

Ok, I’ll write my thoughts on that book. It’s a deep one.

Hey Tony

Your sun cream stories make me laugh – on recent Zoom chats, I can see that my friends have been out and not put on any/enough sun cream and I have to stop myself from nagging at them – they should know better!

My car too had a flat battery but a neighbour had jump leads so started it up for free – I now need to make sure I don’t leave it for more than a week undriven, else it will go flat again.

Anyway, great savings rate and good going on your goals!

I’m the same with ebooks – I don’t mind them but much prefer physical books. My Kindle however is fantastic for taking away when I’m travelling/on holiday. I’ve been making use of Borrowbox so I can borrow from my local library but it’s very popular so I have to reserve (and wait) for nearly all the books I want to read.

I think it’s been well over a year since I was last in the sea – who knows when the next time will be!? 🙁

Haha, glad to see I am not the only one who finds it funny! 😀

I was unlucky that no neighbours had jump leads. In fact, I found out that many people are leasing their cars and don’t worry about batteries as their insurance covers it.

Thanks, Weenie, yeah I am doing well on my savings and goals so far. Fingers crossed I’ll keep it for the rest of the year.

You should still be able to enjoy the sea in the UK this summer. I see loads of new people coming here that I assume they used to go abroad before. Maybe is time to come down south? 😀

Despite growing up near the coast, I still think the sea is far too cold here, Tony! 😉 Mabye it’s a bit warmer down south!?

It should be warmer, but nothing too extraordinary I guess. I am ok with swimming during heat waves but that’s it. Recently watched that Portugal is negotiating corridor holidays deals with the gov., so maybe is good idea to have a look at those.

It has been a while since I last went to Portugal so yes, I will take a look, thanks!