Income, Expenses & Savings, April 2020 – £1545.3 Saved

Fully equipped with a nice pair of sunglasses, +50 SPF suncream on my bald patch and lying on a deckchair on the beach next to a fridge full of beers while reading a good book in the shade of an umbrella is how I was picturing myself to be somewhere around this time.

But this picture has become twisted, and I can’t see travelling to Spain anytime soon. I normally try to avoid flying during the high holiday season as prices are much higher, but does the high season actually exist anymore? Will people travel this summer?

Speaking with some colleagues, they would not travel anywhere even if the lockdown restrictions were to be lifted, so I may have a chance to get cheap flights and do a longer stay. Return flights to BCN from Gatwick stay around £100 at the moment. I could purchase them now but who knows what will happen by then!

So, I am pretty much mentalizing with the idea that I may need to spend the whole summer in the UK, which sounds terrifying but the weather is treating us well so far, hopefully, it will continue though! My bald patch wants to be tan, not white! 😛

I don’t know if these uncommon sunny times come from improved breathing of our planet, but I know a thing that is totally breathing better these days!

My bank account!

Table of Contents

Income, Expenses & Savings Rate

My bank account feels like my lungs felt just 11 months ago. Obviously, It can’t stop smoking completely, as there will always be some bills to pay but what a month in savings it’s been!

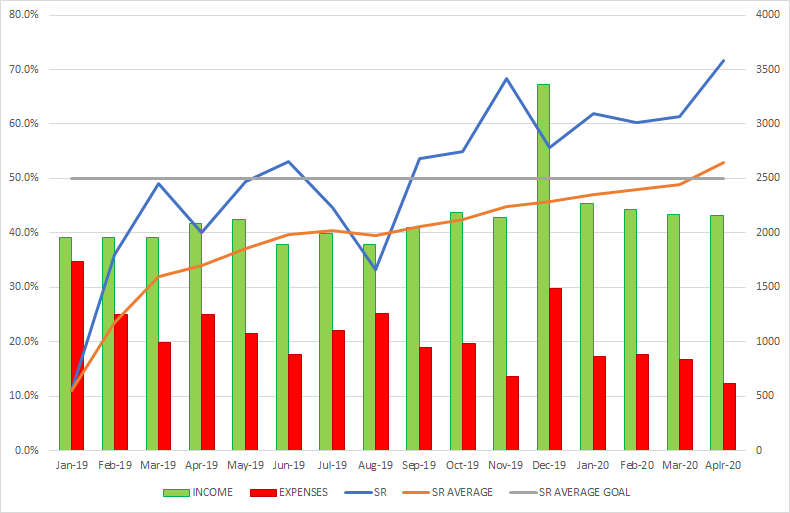

This is an overview chart of my income, expenses and savings rate so far:

My total net income in April was £2,145.37 (2,467 EUR) and my expenses were as small as £618.2.

I was able to save £1545.3, which results in a savings rate of 71.4% Mamma Mia! 😀

So, that means that approximately 30% of my income is tied for my basic needs, which I think is a great achievement, as housing is considered expensive in the UK. I don’t think I can beat that percentage anytime soon.

Some more good news is that I finally crossed that grey target line of 50% average savings rate (the orange line crossing the grey). I know I am a nerd, and I am fine with that! 😛

My portfolio growth looks rubbish but can’t say the same about the savings rate chart. I am loving the upward trend.

Monthly Cash Flow Sankey Diagram

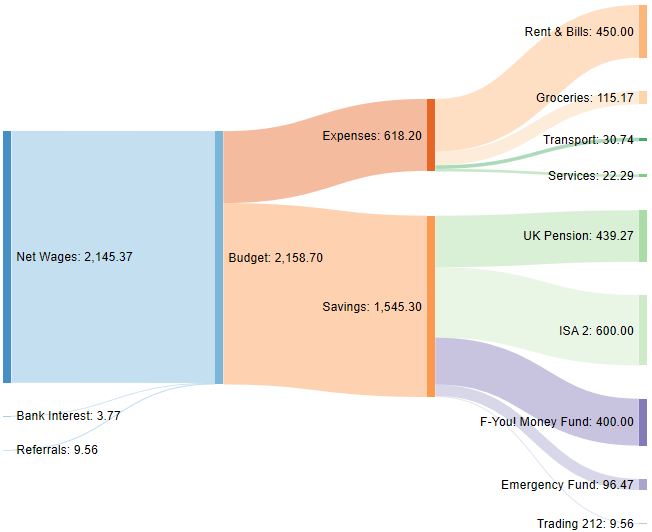

Breaking it down into categories, this is how my cash has flown during April in Pound Sterling (£):

Income

In April I got £0 as affiliate income and a National Grid free share from Trading 212 worth £9.56.

Thank you to whoever used my link to join the platform (Remember this is only for The UK, France, Germany, Switzerland, Austria or The Netherlands residents).

Bank interest comes from my bank account with TSB, which pays 3% gross interest on balances up to £1500.

Expenses

Rent and bills remain fixed at £450.

I spent £115.17 (£215 last month) on groceries. I had to double-check the numbers twice as there’s a noticeable difference compared to last month. It’s been shocking to me, but that tells me I was spending about £100 a month on ‘unnecessary’ things. We live near a small Tesco where I purchased some treats such as desserts, drinks or others. These local stores offer products at a premium price, but did not expect I spent so much on it!

That’s another fact I should add to my covid-19 eye-opener list.

Transport includes fuel expense. I use Forkari less but I still filled up the tank as I could not resist the low oil prices. I expect that would last me the whole month of May.

Services blog expenses and others: £22.29. I even stopped renewing my Giffgaff Goodybag as I manage to do everything online.

An easy month in terms of expenses!

Goals

Time to have a look at how I am keeping on with my 2020 goals. As Peter Drucker said 40 years ago, what gets measured gets improved.

Some of my goals aren’t monthly measurable, but some others are. I’ve built a simple table to display the progress.

April goals

March goals (comparison purpose)

Overall, it’s been s good month for my goals. I am having fewer treats as chocolate biscuits or similar unhealthy stuff and keep with the habit of running nearly every day. That’s helped me to lose almost 1 kg, improved my heart resting rate and catch up with my daily goals. Awesome.

When I work from home I chose to go for a run during the midday, this way I can keep myself more awake, active and productive during the afternoon. I am trying to be as productive as I can while working from home so my boss misses my productivity after the lockdown. Anyone who’s read the “4 hours workweek” by Tim Ferris will know what I am trying to accomplish here.

Currently reading “Happy Money” by Ken Honda. It’s a piece of cake to read, but enjoying the Japanese point of view about money. There’s interesting content about money personality types, so I may do some research on this topic and write a post as I found it psychologically fascinating.

Giveaway

To celebrate I reached my 50% average savings rate I am doing a giveaway to one of my readers for free. The biography book of Elon Musk posted to your doorway for free.

One of my goals for 2020 is to read the biography of someone successful.

— Tony @ OneMillionJourney.com (@JourneyMillion) February 19, 2020

It’s time to get my mind lost in space ? and beyond (Mars).https://t.co/Rnt6mqK0kM pic.twitter.com/JdXQNl4JPK

If you’d like to take part just leave a comment down below I will pick someone randomly.

The winner will be revealed on my portfolio update on Sunday 10th of May.

That was it. Stay safe amigos.

Tags In

Tony

Related Posts

18 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Man, beers on a beach. That does sound good right about now! Hopefully this clears up enough that it’s still possible in late summer, or even autumn.

Interesting to see your reading goals. I’ve mostly been reading fiction recently, but might have to follow your lead and read another finance/investing book soon. What other investing / personal finance books are you intending to read?

I’ve noticed a similar thing with regards to grocery spending this month. I seem to have spent a lot less than usual! I think part of it is because we generally have pretty full cupboards, so we’ve been using up some of our stock to avoid going out to the supermarkets quite so often.

Great work with the savings rate. Hope you have a good May!

I’ve got a few books on the list. I’ll teach you to be rich by Ramit, your money or your life (haven’t read this one yet), the next millionaire next door, the simple path to wealth and others. I want to read them all, I am such a nerd hehe. I’d also like to read a book about property in uk, to get ready as we may consider buying again if prices drop and are able to keep our jobs.

Have a great May too Doc. 😀

Holy moly that’s some low expenses for the month! I thought I was doing great in this lockdown with my $1,100 spendings during April. This is by far the least amount I ever spent.

Well, you spend more on rent than I do, my area is probably cheaper than yours to live, so it’s like comparing apples with pears :). Also, £618 are $772, so we aren’t that far each other!

Looks like the numbers of April are great – very low spending and you’re progressing very well on your goals. You will be finished with the majority of them before the year ends! Do you have any book recommendations? I’m currently reading Deep Work and Inferno (Dan Brown). I have the same goal of reading 12 books this year, so I need some inspiration!

Thanks, I am on track with my goals, the weight one will be the hardest though, will see. I think you’ll definitely enjoy Happy Money from Ken Honda! 😉

Great saving rate there Tony. Your doomed for FI no matter what way you go 😀

Yup! Agree! No one can stop me now, hehe 😉 You are doing well too my friend. Thanks.

For some reason, I can’t see any comments under your post, even though I received an email notification that you replied. Assuming it’s just me, I’ll write my reply here:

I had not heard of The Next Millionaire Next Door. I’ve read the first book, but didn’t realise it had a sequel. You’ll have to let us know if it’s as good as the first book!

You were right, thanks for telling me. I did not realize as I was operating through the WordPress app. The Next Millionaire Next Door is the updated version of the original The Millionaire Next Door, as this was written in 1996. So, I am curios to know about the recent data on millionaires.

Hey Tony, Jean from France here. I’ve stumbled upon your blog just a few weeks ago and I’ve read many of your posts. You’ve motivated me to start my own journey to 1 million. I’m still a newbie with a networth of around 10 000 €, compared to you.

Anyway keep up the good work and hope to learn more from you! 🙂 Cheers!

Hi Jean, thanks for your kind comment, it’s truly appreciated. I am immensely happy that my blog has motivated you to start with your own journey. If you stick with the good habits you’ll reach me in no time, anyway everyone’s journey is different, so we should not compare each other but support us 🙂

Looking forward to following your journey.

Suncream, even in UK is a must and I’ve been horrified that some of my friends still think it’s ok to sit in the sun with no cream and then look like they’ve been over-cooked! They never learn!

Anyway, incredible savings rate, well done! Your expenses are on a par with SavingNinja’s so it’s great to hear that in lockdown, you’ve managed to get costs down to a minimum.

Hope you have a great May!

Hahaha you made me laugh out loud! I’ve heard that sunshine in the UK is more dangerous than in Spain as here we are closer to an ozone layer hole. I don’t know if that’s true but I did notice I was getting sunburned quicker than in Spain.

Thanks. I did not beat SavingNinja’s expenses, but he knows I would have if I weren’t renting! 😛

Awesome savings rate Tony!!

That beach sounds perfect, I can’t wait to get outside again. We were going to go on that long hike this summer before COVID ruined it all 🙁

Are you spending your extra quarantine time on learning any new skills? I should probably spend it more on writing, but I seem to be stuck in a funk.

The Ashley Vance biography is one of the best I’ve read, good choice!

Thanks, SavingNinja, spending only on basic needs has made a difference, especially on groceries.

That’s right, It would have been lovely to go for that long hike during this time, shame. Perhaps, we still got a chance to go in September-October? Depends on how it is like, I and GF both enjoy the Autumn landscape.

I am not precisely learning any new skills, I just spend more time relaxing really. What a lazy bastard! 😀

Forced writing doesn’t work, at least in my case I need inspiration or motivation to get somewhere. I’ll be soon writing my first guest post in English, so that will be challenging as English isn’t my first language, but it’s an opportunity to push myself a bit further while contributing for the blog.

I’ve been in the funk many times, and it’s alright! It will pass soon, don’t be too hard on yourself!

These are some strange times and it doesn’t seem that they will be ending anytime soon. We can only hope that everyone around us stays safe and healthy. This situation does provide me with extra mental fuel to stay focused on my journey to FI and make the right moves for my future self.

As for book tips I have something more out there: “The life-changing magic of tyding up” by Mari Kondo. It’s something else, but I found it a fun read.

Stay safe Tony!

Hey, Mr.Robot,

Yes, I agree. This strange times won’t fade anytime soon, I think it will be our homework to accept it as a reality and deal with it, we have no other choice. I see loads of people complaining and shouting out loud to governments but I don’t think there’s anyone to be blamed on this one. This experience is also benefiting me in terms of clarifying what I want, and yes my FI goal stays in the list stronger than ever.

Stay safe you and thank you for stopping by 🙂