Portfolio update #1 December 2018

Table of Contents

Performance 2018

Bye, bye 2018, welcome 2019! Another year ahead with plenty of great opportunities awaiting for us to invest to (or at least I hope so!). But before that, I better organise my ‘messy’ portfolio to see what has been delivered this year and what I am planning to do for 2019.

Highlights

- Portfolio value: 144,731 € (+821%)

- Transactions (Deposits – Withdrawals): 102.875€

- Total earnings: 38,762 €

- Passive income: 1,715 € (4.4% of earnings)

2018 has been a revolutionary year for me, I added a high percentage of my savings into my investment portfolio and battled the fear to be invested. I have no regrets so far after seeing the results.

Earnings by platform

The big champion is Algotechs, however, I am experiencing withdrawal issues and I don’t recommend it for now, at least, until this issue is sorted. Grupeer stands second on the list, 8.9% since May-18 (8months), followed by Property Partner, 6.9% (12 months)

| Platform | Value BEGINNING 2018 | Deposits | Withdrawals | Value END 2018 | Earnings | Return |

|---|---|---|---|---|---|---|

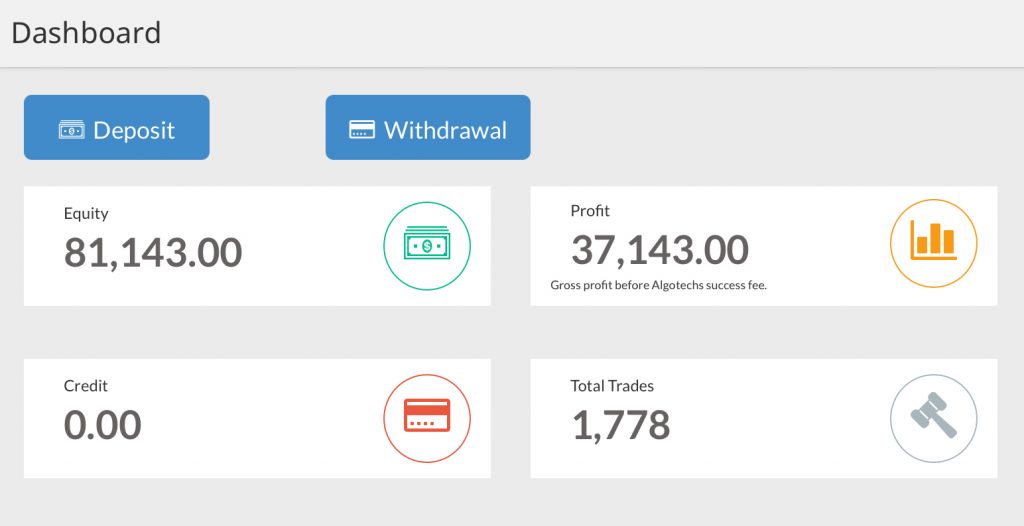

| Algotechs | 3093 | 47000 | -6000 | 81143 | 37079* | 85% |

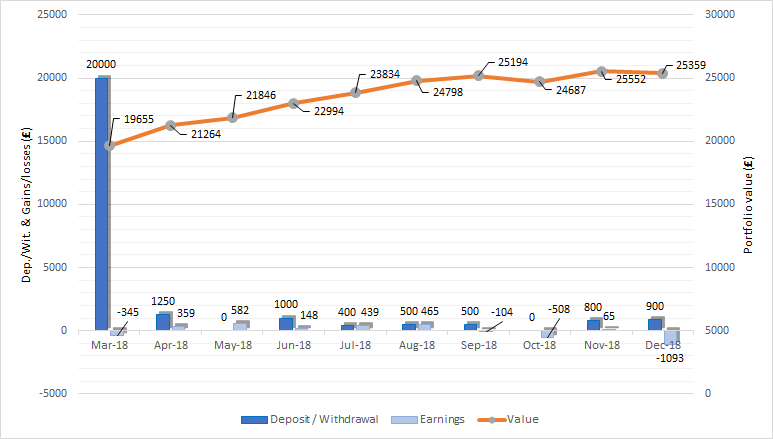

| Vanguard (ISA)£ | 0 | 25350 (28138 €) | 0 | 25359 (28148 €) | 9.3 (10 €) | 0.04% |

| Property Partner (£) | 0 | 5596 (6211 €) | 0 | 5839 (6481 €) | 243 (269 €) | 6.9% |

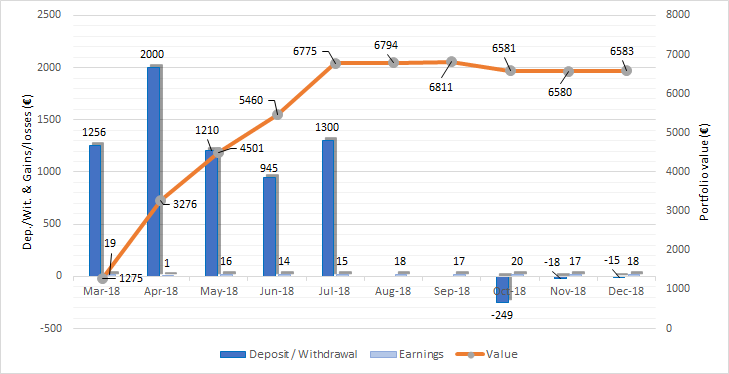

| Housers | 0 | 6711 | -282 | 6583 | 128 | 2.4% |

| Grupeer | 0 | 16005 | -1343 | 15765 | 1102 | 8.9% |

| Mintos | 0 | 2010 | 0 | 2089 | 79 | 3.9% |

| Crowdestate | 0 | 2000 | 0 | 2022 | 22 | 1.1% |

| Envestio | 0 | 1425 | 0 | 1479 | 53 | 4.1 |

| Fast invest | 0 | 1000 | 0 | 1020 | 20 | 2% |

| TOTAL | 3093 € | 110.500 € | -7.625 € | 144.731 € | 38.762 € | 47% |

*A 25% success fee is not deducted yet

Algotechs, Vanguard and Grupeer are my three biggest money holders. By mid year, I decided that diversifying across multiple platforms would be beneficial to lower risks and improve my passive income. I started with Mintos and Crowdestate, at the same time in August, and Envestio and Fast Invest, a few months later.

Passive income

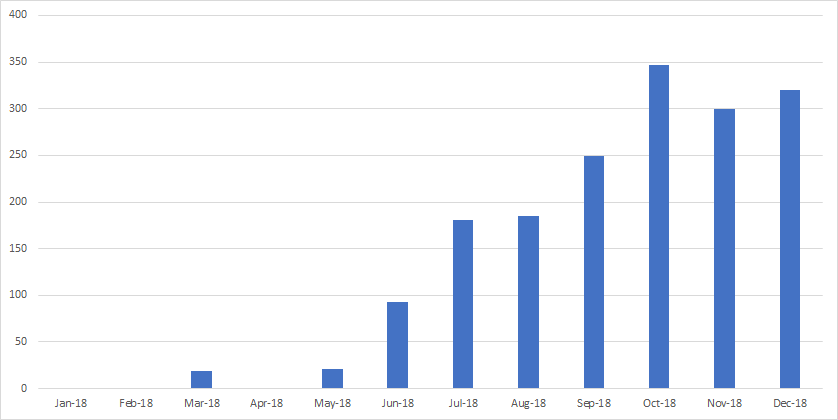

My main passive income streams are from P2P lending platforms, bond funds, rental income and index funds dividends. The chart is picking up momentum since I started investing with crowdfunding platforms back in February. Only 4.4% of 2018 earnings are passive income, I would like to increase it by 10%, reaching an approximate value of 700€ per month by the end of 2019.

December

| Platform | Value November | Deposits | Withdrawals | Value December | Earnings | Return |

|---|---|---|---|---|---|---|

| Algotechs | 81765 | 0 | -3000 | 81143 | 2378 | 5.40% |

| Vanguard (ISA)£ | 25552 | 900 | 0 | 25359 | -1093 | -4.31% |

| Property Partner (£)) | 5273 | 499 | 0 | 5840 | 68 | +1.2% |

| Housers | 6579 | 0 | -14.9 | 6587 | 18 | +0.3% |

| Grupeer | 15575 | 0 | 0 | 15765 | 190 | +1.3% |

| Mintos | 2073 | 0 | 0 | 2089 | 16 | +0.8% |

| Crowdestate | 2012 | 0 | 0 | 2022 | 11 | +0.5% |

| Envestio | 1454 | 0 | 0 | 1479 | 25 | +1.7% |

| Fast invest | 1009 | 0 | 0 | 1020.18 | 11.3 | +1.3% |

| TOTAL |

Algotechs

Not a bad month for Algotechs, returns are above 5% but below the 2018 monthly average of 7.5%. The EUR/USD exchange has been very volatile this year and this is exactly what this algotrading software likes (and explains the great returns). I withdrew 3000€ from my trading account, however, the funds are blocked in a Danish bank for the time being. The value declines 622€ compared to last month.

Vanguard

Stocks got hammered, and so did my Vanguard ISA account, dropping -1093£ in December. News that the Federal Reserve would continue its planned interest rate hikes, a government shutdown loomed and disappointing financial results spooked investors. S&P 500 dropped up to -20% from its all-time high level and bounced back to recover a few points. The index drops -6.4% in 2018.

Luckily for me, I follow a 50/50 portfolio policy, 50% bonds and 50% stocks, as Benjamin Graham recommends to defensive investors. Therefore, my ISA beats the market and gains 0.04% for 2018. Thanks Graham!

This is how my ISA is distributed by the end of 2018 :

While fear is all around, long-term horizon investors have the chance to buy stocks at a retail price. My plan is to keep buying stocks when the market drops and rebalance back to a 50/50 partition. 900£ went into my account this month to buy more shares of S&P 500 UCITS ETF (VUSA) and

Global Value Factor UCITS ETF (VVAL) funds.

Property Partner

December is the third best month for Property Partner since inception, +£68 into the pocket. I sold my shares of Golden Hill Fort, Isle of Wight at a 13% premium price with a total return of £19.41. I also deposited £499 to purchase shares of the new listing property opportunity posted a few days ago. It offers a 6.72% rental yield and the transaction fees are reduced by 50% until the 3th of January.

I wrote my first review of Property Partner after one year of investing sharing my results and opinions here.

Housers

Average earnings this month for Housers, the Spanish real estate platform. The returns are generally lower because it automatically deducts taxes from income. Also, part of my funds are invested in what the platform calls buy-to-sell opportunities, which means I will get the returns once the properties have been sold. Some of these projects are near the end of term and I expect a rise in earning soon.

I received delayed rental income from Estadio Nacional, as usual. As a consequence, I am selling my shares in the marketplace, as I am neither happy with the payment delays nor the monthly rent agreed on the tenancy contract, making the current annual yield lower than the previously estimated. So far, 150 shares are sold and reinvested in the last two development loans, and 150 remain in the marketplace for selling.

Housers is currently offering 25€ cash back after a minimum of 50€ first investment, if using this link (I get another 25€ too). I plan to write a review on Housers in February after one year of investing.

Grupeer

Another great month for Grupeer, however, I still would like to withdraw some money and diversify it over other platforms. A 1000€

returned to my account as a principal payment from a business loan. I wanted to transfer this money to Envestio but no opportunities are available at the moment. According to Envestio support, they have ongoing negotiations with new projects owners, and perhaps, new opportunities will be presented starting from January. This is not exactly what I wanted to hear, so I reinvested the funds in Grupeer’s well-known development project, Promenada (final stage) with a 14% interest rate. A few investments will finalise in the upcoming months and I will have some more chances to diversify.

Mintos

This is my 5th month with Mintos, and my impressions are positive. I was reluctant at first but I began with the Mintos secured loan strategy. It located most of my funds in Mogo cars and mortgatge loans with an 8% net annual return. I gave myself some time to learn how Mintos works and how to use its auto-invest tool properly. The returns are now at 9.14% and should keep improving as my auto-invest is set to buy short-term loans at 12% with buybacks guarantee.

Crowdestate

Crowdestate returned funds to investors from the project Juurdeveo 25c, 13113 Tallinn 6months earlier than expected. That is my first exit from a Crowdestate project. After this positive outcome, I reinvested the capital in

Inger Hotel, Narva, Ida-Virumaa, 20306 with a 12% interest, monthly payments, secured debt and risk class A2.

As in Housers, some of the projects only pay interest at the end of the maturity loan (bullet repayment). After one year of investing I should get a better approach to the real rate of return.

I opened accounts with Mintos and Crowestate at the same time, I am looking forward to see which platform will deliver better results in 1 or 2 years term.

Envestio

And the best crowdfunding performer is… Envestio! The realised return is already 4.25% since account opening, three month ago (affiliate bonus included from Jørgen at financiallyfree.eu). I expect future opportunities with lower returns. In fact, the last two projects of the year yielded 16% (far off from those 22% previous ones). Still, it is the leader within my crowdlending platforms and I will be tunned closely to see what they have to offer in January, and ready to deposit funds using transferwise.

Fast Invest

Fast invest is my two months old newborn investment. As its name suggests, it grows fast! It earned 11.09€ (+2.21€ than November), no affiliate commission on this case. Most of my loans are from Denmark and Spain at 13.5% and 15% rates. More funds will pop in soon!

Thoughts

2018 has been an intense year, I changed my job, met new interesting people, bought a cheap second-hand car, moved to a different town, became fully invested, read 13 books, travelled to two countries, and last but not least, started my own blog! I am especially excited with the last one, although, it may be just the fresh feeling of a beginner. A lot to learn and improve in a newly discovered world, that’s just what I love.

Main goals for 2019

Unlike the majority of financial freedom pursuers, I am still not settled down in a place and some changes will probably come. That makes it more difficult to set financial goals, as I don’t know when I will need to spend funds from my investment portfolio. However, I will do as much as I can to archive the follows:

- Increase portfolio value between 180,000 – 200,000€

- Increase passive income to 700€/month

- Read at least 12 books (santa brought me 3 to begin with!)

- Become fitter, reduce body fat to 15% (21% now)

- Improve my writing and speed

- Write 20 blog posts

- Earn my first blog income and donate it to a charity

Thanks for reading my first portfolio update, hope you enjoy reading it as much as I did writing it. I would love to hear from you, so please leave a comment if you liked what you read, thank you.

You can follow me on twitter where I share some thoughts from time to time and connect with other like-minded people.

Wish you a successful investing year 2019!

Tony

Related Posts

4 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Very impressive numbers, great job! Made me curious to check out Algotech. I’ll be following your progress ?

Thanks for your comment Luigi, the numbers are impressive because Algotechs, however I don’t recommend them for now.

I’ll make sure I follow yours too 😉

I appreciate your honesty Tony, in that case I’ll let that be for now 🙂

[…] my first portfolio update, I set a series of goals for 2019. Even though I completely gave up on them after this, I think it […]