Portfolio & Savings Update #44 Q2 2023 – €210,706

It is time to sit and write another portfolio & savings update to take into account Q2 2023 in the books.

Table of Contents

Q2-2023 In A Nutshell: We Are Homeowners

Well, well, it finally happened! We are homeowners! The completion date was at the end of May, making the purchasing process last for nearly four months. It was a long wait, but a well-worth one. Moving in was stressful, but we managed to do it by ourselves, as we didn’t have any furniture, and we are rather minimalist, so we didn’t have a lot of stuff to move from the rental flat in Liverpool to our new house in Warrington. Still, it was pretty laborious and took a few travels, thank God Liverpool and Warrington are only a 30 min drive!

Anyway, moving in was only the beginning. Since we didn’t have any furniture, we decided to buy the bare minimum to survive and also borrowed a picnic table from friends that we used as a dining table for a while.

There was a family with young kids living here before that enjoyed drawing on the walls, so painting was a priority number one. We painted the master and small single bedroom, and right after that I removed the carpets and installed new laminate flooring. I am writing this update on the single bedroom, which we use as a studio for now. We had my fiancée’s family coming in (our first guests! :)), so the pressure to get the house ready before they came in was high. Now, I still need to paint and install new flooring for the rest of the house.

The house is 20 years old, and besides basic painting work, I don’t think it has ever been refurbished. Both the bathroom and kitchen look old and need upgrading. My initial plan was to upgrade them next year or whenever interest rates go down (if ever?), but I could feel my partner was greatly disappointed about that, so we shopped a little bit around to get an idea of the costs, and we found out a tempting financial option. I guess the cost of living crisis is making a dent in people’s finances, and demand for new kitchens may have dropped, hence why you find more attractive financing options these days. In the end, we fell for it, purchased a new kitchen, paid a 10% deposit and the rest borrowed at 0% interest rates and repaid monthly within three years. Installation starts end of next week, and once it’s finished I’ve got to install the new laminate flooring and put new tiles on the walls.

I’ve got plenty of DIY jobs to do! I enjoy learning how to do it, and mostly it feels rewarding once you have finished, and my bank account and investment returns feel it too!

Sale Of Flat Completed

But yeah, the new house wasn’t the only big financial news of the quarter, I have another one to document. Coincidentally, by the end of May, we formally finalized the sale of my flat in Spain, so Tony Peperoni got a nice injection of cash. I thought I would write a blog post summarizing the numbers, so then I can compare it with those I considered in this blog post, but I am finding it hard to get the time for it. I am glad I found a spot to write this update.

However, I can report that I sold the flat for a net value of €83,670, so that is an extra €20K from what I had originally expected, which is good news. This can vary a little bit though, as even though I paid 3% of the value as a tax for non-residents, I got to report this to the tax authorities and I may be returned or need to pay more money.

Now for the numbers for this quarter.

Quick Recap of Q2-2023 Numbers

- Net worth: €641,000 (+1.4%) – details HERE

- Portfolio value: €210,706 (+9%) – details HERE

- Quarterly growth from investments: €13,412

- Passive income: €4,307

- Savings rate so far in 2023: 45.4%

Comments

The appreciation of the Pound Sterling and growth in stocks have been the main contributors to the rise of both my net worth and portfolio for this quarter. My portfolio is now at a new all-time high which is great to see, the previous reported all-time high was back in July 2022 at a €200,681.

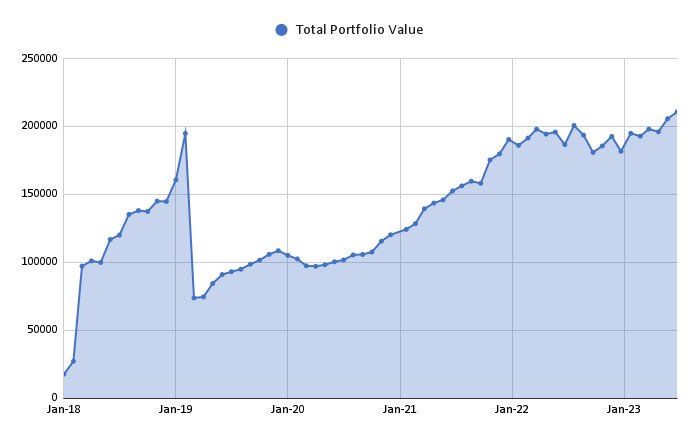

The graph below shows the ups and downs of my portfolio and how it has evolved since I started documenting via this blog:

Since I now have a new injection of cash sitting in my savings accounts thanks to the sale of the flat, I need to ponder how I am going to manage this money. For now, what I am certain about is maximizing my S&S ISA for this tax year, so I decided to dollar cost average by adding £2,000 on a monthly basis as opposed to investing a lump sum, and yeah, I am boring enough to simply buy shares of a Vanguard Global Equity Fund!

Portfolio Performance

This is the portfolio performance for this quarter:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 15 % discounted to estimate future withdrawal tax payments

Honestly, there’s not really a lot to say. As I am exiting more and more investments, tracking my portfolio is becoming much easier, and since I am not digging into any new investments, there’s not much to comment.

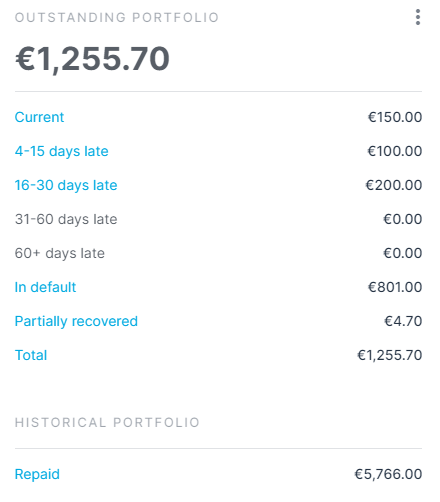

Perhaps, what I would like to add is my increasing disappointment with Estateguru, most of my current loans are either defaulting or being postponed. It is taking ages to withdraw any money from this account.

Out of all my current investments via P2P, the only one I am happy with is Crowdestate.

My crypto investments aren’t playing out well either, fortunately, it is not a big amount what I have in there. lets just keep the gamble on for now.

Dividends!

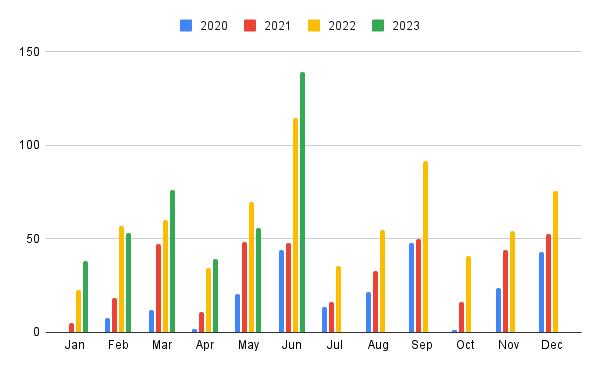

My dividend portfolio generated €234,9 of passive income this quarter (€167.11 in the previous one). That’s a 7.41% dividend growth compared to last year’s Q2. This is despite me contributing €0 to my dividend portfolio this year since the upcoming dividend tax policy changes in the UK are putting me off investing in dividends, so that means most of this growth has been internal/organic, that is the power of compounding and dividend growth doing its job.

Here’s an updated overview of my monthly dividend income so far:

This past quarter I fully sold two of my dividend stocks, that was ExxonMobil back when it was at $115 and 3M at $100.

I bought Exxon before Covid as a value investment stock with a nice yield and great paying record, I kept buying shares during Covid when everyone thought it was the end of oil. Since then, the price had more than tripled and felt a bit hot and overpriced, so I decided it was a good time to sell it. I know that this seems like timing the market, but firstly I don’t like the CEO and how much he has inflated his wages over the last year. The share price growth is mainly thanks to the increased demand for oil, and not directly because of him. Secondly, I am not too fan of oil as an investment due to its cyclicality. If I ever buy oil again, it’s highly likely to be from a European company such as Shell.

I also sold all my 3M shares as I am not too confident about how the company is going to deal with the current amount of lawsuits is facing. The risks are way too high compared to any potential growth from my point of view. It was hard to sell 3M, as I know their products are first quality, at least from what I could see in the manufacturing environment. I recall welders from my previous workplace always asking for 3M products as they last way longer and are easier to work with and were worth paying the price. This is the reason number one I got interested in 3M, but those lawsuits are just a potential business killer.

I reinvested the cash into existing stocks, I didn’t add any new ones. Most were reinvested in BlackRock, Realty Income, Johnson and Johnson, British American Tobacco, Legal And General and Home Depot.

Final words

That’s mainly all I’ve got to report for this quarter. There’s still a long journey ahead before I reach the million, but I am happy to see the progress made so far and also equities starting to gain some traction!

Tags In

Tony

Related Posts

2 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Well done on the DIY flooring!

And congrats on the flat sale!

Looks like you’ve got everything on track now. Are you installing the kitchen yourself?

Good Call on exxon and 3M! 🙂

Thank you, Nick! 🙂

No, I am not installing the kitchen by myself, we hired a fitter. This way we can have it done in a week, otherwise it could take me much longer as I would have to learn the process and contact electrician and plumbers myself, which all adds time. I will be fitting the tails and flooring though, but this can be done after installation.