Portfolio & Savings Update #33 August 2021 – 159,635€

Ladies and gents, another month went by, which means it is time for another monthly portfolio & savings update to count in August 2021.

Table of Contents

August In A Nutshell

August is a holiday month for most Spanish workers. By law, In June employers must pay a double payslip to their employees (at least in Catalonia, not sure about other areas). This makes people feel cash-rich and ready to deploy all this extra money in a very well deserved holiday. I think this is quite clever and works well for the local economy as consumerism ramps up during the summer months.

I am not a big fan of this holiday culture myself though, so as far as I have no kids, I don’t see the point to overpay for the overpacked. I am prone to go on a holiday in June, September or even the first weeks of July. This year I will be on a road trip in Spain during the last two weeks of September, so I am pretty much looking forward to it!

August was a bit lonely. My girlfriend had to move to the Czech Republic to get her Covid jab as I could not find a way to do it in Spain, so I’ve spent most of the month on my own. I met and had a nice time with some friends, which was great, but I felt a bit lonely occasionally and started rewatching the series Lost. I remember watching this series when I was at uni in Spanish, this time I am doing it in English and have to say it is much, much better that way, especially now that I am able to recognize several sorts of English accents.

Anyway, watching Lost while eating ice creams and watermelons is not all I’ve done this month! I’ve continued clearing out my flat and garage and sold some more stuff online. At this stage, I don’t have much left to sell, rather than essential needs which will be sold last minute. This is good news, as it means I am finally reaching the end of the decluttering tunnel. This experience is making me become “allergic” to stuff, honestly. Everything that takes up space and has no utility must go. The next stage for me is to sell the slabs of my flat to the second-hand market! 😛

My garage is now almost completely empty, and I am glad to say that I have found a potential buyer who is willing to pay €16K, which is a bit more than €12800, the value I was counting on my net worth balance sheet. So that is some good news.

Regarding the flat, we’ve decided to sell it, unless we would come across an interesting renting opportunity, but this is quite unlikely. After emailing several agencies, I found one who is willing to do all the hustle for a moderate fee of €3,000. Their recommendation is to not empty the flat and leave it with the furniture. That way apparently gives a better interpretation of the sizes of the flat on the pictures, and therefore it gives a better option of selling, as my flat has nice size bedrooms, living room and kitchen. It should not be a problem to sell it, even after I have left abroad. I just need to do some paperwork and voilà! They can manage it all of me. This was relieving to know as it’s something that was barking at the back of my mind, so it was good to know there’s a straightforward solution.

Now, what will I do with all the money after selling? Certainly, use it as a deposit for a new house. What remains unanswered is the where.

So, that’s been the recap of my August, but what about the numbers?

Quick Recap of August Numbers

- Portfolio value: €159,365 (+2.48%) – details HERE

- Contributions to the portfolio: €-140

- Monthly growth from investments: €3,881

- Passive income: 1,169 € – details HERE

- Savings Rate: 68.5%

August was another great month in terms of portfolio growth. What a year we are having so far, the bull sentiment on the market is still in its momentum. The YTD growth for the S&P500 Index is over 22%, not bad at all, huh? However, I am not getting too excited about it, as a correction can happen at any time. Apparently, a correction occurs, on average, every 1.83 years.

For the first time in the last two years, I practically stopped contributions to my portfolio. My only purchase for the whole month was some shares of the Global Clean Energy ETF as a part of my 45K Project Fund, and the minimum contributions to my UK work pension. Overall, the contributions are negative as I continue withdrawing funds from some P2P lending platforms.

The reason why I have not purchased any Index funds or dividend stocks is not that I am trying to time the market, but because I want to build some cash reserves in my UK bank account, and also because September will be a rather expensive month, so I will need more cash than usual.

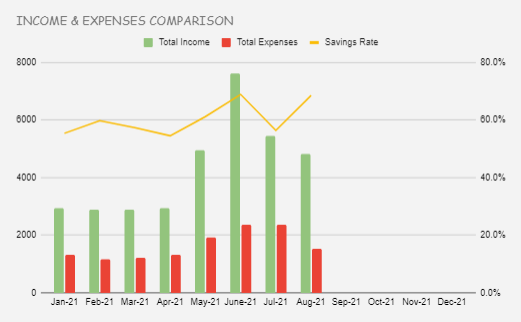

Monthly Income and Expenses

In August, the family income was £4,819.7 (5,639 EUR).

As selling continued, I managed to make £235.95. That’s pretty much going to dry up from now on, as there’s not much left to sell.

Expenses remained lower than usual, despite the massive cost increase on my mum care costs, which ramped up to over €1,300 a month (€480 before). I am not complaining though, I think it is well worth the money.

All together, I saved 68.5%, so good for me for reaching the 60% target mark this month.

My passive income covered 65.8% of all expenses.

Savings Chart

Portfolio Performance

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

I am really loving 2021 so far, guys. In August, I saw another loss reduction of 1.8%. Last month, it stood at -15.6%, this month -13.8%. In January, it was at -24%. That’s quite a change in just 8 months. Sometimes, when I think of all the effort I am putting in to just break even, I want to hit my head against the wall, but I promised myself that I am going to make all this worth over the long term, and I am going to show it and document it all on this blog!

Alternative Investments Portfolio

My alternative investment portfolio provided me with €69.6 of passive income.

To be honest, I don’t have much to add up that I have not written about it before in previous updates.

I only made two moves, and both were to withdraw funds from Crowdestate (not a fan, since all new development loans are full bullet) and Crowdestor (which I don’t trust, especially since the Crowdestor Flex addition)

Estateguru* and Reinvest24* are the platforms I like the most at the moment. Estateguru is completely hustle-free if using the auto-invest feature, so I just keep it on and look forwards to earn interest payments every month. On Reinvest24, I am always looking forward to new rental property investments. If you would like to know more about Reinvest24, why not check out my review and personal experience with the platform?

Dividend Portfolio

My dividend portfolio in August generated €32.99 of passive income.

This was the outlook of my holdings at the end of the month:

No additions to the dividend portfolio this month, I only reinvested the dividends to buy more of the same stock.

The best runner is Microsoft by far. I bought it during the coronavirus meltdown, and now it has more than double the purchase price. I remember wanting to buy more shares but having no more cash for it, a pity!

Kroger´s price has done well lately, too, mainly thanks to the e-commerce optimistic future plans and Warren Buffet purchasing shares.

Dividend Payments

I received dividend payments from a total of 5 companies:

- AT&T (T): €15.19

- Bristol-Myers (BMY): €5.34

- Mastercard (MA): €0.57

- Toronto Dominion (TD): €8.45

- Realty Income (O): €3.44

Total Dividend Income: €32.99

Here’s an update on my year-over-year dividend comparison:

The €45K Project Fund

Another month has passed which means I saved another €60 as a non-smoker, cash that goes into my 45K Project Fund.

In August, I contributed all non-smoked funds to the Global Clean Energy ETF.

So far The 45K Project Fund consists of:

- Abundance Investment: €1,464.9

- Kiva: €442

- Qardus: €224.2

- Global Clean Energy ETF: €728.6

So far, I have recovered 6.14% of my loss = €2,859.7

42,140€ left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

Goals and Habits 2021

It’s time to have a look at how I am doing with my 2021 goals and habits for 2021.

All my goals are monthly measurable, so I’ve built a table to keep an eye on the progress, this is how it is going so far:

Goals and Habits This Month

Goals and Habits Previous Month

The higher temperatures in August made it a bit more challenging to do weight lifting, so I am still lagging on that. The two weeks road trip won’t be good to catch up with some of my goals. We’ll most certainly do loads of walking visiting places, so that should help my step goal and hopefully reduce body fat?

I finished reading the free e-book The Almanack of Naval Ravikant. A good read if you’re into the wealth and happiness topics. I may take the notes I liked from this book and write them in a form of a new millionaire mindset blog post.

Currently, I am reading The Wit and Wisdom Of Charles T. Munger as a Naval’s reading recommendation. It can become a bit of a tough read sometimes, but reading about Charlie’s wisdom is definitely making me smarter, so not a waste of time. Thank god that I learned English!

That’s all for this month. As usual, thanks for reading, and you take care, babies! 🙂

Cheers.

Tony

Related Posts

11 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

I Think I missed something!

You’ve just moved to Spain where you’ve got an apartment that you’re now planning to sell. Are you not living in the apartment atm? And where are you planning to go? (Czech Republic?)

Why not rent out the apartment? Too much of a hassle and too low a return, or?

And why do you need money in your UK bank account!? I’m so confused! ?

Yes, I am in the apartment in Spain where I live and work remotely for my employer in the UK.

We still don’t know where to go 100%, we are between two places, but it won’t be Czech Republic.

Don’t won’t the hustle of renting out the apartment, there’s not much growth on the area and the returns after tax are low. May need to write a post about this.

UK is on the list of possible place to live. If so I will need some cash for settling. It’s just a move to be ready for whatever.

Learning a lot of techniques/methods from your blog. Thank you for taking the time to produce it each month.

Thanks for your no nice comment, appreciate your time 🙂

Hi Tony!,

65% of your expenses covered with passive income, that’s amazing. Can’t wait to get somewhere there myself, I think as soon as I get anywhere near 50% I’ll just move to Thailand or something similar and chill for a bit hahaha.I heard with that kind of money you can have quite a good life style in Thailand.

Anyways! Have you ever considered Portugal for example as next destination? Particularly they have this Non Habitual Resident visa with a very convenient tax scheme where you pay little to know taxes on any income source outside of Portugal. I’ve been looking into it myself, and Portugal does look very nice to me.

Fun fact! I also watched Lost while I was on my college years.

Have a great week!

Hi Juan! 🙂

65% sounds good, but it’s quite misleading as I didn’t have to pay many bills, taxes, insurances or any other common expense. Generally, my passive income covers about 30% of my expenses or so, so still a long way to go!

Moving to Thailand sounds amazing, I still haven’t visited this country but definitely want to do so at some point!

No, I have not considered Portugal. I think it would be a great idea actually, been in Portugal once and loved its people and weather. It could be a good option once I have reached my million! 🙂

Lost was a must-watch at that time!

Have a great one, you too!

Hi Toni

Each month brings you one step further towards FI. A big portion of your expenses already covered by passive income and with your high savings rate you give your wealth accumulation process an additional boost.

Keep it up mate, and all the best ??

Cheers

Thanks a lot for the support amigo, appreciated as usual! 🙂

OMG, I have been tempted to rewatch Lost!!! I think it’s just the last season I haven’t watched (so I don’t know how it ends…). It’s something I will do at some point but there are other shows I have been watching.

I wish I could say that my garage is empty, I haven’t even started clearing that stuff out yet and it’s 3/4 full! The shed too is full of stuff…

All the best with the selling of your flat and look forward to hearing where you will buy your house.

I did watch it to the last episode and I do agree with the general opinion of being rather disappointing, but still worth it to kill the curiosity.

Good thing of all this sorting out mess is that (at least in my case) it makes you realise that many of the stuff/ possession I own are just there to take space but don’t have any purpose today. So it will be worth asking when buying– is this something I am going to use long term? Do I really need it? And so on. Always a positive side! Sure you’ll breath better after moving to your new place! ?

Thanks, I am excited about what’s about to come!

SPOILER ALERT! They are in purgatory all along….m000hahahah 😛