Portfolio Update #23 October 2020 – 107,320€

Amigos, welcome to another portfolio update, this time being for the month of October 2020.

Has anyone noticed the US election going on this week? I bet even the top-ranked Buddhist monks in the world heard about Trump’s tweets!

Table of Contents

Quick Recap of October Numbers

- Portfolio value: 107,320 € (+1.45%) – details HERE

- Monthly Transactions (Deposits – Withdrawals): 2,108 €

- Monthly growth from investments: -1279 €

- Passive income: 446.9 € – details HERE

October was an excellent passive income month for me. I earned 446.9 € which could have covered 40.5% of my monthly expenses. The last time I crossed the 4 hundred line of passive income was back in December 2019.

I remember that one of my goals at the start of this journey was to earn 700€ a month of passive income by the end of 2019. That hasn’t materialized even today, although I was not too far off from reaching it in 2019, as I earned 593€ in December.

The goals I pursue today have shifted from those I had early days, I no longer prioritize my investments on ways to maximize my streams of passive income, but in accumulating long term capital appreciation instead.

However, I must tell you, my dear reader. I love earning passive income, and I love it a lot! It’s like a drug addiction, you just want to earn more and more, as long as the taxman doesn’t put an end to your excitement, obviously.

Anyway, let’s leave the “drugs” behind and have a look at how my investments performed during October:

October Portfolio Performance

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted as estimate future withdrawal tax payments

Stocks didn’t do very well in October. The S&P 500 Index dropped about -3.3%. My dividend portfolio didn’t do any better either, but I am glad to see how the combination of my S&S ISAs actually did. I wonder if the outcome of investing in global funds is becoming more noticeable, as a larger diversification should mean less price volatility.

My UK pension, as usual, did better thanks to my employer contributions and tax reliefs.

As an overall, my portfolio decreased only -1.21%, which isn’t too bad.

The Pound Euro exchange rate remained at a similar value: From 1.10 at the of September to 1.11 at the end of October.

Alternative Investment Portfolio

My Alternative Investment Portfolio provided me with 232.68 € of passive income. That accounts for 52% of my total passive income this month.

During October, I managed to sell all my long-term standing loans on Robo.cash*, which put me in an exiting position and gave a nice income shot of 127.1€. At the time of writing, I have already fully exited this platform and received the cash successfully into my bank account. It’s all moved so well and smoothly that I feel even sorry for leaving this platform. I may consider joining back in the future, but only after:

- Tidying up my P2P lending mess a bit deeper.

- Seeing how EU platforms will adapt during 2021 to the EU rules for crowdfunding platforms published recently.

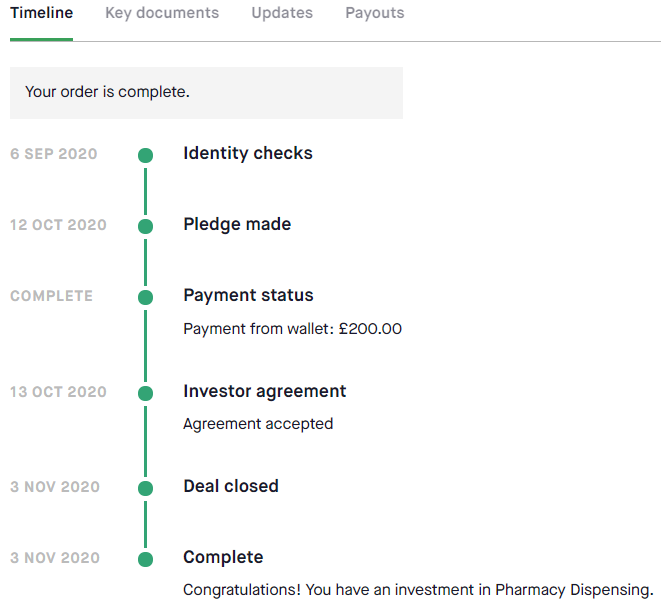

Besides this, I made my first investment of £200 for a 12.15% interest in my recently added Qardus* platform, which is based in the UK and operates under the FCA regulation.

Joining and making my first investment felt secure. I first had to pass a short test to confirm that my risk tolerance is adequate for this sort of investment, then I had to download the offer document, read it through and accept the investor’s agreement.

I should receive my first interest payment soon, as it pays monthly.

The following are the platforms which I am currently invested in, classified from 1 to 9 by my level of contentment. I have not included Qardus on the list yet, as it’s too early to express any level of contentment.

1. Crowdestate

My investments on Crowdestate* are doing well. None of my loans has defaulted and all payments are on track.

As I am happy to keep my Crowdestate portfolio close to 2K, I am no longer withdrawing funds at this stage. I am building up cash on the platform until I can reinvest in more development projects.

2. Estateguru

Things still keep running fairly well at Estateguru’s*.

My portfolio consists of 35 loans (35 last month), where 31 are being paid on time and 4 are late (5 last month). I have no defaulted loans so far and withdrawals are processed on the very next day. It is a shame there’s a 1 EUR fee per withdrawal execution though. I only withdraw once a month to avoid paying too much on fees.

My account value is 1.8K, I plan to keep withdrawing until I get down to 1.5K (at least for now).

If you want to give it a try, please consider using this link and get a 0.5% bonus on your investments made during the first three months.

3. Robo.cash

As I commented above, all my loans on Robo.cash* were sold in October.

At the time of writing this, I have fully exited the platform successfully. Total profit amounts to 328.7€, which is about a 12% XIRR.

4. Crowdestor

The outlook at Crowdestor’s* is worsening. Out of 19 loans I am invested in, 7 are delayed (5 last month).

The recently added secondary market is rather rubbish. I placed all my loans on it and I sold none of them.

We’ll see how things keep progressing. I hope it will improve.

5. Property Partner

Property Partner finally paid some rental dividends in October!

All property valuations were updated. That gave a boost into my virtual account.

As things seem to be getting slowly better at Property Partner’s, my level of contentment with this platform raised above RateSetter’s.

During this second lockdown in the UK, universities and schools are still “open”, so I am hoping that there won’t be the need to remove all dividend payments again.

6. RateSetter

RateSetter is having a tough year as it was forced to halve interest rates for the rest of 2020 in an attempt to stabilize their provision fund. Obviously this is better than facing bankruptcy or stopping all payments as Grupeer or Property Partner did back during the first lockdown.

I am on the slow process of trying to exit this platform. I requested all my funds back in August. There are 18,850 investors (19,993 last month) in front of me before I can withdraw my money.

At this speed, I could take me about 3 years (give or take) to get my money back…

7. Housers

Housers is a no-escaping-way total disaster at the present moment. My Housers page speaks by itself.

Repayments for the Albufera loan started, so that will give an uplift to monthly income.

I got many projects that are not generating any income at all. One of them was recently sold. That should free me some cash soon.

Looking forward to it!

8. Fast Invest

Fast Invest monthly income is stabilizing. I have not requested any new withdrawal yet as I am waiting to free up some more cash in my account. The aim is to avoid paying to much on withdrawal fees.

Dividend Portfolio

October was a quiet month for my dividend portfolio, which only generated 1.46 EUR of passive income.

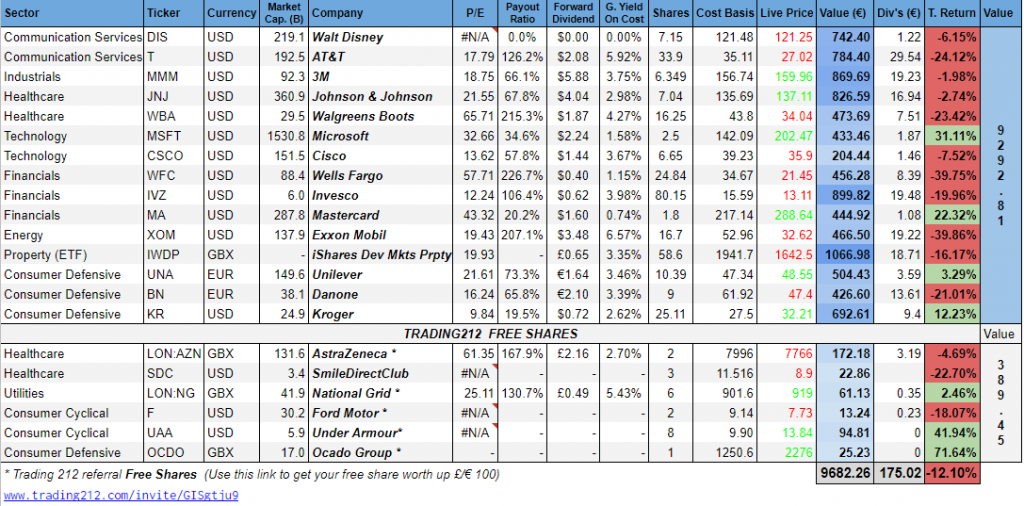

This is the outlook of my holdings at the end of the month:

My dividend portfolio finished badly in the red for the majority of my positions. I am about to exchange the red for the green colour so you guys think I know what I am actually doing? Hah… 😉

Putting on the side my free shares (which are in fact performing better than my formal positions), I own shares from 15 companies. I think this is quite the limit number of companies I want to own. Many of them do their quarterly reports during the same day or week, and it’s challenging keeping track of this. In fact, I have not done my homework and skipped many quarterly reports 🙁

I definitely don’t want to end up with a portfolio of 50-100 positions. I’ve never understood why people do this and how they manage to keep an eye on all of them.

In addition, I wonder how Joe Biden presidency of the US will affect the markets and the big tech industry over the next few months, especially when corporate taxes get increased.

In my case I will keep calm and carry on investing, just like this guy keeps playing the piano in Barcelona amidst the chaos:

(Thanks Hot Head for the video)

Dividend Payments

Only one company paid dividend in October:

- Cisco (CSCO): 1.46€

Total Dividend Income in October: 1.46 €

New Holdings And Purchases

All contributions to my dividend portfolio came from earned free shares. Thanks again for using my referral link.

- SmileDirectClub, Inc. (SDC) 2 shares @ $12.54 *FREE SHARE*

- SmileDirectClub, Inc. (SDC) 1 share @ $9.47 *FREE SHARE*

- SmileDirectClub, Inc. (SDC) 1 share @ $9.15 *FREE SHARE*

The €45K Project Fund

Another month, another £54 saved as a non-smoker and put in the 45K Project Fund.

I withdrew all sitting cash from Abundance due to the lack of interesting investments and invested in Qardus* instead. Albeit I don’t think Qardus investments are as ethical as those from Abundance I am still going to count them in this recovery fund.

So far The 45K Project Fund consists of:

- Abundance Investment: 1,103.1 EUR

- Kiva: 42.26 EUR

- Qardus*: 222 EUR

So far, I have recovered 3.03% of my loss = 1,367.36 EUR

43,632.64 EUR left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

This is it for this month, hope you have a great month of November wherever you are. Take of yourself and your loved ones and stay safe. Much love.

Tags In

Tony

Related Posts

4 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hey T, thanks for a great update as usual. I really enjoy reading your posts.

Regarding your new P2P platform, i know that it is “regulated”, but it seems a very risky platoform!! It reminds me of the scam platform styles. Especially compared to Robocash whom you have left… what were you thoughts behind signing up?

do you have some criteria to chosing a platform? after the scam platforms, my risk preference has decreased dramatically..

how are you evaluating the performance of your dividend portfolio?

is it worth to add the performance of an index like ftse or s&p and also against if you had just invested in the msci world etf?

take care,

Steve

Hey Steve, I am glad you enjoy reading my posts 😀

P2P Lending is generally a risky way of putting your money to work, and Qardus is not an exception.

I needed a new platform to carry on with my “45K Project Fund”, as Abundance lacks new projects with acceptable yields.

I choose Qardus because it offers something unique in the P2P market. The platform lends money to UK business owned by Muslims, therefore they can only raise money from Shariah-compliant loans that are governed by the requirements of Shariah law and the principles of Islam.

These won’t include investments such as:

– Conventional finance (non-Islamic banking, finance and insurance, etc.)

– Alcohol

– Pork-related products and non-halal food production, packaging and processing or connected activity

– Gambling

– Adult entertainment

– Tobacco (love this one!)

– Weapons and defence

In addition, there are requirements surrounding the use of debt and interest-bearing assets. Islamic law prohibits the collection and payment of interests by lenders and investors.

I believe everyone no matter what their religion is deserves the chance to get financial aid.

I also found interest rates to be rather high compared to business credit risks.

Once you register you get access to the Information Memorandum document, where it displays the risks, company financials, loan purpose, returns and so on.

My risks preference has also decreased considerably after Envestio scam, that’s why overall I am still lowering my percentage allocation. That has not changed!

I evaluate the performance of my dividend portfolio using Google Sheets. It allows you to track stock live prices, so once set it’s all updated automatically.

I am not all invested in Global Funds. All my new contributions since April 2020 go to Global funds, but I still keep my old ETFs (check out my Vanguard page).

Stay safe Steve and thanks!

This is my first time stumbling upon this–what a great breakdown. It’s always interesting to view the investments outside of my native US of A. Quite literally foreign territory for me! Great way to learn a new financial language. Thanks for sharing!

Thank you Impersonal Finances, truly appreciate your comment bro.