Portfolio & Savings Update #50 Q4 2024 + Full Year – €328,445

Happy New Year 2025, everyone! It’s time for me to write another portfolio & savings update to account for Q4 2024. I will also pack it with my numbers for this year including income, expenses, savings, returns, and some thoughts and conclusions for the year.

Table of Contents

Q4-2025 In A Nutshell

The last quarter of the year is my second favourite quarter. True, days become shorter, darker and colder. Still, you get to enjoy the beautiful landscape of autumn, the light decorations in the cities, the bonfire, Halloween and the Christmas season that comes along with its markets, decorations, presents and family time. Financially speaking, we generally get to enjoy a market (Santa) rally which pumps up our portfolios just before looking at the numbers for the year.

In October, we managed to enjoy some walk trails in the Peak District. November was quiet, we had good friends coming over to our place and spent the day playing board games. Then it was Black Friday. My wife turned into an obsessive impulsive spender and bought a new fireplace and blinds for the whole house (yeah, we still didn’t have proper blinds after over a year since we purchased the house!). Then I spent part of December fitting the blinds. I still have to fit them in the studio and second bedroom. I am supposed to be doing that now, but I am writing this instead (until my wife finds out!)

This year we managed to spend Christmas in the Czech Republic with my wife’s family. Before that, we visited Budapest for three nights. What a beautiful city! I was impressed with the architecture, the Christmas markets and the sizes of its dishes.

And then finally this bad financial decision happened.

Quick Recap of Q4-2024 Numbers

- Net worth: €782,903 (+2.7%) – details HERE

- Portfolio value: €328,455 (+10.17%) – details HERE

- Quarterly Total Growth: €15,343

- Quarterly Savings Rate: –24%

Comments

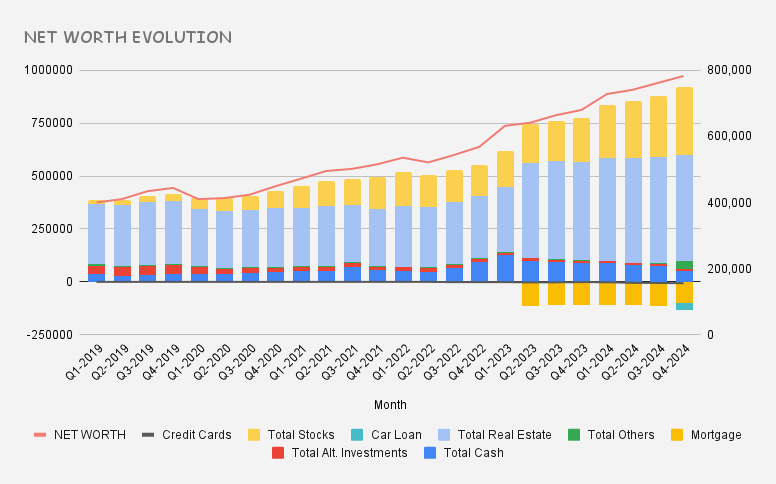

Another pretty good quarter for stocks, which is the main contributor to my net-worth growth. Stocks make up 42% of my net worth. Back in Q1-2019, stocks made up only 4.2% of my net worth.

I have a negative saving rate this quarter as I transfer part of my cash to Tesla shareholders.

Quick Recap of 2024 Numbers

Now, let’s compare 2024 numbers against 2023’s.

My net worth at the end of 2023 was €680,150. It is now €782,903, which is an increase of €102,753. This is way above my income from all sorts for this year. In the last two years, we’ve seen amazing growth. In the previous one, my net worth grew €110K. That makes over €212K of growth in only two years. It’s crazy when you think about all the effort and time it takes to get to the first €100K, but then how effortless it is to create wealth as the pile just gets bigger.

Below is a breakdown of my net worth value from 2019 to date. The trend is clear. Stocks have taken more protagonism, my stake in alternative investments has been reduced, my cash reserves ended the year lower, the mortgage is slowly being reduced, real estate stays relatively flat and a car loan and car on Total Others was introduced this year.

My investment portfolio was €237,110 a year ago. That compared to today is an increase of €91,345, which is a 38% annual increase. I’ve got nothing to complain about here either!

Total taxable passive income for 2024 was £17,441. This also increased this year by £2,531. Besides rent and dividend increase, the main contributor to passive income growth was the interest payment of a 1-year fixed-rate saving account coming to an end.

That nice July spike shows the magnitude of the interest payment cash injection I received. Rather than that, the flattish trend stays the same as usual, as I’ve contributed mainly to accumulators.

Income and Expenses 2023

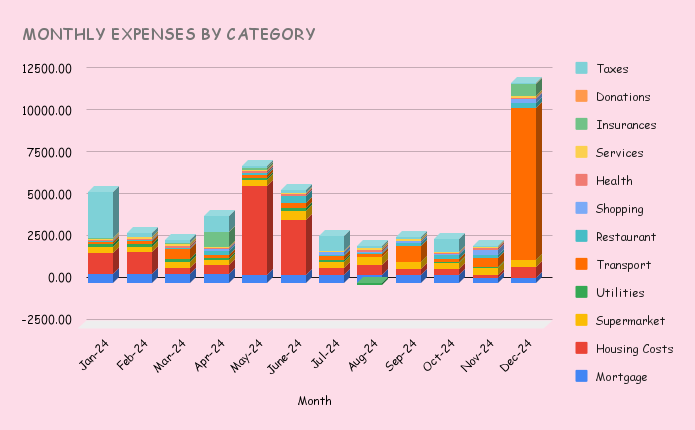

In total, I spent a whopping £54,533 this year. Yikes! The deposit payment for the Tesla in December looks like a SpaceX rocket ready to launch. I also paid for the solar panels in May and June, and in January, I paid taxes from my previous tax year earnings as a sole trader to HMRC. All of this has put a significant increase on my 2024 expenses.

Likely for me, despite this expensive year, I managed to keep my income slightly above my expenses. My total income for 2024 was £57,777. I saved £3,245. This is the breakdown by categories:

My job income increased again this year thanks to a better-paid job I started in September. Interest income this year saved me from entering the red ground, as I received £4,299 in interest payments, however, this will be taxed the next tax year 🙁

This is the final outlook for my income and expenses in 2024:

My savings rate for this year is 5.6%. That’s a single-figure rate and the lowest since I started documenting. It is not the best example I can give to others, but I hope the capital spent on the house and car will help us save more money in the long term, and help with improving the value of the house.

Investment Portfolio Breakdown

This is how my investment portfolio breakdown looks for the end of this year:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

Seeing the Gains and Total Return both in green on the bottom line feels simply awesome. 2024 was the year I turned a negative portfolio into a positive one. €59K of fuck-ups, finally overturned by positive growth. I have shown that even for those having a rough beginning in investing, the fact of not giving up, learning from mistakes, and documenting and implementing better saving and investing habits, simply works. This blog doesn’t have many readers left, (especially since I stopped sending these updates to subscribers), but if you are reading this and had a bad start, I hope my experience will encourage you to keep going.

Analysing my portfolio is now dead easy. Equity global trackers account for 87.8% of my total portfolio, and these have returned 22%.

22% for doing nothing. I’ll take that!

Dividend Portfolio

Now as usual I get to look into my dividend portfolio which generated £129.5 of passive income this quarter (£177.19 last quarter).

The total dividend income of this year was £730.81. The previous year was £692.61. Once again, this year, I have not directly contributed to my dividend portfolio. However, I had an indirect addition. Alphabet started distributing a small dividend to investors this year, so my position was automatically added to my dividend portfolio. This added £16.04 of dividends for this year. The remaining increase compared to last year was organic, and sadly it has only been 3.1%, which is a bit disappointing.

In terms of performance, though, my holdings did great as they increased 25.2% in value, which means I beat the US market. However, when you look closely at the chart, you can see how it was underperforming for the whole year until December. That was when Broadcom’s $AVGO share price went to the moon.

If on top of that, I add the dividends, then my total return for 2024 was 27.5%.

Next year, I would like to pay more attention to my dividend portfolio. I have not actively contributed to it since 2021, and since it is now wrapped in an ISA, it makes more financial sense to contribute.

Here’s an overview of my monthly dividend income so far:

Final words

2024 was another good year.

It was capital intensive, but we made a lot of progress with renovating our house, and our investment in solar panels and a battery system will bring energy savings down the line.

This year I also committed a financial crime by buying a new car, but despite this, I still managed to save 5.6% of my total income.

I also changed my job to work for a global company that offers better pay and benefits packages.

My world trackers returned 22% and my dividend portfolio 27.5%

But most importantly, this was the year I went from having a depressing portfolio with red losses, to a green and more optimistic one with positive returns.

2024 was a pivotal year for me. It is when all the 2019 darkness is put behind me for good.

Let’s make 2025 another year to remember!

Tony

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.