Income, Expenses & Savings, March 2020 – £1332 Saved

Remaining positive is becoming somewhat challenging, yet it is so crucial to do so. It is imperative to shield positivism from negativism, a fact that needs no introduction and recalls the spreading science of this “welcoming” respiratory virus that we are living with these days (stay at home and shield).

As a comparison, negativity would be the virus, and positivity, us. That brings us to the time we are now, the time to take care of ourselves and our loved ones, and the time to protect us.

I hope you and your relatives are all well and remain to be healthy until all of this is over, that’s the most important thing of all, well above money.

March has felt like such a long month, there has been so much going on that I am still trying to assimilate part of it. Three weeks ago, on the last post I wrote, I said I had no idea how the coronash*t would end up, today, it has become a pandemic. My assimilation speed is slow and I’ve been through several ups and downs these days. I always compare myself with the stock market. On some days I grow, on others, I walk backwards, but always keeping a big picture that represents continuous improvement and growth.

The current conditions affected my focus, changing it from a growth perspective towards a defensive point of view. And you know what? It sucks.

If you are asking yourself why I am saying so the answer is simple. Because I am (and you quite possibly are too) meant to keep growing, meant to embrace opportunities and meant to jump over obstacles. Not to keep yourself and your family shielded at home, living behind a mask or going out for shopping in a state of fear.

But as Charles Darwin put it (and yes I believe in the theory of evolution) :

“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change.”

— Tony @ OneMillionJourney.com (@JourneyMillion) March 22, 2020

– Charles Darwin

So, there you have it, whoever adapts to the changes that Covid-19 has brought to us wins. It’s a ‘take it’ or ‘take it’ deal. We have no other fu***ng choice.

Table of Contents

How Covid-19 has affected me so far

My misses, my family and I are all fine so far. None of us has had any symptoms and we are all feeling healthy. 🙂

Like many other people, I must admit that coronavirus seemed like a joke to me at first. I had absolutely no idea of how coronaviruses spread when taken from a scientific approach.

Initially, the virus only affected my stock market investments, and I was rather happy, as I’ve been “waiting” for a market crash to happen, hence my super defensive 50/50 bonds/stocks allocation in my ISA since 2018.

But things have been escalating quickly, as you all know, and that situation that I initially took as an opportunity may turn to be a complete f**k up. (I’ll discuss this further on my next portfolio update, spoiler: P2P).

When I realised this wasn’t a joke

The first time I freaked out was during a coronavirus work emergency meeting. My boss looked pallid and frighten while communicating us that there had been a worker sent home due to a high fever symptom. (Then I became pallid! Today still no one knows whether he had it or not as he was not tested).

On the meeting, we traced a plan to help minimise the chances of getting infected. (doors left open, disinfecting communal surface areas often and keep a one-metre distance among us and other measures).

Soon after, before the lockdown in the UK took place, bosses decided to split the team in two, team A and B. One team would work from home whilst the other works at the premises, next day vice-versa.

I was delighted with this idea as I thought it could give me an opportunity to get a real sense of how working from home feels like it without having to leave my day job, and also get a chance to show that I can be more productive from home, without the distraction of other people.

We’ve been working like this for two weeks now, and whilst I am far more productive at home, communication among us is becoming a problem. Also, many suppliers have shut down. I am not sure how long can my employer keep going on with this situation. We’re only 20 people left.

Also, living abroad with this current situation isn’t helpful neither, as I am not only worried about the situation in the UK but also in Spain and Catalonia, where some of my friends and family live. It’s like having a double dose of corona news and it is not a thrilling experience.

I’ve reduced the time I spend on Twitter as there has been too much negativity shared on this social media and also noticed an increase in gamblers.

The only good news (besides remaining healthy) is that I didn’t have any holidays booked yet, so guess who is no losing money due to cancellations so far?

Captain Tony! 🙂

Income, Expenses & Savings Rate

In March we managed to meet with some friends on a Saturday in Brighton before the UK lockdown. We had lunch, burned some calories playing the laser tag game (a lot of fun!) and add some more eating yummy waffles! 🙂

My income streams in March remains at normal levels, I got my salary in full and rent payments as usual. My employer wants to keep doing business as usual as most of our customers are farmers and construction businesses, industries that are still operating despite the lockdown. So far I am grateful for this. I have tons of designs to be completed.

This is an overview chart of my income, expenses and savings rate so far:

My total net income in March was £2,172 (2,422 EUR) and my expenses were only £840.1.

I was able to save £1332, that results in a savings rate of 61.3% :D.

My savings average ratio is getting closer and closer to the 50% line goal and currently sits at 48.9% (48% last month).

Monthly Cash Flow Sankey Diagram

Breaking it down into categories, this is how my cash has flown during March in Pound Sterling (£):

Income

In March I got paid £32 as affiliate income, most of it comes from January sales. I expect to barely have any income from affiliates moving forwards.

Bank interest comes from my bank account with TSB, which pays 3% gross interest on balances up to £1500.

Unfortunately, I didn’t get any referral income this month 🙁

Expenses

Rent and bills remain fixed at £450.

I spent £215 (£215.91 last month) on groceries, which is among the average numbers. We buy all groceries we can from Lidl, and the remaining from Tesco. My Fordkari is being helpful to make us save money in groceries :). As you can see we haven’t been stockpiling any food. I am surprised and grateful for the way Tesco is tackling the situation, giving antibacterial wipes to disinfect trolley’s handles, scanners or even your hands whenever you need it as well as increasing staff members. We go early in the morning at 7 am and most shelves are full so far.

Transport includes fuel expense and car taxes. This is lower as I now work some days from home. It’s also great to work close by in this area (massive traffic jams) as it means that I spend less on transport: £40.

Health expenses are reduced to £0 as I’ve cancelled my gym membership. I felt a bit sorry for not supporting them but I was a recent customer and I didn’t build any kind of relationship with their stuff.

Services include phone, blog expenses and others: £33.5.

Shopping includes a T-shirt from TK-Max and ……….

masks just in case? (I know they say they are useless, haven’t used them yet)

for £37.

Goals

Time to have a look at how I am keeping on with my 2020 goals. As Peter Drucker said 40 years ago, what gets measured gets improved.

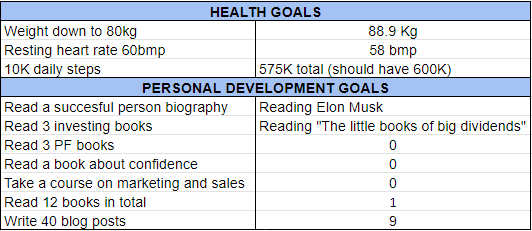

Some of my goals aren’t monthly measurable, but some others are. I’ve built a simple table to display the progress.

March goals

February goals (comparison purpose)

With gyms being closed I am back to the habit of running on a daily basis for at least 30 minutes. This is more than what I used to in the gym (15-20min on the treadmill) and I think it has contributed to helping me burn one more kilo this month (yes, yes, yes!). Some of this weight loss comes out of a muscle percentage decrease (no weight lifting) as well as a visceral fat decrease, good! I’ve also caught up a bit with my daily steps. Thanks God the UK lockdown still allow us to do some exercising once a day. Glad to see people are keeping the 2m recommended distances as we don’t want to end up in a Spain lockdown type (not allowed to go even for a walk or run, no wonder why beers are out of stock in the supermarkets and not toilet paper anymore, XD)

Looking at my personal development goals, I am still reading Elon Musk’s biography, I found the start an interesting read but struggle to keep interested in continuing. I don’t connect that well with this book as the writer explains someone else story and I don’t feel that attached with it.

I can’t say the same on the next book I am reading, “Principles” by Ray Dalio, an extensive book that has been on the bookshelf for some time. It’s nearly a 600 pages bible, a nice one. Dalio divides it into three books. So far I’ve read the first one, which is a sort of self-biography. I am really enjoying his elegant and charming writing style. I also think I am reading it at the right time, Dalio’s main overall principle is learning from mistakes, which I seem to be a great collector of (especially in the investing circle).

That was it, my amigos! Portfolio update coming soon (unfortunately).

How was your month?

Tags In

Tony

Related Posts

9 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi Tony. Nice to hear you holding on. Im holding on as well. Work from home fully for 3rd week. All family ok. Starting to get used to it. Will calculate my income/spending also. Not that good as yours 50% but shoild be positive and around our goal of 20%

Cheers man thank you. I haven’t been calculating my income and expenses before as I thought the numbers are simple and I managed to save well without needing to track it all. Giving it a go now for a few months to see wether I can see an improvement from doing it.

Glad to hear you are all well 🙂 20% is not that bad, most people save 10% if any.

Take care.

Nice blog.

You believe we evolved from fish and then monkeys!?! Hahahaha

Really , what you believe in?

Thanks Steve. I don’t know if we evolved from fishes to monkeys. I am not a scientist, but to me, mutation or genetic variation passed from generation to generation makes sense. How would you explain that newer generation are born with some wisdom tooth missing?

Being able to adapt quickly to new environments is a skill I developed when I stepped out of my comfort zone at the time of moving to the UK. I am so grateful for this, as if tougher times are to come I’ll be ahead of many.

Hope you are doing well these days. Take care.

Hey ,

I believe (as logic would tell us) that we have been created and that there is no such thing as evolution. There is no evidence of one species evolving to another… This also has nothing to do with adapting to new situations. Definitely you moving to the UK has helped make you who you are today and better for it. Me too, I’m in my 3rd country so far.

Definitely tougher times are ahead as we are now facing a world depression much bigger than the last. Turn off the TV and research the facts behind Corona and you will see it is nothing to be afraid of.

Take care, like your blog. All the best man.

Just stumbled across your blog. Interesting read. I love a good graph and was enjoying your first with income, spend and SR overlaid…. until I scrolled down and say that swanky ‘Sankey’ diagram ?

Hi, Brian

Yes, I am a graph lover, I found fascinating how a graph transmits data in a quick and organised way. Sankey Diagram is free os use for everyone, visit http://sankeymatic.com/build/. Let me know if I can be of any help. Checked your blog and it’s astonishing how fast your income has grown since 2009!

Thanks for stopping by 🙂

Hey Tony

Good to read that you are ok and that you too are remaining positive.

I agree that we must adapt to go on – things will go back to ‘normal’ but it will be a different normal to the one we had before. Businesses will disappear, the survivors will change and there will be new businesses which did not exist previously but which suddenly provide something which people didn’t need before.

Good going on your financial and your health goals – I really miss the gym, find it hard to motivate myself at home but I’ve been doing a few workouts.

I hope things aren’t too bad on the P2P front…

Hi weenie

I totally agree with your reasoning, things won’t go back to the same stage we were before and we’ll enter a new circle.

Miss gym too, I am lucky in this respect that I also love running, hopefully, we’ll soon be able to rejoin the gym, the few bucks I save are not worth it in this regard.