Portfolio Update #15 February 2020 – Coronablood

Hola financial shapers and welcome to another monthly portfolio update.

February’s keyword is clear: Coronavirus, and for what it seems it may become the keyword of the whole of 2020 if the outbreak continues to spread all over the world, it’s nuts!

In my mind are floating the same questions as everyone is wondering about. How pandemic will coronavirus get and how much will that influence the markets or my investments, is this the next market longterm downturn? (As I finish writing this update, Italy has just formally locked down more than a quarter of its population).

If we step out of speculation, no one knows for certain, and that’s the psychological fact that establishes this collective panic disorder, in my opinion.

When studying this list of stock market crashes, one could conclude that generally, not two consecutive market crashes are derived from the same causes. This is the main reason why I’ve been biased for investing in real estate since 2018 when I started investing with Housers and Property Partner.

Coronavirus came out of the thin air and unfortunately didn’t bring a vaccine with it, I am glad the death rate is only about 3%.

Anyway, putting the coronavirus to one side, vivid readers know that my portfolio should tackle in market crashes well. Is that being the case?

Without further ado, it’s time to show you February numbers babies! 🙂

Table of Contents

Quick Recap of February Numbers

- Portfolio value: 102,469 € (-2.46%) – details HERE

- Monthly Transactions (Deposits – Withdrawals): 152 €

- Monthly growth from investments: – 1,848 €

- Passive income: 6 € – details HERE

Now, let’s get into the details.

Portfolio Performance

* Referal or Affiliate links

** 20 % discounted as future withdrawal tax payments

Did you notice the different outlook of my data table? Thank you! 😉 I uploaded all my data tracked on Excel to Google Sheets. That’s kept me busy these days as I ‘ve replaced Excel charts for Google Sheets embedded ones. I think my data tables and charts look now simpler and better, would you agree? Hopefully, Google Sheets won’t let me down.

I am happy with my portfolio still being above the 100K, not sure it would resist another market hammering though.

My portfolio return for February, without considering currency fluctuations, is -1.8%, not a bad number when compared with the S&P500 drop of -8.4%. My balanced ISA and alternative investments helped to cushion the drop.

I only earned 6 EUR of passive income this month as I experienced some loses after exiting Wisefund.

I also sold all my REIT’s I had purchased via Freetrade and will use Trading 212 as a sole active broker to simplify my portfolio tracking moving forwards. I was lucky enough to sell before the downturn. I owned mainly British student REITs and the total return don’t look alike Property Partner one’s… I’ll just leave it there.

I sold some property shares on Property Partner at just a little discount! YAAS!

The GBP/EUR currency ratio shrinks from 1.19 to 1.16, reducing the value of my Euro portfolio. I wonder how the Brexit transition period will end up in 2020 since the fight against the coronavirus spread is a top global priority.

Stocks & Shares ISA (Core Portfolio)

My stocks & shares ISA growth shrinks for the third month in a row -1057.9 EUR incurring a -1.8% monthly return.

I follow a balanced 50/50 (stocks/bonds) ISA portfolio allocation, so in February it was interesting to watch how my holdings performed in a market panic scenario.

I saved a screenshot from my holding dashboard this month for you to check out:

This swing changed my portfolio allocation to 45% stocks and 55% bonds. I normally rebalance only twice per year (summer and end of the year), but after this big oscillation, I chose to rebalance now.

This crash reminds me of the crash we had at the end of 2018. My ISA portfolio allocation at that time was 50/50 as well. I rebalanced after the drop but I still kept a 50/50. This time I am going to do it differently and take more risk on as US treasury yields are well below inflation and nearing the 0%.

The further stocks drop the more I will increase my ISA stock allocation. So, on the 29th-1st Feb-March weekend, I set several transactions to rebalance at a 60/40 (stocks/bonds) proportion. If the market keeps dropping, my next rebalance will be at a 65/35. Does that make sense?

Besides this, as usual, I paid myself £780 out of my payslip as an automatic regular monthly payment and also added £665.7. That maxes out my S&S ISA for the current financial year.

My top ETF so far is the USD Corporate Bond UCITS ETF (VUCP) + 17.01%.

The worst ETF so far is Global Value Factor UCITS ETF (VVAL) – 17.96%

2020 returns:

- S&P 500 Index : -9 %

- My balanced Vanguard ISA: -2.75 %

Alternative Investment Portfolio

I continue withdrawing funds from my peer-to-peer lending investments. My current allocation stands at 36% (40% last month). So far I am having a smooth experience and I am not experiencing any withdrawal issues at all.

I February I exited Wisefund, which contributed to an early exit fee loss and a monthly passive income of 6 miserable Euros, but hey! I am still on the positive side! 🙂

The platform that inspires me more confidence right now is Estateguru*. In February the company announced that it’s strengthening their payment process by choosing Lemon Way as the primary payment service provider. Lemon Way is authorised by the ACPR – Banque de France, and it’s also Houser’s payment service. I embrace the idea of investing in P2P companies that segregate investors fund in separate accounts.

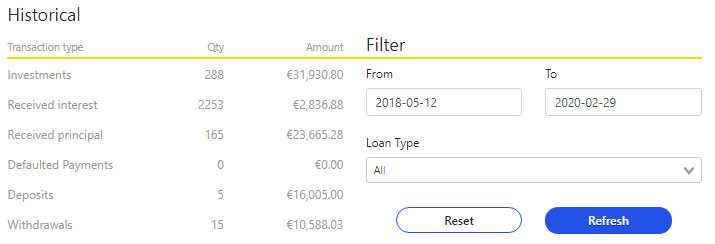

Besides this, I loved the new Grupeer portfolio statistics dashboard. The following screenshot shows a historical overview of my investments with the platform since inception:

I have other platforms on my radar that I would happily join once I have lowered my P2P allocation a bit further, and the stock market stops falling.

Dividend Portfolio

What a month for my dividend portfolio!

I buy dividend stocks as soon as I get any P2P free cash in my bank account. Unfortunately, I started before the crash which makes my portfolio to bleed. However, I am not worried about it at all, as the beauty of investing in dividend companies remains in the cash income they produce.

Shall stocks keep falling that’s fine, as I still got 10K to withdraw from P2P investments. The fact of not being able to cash it all out immediately is also favourable in terms of dollar-cost averaging towards the end of the well. Buying stocks on the fall at a 0% commission rate is tempting to me so, that works as a regulator.

In February, besides purchasing shares on some of my current holdings, I added three companies to my portfolio: 3M, Exxon Mobil and Invesco.

3M (MMM) is a well-know industrial dividend aristocrat and a dividend king that has raised dividends for 61 consecutive years. It sells more than 60,000 products over 200 countries, which are largely used in manufacturing industries and tend to be of a higher quality than competitors. Since I am an industrial mechanical engineer I am familiar with some of the products. I bought 6 shares that should provide me with a $35 annual income.

Exxon Mobil (XOM) is an oil and gas dividend aristocrat. I was sceptical at buying shares of a gas company, as valuations and earnings derived from the price of a barrel of oil. The coronavirus spread in China has lowered the demand for oil and consequently its price. That’s made my shares to plummet for almost 20% so far. The yield looks juicy at 7% to buy more shares but considering Exxon’s payout ratio is above 100%, the long term dividend growth is at risk. If oil prices don’t increase during the next years Exxon can have a tough time. However, I am happy to have at least one oil company in my dividend portfolio. Also, I fill up my car in an Esso petrol station. The feeling of getting paid when filling up the tank is awe-some.

Invesco is a is a publicly owned investment manager offering financial services. This stock is been badly beaten as the recent sell-off means less asset value under management which directly affects company revenue. I see this as a cyclical event. The dividend yield at the current price is over 9%. Book value per share is $21.73 while the share price is trading at $13.12. Invesco offers a large number of ETFs, the S&P 500 particularly has 0.05% management fee whereas Vanguard’s costs 0.07%. Trading 212 sells Invesco ETF’s, I am pondering about transferring my S&S ISA to Trading 212 and buy Invesco cheaper ETFs instead of Vanguard’s (and also avoid the 0.15% Vanguard account fee).

My dividend portfolio consists of other stocks that I haven’t mentioned here as they were purchased during the first week of March. I think I am becoming a shopping addict! The more I buy, the more I want! Hopefully, this will bring me some returns at some point.

The €45K Project Fund

As usual, my savings on tobacco as a non-smoker went straight away to my Abundance account. That’s another £50 that I invested in the latest ethical investment, the second fundraising phase for Liverpool Community Homes.

A quick description of the project taken from the website (no affiliates here!):

” Liverpool Community Homes 2 is a green housing investment that takes a positive step towards fixing our broken housing market, with its mix of 20 affordable one-bed flats and seven two-bed houses for supported living. This investment provides real and immediate action to address the UK’s social and affordable housing shortage while providing homes that alleviate fuel poverty and reduce the carbon impact of the UK’s housing stock.”

For this tax year, the whole €45K Project Fund is invested in Abundance, as I am using an IF ISA account (tax-free).

So far, I have recovered the 1.83% of my loss = 822.8 EUR

44,177.2 EUR left to go.

See further details and the portfolio chart in the Abundance page

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

Joining links and offers if interested

Estate Guru (0.5% bonus on your investments made during the first 3 months)

Evoestate (15 EUR cashback for a minimum investment of 50 EUR)

Mintos (0.5% bonus on your investments made during the first 3 months – UK residents temporally not accepted)

Housers (25 EUR cashback for a minimum investment of 50 EUR)

Trading 212 Trading platform UK and EU (Free shares worth up to $/£/EUR 100 )

Property Partner – (share up to £1500, details here). Focused on high net worth or sophisticated investors.

This is it for this month, hope you had a good one?

You can follow me on Twitter where I share some thoughts from time to time and connect with other like-minded people. You can also follow me on Facebook.

Please, make sure you read my disclaimer at the bottom end.

Tags In

Tony

Related Posts

4 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi Toni

A dynamic month in the books and several interesting additions to your portfolio. I like 3M and XOM, particularly at these price levels. I also like your moves to rebalance your P2P/CL positions, reducing risk exposure and enhancing liquidity which you can handsomely put to work by acquiring beaten-down stocks. The current market turmoil reminds me rather the Euro-Crisis some years ago than December 2018. This thing has the potential to take months to normalize, and just considering the blow to global economy. I wouldn’t be surprised to see dividend cuts particularly next year and many companies going out of business. A severe oil glut … et voilà, the perfect storm.

That‘s exactly the time to find good value at very attractive prices. Not yet super exciting, but it will get more attractive. Just a few more weeks, and great businesses can be added to our portfolio at discount prices.

Keep it up and happy investing! ???

Thanks for commenting financial shaper! 🙂

You might be right, I wasn’t invested during the Euro-Crisis but it does look like Italy lockdown could cause a similar type of crisis. When looking at previous virus spreads markets have recovered quickly. I initially thought that would be also the case with this covid-19 but the spread speed is mental, so it’s hard to come up with any clear conclusion. We can just wait and wait how it goes while looking for cheaper investments.

Happy investing ??

Bet you are enjoying the fact that your portfolio has so many bonds about now! Being a little younger (I presume), 100% equities bit hard this month! Let’s hope the swing back happens soon-ish (well- within the next 10-15 years!)

That’s right, I’m happy I sticked to my conservative allocation besides my age. Even so my returns are negative, but the fact of selling bonds at a profit to buy stocks on sale calms me down.

I’ve been waiting for a market crash since day one of my investing journey, I’m sad that it had to be this way though, it’s too hardcore.