Monthly Update #11 October 2019 – Back At The 6 Figures

Hola financial amigos 🙂

October and Halloween are over and in the books here at the one million’s.

It’s hard to believe that this is already my eleventh update. Time seems like having flown by. My first year is approaching and I still enjoy updating my portfolio and writing these monthly updates as if they were the first ones 🙂

October, besides of being a shitty weather month (I can’t remember the last time I sensed the warmth of the sun on my skin) has been an eventful month for the finance and investing community here in the UK and also for my portfolio.

Let’s do a quick recap of a couple of things that you probably know but won’t mind to read them again, right? 🙂

- Vanguard has reduced the ongoing charges figure (OCF) on 36 funds. I’m sure you will agree on this being good news. For UK investors, all info is here. All my three USD bond ETFs have been cut down on charges. My last fees bill was £16.73 in September 20019, the next one is in December which should be lower. YIPEE! 🙂

- Funding Secure, a British peer-to-peer pawnbroker and property lender regulated by the FCA, has gone into administration. This is the second P2P lender bankruptcy in the UK so far in 2019 and the third one for the last two years. The property finance company Lendy collapsed in May this year and the P2P lender Collateral in early 2018. This might don’t even end up here. Funding Circle got the odds to be the next one to fall off the cliff, as their financials aren’t getting into the right shape. I interacted with some peeps on Twitter after posting my peer-to-peer lending risk posts, who confirmed liquidity issues and long waiting times to access their funds with the platform. Luckily I didn’t get my fingers trapped in any of these.

Next, a quick recap of some other personal finance and blog news:

- I’ve created a page for every single platform I use. This means that my monthly update layout is changing. Charts and some new statistics will be only shared in the pages.

- I joined another real estate investment platform, EvoEstate. I am thrilled! More details later on.

- I’ve added my UK Pension to my investment portfolio.

- My investment portfolio has 6 figures again! (Yes, the UK pension addition helped). Remember dear readers that my portfolio was at 198K in February, so it feels awesome to be back at the hundred thousand if you ask.

- I’ve reached another new record on monthly passive income.

- But hold on! I’ve also had a savings rate record in October!

Let’s get into the details.

Jump to

Table of Contents

Monthly hightlights

- Portfolio value: 101,586 (+3.1%) – details HERE

- Monthly Transactions (Deposits – Withdrawals): 1,165 €

- Monthly growth from investments: -1,075 €

- Passive income: 593 € (+47% ) – NEW RECORD! I’m 49.5% Financially Free – details HERE

Monthly earnings by platform

| Platform | Inception date | Investment Description | Value September | Transactions | Growth | Value October | Return October | Cumulative Return |

|---|---|---|---|---|---|---|---|---|

| Property Partner (£) | 01/2018 | Buy-To-Let | 5,640 (6,373.2 €) | 0 | -159 ( -184.4€) | 5,481 (6,358 €) | -2.8 % | 4.5 % |

| Stocks & Shares ISA (£) | 03/2018 | Stocks & Bonds | 47,833 (54,051€.3) | 780 (904.8 €) | -1272 ( -1,475.5 €) | 47,335 (54,908.6 €) | -2.7 % | 12.5 % |

| Housers | 03/2018 | Buy-To-Let and Dev. Loans | 6,745 | - 6 | 12 | 6,751 | 0.2 % | 5.6 % |

| Grupeer | 05/2018 | General P2P Lending | 8,498 | 0 | 96 | 8,593 | 1.1 % | 23.4 % |

| Mintos | 08/2018 | General P2P Lending | 1,607 | - 156 | 13 | 1,364 | 0.9 % | 12.6 % |

| Crowdestate | 08/2018 | Development Loans | 2,766 | - 1,054 | 17 | 1,739 | 0.6 % | 11.9 % |

| Envestio | 10/2018 | Business Loans | 5,643 | - 644 | 80 | 5,079 | 1.4 % | 19.6 % |

| Fast Invest | 10/2018 | Consumer Loans | 1,127 | 0 | 12.2 | 1,139 | 1.1 % | 13.9 % |

| Trading 212 | 03/2019 | Dividend Investing | 1,585 | 0 | 48.6 | 1,633.6 | 3.1 % | 50.6 % |

| EstateGuru | 05/2019 | Development Loans | 3,064.3 | 0 | 17.4 | 3,081.7 | 0.6 % | 3,1 % |

| Abundance (£) | 05/2019 | Business Loans (Ethycal) | 450.15 (508.7 €) | 50 (58 €) | 0 | 494 (573 €) | 0 % | 1.8 % |

| RateSetter (£) | 08/2019 | General P2P Lending | 1000 (1130 €) | 0 | 0 | 1000 (1160 €) | 0 % | 0 % |

| Crowdestor | 08/2019 | Business & Develop. Loans | 2290.3 | - 21 | 21.2 | 2,290.5 | 0.9 % | 1.8 % |

| Robocash | 08/2019 | General P2P Lending | 2029.4 | 0 | 20.4 | 2,049.9 | 1 % | 2.5 % |

| Wisefund | 09/2019 | Business Loans | 1007 | 1053.3 | 37.8 | 2,098.1 | 1.8 % | 2.9 % |

| Freetrade (£) | 09/2019 | REITs | 105.4 (119 €) | 0 | 2.7 (3.13 €) | 113.1 (131.2 €) | 2.45 % | 3 % |

| Evoestate | 10/2019 | Buy-To-Let & Others | 0 | 300 | 15 | 315 | 5 % | 5 % |

| UK Pension | 10/2019 | 100% Global Equity Fund | 1901.2 (2,205.4 €) | 87.9 (102 €) | 165 (191.4 €) | 2154 (2498.6 €) | 8.7 % | 27 % |

| TOTAL | 98,553 € | 1,165 € | - 1,075 € | 101,856 € | -1.1 % | -38.6 % * |

*Includes Algotechs loss

The table is getting larger. It now compiles 14 lending platforms, my UK pension, my Stocks & Shares ISA from the UK and two stock brokerage accounts.

Albeit it seems a bit messy, I rather track it all together in a sole table. It allows me to compare what investment vehicles and platforms perform better than others. I’ve added a short description of what type of investment every platform classifies in or what I intend to use it for. For instance, Freetrade allows the user to buy several stocks and ETFs but I am only using it to buy REITs for now.

My experimental Trading 212 fun account will soon start getting a more serious investing approach. Before starting with this blog I spent 30 minutes every day reading The Wall Street Journal and Barrons, a habit that led me to start with my experimental account. Today, I no longer read these magazines and I never know what is going on or what the next hot stock pick could be. So I decided to sell Lam Research (LRCX) after a nice raise and Micron (MU) will follow soon. My next purchases will be only from dividends aristocrats stocks. Ah! Have you noticed that the total return since March this year is 50%? 😮

Following the table, we can see that my best performer has been my UK pension +8.7%. The % return is complex to calculate, so I wouldn’t expect it to be accurate, but it should be good enough to give a general approach for comparison purposes. I take into account my employer contributions and government tax reliefs as an investment return. The returns are high at the moment because my pension pot is small. This will decrease over time. I have increased my monthly contributions from 5% to 15%.

On the alternative side of my portfolio, Evoestate, Freetrade and Wisefund are my three top performers for October. Evoestate includes the 15 EUR

The GBP/EUR currency ratio grows from 1.13 to 1.16. The Pounds gets stronger, and as a rule, it should give a positive impact on the value of my portfolio, but this hasn’t been the case as my…

…Stocks & Shares ISA…

…decreases in value by -1272£. This is because of the weak USD Dollar and my bonds.

As usual, I paid

My best performer is no longer the USD Corporate Bond UCITS ETF (VUCP) but the S&P 500 UCITS (VUSA) +17.8%. That makes sense now 🙂

The worst performer so far is Global Value Factor UCITS ETF (VVAL) -2.1%

So far this year:

- S&P 500 Index : +21 %

- My balanced Vanguard ISA: + 9.6 % – sniff sniff 🙁

See further details and the portfolio chart in my old Vanguard page

Related content (though a bit outdated): My little British Empire as an Expat

Property Partner

Rental Income from Property Partner is £18.66 (£15.5 in Sep).

The valuation of my properties has decreased by £-176, which gives a total negative growth of £-159.

This all comes down to one of my student accommodations underperforming on lettings for the 2019-2020 term. This property relied on international European students. Knowing this now it seems silly to have initially bought shares of this property amid Brexit. I didn’t do proper due diligence. I don’t mind sharing these mistakes since my ego is not my amigo, so you guys can also learn something from it too.

This mistake bonds me with Property Partner for the long term as my shares have lost more than 20% of its value and I am not willing to sell at this price.

Good news is that I got the rental income kicking in every month until the property valuation increases, at least up to the initial value, which soothes me.

The 2018 financial statements are posted at the Companies House. The loses are £5.3m (£6.2m in 2017). Their current assets are enough to cover current liabilities. That makes me believe that they should be able to keep going on for now. However, we are near the year-end of 2019 and the financial statements refer to the 31-Dec of 2018. Who knows how different the balance sheet may look by now?

See further details and the portfolio chart in my old Property Partner page

Related content: Property Partner Review & Property Partner Stabs Their Sm

Housers

Income from Housers in October was 15€. This is income after-tax.

I sold 50 shares of Firenze San Gallo with a value of 50EUR for 47EUR, so my real portfolio growth is 12EUR. Investors haven’t received any income from this property since December 2018!

Besides Firenze San Gallo, other two rental properties haven’t generated any income.

See further details and the portfolio chart in my new Housers page.

Related

EstateGuru

EstateGuru income is 17.4 EUR (25.5 EUR last month). I have a portfolio of 57 loans (57 last month), where 7 are delayed on payments (7 last month). 3 loans are delayed between 31-60 days and one over 60 days (none last month). None of my loans have defaulted.

EstateGuru has introduced a diversification model feature which gives you a diversification score and works exactly the same way as the housers one, which is cool, but the biggest news for EstateGuru this month is the introduction of a secondary market. It has taken them a while, but selling your loans is now possible with Estteguru.

See further details and the portfolio chart in my new Estateguru page.

Crowdestate

My Crowdestate portfolio earns 17 EUR (28 EUR last month).

It’s been such a party at Crowdestate this month. If you’ve been following my last updates then you’ll know that several of my loans carried delays on payments. I’ve been fortunate to be able to sell them all, some of them at a premium and others at a discount.

I was especially lucky with the Baltic Forest project. I sold it two days before it became suspended on the secondary market after letting us know that interest payments would be suspended until 30.06.2020 due to a lack of revenues from the borrower.

Phew, that was close, wasn’t it? Thank God that Crowdestate marketplace is active. I am sorry for whoever that bought my 500 EUR loan for 483 EUR, but this is the wild west amigos!

Now, my Crowdestate portfolio consists of 11 loans with no dela

See further details and the portfolio chart in my new Crowdestate page

Mintos

Mintos

UK residents are still not allowed to invest in Mintos, so I am just withdrawing any free cash until further notice.

Most of my loans with yields over 10% are sold and only those under it are left in my loan portfolio.

See further details and the portfolio chart in my new Mintos page

Related content: Mintos Review

Grupeer

The platform has introduced some more new loan originators increasing the total to 20.

It also seems they’ve just introduced a Grupeer rating which shows the relative risk level of their loan originators. I’ll need to keep a close eye into this.

See further details and the portfolio chart in my new Grupeer page

Related content: Grupeer review after 15 months of investing.

Envestio

Steady performance at Envestio’s returning 80 EUR (81 EUR last month).

The platform has issued new projects yielding up to 20%. Unfortunately, I missed them as they came a bit late and after I had withdrawn all my free cash.

See further details and the portfolio chart in my new Envestio page

Fast Invest

Another solid month for Fast Invest returning 12.2 EUR (12 EUR previous month).

Everyone is talking about the latest loan originator addition to the platform, the Russian Kviku offering 12% rates. As far as I am aware this is the first time that Fast Invest discloses the name of any of its loan originators, which is a nice step towards an improved level of transparency.

However, this doesn’t change my strategy for this platform. My

Check the progress out in my new Fast Invest page

Robocash

October is my third

I originally joined Robocash to use it as a Mintos substitute and I am loving it.

Same as Fast Invest, it’s a completely hands-off platform; invest, set and forget, which is much appreciated when you’re dealing with 14 platforms.

Robocash platform allows investing in the loan portfolio of Robocash Group with a 100% buyback guarantee and fixed 12% rates. This is a pretty good deal if taking into consideration that the company, which was born in 2013, is highly profitable.

So far I ‘ve invested 2K and plan to increase it by another 1K soon.

See further details and the portfolio chart in my new Robocash Page

Crowdestor

Crowdestor returned 21.25 EUR (13.13 EUR last month).

I joined Crowdestor in August after seeing that everyone was giving positive feedback on this platform. In addition, I especially loved one of their renewable energy projects, which it literally dragged me in.

However, they crowdfunded in October a fur processing company which is the most unethical investment I have seen so far in my investing career.

I had good expectations with this platform but this has put me off. There are many other great business platforms at the moment which don’t contribute to unethical purposes just for the sake of making money.

See further details and the portfolio chart in my new Crowdestor page.

Wisefund

This is my first full month with this platform. It returns a whopping 37.8 EUR out of 2,053 EUR invested (+1.8%). This includes the initial 0.5% cashback on investments.

This is the first time I decided to take on more risk and invested in a new-born platform.

Wisefund supplies risky business loans with attractive interest rates of 14%-20%. Loans are protected by a third-party Buy Back Guarantee and a protection fund. However, I would need a bit more transparency on this before I can remove the word “risky” form the first sentence.

Interest payments are all paid at once on the last day of the month. I am keen on this approach as it can be beneficial to reduce cash drag. Also, receiving an email every time a payment has been made to your account can become distractive when you’ve got your money spread over numerous loans.

See further details and the portfolio chart in my new Wisefund page

New addition to my portfolio: Evoestate

Evoestate is real estate investment platform that collects and sources deals from several European platforms. So far they work with 18 platforms across several European countries giving a good chance of diversification

As a real estate investor passionate I had been following Gustas (CEO) blog entries at Evoestate’s blog for a while before I got in touch with Audrius by email.

I was keen on their investing approach but I never considered the option of investing via Evoestate as I originally thought it was unnecessary to add more risks by investing thorough a middle man betwwen me, the lender, and the borrower.

However, Audrius informed me that if the EvoEstate goes bust they will open accounts for all investors in all platforms where we have assets.

They invest their own capital in some of the listed deals and explain the reasons for doing so. This is what they call skin in the game deals.

I started investing 300 EUR in a Spanish short-term holiday rental property from Brickstarter. If things run fine I plan to build a 5k buy-to-let only portfolio.

See further details and the portfolio chart in my new Evoestate page

The €45K Project Fund

The project fund is growing slowly. I haven’t tried match betting anymore, which was the primary income source besides my monthly savings of £50 as a non-smoker. I lack the time for it, or better said, I rather spend my free time doing other things. I don’t plan to give up completely though. The donation milestone is finishing soon on the 31st of December. After that, I will decide on weather I want to spend time on match betting or my blog, but until then I am comminted to finish what I started.

My GF said she wants to learn MB. I was so excited about it that I even shared it on Twitter LOL. She’s just watched her first video tutorial but now it seems she’s switched to Netflix as I am writing this. Oh dear!

So far, I have recovered the 1.27% of my loss = 573 EUR

44,427 EUR left to go.

See further details and the portfolio chart in my new Abundance page

Related content: How I FIRED 45k with

Savings Rate

My total net income in September was £2,189 (2,539 EUR).

This month I’ve achieved a new savings rate record of 55%. YAAY! 🙂 It seems that my FordKari it’s doing its main job; move us around cheaply. So far it’s running fine, no breakdowns though it has began making some wierd noises.

My savings rate average increases from 41.14% to 42.5%. I am getting closer to my 50% goal 🙂

Health as non -smoker

My exercising time has decreased in October. The bad weather conditions and time changing haven’t helped. I live by the seafront but it is completely dark after 5 pm. I managed to run prior to going to work some days, but as temperatures keep decreasing I don’t know how long I’ll be able to do that without freezing up. Brrr, I am cold just thinking about it!

On Thursday, I retrieved my weights and practised some exercises before work. I still suffer from muscular aches though!

My heartbeat increases from 58 bpm to 60 bpm.

The donation milestone

Some more people used my links this month, thank you for doing so.

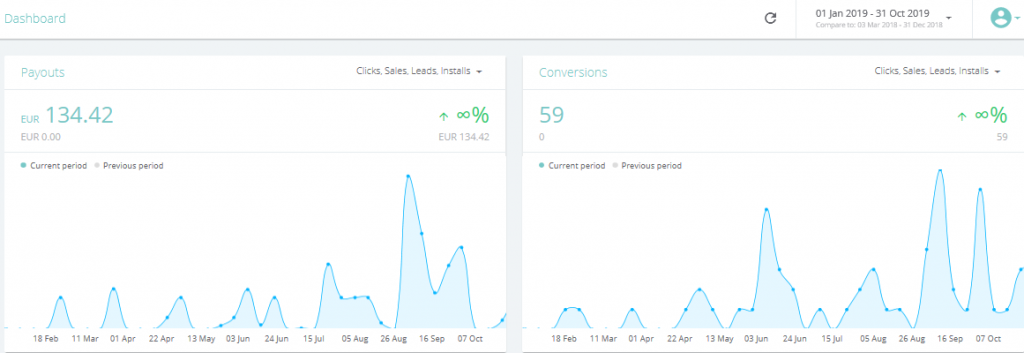

My total income since January from Targetcicle is 134.42 EUR (115.57 EUR last month)

Besides this income, I’ve got £3 from Property Partner and 75 EUR from Housers.

That makes a total blog income of 212.9 EUR, a bit closer to my 1000 EUR donation goal.

Joining links and offers

Property Partner (share up to £1500, details here)

Estate Guru (0.5% bonus on your investments made during the first 3 months)

Mintos (1% bonus on your investments made during the first 3 months – UK residents temporally not accepted)

Envestio (5 EUR first deposit bonus + 0.5% bonus on your investments made during the first 270 days)

Wisefund (0.5% bonus on your investments made during the first 270 days)

Housers (25 EUR casback for a minimum investment of 50 EUR)

Evoestate (15 EUR casback for a minimum investment of 50 EUR)

Grupeer (Get 1% Cashback on all investments exceeding 100 EUR until 17th of November only)

Fast Invest

Crowdestate

Crowdestor

Trading 212 Trading platform (Free shares worth up to $/£/EUR 100 )

Freetrade Trading platform UK (Free share worth up £200)

Until next time

I wish you a succesfull investing month.

Thanks for reading! :D

You can follow me on twitter where I share some thoughts from time to time and connect with other like-minded people. You can also follow me on Facebook.

Disclaimer: Most of the links on this post are affiliate or referral ones. If you join to a platform using my affiliate links you may get a bonus or commission and so could I. I’m going to donate any commission I get throughout 2019 to a charity. You can read more about the purposes of this blog here and where this money is going to go here. Thanks.

Tags In

Tony

Related Posts

19 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Congrats on the new income record! Seems we both set some new records this month!

I too was put a bit off by the fur-investment at Crowdestor, but it’s not going to deter me from investing with them in the future – I just skipped the fur one ?

I can’t imagine how it must be as a Spaniard, living in England with even crappier weather than Denmark! Are you not considering returning to Spain? ? I would! Haha! When we FIRE, I want to live in a southern country during the cold winter season! Fuck this cold dark northern weather, man! It’s making me depressed! ?

How long does it take you to write these updates? Keep up the good work! I will have a look at EvoEstate too ?

Thanks Nick 🙂 Congrats on your new records too, I am glad to see your investment with Bulkestate worked out well.

I know I shouldn’t be mixing emotions with investing but the main reason I originally opened my Crowdestor account up was cos its renewable energy investment, so the fur investment hit me hard. It will probably pass away but at the moment it doesn’t.

It was hard but I’m getting used to the British weather. I even like it sometimes hehe. Those cosy home evenings at home watching a nice film covered by a warm blanket wouldn’t be the same without the rainy darkness hehe.

Understand you want to live somewhere warmer, so I want some day, but financial independence is easier to reach here than there, so hold on mate you’ll get there amigo and we’ll be soon having some drinks by the beach (on the shadow no worries)

This update took me nearly two whole days, but I’m a slow writing in English and had to set all the new pages.

Drinks on the beach! Whoever gets to €1M first pays! Deal? ?

Haha deal! 😉

Funny how we both hit the six figure portfolio at the same time, albeit you hit it in the past as well!

I’m considering EvoEstate but wonder if I will end up investing in enough projects, lately there’s loads on the platforms I invest with.

Great savings rate too! A solid month all in all.

That was such a coincidence., indeed. With your income and terrific savings rate you’ll hit the 7 figures next much ealier than me 😉

That depends on you and your plans. In my case I will use EvoEstate to diversify my real estate investments across several EU cities without getting myself nuts. At the moment most of my investmenrs are focused on the same areas, baltics and Madrid. I want to expand to Nederland Germany, Barcelona, Denmark, southern Spain and even US.

We’ll see how that goes

Thanks for stopping by 🙂

Great portfolio update Tony, as usual!

Congrats on exceeding the 100K barrier, it’s a very important milestone. I wanted to ask you regarding your financial freedom target. I saw that it’s 1200 euros. Maybe I missed the article where you explained it, but this seems a little bit low income (to me). What are your plans when you reach the 1.2K target?

Keep up the good work ?

Hey Gonzalon thanks 🙂

The 1200 euros is only a personal indicative value. It also adds some fun in the game 🙂

My monthly expenses are low as I live out of the city in a cheaper area. It may looks like 1200 eur per month isn’t enough but it would pay my current lifestyle.

My plan after the 1.2k is to continue saving and investing until I get up to the million. I’ll probably set another passive income goal but I haven’t thought about it yet.

I don’t have a post that explains it, so perhaps I should write one in the near future explaining my plans. Thanks for the idea 🙂

Congrats on you milestone Tony!

Thanks Erik, appreciated man! 🙂

Hi Tony

Congats and well done on breaking more records and reaching that important milestone! Your passive income is looking great and the best thing is that it will continue to grow.

Although your table is getting larger, it looks great for comparing your various investments. I’d do something like that but don’t have the time to tinker more on my spreadsheets. I see that you are spreading your risk with so many different platforms, which in light of Funding (Not-so!) Secure going under, is probably a good move.

Anyway, good luck to your gf with her matched betting (when she gets round to it!)

Hey weenie thank you, it’s great when you see the passive income ball rolling. Consistency seems to be paying off 🙂

Thanks for the feedback on the table. It takes some time and I don’t mind doing it now, but I’d probably skip it if I were very busy.

Thanks I’ll let her know 🙂 she’s still getting distracted easily…. hehe

Thanks for mentioning us on your blog.

I wanted to clarify one thing about the case if we went bankrupt (which is very unlikely: A. We are cash flow positive in October B. EvoEstate only facilitate transactions and all client funds are separated from EvoEstate’s operational funds)

As we are adding new platforms, opening accounts is not the solution anymore, because some platforms can not accept foreigners as customers.

Should EvoEstate suffer financial difficulties or go bankrupt, client funds are safe and can still be accessed. In such an unlikely event of EvoEstate bankruptcy, a contractual entity will be appointed to take over the role of EvoEstate to serve all the investments. The budget for contractual entity’s services is being increased to 10,000€ and separated from operational and investment funds.

The latest part will be updated by official records on our blog during the month of December.

Thanks for the clarification Audrius. Appreciated.

another big investor in P2P – do you not find that keeping an eye on all these investments takes up too much time?

Nice reporting by the way – glad to hear you stopped smoking – it’s such an obvious improvement but sometimes what’s obvious gets forgotten.

Good luck!

It takes time to set a spreadsheet out, but once you have it done is pretty straight forward to track your P2P investments. Some platforms are more time consuming than others, but yeah being up to date with financial statements, loan originators, company news, cashback offers and all of that requires time. To me so far feels like a hobby I enjoy so no probs.

Thanks for the feedback on my reporting 🙂

Agree. I have to say that blogging about it is immensely helpful, I am surprised by the results. The previous times I tried to stop smoking I cheated and had some puffs but this time nothing at all. Hopefully if I continue with the blog I will never forget it.

Thanks for stopping by and dropping a few words.

Hi Tony,

Pretty late comment, but everything is looking good in your update!

It’s good to see the portfolio back over 100k!

Matt

Thanks Matt, it’s never too late my friend, you’re always more than welcome at any time 🙂

[…] last time I crossed the 100k was in November 2019. Then in March 2020, the sh*t hit the fun (COVID-19) and that put me back below the […]