Portfolio & Savings Update #38 January 2022 – €186,050

Hola amigos/as! Another month went by, which means it is time for another monthly portfolio & savings update to count January 2022 in the books.

Table of Contents

January In A Nutshell

January was quite a lively month, with much happening not only within the investing world but also in my personal life.

Here’s a quick snapshot:

- Continued emptying my flat and made a few bucks by selling some items.

- Listed my flat for selling through an estate agency. Agent thinks I may get a chance to sell it for €100K. That’s more than the 70-80K I was expecting. Curious to see what the real selling price will end up being, though.

- Did some hiking in Montserrat (cover picture on this post was taken there, and yes the guy shown it’s me! Can you notice the rounded shape of my after Christmas belly?) and The Costal Path to San Pol (cover picture of this update), both were lovely to do!

- Completed my sugar and chocolate free challenge successfully and lost 2 kg, YAY!

- Sold my car for €6,100 (€2,100 more than I had accounted in my net worth).

- The company I work for announce they took the decision to liquidate.

So yeah, that’s an out of the ordinary way of starting a new year, isn’t it?

Company closure was a bit of a dirty move from directors, although it was pretty obvious what the end road for this company was after the suspicious sudden drop of new projects a couple of months ago. Employees that were working from home that day got an email about the liquidation decision, and shop floor employees had a general meeting. In fact, this happened only a couple of hours after I tweeted this:

I suspect my employer is about to go out of business.

— Tony | Onemillionjourney ?? (@JourneyMillion) January 26, 2022

My current level of worry: 0%

Emergency funds work.

Maybe that’s a sign I should start timing the market?

Only a small team of key employees stay another two weeks to complete the remaining projects, myself included. My last official day of employment will be the 9th of February.

So, now what’s going to happen to Tony Pepperoni moving forward? I live in Spain but was employed from the UK, am I screwed?

Well, not really! I am after all rather lucky (I think!). I’ve been offered the chance to do some designing work for my (soon no longer) boss in a form of self-employment. What does that mean? I don’t know yet, hah… Details about the offer still need to be discussed, hopefully, that will happen some time soon! I am optimistic and like to see it as an opportunity to see how I feel about working on my own? I am excited but confused as I am still unaware of all details. Maybe it won’t pan out well.

I’ll see how it develops during the next few weeks.

Let’s jump into the numbers for this month.

Quick Recap of January Numbers

- Portfolio value: €186,050 (-2.26%) – details HERE

- Contributions to the portfolio: €2,047

- Monthly growth from investments: €-6,671

- Passive income: €1,162 – details HERE

- Savings Rate: 64.7%

Contributions

- €114 to UK Work pension.

- €1,200 to buy FTSE All-World Acc shares.

- €1,000 to my dividend portfolio.

- €-1,482 withdrawn from P2P.

- €1,126 to buy crypto.

- €89 to my 45K project fund.

Comments

The pound sterling gained against the euro (1.19 to 1.20), which helped to alleviate losses (thank you, Boris, I like you at the time everyone hates you, you shall come for a party in Spain sometime soon if so I could show you some dancing moves! Don’t expect me to go out running in my underwear, though!).

I was expecting to get over my all-time highs of 195K by now. I must have a member of the FED subscribed to my blog who’s decided to increase interest rates just at the best time to annoy me? Haha.

Another month of stable passive income. We are increasing the monthly rent of our industrial unit from next month. That’s going to be a whopping +6.5% increase as per inflation levels in Spain. Wasn’t sure whether tenants would complain, but they seem to be fine. We didn’t increase rent last year following a request, so I guess that’s keeping them quiet this year.

I managed to sell almost all remaining shares of my Property Partner portfolio, although at a loss :(. The only property I’ve got left is currently in the process of being sold after the 5 years period passed. I used all liquidity to buy crypto.

Monthly Income and Expenses

This month, savings amounted for £4,208.8 (5,050.6 EUR).

This is the outlook of my income and expenses in 2022 so far:

A great savings month, mainly thanks to the capital gains received from selling my car (+€2,100). I also cashed in €48 from selling some little appliances left in my flat, not a lot, but every little helps! I may still manage to sell some other bits and pieces before I leave this flat for good.

Portfolio Performance

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

What can I say about the markets that you probably don’t know about yet?

The circle keeps repeating, and yes it’s boring to write about it as it’s always the same story over and over again. Interests up, markets down, interests down markets may go up, quantitative easing market goes up. FED this, FED that, Powell has said this, Powell has said that. Blablablabla… Kudos to all content market creators, they need a great deal of creativeness to keep writing about the same developments but still make it interesting to readers.

I guess that if I find it boring is because I am playing this game right?

The Russo-Ukrainian crisis is something to bear in mind, it creates global uncertainty in the markets, but it won’t affect my core investing strategy: To pump most of my monthly savings into equities whether they go up or down.

Crypto Portfolio

In my previous update, I mentioned I was considering the option to stick to a crypto index fund and forget about buying individual coins. I actually ended up doing the switch this month, sold most of my crypto assets and bought crypto index funds instead. The plan is to keep Bitcoin and this crypto fund and call it a day. Got some LUNA and SOL coins fixed in a 90 days term on Binance. As soon as I am able to withdraw, I will use the liquidity to buy more crypto index funds.

What I like about this crypto index fund is that it invests in the 20 top coins by market cap. That way I can still be invested in crypto but without the hustle to spend time on speculating which coins will be the winners. Chances are I would guess wrong, and while I don’t mind losing a bit of money, losing time for nothing sucks big time. I rather use this to focus on my goals, which I fear I will struggle with once again this year after the closure news…

I must say that I enjoyed learning about the Defi and some of its strategies while I had more free time back in Portugal. Now I am back to normal business, and I could notice how my face was slowly turning this way:

And I kind of rather keep taking care of my looks if you ask me!

Alternative Investments Portfolio

My alternative investment portfolio provided me with €71.3 (€119.3 last month) of passive income this month.

Once again, the biggest contributor was Crowdestor. I’ll give it two more months, if this positive trend continues I may think to switch from withdrawing to reinvesting.

I noticed a sudden drop of interest rates on Estateguru after they introduced some lovely new fees. Some of these rates are as low as 7% which is near to insulting. I amended my auto invest strategy, so it only buys loans equal or above 10% rates. If by the end of the month I find any cash drag in my account, it will be withdrawn and reinvested elsewhere, maybe to Reinvest24?

Don’t get me wrong, Estateguru is still one of the safest platforms out there, but when considering the risks of P2P in general, I’d rather invest in high yield dividend companies such as British American Tobacco which also pays 7% at the current share price. P2P investments with less than 10% returns aren’t attractive enough to me.

In case you’d be interested in joining Estateguru or Reinvest24, these are my referral links:

Dividend Portfolio

My dividend portfolio this month generated €27.7 of passive income.

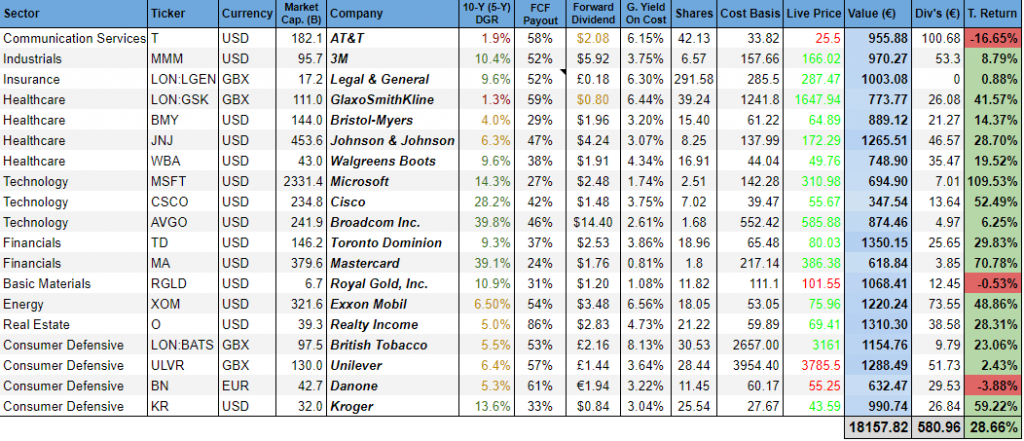

This was the outlook of my holdings at the end of the month:

As usual, I reinvested all dividend payments in the same stock.

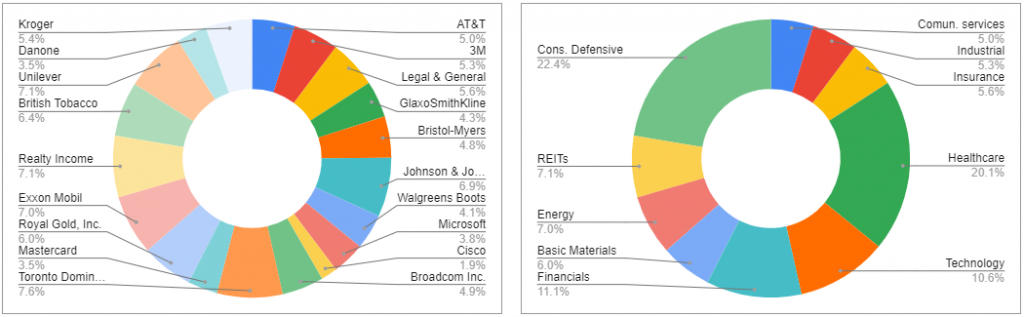

I introduced a new stock to my dividend portfolio, Legal & General, a British multinational financial services and asset management company headquartered in London. Its products and services include investment management, lifetime mortgages, pensions, annuities, and life assurance. I bought 291.58 shares at a p285.5 each. This adds £52.48 of gross annual dividend income.

Here’s a comparison among other similar insurance British companies I considered:

After this addition, this is how my dividend portfolio diversification looks like:

Dividend Payments

I received dividend payments from a total of 8 companies:

- GlaxoSmithKline (GSK): €8.92

- Cisco (CSCO): €1.96

- Walgreens Boots (WBA): €6.01

- Broadcom (AVGO): €11.82

- Royal Gold (RGLD): €3.1

- Realty Income (O): €3.88

Here’s an update on my year-over-year dividend comparison:

This will be my third year as a partial dividend investor. I have some dividend cuts approaching this year, AT&T and GlaxoSmithKline. This will make a noticeable dent on my income as they both are high yield companies, but I am optimistic the changes will be good for both of them and therefore for shareholders on a long term perspective.

Goals And Habits Update

I foresee me having another tough year to accomplish my goals. Since I am now about to lose my job, I am not sure whether I will manage to smash my savings, portfolio and web developing goals. My priorities will be to ensure a stable monthly income, whether that will be though a new job or switching to self-employment I still don’t know, but I shall be getting ready for whatever is coming next.

| GOALS AND HABITS 2022 | January |

| Increase Portfolio to €240K | €185K |

| 50% Average Savings Rate | 64.7% |

| Make 2.92 Million Steps (8K Daily Steps) | 242,553 |

| 2600 min Of Weight Lifting Training (50 min a Week) | 185min. |

| Reduce and Maintain Body Fat to 24% (28.4% beginning of January) | 27.1% |

| Read 3,650 Pages Of Non-Fiction Books (10 Pages A Day) | 181 |

| Complete all tasks (681) on the Web Developer Bootcamp Udemy course (13 tasks a week) | 79 |

That was it for this month, hope your month was a bit better than mine? Until next time, all the best!

Tony

Related Posts

8 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

“I am excited but confused as I am still unaware of all details. Maybe it won’t pan out well.”

Of course it will pan out, TP! No worries ??

Hope you get to cash out on that flat soon! Fingers crossed from here at least 🙂

Any news in regards to where you’re gonna live next then? Still going back to the UK? (And why did you sell your car!?)

I sold it, so I can pump more into the portfolio and make it more difficult for you to catch up with me? haha just clearing out everything I own in Spain, and I am able to, my car was a part of it.

UK maybe or maybe not? We re kind of last minutes,guys! Need to see how it keeps panning out as I go.

Nice update T. Where will you live if you sell the apartment? No job , no home? I sense something big on the horizon.

Thanks Steve. Somewhere were I can sing The Yellow Submarine.

Hi Tony, Could you provide some more information on the Crypto Index Fund that you mentioned?

Hi, I’d rather keep it private for the time being, but if really interested then DM on Twitter or email me.

Nice pictures!!! Looks like the hiking should probably take place in Spain instead of Ireland hahah. Good catch on anticipating the directors move, maybe this is the time to take a break and go after a different challenge? Companies are going crazy to hire people, so in any case you will be alright for sure.

Man… starting the year with a 64% savings rate? that’s sweet!!!

BTW, have you thought on any next steps for AT&T? Last year I decided I would keep them regardless, but they are also one of my core dividend payers so it stinks that they are cutting the dividend.

Cheers!!!

Juan, sorry for the late reply! (nuts times for me)

Heard about beautiful places in Ireland to go for a hike or a nice walking trail, but yeah you need good luck with the weather, maybe during the summer is the best time?

For now, I keep doing little jobs for them as a “self-employed”. It will do for now until I sort my mess out.

Regarding AT&T, I am happy with the upcoming spin-off, I think that was a necessary move to get the company out of the decaying spiral. At the current share price, the dividend will still be over 4%, in the range of Verizon. After the split, AT&T will be a slow 1-3% grower with a stable dividend. With a lower payout ratio, they will be able to raise dividends for the upcoming years once again. I am keeping my shares for sure, what I am unsure about is what to do with WarnerMedia shares after the split.