Portfolio & Savings Update #43 Q1 2023 – €198,073

Here we go once again with another portfolio & savings update, this time to take into account Q1 2023 in the books.

Table of Contents

Q1-2023 In A Nutshell: House Hunting Over?

I am happy to report that we’ve finally found a place where to live (without needing to leave the country)! Hooray! This means that we put down an offer to a semi-detached 3-bedroom house in Warrington, and it was accepted by the seller. That happened right at the beginning of February, yet with some luck, we’ll just move in by the end of May… The whole buying process is dead slow, and the system lucks a little bit of caffeine I would say, maybe some AI here and there will be helpful in the future to speed things up?

Buying a house is uncertain in the UK, as neither the buyer nor the seller is legally tied to complete the transaction until both exchange contracts. That currently takes an average of 5 months. That’s plenty of time for someone to change their mind. Buying or selling a house is an important decision, so theoretically it should be relatively safe to wait that long, however, the shortage of houses in the UK increases the buying competition, and sometimes the seller may receive higher attractive offers from other buyers and decides to accept a new one before exchanging contracts. That’s known as gazumping and adds some stress to the process.

Nevertheless, it’s quite unlikely that we’ll be gazumped. The owners of the house reside elsewhere, and the property has been tenanted for a while. The house was advertised as a BTL investment, but our offer was accepted despite us wanting to move in. The drawback is that the tenants are legally entitled to 2 months’ notice, so the property won’t be vacated until the beginning of May (which makes the progress even slower). Given that, it would be too risky for the seller to change buyers at this stage as if things don’t pan out well, they will be left with an empty house and a new set of expenses to be covered. On top of that, the housing market has slowed down (thank God!), so the chances of getting higher offers these days are less likely.

So, how long have we been hunting for a house? Well, if I relate back to this blog, we were first looking to buy a property back in 2020, it all started around here. So altogether, it has taken us almost 3 years since we took the decision to buy, and we actually went for it and had an offer accepted.

So if everything goes as planned, in the next quarterly update I should be able to say that we are UK homeowners! 🙂

Rather than the housing news, there have not been major changes in my life. I am tired of living in a small studio, but hopefully, that’s going to change soon. In the meantime, I enjoy living in Liverpool. We keep going to meet-ups with other international people, and as we start meeting more new people, we are slowly creating some small groups of friends to play board games and badminton or go hiking, which is very nice.

Quick Recap of Q1-2023 Numbers

- Net worth: €631,963 (+11.1%) – details HERE

- Portfolio value: €181,684 (+9%) – details HERE

- Quarterly growth from investments: €7,169

- Passive income: €4,781 (€4,181 previous quarter)

- Savings Rate: 62.2%

Comments

Despite the current market volatility, Q1-2023 was great financially speaking. In January, I received a payout of €22K from my mum’s life insurance, hence why the net worth numbers have once again received a good upwards push. I have not invested this but kept it as paying interest cash. This payment became handy as at that time we were still house hunting. Thanks to this, we are increasing the deposit from 70K to 90K. Given the higher mortgage rates, I rather pay as much of a deposit as possible, as otherwise the monthly interest to pay rumps up quickly. We should have moved into the new house by the next quarterly update, so by then it may be a good time to specify some final numbers.

Passive income was slightly higher than in the previous quarter. That’s thanks to some dividend income growth, higher interest rates, more cash available, and a modest uplift of +3% on the warehouse monthly rental income. Following the rental agreement, I was entitled to raise the rent by 5.7%, which is the inflation value (IPC) of Spain for 2022, but I have perfect tenants, so I wanted to be nice and raised only 3%.

Savings rates look unreal thanks to the nice extra income I earned freelancing. I managed to complete and invoice most of the projects I was working on before the end of the tax year 2022-2023. Now moving forwards I won’t be invoicing that much as my attention will be on my main job and moving to the new house. The latter is especially going to take up a lot of my free time during the next few months, not only with the moving, but also with some refurbishment I’d like to do. The house was built in the early 2000s, so it is in good condition, however, it has carpet, and we want to change it to a wooden laminar floor. So, it will be time for some DIY work, like a proper FIRE man! ;). I’ll see if I can take some before and after pictures, and if I am successful I will add them to a blog post, otherwise, I will delete these lines and pretend I was never going to do that (haha).

Portfolio Performance

Next, we move to analysing my portfolio performance for this quarter:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 15 % discounted to estimate future withdrawal tax payments

Thirty thousand Euros. That is the amount between now and breaking even. It can look like a lot of money, but I’ve learned to look at it from a different angle. What is 30K out of one million? It’s almost nothing, just a tiny little 3%. This is how this 30K that currently feels like a big burden will feel like if I continue saving and investing.

As we approached the end of another tax year, I sold my shares of the global tracker I held in my Free Trade general investing account to help max out my S&S ISA £20K yearly allowance, I contributed the remaining to my SIPP, which will give a little boost of £3K as tax relief soon.

Dividend Portfolio: To Keep Or Not To Keep

The latest change in the dividend allowance from the gov is making me wonder if it is worth it to keep growing my dividend portfolio, or whether it is worth keeping it at all.

My interest in dividend investing originated back in February 2020 (a post I apparently wrote on a grey day, coincidentally today’s day has similar characteristics. Yay, this is England!), after this and this happened. At that time, the dividend allowance was £2K, which means investors pay no dividend tax for the first 2K earned in a tax year outside an S&S ISA. Now, why bother investing outside an S&S ISA anyway? Well, as far as I know, you can only use £ to invest in ISAs, so the dividend allowance is great to me as it means I can invest in Euros in a general account and still pay no taxes to the UK gov. I was never planning to exceed the 2K, so I guess my dividend growth experience was capped sooner or later, however, this has been rather sooner than later thanks to the change of direction of the UK gov.

The dividend allowance for 2023-2024 tax year has been halved to £1K, and then it will be halved again in the following tax year to £500. Anything earned after that, the tax man will want its cut, currently at 8.75%. It is not a lot, but still, it makes me consider if I should change my investing strategy.

My projected annual gross dividend income is only £729 at current exchange rates, if I deduct withholding taxes, then my dividend income before UK taxes is £620. In the 2024-2025 tax year, £120 will be taxed at 8.75%, which leaves a net dividend income of around £610 and a net yield of 2.65%. That in today’s environment feels low, since you can easily earn 3.5% cash interest with a higher allowance (£1,000).

These changes are a bit of a bummer, even though I wouldn’t have to pay that much in taxes during the early days, the fact that I would need to fill a self-assessment tax return just for a few pounds makes me ponder if it’s worth the hustle. Anyway, this won’t affect me this tax year, but I will need to consider this and make a decision for the following one.

Dividend Income

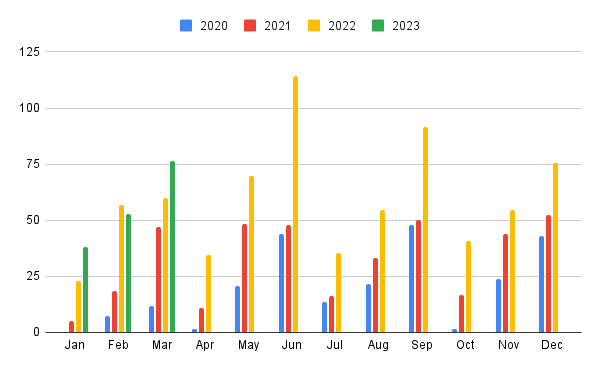

My dividend portfolio generated €167.11 of passive income this quarter. That’s a 19.6% dividend growth compared to last year’s Q1. (€139.67 Q1-2023).

Here’s an overview of my monthly dividend income so far:

I have not deposited any fresh capital into my dividend portfolio this quarter, I only reinvested dividends to buy some Cisco shares at $47, Johnson & Johnson shares at $153, Home Depot shares at $284 and Realty Income at $65.

I would like to own more shares of BlackRock, so if the share price keeps below $700 I will be looking to reinvest some of my dividend with them.

Two stocks I have uneasy feelings right now are 3M and Leggett & Platt, the former is experiencing a lack of growth and on top of that the litigation issues add a lot of uncertainty to the equation, the latter is a cyclical business going through tougher times with a not so strong balance sheet.

Final words

That’s all I got to say for this quarter. I don’t have any clear investing idea this time, rather than keep buying global trackers inside taxed advantaged accounts. The last quarter’s Alphabet purchase is playing well so far. I bought 48.97 shares at an average price of $92.24, now it’s over $106 per share.

The next update will be in July.

Tony

Related Posts

1 Comment

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Oh, buhu! 8.75% – we pay 27% on the first dollar! Haha

Looking forward to seeing your DIY flooring project 😛