Portfolio & Savings Update #45 Q3 2023 – €216,864

It is (finally) time to sit and write another portfolio & savings update to take into account Q3 2023 in the books.

Table of Contents

Q3-2023 In A Nutshell: We Are a Married Couple!

I am fairly late in writing this quarterly update, but I do have a good excuse, and that is described in the headline above. That’s right, it took a while (two years since I proposed marriage), but we finally managed to get things arranged for a successful wedding in Las Vegas, followed by a road trip honeymoon in the US in October. It was such a great experience altogether. We travelled between California, Nevada, Utah and Arizona. The climate was perfect, although even a little bit too hot in some parts of the desert. Generally, I loved the US, there are plenty of Spanish speakers and that made me feel a little bit less of a stranger. Also, it’s so straightforward to speak to Americans, and the fact that they are so used to the Spanish accent makes it even easier and friendlier to communicate with them. Nonetheless, I found it expensive to live there, especially in California. In Los Angeles, you will struggle to buy a house for less than a million dollars, there’s no Costa or Nero but only Starbucks coffee and in some places is extremely expensive. I paid up to $8 for a latte, and that’s without taxes and tips included! Most places ask for a minimum of 18% tips, and the restaurant will charge you this as standard in your final bill. WTF? I am a FIRE pursuer! You can’t do that to me! You understand, yo! 😉

Jokes aside, it was an unforgettable two weeks when we managed to see 3 big cities (San Francisco, Las Vegas and Los Angeles) and a few national parks (Grand Canyon, Zion Park, Yosemite Park and Bryce Canyon among other stunning spots). We definitely must return to the US as tourists again. We still got to visit New York and the most visited national park, the Great Smoky Mountains.

Workwise, I managed to get a pay rise from my current employer, but not before handing in my notice. After a series of interviews, I gained two job offers. The second and better offer gave me a 28.5% pay rise and a better benefit pack. Despite this, I was not 100% clear with the move, as the design and manufactured product of the new job were simpler. That would sound nice and possibly profitable as an investor, but as a mechanical engineer, I felt I would get bored and stuck in my career progression. Three weeks after handing in my notice (I gave two months) my current employer began to try to convince me to stay with him. I ignored him as I thought he would never be able to match the offer, but in one of our latest conversations, he put in an acceptable offer, a 14% pay rise, which I ended up accepting. So I refused a 28% rise for a 14% one. Most people would think that I am stupid, but I don’t see it that way. We spend a lot of hours in our jobs, I enjoy mine and get to learn more about engineering every day, this has an enormous value. Do I want to risk losing that for an extra 14% rise? After all, the main idea of “retiring early” is that we have the complete freedom to choose to do nothing or a job/project that motivates us, but what if I already enjoy what I do now? Does it make sense to switch to a better-paying but less enjoyable job for the sake of retiring earlier? In addition, the learnings from my current workplace accumulate and in a few years, I will be more knowledgeable and have a chance to earn even more money than I could if I switch now. Probably one of the reasons why I can’t see many mechanical engineers in the FI/RE movements is that we don’t really get to earn a good salary until we become very knowledgeable and experience and that normally doesn’t happen until around the forties unless you are a genius. Many run out of patience and change careers (I was almost one of them!) to IT or software as salary rewards come in faster.

Now for the numbers for this quarter.

Quick Recap of Q3-2023 Numbers

- Net worth: €664,155 (+3.6%) – details HERE

- Portfolio value: €216,864 (+2.8%) – details HERE

- Quarterly growth from investments: €553

- Passive income: €3,993

- Savings rate so far in 2023: 31.1%

Comments

Q3 was a quarter of little return. Most of the growth of my portfolio is thanks to my contributions. We had a good month in July, but after that, stocks haven’t stopped losing value to date. As usual, I am not too worried about that, as I know it is part of the cycle. I also don’t panic about a “super-market crash sell stocks now to survive” as I know I am in until retirement which is still a long way to go. It is the latest, newer war between Israel and Hamas that I see as a potential risk. In case there’s an escalation of the conflict with the involvement of Iraq and the US, it could bring another energy shortage, followed by more inflationary pressures and further interest hikes that would affect us all and shake the global economic stability. Fingers crossed that this won’t happen.

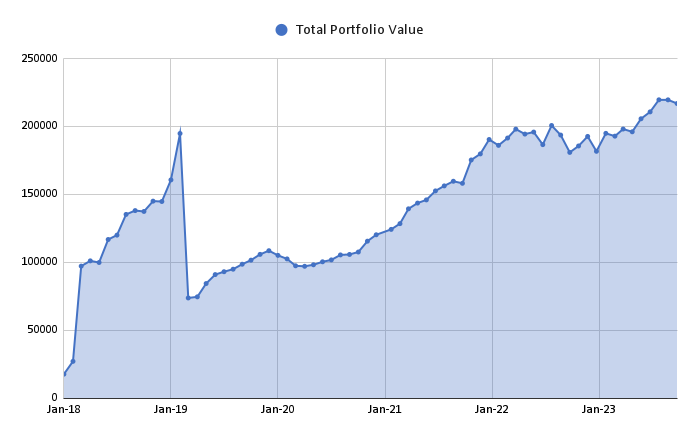

The graph below shows the ups and downs of my portfolio and how it has evolved since I started documenting via this blog:

Portfolio Performance

This is the portfolio performance for this quarter:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 15 % discounted to estimate future withdrawal tax payments

Stocks are slightly in the green, except for my dividend portfolio. Some of the companies I hold in this portfolio have been badly hammered. Some of these are Toronto-Dominion Bank, Realty Income, Bristol-Myers, Walgreens, Leggett & Platt and even Mr J&J. My crypto assets have continued the bleeding journey, although it seems Bitcoin has recovered some ground these last days. If it manages to stay like that or higher, then it will (finally) show a positive return in the next quarter.

Estateguru is slowly sorting out its mess. I managed to recently (October) withdraw another €250. This is not shown in the Q2 numbers.

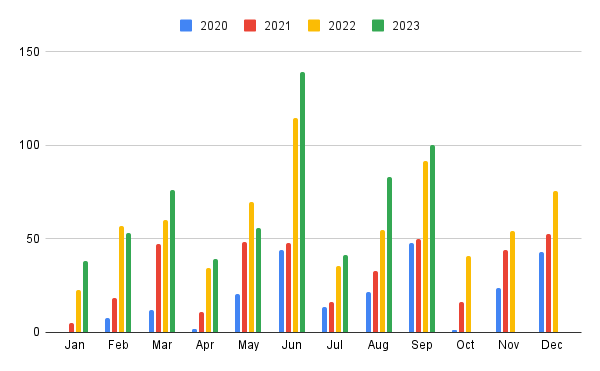

Dividends!

My dividend portfolio generated €224.6 of passive income this quarter (€234.9 in the previous one). That’s a whopping 23.6% dividend growth compared to last year’s Q3. This is despite me contributing €0 to my dividend portfolio this year since the upcoming dividend tax policy changes in the UK are putting me off investing in dividends, so that means most of this growth has been internal/organic which shows that the compounding and dividend growth is doing its job.

Here’s an updated overview of my monthly dividend income so far:

It’s okay to have stock valuation decline as far as my dividend income stream is safe. So far it has been safe, bet there is a company whose dividends don’t feel especially safe any more, and that is Walgreens.

Being a couple of weeks in the US was helpful to meet in person some of the businesses I invest in. I visited Walgreens, Walmart, Target and Home Depot. My impression was that Walmart and Home Depot were better managed. Target looks clean and organized inside, but they prioritize clothing sales before groceries. We stayed near a Target store, and we found it difficult to find all the groceries we needed for our stay, as they had limited stock. When you first come in a Target store you find yourself in the clothing section, you need to walk all the way through the store before you get to the groceries section. Also, there was a ROSS Dress For Less store in the same facility centre, which I bet gives Target some tough competition for selling clothing. I also paid attention to what were people buying the most in Target, and guess what, it was groceries. So I don’t understand Target’s strategy, and probably not ever their CEO does. It was a shame as I was expecting to get interested in Target after visiting it and get some “cheap” shares after their share price dropped, but I guess the drop is justified, and given that there doesn’t seem to be a clear trajectory for them at the moment, it’s better to stay out.

Back to my dividend worry, my impression of Walgreens was that their stores are close to each other in some areas, and therefore closing down some stores, which is within the Walgreens management plan, is quite likely to be beneficial to cut down costs with a minimal impact on sales.

For instance, let’s have a look at the Walgreens stores located in Las Vegas via Google Maps. The three stores located on the left side closer to the top are only a 25-minute walk or 4-min drive apart from each other. Is there a real need for three stores in that area, which is far from the city centre?

I went into a few stores, some were busy, and others were nearly empty, it depended on location. One of these empty ones is projected to close in November. Looking at the cash flows of the company, the dividend is at risk, but I can validate that management seems to be doing the right thing to sort this out, so I am giving them another year before I sell my shares with the hopes that the new CEO Tim Wentworth will keep the dividend. It is risky but selling now would involve taking a big loss of -36% (including dividends). I have hopes that Tim will be able to deliver good news and turn a stock that is trading at 6.3 times forward earnings around.

Most of my dividends this quarter have been reinvested in Realty Income. The Wall Street Wolves are hammering it, so it is a good time for Tony the Tiger to keep loading the track!

Final words

That’s mainly all I’ve got to report for this quarter. I hope the two or three readers left of this blog are doing great. The next update will be in January 2024, so for anyone reading this before that, Merry Christmas and Happy New Year folks!

Tags In

Tony

Related Posts

3 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Congratulations on your new status as a married man!

We’ve also toured the US a couple of times (my wife also has family there). We’ve not been since covid, and for a while I didnt miss it – but now I feel like it’s time to pay the US another visit! Especially when reading about your experiences there ????

Fingers crossed that the World doesnt go to shits once again in Q4!

Many thanks Nick!

The sense of freedom you get in the US is uncommon to experience in Europe, I would get back there anytime!

Yes, fingers and toes very crossed!

[…] last quarter of the year was super quiet. We needed this after our marriage and a two-week trip to the US. We spent Christmas days at home, and then we travelled to the South of England to spend four days, […]