Monthly Update #5 April 2019 – Game Over

Table of Contents

April…

… such a great month in terms of sunshine and good temperatures have been. Birds are signing at dawn, seagulls are getting ready to attack tourists enjoying their fish and chip, people wear smiles while having nice conversations about their holidays’ plan, and bills are lower as the temperature is higher. Everyone seems happy, life is good, I love the spring feeling…

We had a nice sunny Easter break, where we visited (finally) the famous Stonehenge and spent one night in Bristol, we loved its independent spirit and the Clifton Suspension Bridge, such a well-designed piece of engineering, indeed. I think that up to this stage I have visited more places in the UK than in Spain, as it’s a hobby I’ve mainly been doing since my move to England!

By the way, we use Airbnb sometimes for our travels and short breaks, we paid only £25 for our stay in Bristol. We were hosted by a friendly Bulgarian couple and slept in a double room. When booking, I realised that Airbnb has a referral program, but it is only available for friends and family. I am not allowed to share the link on the blog, but if interested feel free to send me an email and I will forward it to you (reward is £25 travel credit).

The welcoming sunny spring and time off from work haven’t been the only causes of my good feelings this month though:

- I let go of some memories and thoughts I had stacked in my mind for several years by writing about them on the new Cashflow Cops’ HumansofFI series, after being arrested due to my bad financial habits 😉

- I interacted and met great new people on twitter and personal blogs.

- I earned my first side hustle income (£85) with match bettings (thanks weenie for introducing me).

- I’ve spent quality time with other more often.

And finally:

I haven’t lost any money and my investments haven’t dropped!

I am no longer a firebug and the fire brigade seem to have extinguished the fire out of my vault successfully, for now… – fingers crossed.

There was not much I needed to be content with in terms of monthly returns, even a 0% return on investment would have been happily accepted 🙂

Game Over

My trading account with Algotechs vanished completely on the 7th of April, funnily just after a few hours of posting my full investing

I knew this would happen and that’s why I considered the whole lot as

unrecoverable loses, which isn’t especially rousing!

The FCA seems to have updated its database thanks to the great work that The Financial Telegram has been doing. Details here.

For those that are curious about how this sort of financial organizations are structured from the background, visit The Financial Telegram, you will be surprised!

Finally, Algotechs Facebook Page and Website have been exterminated.

The GAME is OVER

via GIPHY

Blog changes

This month I have added a new page on my blog called FI-Ratio – PI with aims of controlling my journey towards FI better and make future updates a bit shorter. There, you will find a chart showing my main streams of passive income and how far I am towards my journey to financial freedom. It possibly needs some improvement though.

Lastly, before I show you the numbers, I’d like to mention that I had some issues with my blog and I had to recover my site from a backup, losing some valuable comments from previous post. I am just mentioning as I don’t want anyone to think I deleted them on purpose.

That being said, it’s time to show the numbers, which are not impressive but at least real! 🙂

Monthly Highlights

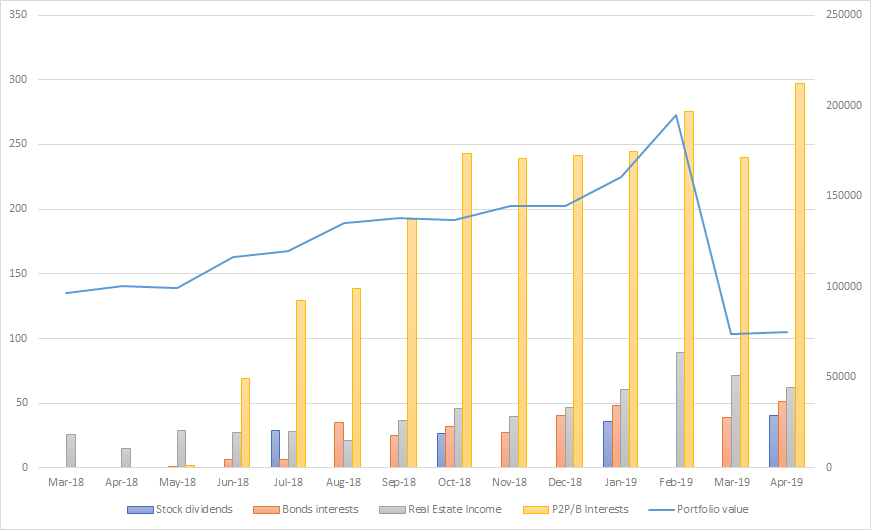

- Portfolio value: 74,822€ (+1.5 %)

- Monthly Transactions (Deposits – Withdrawals): -420 €

- Monthly earnings: 1418 €

- Passive income: 451 €(+25%)

My portfolio value has increased by 1.5%, although the withdrawn amount

is larger than the deposited. I am reluctant to continue adding more cash into my current P2P platforms, so I’d like to add a new one to the roaster but I am a bit unsure of what to choose. Possibly a new real estate

Any recommendations?

Passive income

My passive income reaches a new high, YAAY! Mainly due to my latest investments on

I’m looking forward to seeing how this chart evolves over time 🙂

My current level of passive income covers

More details on my new page – HERE

Monthly earnings by platform

Both of my stocks, AMAT and FSLR increased in value, raising my Trading 212 account over 5%. My ISA has been doing well too, growing +3.2%. Crowd Estate (+0.87%) stands on the first position of my real estate crowdfunding portfolio, and Envestio on my P2P/B lending one (+1.8%).

The GBP/EUR currency ratio stays at the same value – 1.16 as last month.

| Platform | Inception date | Value March | Transactions | Value April | Earnings | Return April | Cumulative Return |

|---|---|---|---|---|---|---|---|

| Vanguard (£) | 14/03/2018 | 29,672 (34,419 €) | +500 (580 €) | 31,124 (36,103 €) | 952 (1104 €) | 3.2 % | 9.6 % |

| Property Partner (£) | 21/01/2018 | 5,366 (6224 €) | 0 | 5,398 (6261 €) | 32 ( 37.1 €) | 0.6 % | 7.6 % |

| Housers | 26/03/2018 | 6,661 | 0 | 6,671 | 10 | 0.15 % | 4.2 % |

| Grupeer | 19/05/2018 | 12,003 | -1,000 | 11,160 | 157 | 1.3 % | 14.9 % |

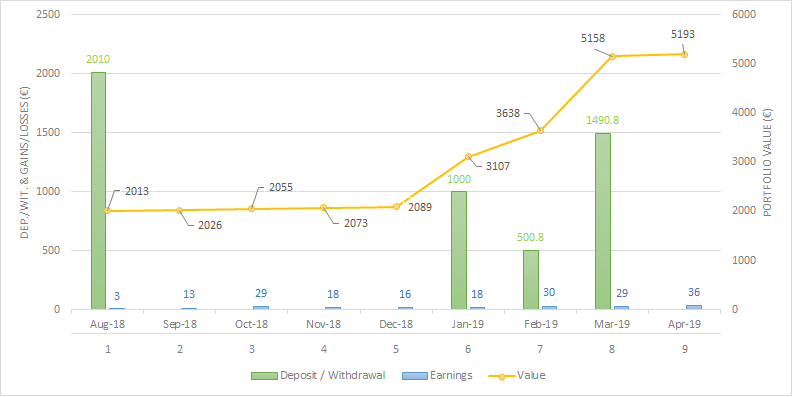

| Mintos | 05/08/2018 | 5,158 | 0 | 5193 | 36 | 0.7 % | 6.5 % |

| Crowdestate | 16/08/2018 | 1,953.7 | 0 | 1,970 | 17 | 0.9% | 6.5 % |

| Envestio | 15/10/2018 | 5,163 | 0 | 5255 | 40 | 1.8 % | 9.3 % |

| Fast invest | 29/10/2018 | 1,054 | 0 | 1,066 | 55 | 1.1 % | 6.6 % |

| Trading 212 | 03/2019 | 1,084 € | - | 1,140 | 56 | 5.1 % | 5.1% |

| TOTAL | 73,722 € | -420 € | 74,822 € | -125,474 € | 1.9% | -43.1% * |

*Includes Algotechs loss

Vanguard

As usual, I paid myself £500 out of my payslip, which I used to purchase some USD Treasury Bond UCITS ETF (VUTY) shares.

Stocks seem to have been doing well lately, as my portion on shares increased up to 54% against 46% on bonds. I rebalanced back to my favourite 50/50 proportion, selling some shares from my S&P500 ETF.

So far this year:

- S&P 500 Index : +15%

- My 50/50 balanced Vanguard ISA: 7.5%

All charts and portfolio details – HERE

Vanguard is a portion of my little British Empire as an Expat

Property Partner

Property Partner has issued the last revaluation and property performance update. The total return since launch is 7.2%, decreasing 0.1% since the previous update. Assets under management increased by £12.3m in the six months to 31 March, reaching £135m. The House Crowd, which I think is its closest competitor stands at 100m and Property Moose at 14m (data taken from their websites)

Some of my property shares have gained in value while others located in London have dropped. My current valuation gains are now £33.58 (£41.96 last quarter). I expected a further drop after all the Brexit noise, so I am quite happy with that result for now.

Normally, the resale market after the revaluation is closed and reopens after a few days with updated trading prices. Agile investors can find good deals and sell or buy shares at a good price. In my case, one of my properties increased by 11% in

The platform has won another award as the Best Property Investment Service 2019 in the Online Personal Wealth Awards (page 22-23), congratulations!

My rental income seems to be increasing month over month, £19.87 in April (£18.82 in March)

On my previous portfolio

So, despite the decrease

All charts and portfolio details – HERE

If you are a first-time reader and feel curious about the platform, you could check out my personal review and results after one year of investing here.

Property Partner is also a portion of my little British Empire as an Expat

Housers

Earning from Housers in April have been the lowest since April -18, getting only 10€ after fees and taxes. Three of my investments haven´t paid out for months now, which are all from the Italian and Portuguese markets… We’ll see how this ends up…

My 50 Estadio Nacional shares are still in the marketplace to sell and will be there possibly forever?

Grupeer

It’s been now 12 months since I started investing with

Mintos

If you asked me what’s the P2P platform that I trust the most out of my portfolio, my answer would be Mintos, and the principal reason is because of its transparency. The platform released the 2018 financial statements online recently, archiving another profitable year. However, the total comprehensive income in 2018 has decreased considerably from 2017 – 195K € (2017) against 13K € (2018). I know I am not a stock owner, but this decrease got me wondering whether I should be taking it as a negative symptom.

Is Mintos still growing or is it struggling with the increasing P2P marketplaces available to investors? Statistics in 2018 have

What caused the drop

That’s literally their answer:

As a result of the significant growth of the marketplace, our revenue more than doubled from EUR 2.137 million in 2017 to EUR 4.647 million in 2018. We continued to invest into further expansion and future development. Even with all these investments, we remained profitable, with a net profit of EUR 13 thousand at the end of 2018.

The profit for the year includes charges of EUR 51 thousand (EUR 45 thousand in 2017) relating to the fair value of share-based payment benefits which are being recognized over the vesting period. By their nature, these payments are not reflective of ongoing trading performance and they are not considered part of the underlying results. Excluding these charges, the result is a profit of EUR 65 thousand for 2018 and EUR 241 thousand for 2017.

My thoughts

I don’t have a crystal ball and therefore can predict

This is only my personal opinion, what about yours?

Crowdestate

I didn’t deposit any extra money to get rid of the cash drag as I said previously.

Envestio

Fast Invest

Do you enjoy watching straight lines?

How are my 2019 goals going?

On my first portfolio

I am also doing this because I don’t want to add any type of pressure on myself for the time being, and just relax for a while until the algorithmic noise feels a bit more far away.

At some point, I’d like to write about the different emotional cycles that I have encountered after losing a big chunk of money,

The goal I don’t/won’t remove

Earn 25€ and donate it by the end of 2019.

In April I had a blog income of 8.16€, adding a total of 13.16€, all out of my Mintos affiliate program. So far, two people have joined and invested money in the platform, thanks for contributing! As an exception and for my donation purposes, Trading C

I need to earn at least 25€ before I can withdraw any funds.

Savings Rate

My expenses in April are £1249 (1448 €), which are slightly higher than my monthly average of 1200 €. This is because we’ve begun booking for our one week holiday in July and also had more expenses from our Easter break. With the little help of my extra income from match betting, I’ve still managed to to get a nice saving rate of 40%.

As we’ve still got some bookings to arrange, it will be difficult to keep my savings rate above 40% over the next months, so I better get cracking on my new side husle! 🙂

Until next time, I’ll see you around…

… and once again, thanks for reading! 🙂

You can follow me on twitter where I share some thoughts from time to time and connect with other like-minded people.

Disclaimer: Some of the links on this post are affiliate ones and some others are not. If you join to a platform using my affiliate links you will get a bonus or commission and so will I. I’m going to donate any commission I get throughout 2019 to a charity. You can read more about the purposes of this blog here and where this money is going to go here

Tags In

Tony

Related Posts

19 Comments

Comments are closed.

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

INTERESTING DEALS

Get £50 with Octopus Energy

Get a Discount on Your New Tesla

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hey Tony! I am happy to hear that you’ve now moved on from the Algotech experience and that the net had closed in on them. That’s mainly down to you not giving up and doing your bit to inform the authorities as well as sharing your story.

Good going on maintaining a solid savings rate. Keep taking it nice and easy. Better to get there slowly than not at all.

Yeah, finally the truth has shown up and I am very happy to have contributed a little bit.

Slowly but surely is the new way to go 🙂

Thanks for your kind words 🙂

It’s probably a good idea to take some distance from FIRE stuff. Luckily it’s just money. And even with small setbacks like that, you’re still in a very good place.

IMO Mintos is a very good candidate for surviving a challenging market. I’ve made the mistake of centralising too much, so I wouldn’t advise putting everything in that either, but it’s a good backbone.

What is match betting? Sounds suspicious.

That’s what I am doing now at some extent, reading about different topics and disconnecting from the world of money, but there’s no break I can have from at least tracking my investments if I want to continue with this journey.

Time will be the best treatment here.

No, it’s not. It’s a very popular side hustle in the UK and many other UK FIRE bloggers are doing it. It’s a technique used to profit from the free bets and incentives offered by bookmakers, and it’s free of risk and taxes!

Congrats on a decent passive income month, Tony! It would appear as though we’re now in a race indeed ?

You’ve got some good solid investments there – I’m still 80% in cash (as of this moment), so you will get ahead of me (for a while at least ? ).

You have a pretty diversified crowdlending portfolio already I’d say, so any new platform would kind of offset the balance a little, I think.

If I were to suggest something that I’m quite happy with though, it would be Crowdestor. It’s comparable to Envestio, only Crowdestor has more new (different) projects. Envestio has been spitting out new tranches of old projects for months now. I’m not too fond of that, to be honest…Crowdestor seem to have an endless stream of new and exciting business to invest in, including transport, restaurants, real estate and education.

I’ve heard rumors that a new P2P platform should also be worth a look. Check out Bondster.

Originally I really wasnt a fan of P2P (I’m still kind of aren’t), but it provides a nice balance to the portfolio I think. I noticed today that all my loans on FastInvest are in fact consumer loans. Not really sure I like that, but let’s hope they add other types as well (like Mintos etc.). I like the “pick-and-choose” projects on Envestio and Crowdestor. I think I will try to find more of those kind of platforms in the future, as I feel like my money can then contribute to something positive, rather than just lending a guy money to buy shit he probably doesn’t need anyway (but society dictates he should have!) ?

Thanks Nick, it’s picking up little by little, which quite motivates 🙂

Haha, yep! Our portfolios and investments differ, so it will be interesting to watch how they develop over time. I think you have a bit of an advantage though, as your savings rate is lower than mine, but the amount in Euros you saver yearly is larger. What interests me the most though is how your overall network will advance after your first property acquisition.

Thanks for your recommendation, you are not the first one who’s recommending Crowdestor, so I think it’s worth an analysis, although I am prone to invest in platforms that offer loans secured by real estate like Estate Guru or Blend.

I also noticed what you are mentioning about Envestio, and reminds me of the “read between lines” article from Explore P2P blog (http://explorep2p.com/secrets/), worth a read!

I’m not to keen on investing in new P2P platforms anymore, as there’s no track record on the legality of their operations (not regulated) or financial statements to verify their business is sustainable, not even a 20% is worth the risk, from my current point of view.

Totally, there’s a real difference between lending your money to someone to purchase a BMW or lending it to a business for the construction of a wind turbine farm. Like you, I would like to give preference for this type of investments but first goes the safety of my money, so diversifying and investing in platforms with a long track record may be the way I follow from now on.

Thanks for your time sharing your views Nick, looking forward to seeing your new acquisition coming up. 🙂

Hi Tony,

After your bad experience with Algotechs, I hope that you are able to get some of your money back. I did a little research and found a site which is going to take class action against them. You probably already know about it, but here is the link in case you don’t:

https://efri.io/bealgo-and-algotechs-funds-recovery

You say that you would like suggestions for a new crowdfunding platform, well I have been investing with Kuetzal since January. They have various interesting projects in the fields of real estate, transport, health, etc. Interest rates are up to 21%! I have invested about €10K so far and the monthly payments are always made on time. If you register with my referral link, you will receive 0.5% instant cashback on all investments for the first 180 days after registration:

https://kuetzal.com/go/1217053/

There is also a bonus of €10 added to your account if you enter the promo-code SPRING2019 if you register by 31/05/2019.

Hey Rob, thanks for sharing that.

Yes, I knew about it and registered my claim a while ago, we will see how it all develops but I am not holding any hopes of recovering my money after reading the terms and conditions I actually signed up for. What I am at least hoping for though, is that justice gets on the way and penalise the responsible for such organization schemes targeting innocent people, including elderly with large sums in the retirement pension funds.

https://www.independent.co.uk/news/business/news/online-scam-thousands-pounds-life-savings-trading-binary-options-fraud-pensioners-fca-a7865856.html

Thanks for your suggestion Rob, I heard about Kuetzal but I didn’t look at it closely yet. AT first, glance seems similar to Crowdestor and Envestio. I’ll make sure to use this link if joining 😉 Hopefully, I will take a decision during this month

Take care 😉

I am glad that you continue blogging, I was a little afraid when I saw “Game Over” title ?

Anyway, congratulations on a very solid month. It will be interesting to follow someone with a more cautious approach.

I agree with the comment from Eelis, Mintos can be the backbone of P2P portfolio but you need to follow it closely, especially its loan originators. Financial results of the platform itself are not enough.

Good luck.

Hey Druss, thanks for that! Albeit I don’t how often I will posting I want to keep the monthly updates at least, as they are the main core of this blog actually.

Totally agree, that’s why I mainly invest in loan originators with a Minto’s rating A, and B occasionally for short-term loans only, although Mogo is taking the most of my portfolio, which I am totally fine as their financials look healthy.

Keeping track of the more than 60 Mintos loan originators quaterly is a lot of hassle, so I just trust their ratings, which seems to be fair and transparent.

Cheers! 😉

Hey Tony

At least you can draw a line on the algotechs situation

Regarding other accounts it depends what you want . I use the following

Ablrate. High risk but 15% returns. Need to manually select investment and understand alot of the borrowers are connected so definitely one i would keep low. I have less than my interest earned in each borrower. Have about £5700 in this

Lending works Auto diversified protected 6.5% returns have about £7k in this

Assetz capital 30 day access account 5% return. Have about 6k in this

Ratesetter 5 year account 5.7% return. Have about 3k in this

Ive been considering property partner and British pearl

Hey, thanks for sharing your investments, it seems I’ve got some homework to do this month.

I’d like to add a British one regulated by the FCA, so I can enjoy from some of the £1000 personal savings allowance free of tax, but that would probably mean that I would have to convert some Euros to Pounds, which sounds like a big gamble up front Brexit.

I can’t say much about British Pearl, but in regards to Property Partner, they don’t have many new opportunities lately and are struggling to raise funds to cover the projects. I am not expecting changes on this until a clear Brexit agreement or some sort of clarity has been set. On the term of reliability, professionality and trustworthiness, they are on the top of my list. Rentals are paid on time and transparency is up to a good level.

Hi Tony, good to see you’ve (mentally) moved on.

I see you’re heavily invested in P2P lending. I’m not a big fan myself, due to the long lock-up of my money and therefore lack of liquidity. I like my ETF portfolio for that. Also, shares give me an upside potential. It seems crowdlending only has a downside opportunity (it can at most be the stated interest minus costs).

Do you invest in longer or shorter projects? I might look into P2P again if there are enough 3-6 month projects available on the platforms. Where would you suggest I start?

Hey, it’s good to see you around!

The liquidity on the P2P lending depends quite a lot on the platform you are using and the quality of the loans you want to sell. Some platforms have an active reselling market, where you may get a chance to sell your investments, but the risk of finding no buyers is also a common thing, which is what is happening to me with Housers. So, knowing your personal situation is a fact that can’t be missed, as you know 😉

In my case, as I am not expecting to need cash from my P2P portfolio any time soon, so I invest up to 12 months term.

My core value investment though is still my ETF portfolio too and plan to keep focusing on it for the long term.

Although my concerns about the stability of the P2P market in Europe grows at the same pace as its growth in popularity, I still consider it as a good investment only in terms of diversification and taking into account that the platforms and loan originators are healthy enough to keep running until the end of the term of my investments (which at the moment I don’t know for certain for all of them I must admit).

Mintos is my favourite P2P platform for the time being, and it offers several sorts of loans and terms, so you could easily find short-term loans and a decent amount of diversification across different loan originators for a small investment.

I would suggest you start by asking other bloggers the same question and see what they think according to their experiences and P2P platforms they use. You may find one that fits you better than Mintos – although I doubt it.

Hope that helped you a little?

Thanks, definitely helps! The two projects I’m currently invested in are 3 and 5 years if I recall correctly, but will look into different projects with shorter duration. Thanks for the information! Really helpful!

Hi Tony,

Another great update. I do like seeing what your up to each month.

Another possible Real Estate platform could be Reinvest24. I have invested with them recently and they seem to be fairly up and coming in this space. Tanel, the CEO,, seems pretty open to chatting, and has posted a few videos and displays of some of their current investments. They are only small at the moment, but worth having a look at.

I will admit that I haven’t received any money return from them yet, but I do think the investments are paid at less frequent intervals.

In regards to Mintos, I hope they don’t get so big that their loan originators don’t get out of hand. It must be difficult to manage 60 at once.

I’m also liking the new FI Ratio page!

Matt

Hey Matt thanks for your suggestion!

I spotted Reinvest24 a while ago and watched their first webinar. At that time I wasn’t after adding any new platform to my portfolio so I didn’t invest any money. Their yields are very attractive, but I tend to be cautious with new platforms and rather wait for a while.

I share your concerns about Mintos, this is when you need to trust their management and their capabilities and skills to make the platform grow in a sustainable manner. That’s another reason why I like to have access to their financial statements, to check how their cash flows. I am not an expert but at least it gives a better insight into the company.

Thanks for your feedback on my FI RAtio page! 🙂

Really glad that you’re bounced back Tony. That wasn’t fun.

I’m looking at P2P more myself now. I have a small amount in there but, given the returns, I’m looking at putting in more. My main concern is about how popular its getting and so whether there are enough high quality loans for all the firms in the market.

I guess it comes down to, as you say, working out if I’m happy with the management. I think I’d be happy to accept lower returns for the lower risk that came with that!

Hey Caveman,

It’s great to see you around and thanks for your kind words 🙂

As I said to B, I also share the concern about the increase in popularity on the P2P market, it feels like a bubble and we know how normally bubbles end up, don’t we? That’s why I will be extremely cautious from now and choose lower returns in exchange for less risk.

The returns from most of the P2P platforms with some track record seems to be low in the UK, 5-6% (Zopa, RateSetter,…). The dividend yield of the whole FTSE100 Index is 4.5%. I am not an expert, but personally, I see more long-term potential into the FTSE100 than investing in British P2P platforms. (just a thought)