Monthly Update #14 January 2020 – A Bananas One

Guys and gals, what a start of the year amigos!

On the European peer-to-peer lending side, everyone is going bananas after the Kuetzal and Envestio cases. I am glad to see that some platforms are tackling the lack of trust by reaching out to investors formally and making announcements on improved transparency and a future realignment once a proper EU regulation has been developed.

On the stock market side, everyone is going bananas following the coronavirus spread that started in China.

So, there’s been some panicking from all sides in January. I am keeping close attention to the markets right now as this can bring some good buying opportunities.

Alright, straight to the numbers:

Table of Contents

Quick Recap of January Numbers

- Portfolio value: 105,058 € (-3.4%) – details HERE

- Monthly Transactions (Deposits – Withdrawals): 799 €

- Monthly growth from investments: – 4,736 €

- Passive income: – 4,318 € – details HERE

- Savings rate: 62 %

Now, let’s get into the details.

Portfolio Performance

| Platform | Inception | Description | Value Dec. | Transactions | Growth | Value Jan. | Return Jan. | T. Return |

|---|---|---|---|---|---|---|---|---|

| Property Partner | 01/2018 | Buy-To-Let | 6,443 | -21 | 21 | 6,498 | 0.32% | 5.5 % |

| Stocks & Shares ISA | 03/2018 | Stocks & Bonds | 58,242.4 | 928.2 | - 540 | 59,123.74 | - 0.92 % | 11.7 % |

| Housers | 03/2018 | BTL and Dev. Loans | 6,808 | -158 | 16 | 6,666 | 0.23 % | 6.3 % |

| Grupeer | 05/2018 | General P2P Lending | 8,793 | -321.57 | 82 | 8,553 | 0.93% | 27.85 % |

| Mintos | 08/2018 | General P2P Lending | 285 | - 285 | 1 | 0 (see ya!) | 0.22 % | 16.6 % |

| Crowdestate | 08/2018 | Development Loans | 2,308 | - 224.55 | 9 | 2,092.24 | 0.38 % | 14.15 % |

| Envestio | 10/2018 | Yacht Financing? | 4,827 | - 249 | - 4,578 | 0 (Ouch!) | - 94.8 % | -74 % |

| Fast Invest | 10/2018 | Consumer Loans | 1,163.4 | 0 | 12.38 | 1,175.7 | 1.06 % | 17.6 % |

| Trading 212 | 03/2019 | Dividend Investing | 1,746 | 813 | - 27.2 | 2,531.8 | - 1.56 % | 58.4 % |

| Estateguru | 05/2019 | Development Loans | 3,149.8 | 200 | 20.54 | 3,370.3 | 0.65 % | 6.3 % |

| Abundance | 05/2019 | Business Loans (Ethycal) | 717 | 59.5 | 1.43 | 767.7 | 0.16 % | 3.7 % |

| RateSetter | 08/2019 | General P2P Lending | 1199.2 | 0 | 4.93 | 1,214.3 | 0.41 % | 2.04 % |

| Crowdestor | 08/2019 | Business & Dev. Loans | 2,544 | 200 | 20.14 | 2764 | 0.79 % | 5 % |

| Robocash | 08/2019 | General P2P Lending | 4090 | - 462.54 | 32.45 | 3,660 | 0.79 % | 4.9 % |

| Wisefund | 09/2019 | Business Loans | 2131.1 | - 65.88 | 32.94 | 2098.1 | 1.57 % | 8.38 % |

| Freetrade | 09/2019 | REITs | 173.3 | 17.5 | 2.3 | 193.1 | 1.33 % | 10.75 % |

| Evoestate | 10/2019 | Buy-To-Let | 1118 | 15 | 2 | 1135 | 0.2 % | 3.1 % |

| UK Pension | 10/2019 | 100% Global Equity Fund | 2,824** | 349.3 | 148 | 3247** | 4.2 % | 45.6 % |

| TOTAL | 108,764 € | 799 € | - 4740 € | 105,058 € | - 4.4 % | - 41.8 % * |

* Includes Algotechs and Envestio loss

** 20 % discounted as future tax payments

*** Click on platform names to get more details

Month after month, the best investment performer is my UK workplace pension. It’s a no brainer that due to employer contributions and government tax reliefs, the fastest route to get me to that million would be to focus on maxing it out, but the fact of leaving my money locked in for at least 20 years as an unsettled foreigner puts me off a little. I tried asking a professional advisor recently, but he was reluctant to give me reliable advice. I am looking forward to getting over the Brexit transition period, so I can be certain of what can potentially happen to my UK pension. Perhaps I am worrying for nothing, will see.

If you run through the table from left to the right, you’ll notice that I have written off my Envestios funds, which has contributed to a negative monthly return of -4.4% on my portfolio. Same as with Algotechs, I joined the collective lawsuit against Envestio organised on Facebook. We’ll see how it progresses, but I am a bit more optimistic than with Algotechs, as we know that there are at least some real development loans.

I always try to remain positive, avoid negativity and focus on opportunity. While it’s true that the – 4740 € of this month hurts, my cumulated passive income over the last 12 months still remains positive at + 539 €, which tells me that the worst-case scenario is leaving my money sitting on my bank account earning nothing. I have no regrets whatsoever.

The GBP/EUR currency ratio grows from 1.18 to 1.19, boosting the value of my Euro portfolio. Thank God, I really needed it this month!

As overall, I am pretty happy that at least my investment portfolio is still over the 100K after the Envestio and market loss.

Stocks & Shares ISA (Core Portfolio)

My stocks & shares ISA growth shrinks for the second month in a row £-454. It derives from the market loss we had over the last few days, or in other quarters, coronavirus. In January I got no passive income derived from stock dividends or bonds interests at all, as I was paid twice in December.

As usual, I paid myself £780 out of my payslip as an automatic regular monthly payment.

My best ETF performer is the S&P 500 UCITS (VUSA) + 22.41%.

The worst performer so far is Global Value Factor UCITS ETF (VVAL) – 6.61%

2020 returns:

- S&P 500 Index : -0.63 %

- My balanced Vanguard ISA: -0.92 %

My balanced ISA normally drops less than the S&P 500 index during market corrections, but this time, the global value index allies with gravity and seems to never be able to recover. Will value ever be what it once was?

Alternative Investment Portfolio

As I commented on my previous post, due to the latest occurrences on the P2P community, I am going to become quieter at writing down my thoughts in regards to my alternative investments here on the blog. There’s plenty of info on other P2P only blogs, so I don’t think my comments will be massively missed.

I don’t have a defined strategy for the future of my P2P portfolio just quite yet, but what I am certain of so far is that I don’t feel comfortable with my current stake invested on Baltic platforms, at least, not until its market matures (improved regulation).

An image says more than a thousand words, so you’ll notice that I am cashing out gradually from nearly all platforms. As my P2P portfolio decreases over time (hopefully because of withdrawals and not faulty platforms), I also intend to step out completely and progressively (auto-invest off only) from some opaque platforms like Wisefund or Fast Invest, unless their opacity would change.

I exited Mintos in order to ease my P2P portfolio tracking. I sold all my remaining loans at a 0.5% discount in just a few days. I’ve posted a screenshot of my final dashboard on my Mintos page. Go and have a look. You’ll see that I had no defaults at all and avoid all the latest problematic loan originators, however, the net annual returns were just a mere 10%.

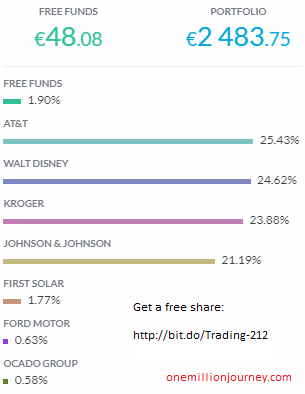

Dividend Portfolio (Trading 212)

Cashing out some funds from P2P means that I can continue my dividend stocks hunting game.

As vivid readers will know, I am using Trading 212 Invest broker to order my stock purchases.

In January two people used my referral link and I got two free shares (Ford and Ocado), thanks for doing so. If interested to get a free share yourself, you’ll find the link at the end of the post. For your information, Trading 212 is regulated by the Financial Conduct Authority (FCA). If questions, I am happy to help!

In January I open position in two stocks; Walt Disney (DIS) and The Kroger Co. (KR).

Disney needs no introduction, it’s a company that has been on my watchlist for a while and even traded in and out a few times but never kept for the long haul. The share price dropped substantially on the 25th of January when Disney closed its Shanghai theme park indefinitely due to the coronavirus spread. I have positive expectations on the Disney+ streaming service and I took the drop as an opportunity to get in. I own 5 shares that will provide me with approximately $8.8 this year (yield 1.28%).

The Kroger Co. is a consumer defensive stock and a well-know retailer in the US. The company operates several supermarkets and market places stores that offer natural food and organic sections, which lines up with my personal moral values as an investor. I own 25 shares that yield 2.32%, that should provide me with a future annual cash flow of $16.

This is how my stock portfolio allocation stands for now:

The €45K Project Fund

As usual, my savings on tobacco as a non-smoker went straight away to my Abundance account. That’s another £50 that I invested in the latest ethical investment.

For this tax year, the whole €45K Project Fund is invested in Abundance, as I am using an IF ISA account (tax-free).

So far, I have recovered the 1.7% of my loss = 767 EUR

44,233 EUR left to go.

See further details and the portfolio chart in the Abundance page

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

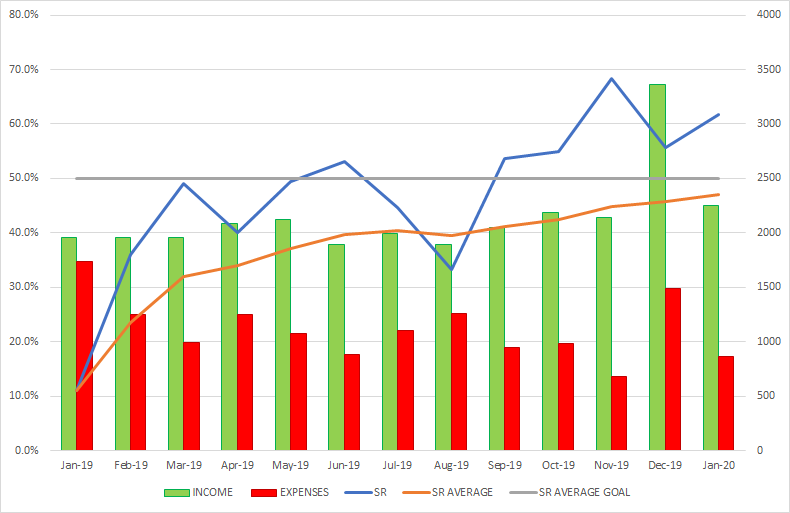

Income, Expenses & Savings Rate

My total net income in January was £2,270.6 (2,702 EUR) and my expenses were as little as £863.

I was able to save £1388.3, that results in a savings rate of 62% :D.

My savings average ratio is getting very close to the 50% line goal, it’s currently at 47%!

This year I want to track my expenses more closely, so I went to spy on my neighbour Route2FI blog once again and stole one of his ideas, the Sankey diagram. I am sure he won’t mind, is that right buddy? 😛

In January I joined back to the gym for a monthly quote of £25 (counted in the Health category). A price I am happy to pay for as It’s really helping me to get my 10k daily steps goal done. I am also building up my muscles again, that hopefully will increase my daily burning calories and help me to remove body fat (visceral fat worries me).

January was quiet as normal. We had a birthday party in Brighton but it was rather cheap as we spent the night playing games. I injured my ribs while catching balls on the air (Oh boy! Ain’t young anymore!).

I also bought a t-shirt and a pair of jeans that I needed urgently. I was happy to wait over the Christmas and get them on sale afterwards 🙂

Finally, a few days ago I donated the promised full amount to Gates Foundation. I could pay in Dollars or Pounds, so I obviously chose the latest to avoid currency fees.

A quick recap:

My total blog income in 2019 was 415 EUR, which 100 EUR were donated to a Crowdestor donation project (see December’s update) and the remaining 315 EUR (£265 at a 1.19 rate) to Gates.

Here’s my latest donation to @gatesfoundation.

— Tony @ OneMillionJourney.com (@JourneyMillion) January 29, 2020

I should have a better proof in two weeks time.

100% of my 2019 blog income has now all been donated.

Thanks ? pic.twitter.com/yUbZDd8wqj

Joining links and offers if interested

Property Partner – (share up to £1500, details here). Focused on high net worth or sophisticated investors.

Estate Guru (0.5% bonus on your investments made during the first 3 months)

Mintos (0.5% bonus on your investments made during the first 3 months – UK residents temporally not accepted)

Housers (25 EUR cashback for a minimum investment of 50 EUR)

Evoestate (15 EUR cashback for a minimum investment of 50 EUR)

Grupeer

Crowdestate

Crowdestor

Trading 212 Trading platform UK and EU (Free shares worth up to $/£/EUR 100 )

This is it for this month, hope you had a good one?

You can follow me on Twitter where I share some thoughts from time to time and connect with other like-minded people. You can also follow me on Facebook.

Read my disclaimer at the bottom end.

Tags In

Tony

Related Posts

11 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Ofc no worries about the Sankey, my friend ? It’s free for everyone to use! Nice month btw. Damn scary about what happened with P2P!!

Thanks, the chart gives such an accurate income-expenses illustration, great to watch and control how your cash flows.

Thanks ?❤

Hi Toni

January was a tough month with the collapse of Kuetzal and Envestio. I‘ve not yet written down the the whole invested amount, but will do it in my next passive income update. Have to face reality. ☹️

Like you, the whole debacle leaves me with very mixed feelings about P2P platforms.

I decided to temporarily cut back and make a deep risk-reassessment but still keep continue building on our P2P portfolio. I want to stay the course, I‘ve seen tough times before with my stock portfolio as well (2007-2009, Euro crisis, severe devaluation of all my foreign holdings against the Swiss franc, the oil glut of 2016, Brexit etc.) but over the medium and long run I‘m glad I remained invested. But clearly: quality and diversification are key and I‘ve to learn my lessons.

Cheers

Hi Financial Shaper 🙂

For me it works in the way that the sooner I write it off, the sooner I will overcome it and get rid of any negativity, fear or a bad feeling. Otherwise, it is like dragging a stone tied in my foot.

I am unfortunately a scammed expert :(. Even though I was conscious that something similar would happen sooner or later in the P2P scene, it came at the time when I was just still emotionally recovering from my last year scam.

I know it is a self-defence mechanism, but I don’t trust the management or ownership of any unregulated P2P lender, for the time being, it doesn’t matter how trustworthy they look. It will probably pass in a couple of months, but this has been a huge wake-up call for me. By no means, I’ll have over 10% of my investable assets in P2P.

Cheers 🙂

Hi Tony. Yeee its a interesting time. Im worried about China economy as it was overheated before and now reccesion can be trigered by the lockdown. 62% saving rate. Wow. You are doomed for succes 🙂

Thanks, I’d rather spend more and lose less though haha 🙂

I share your opinion about the P2P world, not sure what I’m doing with my investments yet. I’m not putting in any new money for now, also upping my stock investments.

Let’s see what will happen with the P2P market, I know that in 2021 there will be regulations – let’s hope that they will come sooner!

Disney is a great choice, I’ve had that one for a long time. Sold it when it bumped from 100$ to 135$, waiting for the dip to buy again. This my be my opportunity, solid company!

Cheers amigo!

Hey Radical FIRE,

Amid the confusion, it’s best to wait until everything comes back to normal and we’re able to reevaluate the situation once we are “sober”. In my case, my portfolio was too exposed to P2P, so it’s a no brainer that I should reduce allocation ASAP but without panicking all over the world.

Yes, I am going to hold Disney forever, love the company, huge moat, I understand the business and loads of potential ahead with Disney +.

Hi Tony,

It’s been such a crazy month with everything that has been happening in the P2P space. It’s good to see that you didn’t loose more than 5% of your total portfolio through Envestio and that mess (I lost 3% of my total through both Kuetzal and Envestio – DUMB but also shows how important it is not to blindly throw all of our money into such platforms).

What I found comforting is that at least one of the projects (at this stage) on Envestio was real, and hadn’t started paying back their loan yet (meaning that they will pay back to investors). Who knows how much, if anything, we can get back.

Matt

That’s right I didn’t lose much with Envestio, what bothers me the most is the inappropriate allocation I had, and still, have in fact. 5K in Envestio was way too much. A more clever distribution would have been 3k in Envestio and 5K in Estateguru.

Yes, I am aware of such a real project. I am looking forward to seeing how it develops and whether the issues get resolved (third party?) or just get messier. For the time being, I can only see a novice financial institution trying to find out how to handle the situation. Fingers crossed!